Whether you’re just getting started, looking to pay a bill, or travelling overseas, here’s what you need to know about managing your Credit Card.

How do I activate my Card and register for an Online Account?

Whether you’re a new Business, Personal or Additional Card Member, activate your Card here.

After clicking ‘confirm’, you’ll then be prompted to set up an Online Account, which will allow you to simply and securely view your Card balance, make repayments and more.

Note: If you’re linking a new Card to an existing Online Account, you’ll need to have your existing User ID and Password ready to enter when prompted. Remember, you’ll only be able to link Cards that are in the same name.

If you’re a new Additional Card Member, you’ll need to have the Primary Card Member’s date of birth ready to enter, along with your own details. However, only you will be able to access your Card information through your Online Account.

Activating your Card

For an easy way to activate your Card, visit amex.com.au/activate and follow the prompts.

Manage your Account online

You can go online to pay your bill, check your transaction history, view statements, offers, and much more.

Pay your Credit Card bill

There are many ways to pay your bill both online and in person. You can decide which one suits you best.

Maximise your Membership benefits

Make sure you’re making the most of your Card benefits. Find out about transferring points, using your Card overseas, and 24/7 Global Support.

Using your Membership Rewards points

You can choose to redeem your Membership Rewards points for Gift Cards, travel, entertainment and more.

Managing your Credit limit

As an American Express Card Member, you can apply to increase your credit limit online or by calling the number on the back of your Card. You can also decrease your credit limit by calling the number on the back of your card, or online here.

Useful Forms and Documents

Your first port of call for forms or information to help manage your Card Account.

Card lost or stolen?

Don’t worry, we’ll aim to get a new Card to you within 5-7 business days. Log in to your Online Account or the Amex App to cancel your Card and order a new one.

You can also Click to Chat with us 24/7 via your Online Account or message us directly in the Amex App.

Contact us immediately if you suspect fraudulent activity on 1300 132 639 (from Australia) +612 9271 8664 (from overseas). Operating hours are 6am – midnight AEST, 7 days a week.

Still looking for your Card? You can temporarily lock/unlock your Card at any time. Your Card will be automatically unlocked after 7 days if you do not permanently cancel it.

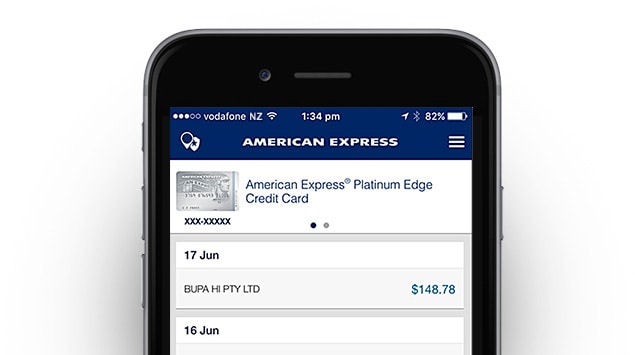

Managing your Account on the go

Use the American Express® Mobile App to manage your Account, view your transaction history, or access AMEX offers any time, at any place.

Seeking a smart, simple way to pay?

Planning to use your Card overseas?

American Express Cards are accepted around the world, so when you’re travelling outside Australia, you know you can always use your Card.

Chip & Pin and Contactless Payments

Chip & PIN and contactless technologies in American Express Cards allow you to make fast and easy payments.

HELLO POSSIBLE

From money-saving ideas to travel inspiration and daily life tips, get inspired to do great things and make your life more rewarding.

What do you want from a Card?

Everyone’s different, so you need a Card that has benefits that best suit your lifestyle.

Choose the Card with benefits that best suit you.

Rewards

Earn Membership Rewards® points from

everyday spending

Frequent Flyer

Maximise rewards for

every trip

Platinum

Enjoy premium

benefits and service

Live life to the fullest with American Express Membership

As an American Express Card Member, you get to enjoy travel benefits that take you further, points that are more rewarding, and services that open more doors around the world.

Want to learn more about Credit Cards?

Understand fees

Some things you should know about Credit Card fees

Your credit limit

Everything you need to know about your Card limit

Interest explained

See how we calculate your monthly interest