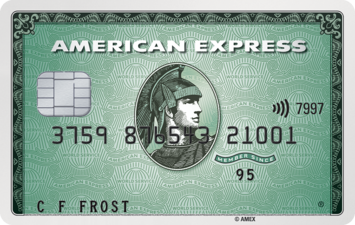

The American Express International

Currency Card

Our Card is available in US dollars or euros so you can pay in a single currency wherever you are in the world. Receive a host of benefits, rewards and experiences on another level.

Including 24/7 Global Assist®, Membership Rewards® and Travel Protection1 to make your trip extra special.

Annual fee US$100 / €100.

Membership Rewards

Your Card is more than just a handy

way to pay. You’ll earn Membership

Rewards points almost every time you

spend to use on anything from flights

to fancy hotels and much more.

Travel Protection

Wherever you are in the world, we’re

right behind you. Your free Travel

Protection covers anything from

delayed flights to travel accidents

(enrolment required).1

24/7 Global Assist

Our Global Assist team are there for

you 24/7. Whether you’ve lost your

luggage, need a lawyer or are laid up

with laryngitis, we’re here to help.

Membership Rewards Programme

Isn’t it great to get a little more? Your American Express International Currency Card is much more than a smart way to pay in euros or dollars. You’ll earn Membership Rewards points on almost all your spend.

Enrolment into the Membership Rewards Programme is free for your first year ($36 / 36 euros thereafter). It’s just our way of saying thank you. Not enrolled into the Membership Rewards Programme yet? Just call the number on the back of your Card.

Whether you’re filling up the car or the fridge, flying to Faro or taking a taxi, you’ll earn one point for every eligible dollar or euro spent.

- Receive 1 point for almost every euro/dollar spend

- Earn points on almost all spend made on Supplementary

Cards (additional Cards you can give to friends and family).

Please note the main Cardholder is liable for all balances on

Supplementary Cards2 - Available in Euro and Dollar

Enrolment into the Membership Rewards Programme is required.

Your points. Your choice. Spend them on travel or new trainers, surprise someone special with a Selfridges gift card. Refresh your wardrobe or upgrade your phone.

Ways to Pay with Points:

- Use points to pay for a transaction as soon as it appears on

your statement - Travel with points – from booking and flying to lounging and

exploring, use your points every step of the way when you

pay at American Express Travel - Transfer points to participating travel and hotel loyalty

programmes - Redeem points for gift cards

- Donate to charities

Travel protection when you need it

Whether you’re fishing in the Forth or relaxing in Rio, your American Express Card comes with some handy travel protection cover. So if you trip up in Tripoli or are delayed in Dehli, we’ve always got your back. Just call us on the number on the back of your Card.

Explore the Travel Protection available on your Card.

- Travel inconveniences

- Personal accident whilst on a trip

For UK applicants the Travel Protection benefit is subject to enrolment.1

There are exclusions in your American Express travel insurance policy which cannot be varied or removed. Age limitations and pre-existing conditions apply. For more information please see full terms and conditions.1

Wherever in the world you are, our 24/7 Global Assist service has your back. So if you’ve broken a bone or had a run in with the local law, our team are here with advice, support and even emergency cash.

We’re here to assist you whenever you need us including:

- 24-hour medical advice

- Local specialists

- Urgent dispatch

- Legal support

- Emergency cash

To contact the Global Assist helpline call +44 (0) 20 3126 4113

(24 hours).

Explore some other great Card benefits

Your Card allows you financial flexibility with longer to settle your bill, and there’s lots of ways to enjoy more rewards when you add friends and family members to your Account.

Whatever the currency and location of your purchases, you have the convenience of a single monthly settlement in euros or US dollars.

Share the perks and privileges of your Card with someone close to you.

Supplementary Cards will also be in euros or US dollars depending upon the currency of your main Card Account. Please note the main Cardholder is liable for all balances on Supplementary Cards.2

World class service

Your Card is backed by world-beating service from our American Express Customer Services team. For questions and Account queries, Supplementary Cards or stolen Cards, or if you just want to check your travel protection, we’re here for you 24/7, 365 days a year.

From lost Cards to lost luggage, checking your Account to checking in to hospital, American Express Customer Services are here for you all day and every day.

Call us for help with:

- Supplementary Cards

- Account queries

- Lost or stolen Cards

- Travel protection benefits