Here’s what you need to know about

Credit Card interest.

What is Credit Card interest?

When you pay by Credit Card, you’re borrowing money, and you’ll be charged interest unless you repay the full closing balance by the statement due date, or within your Credit Card’s interest free period.

How does Credit Card Interest work and when is it charged?

The amount of interest you’ll be charged depends upon:

- The interest rate of your Credit Card

- The amount you spend

- When you spend it

- When you pay your Credit Card bill

Most Credit Card holders can avoid Credit Card interest payments by paying off their full balance each month. But if you pay anything less, such as the minimum payment, you will incur interest on outstanding balances, as well as any previously charged interest. Details of your purchases and the amount of interest you’ve been charged will be clearly displayed in your Credit Card statements.

How is interest calculated?

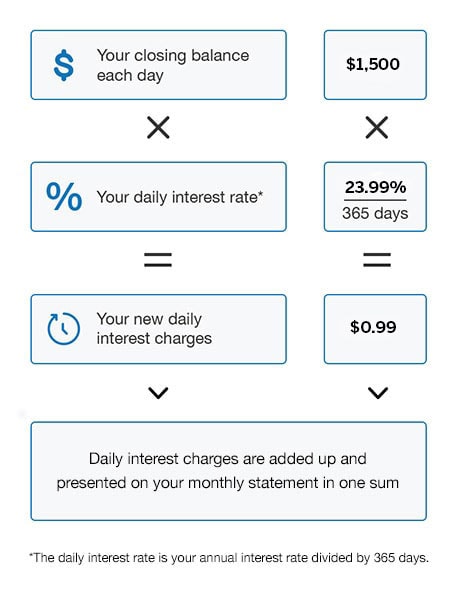

Interest is applied to your closing balance at the end of each day and then totaled up to calculate your monthly statement balance1.

What is a Credit Card interest free period?

The Credit Card interest free period, or ‘interest free days’, refers to the time between purchasing something with your Credit Card and when interest is applied to that purchase. Depending on your Card, this can be up to 25 days following the end of your statement period.

To get the most from your Credit Card's interest free days, make your purchase on the day a new statement period begins and pay the closing balance by the due date shown on your statement.

In the example below, the Credit Card has up to 55 interest free days and assumes that the previous two months’ balance has been paid in full.

1 Jan

Statement period begins

Your 30-day cycle begins from today

10 Jan

You make a purchase

You have 45 Interest Free Days to pay for this purchase

30 Jan

Statement period ends

It's been 30 days since the statement period began. You now have 25 days to pay your closing balance.

31 Jan

New statement period begins

24 feb

Payment due date

Your Interest Free Days end now. Pay your closing balance to avoid being charged interest on your unpaid balance from the due date.

How does interest differ between Credit Cards and Charge Cards?

The key difference is that Charge Cards require you to repay the full closing balance of the statement each month, meaning no interest is charged on your purchases. However, a fee will be charged if the closing balance is not paid in full by the due date. On the other hand, a Credit Card allows you to repay your balance over time by making the minimum payment each month, with interest applied to the unpaid balance. A late payment fee will apply if you don’t meet your minimum monthly repayment obligation.

What are the benefits of having a low interest rate Card?

- If you choose to carry a balance from month to month, a low interest rate Card helps reduce your cost of borrowing.

- With less interest charged, you can pay down your balance sooner.

- Allows you to enjoy a low ongoing interest rate for any unpaid balance.

- Statement period: The period in which the transactions reported on your statement relate to. Generally, your statement period will be every 30 days, the actual dates can vary slightly from month to month.

- Interest: When you use your Credit Card, you will be charged interest unless you repay the full closing balance by the statement due date. Interest will be expressed as an annual percentage rate.

- Interest free days: Interest free days are the time from when you buy something using your Credit Card to when interest is applied to that purchase.

- Repayments: When your statement arrives, you can pay off the entire closing balance on, or before, the statement due date, – in which case you’ll avoid paying interest. You also have the option of paying the minimum payment, however you will be charged interest on the unpaid balance.

- Closing balance: The amount you owe at the end of a statement period.

Pay off your balance in monthly instalments

Plan It™ Instalments offers you a flexible way to pay off your Credit Card balance in equal monthly instalments, with 0% p.a. interest and a fixed monthly fee*. It’s already on your Card, so you can keep buying wherever you normally shop and pay later in instalments.

- You can create an Instalment Plan as long as your account is in good standing. We may limit the amount that can be transferred to an Instalment Plan.

- Each Instalment Plan will begin from the date it is successfully created, as communicated to you in your Online Account.

- Payment of your first Monthly Instalment will be due in your next payment cycle.

- You will be charged a Monthly Plan Fee for each Instalment Plan created.

- This fee will be charged each month your Instalment Plan is active and will be notified to you before you create the Instalment Plan.

- View the full Plan It™ Instalment Terms and Conditions here.

What do you want from a Card?

Everyone’s different, so you need a Card that has benefits that best suit your lifestyle.

Choose the Card with benefits that best suit you.

Rewards

Earn Membership Rewards® points from

everyday spending

Frequent Flyer

Maximise rewards for

every trip

Platinum

Enjoy premium

benefits and service

Live life to the fullest with American Express Membership

As an American Express Card Member, you get to enjoy travel benefits that take you further, points that are more rewarding and services that open more doors around the world.

Want to learn more about Credit Cards?

Applying for a Card

Everything you need to know about making an application

Your credit limit

Everything you need to know about Credit Card limits

Understand fees

Some things you should know about Credit Card fees

Life with Amex

From money-saving ideas to travel inspiration and daily life tips, get inspired to do great things and make your life more rewarding.

1. Credit Card Interest. Refer to your Card Member Agreement for a full breakdown of how interest is calculated.