Access granted

Discover how your Marriott Bonvoy® Business American Express®* Card can help transform how you do business – from special benefits at luxurious properties worldwide to business management tools and more.

The Marriott Bonvoy program unlocks a world of rewards for you and your business – from distinguished stays to unforgettable experiences and more

Earn points

Earn 5X the points

for every dollar in eligible Card purchases at participating Marriott Bonvoy properties1

Earn 3X the points

for every dollar in Card purchases on eligible gas, dining and travel1

Earn 2X the points

for every dollar in Card purchases

everywhere else1

Use the calculator to find out

the earning potential of your eligible expenses.

*This calculator is for general illustration purposes only and does not reflect returns, credits or adjustments.Your actual Marriott Bonvoy points earned may differ. Amounts shown are based on equal monthly purchases over 12 months at an earn rate of 3 points for every $1 in eligible gas, dining and travel, and 2 points for every $1 in eligible spend on all other Card purchases. Refer to the Program Terms and Conditions for more details including restrictions.

Redeem points

Free nights at extraordinary destinations

Redeem points at over 10,000 of some of the world’s most luxurious hotels and resorts around the globe – with no blackout dates.2

Frequent flyer flexibility

Transfer points to frequent flyer programs with a wide selection of the world’s leading airline.3 Get 5,000 bonus miles from most airlines when you transfer 60,000 points to a frequent flyer program.4

Rewards beyond travel

Put your points to work for you and your business. Redeem points for gift cards or merchandise5 to use for employee incentives, client gifts or a personal pick-me-up for achieving a major milestone.

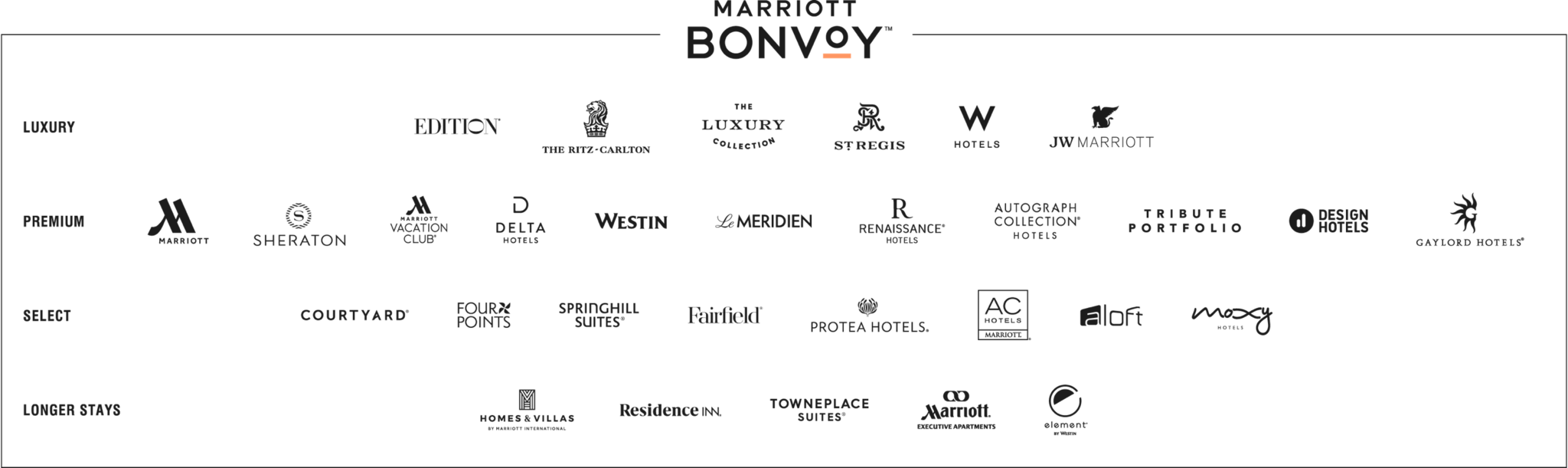

Over thirty distinct brands include The Ritz-Carlton®* and The Ritz-Carlton Reserve®*, St. Regis®*, W®*, EDITION®*, JW Marriott®*, The Luxury Collection®*, Marriott Hotels®*, Westin®*, Le Méridien®*, Renaissance®* Hotels and Sheraton®*.

Annual Extras, automatic upgrades and more

Annual Free Night Award6

Receive an Annual Free Night Award at participating hotels and resorts worldwide for a room with a redemption value of up to 35,000 points each year after your anniversary.

Marriott Bonvoy Elite status

Get automatically upgraded to Silver Elite status, with access to priority late checkout, 10% bonus points on stays, complimentary Wi-Fi and more 7. Easily upgrade to Gold Elite status when you reach $30,000 in purchases each year.8

Extra Elite Night Credits

Receive 15 Elite Night Credits that you can use towards attaining the next level of Elite status in the Marriott Bonvoy program.9

More Possibilities to Earn

Marriott Bonvoy members earn 10 points for every eligible US dollar spent at over 7,000 participating hotels and resorts. This is on top of any points you get through your Marriott Bonvoy Business American Express Card.

Discover Marriott Bonvoy Moments™

Use your points to bid on access to once-in-a-lifetime experiences. It’s the ultimate reward for all your hard work. Marriott Bonvoy Moments includes unforgettable opportunities like meet-and-greet with A-list artists and athletes, backstage concert passes, pro golf clinics and more.

Leverage Marriott Bonvoy™ Meeting & Event Planning

Marriott makes it easy to search for meeting venues, compare rates and availability, submit proposal requests and get every detail right - all while earning you points. One-stop booking online anytime at participating hotels in the U.S. and Canada.

1. Account must be in good standing. You will earn five (5) Marriott Bonvoy points from American Express for every $1 of eligible purchases (less credits and returns) charged on your Marriott Bonvoy Business American Express Card when charged directly with participating Marriott Bonvoy properties, standalone Marriott Bonvoy retail establishments, and Marriott Bonvoy online stores (including online purchases of Marriott Bonvoy gift cards), that in each case, are owned or managed by Marriott International, Inc. and its affiliates. You can earn three (3) points for every $1 in eligible purchases charged on your Marriott Bonvoy Business American Express Card at American Express retail merchants as follows: (i) at stand-alone automobile gasoline stations in Canada; (ii) restaurants, quick service restaurants, coffee shops and drinking establishments in Canada; and (iii) for travel services or travel bookings including air, water, rail and road transport, but not including local and commuter transportation, and lodging. Purchases at merchants where travel sales are not their primary business (including general merchandise retailers) do not qualify for the earn rate in this category. Merchants are typically assigned codes and categorized based on what they sell. Earn rate of two (2) points for every $1 applies when the merchant code is not in an eligible category, using a payment account or service of a third party, a card reader attached to a mobile phone or online retailer that \ sells goods of other merchants or the merchant category is otherwise not identified. Points will be earned on the amount of all eligible purchases, less credits and returns. Funds advances, interest, balance transfers, Amex cheques, annual fees (if applicable), other fees, and charges for travellers cheques and foreign currencies are not purchases and do not qualify for points.

2. Free nights apply to standard rooms only as defined by each participating property; contact the property before booking to check availability. To view the full terms and conditions, visit marriottbonvoy.com/terms.

3. Transfer ratios, minimum requirements, and maximums vary by airline. To view the full terms and conditions, visit marriottbonvoy.com/terms.

4. 5,000 bonus miles is awarded only when 60,000 points are transferred as part of the same transaction and is based on airlines with a 3 points to 1 mile conversion rate. Other terms and restrictions apply. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

5. In most cases gift cards, gift certificates, and merchandise awards are available to members who have a mailing address in the U.S. or Canada and are redeemable at websites and/or locations within the U.S. and Canada. To view the full terms and conditions, visit marriottbonvoy.com/terms.

6. Each year starting after your first year of Card membership, 8-10 weeks after your annual reset date, you will earn an Annual Free Night Award redeemable within 1 year from issuing for an available single or double occupancy standard room at participating Marriott Bonvoy properties with a room rate of up to 35,000 points, inclusive of room rate and applicable taxes but exclusive of resort fee. Account must be in good standing. To view the full terms and conditions, visit marriottbonvoy.com/terms.

7. Based on availability. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

8. Each year if, before the annual reset date based on your Card anniversary, you reach $30,000 in net purchases charged to your account, or after you stay 10 qualifying paid nights within one calendar year and combine these nights with 15 Elite Night Credits from your Card, you will earn Marriott Bonvoy Gold Elite status in the Marriott Bonvoy program for a minimum of 1 year (unless you are already enrolled at that or a higher level). Account must be in good standing. On the annual reset date, the amount of annual net purchases resets to zero. Gold and Silver Elite Benefits are subject to the terms and conditions of the Marriott Bonvoy program available at marriottbonvoy.com/terms. If you already have Gold Elite status or higher status in the Marriott Bonvoy program, you will retain that status as long as you meet the requirements specified in the Marriott Bonvoy terms and conditions.

9. To be eligible to receive the 15 Elite Night Credits with this Card, you must be the Basic Cardmember, your Card Account must be in good standing at the time of the 15 Elite Night Credit deposit, and you must have an active Marriott Bonvoy program account. To receive the 15 Elite Night Credit deposit, your Card Account must be linked to a Marriott Bonvoy program account in your name. You will receive a maximum of 15 Elite Night Credits per calendar year even if you have more than one Marriott Bonvoy Consumer or Small Business credit card account or have more than one Marriott Bonvoy program account. American Express is not responsible for fulfillment of this benefit. It will take approximately 8 weeks from Card Account approval date for the credits to be applied to your loyalty account. Your 15 Elite Night Credits for subsequent years will then be deposited on or before March 1 of each subsequent calendar year.

§ The Marriott Bonvoy program is operated by or on behalf of Marriott International, Inc. and is subject to terms, conditions and restrictions. For details, please see marriottbonvoy.com/terms.

®*: Used by Amex Bank of Canada under license from American Express.

TM; ®: 2025 Marriott International, Inc. All Rights Reserved. All names, marks and logos are the trademarks of Marriott International, Inc., or its affiliates, unless otherwise noted.

Gain more control over your business with a suite of management tools

Payment Flexibility with Plan It®

Built right into your card, you can split large purchases into smaller mangeable monthly installments for a fixed fee1 and no additional interest with Plan It.

Take advantage of Plan It to help spread out business expenses to better match your cashflows – from new tech to marketing expenses.

Dedicated Business Specialists

Get information about Card benefits or online account management from specially trained Business Service Representatives. Simply call the number on the back of your Card and enter your Card number to reach a business specialist.

Reward your key employees with the type of freedom and benefits that can come with a Supplementary Card on your account.

- Manage your expenses more efficiently with one statement showing all charges separated by Card

- Earn Marriott Bonvoy points on all Supplementary Card purchases

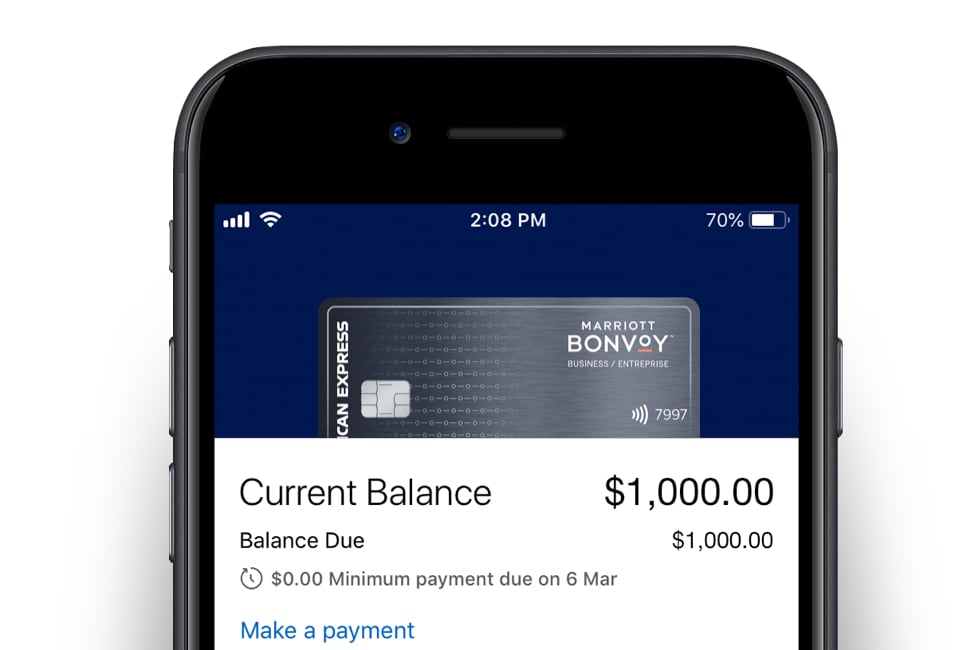

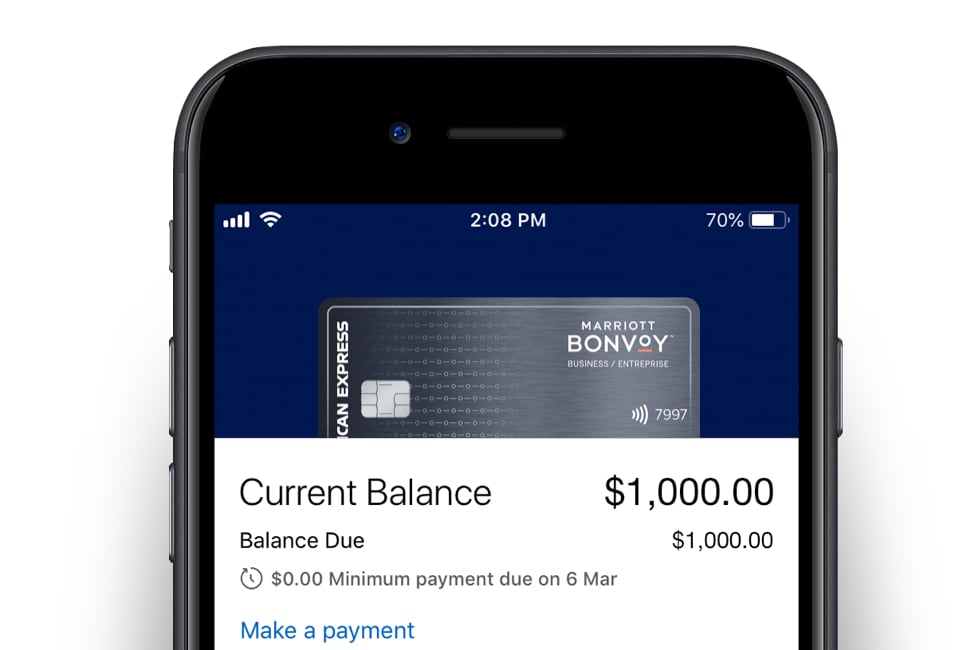

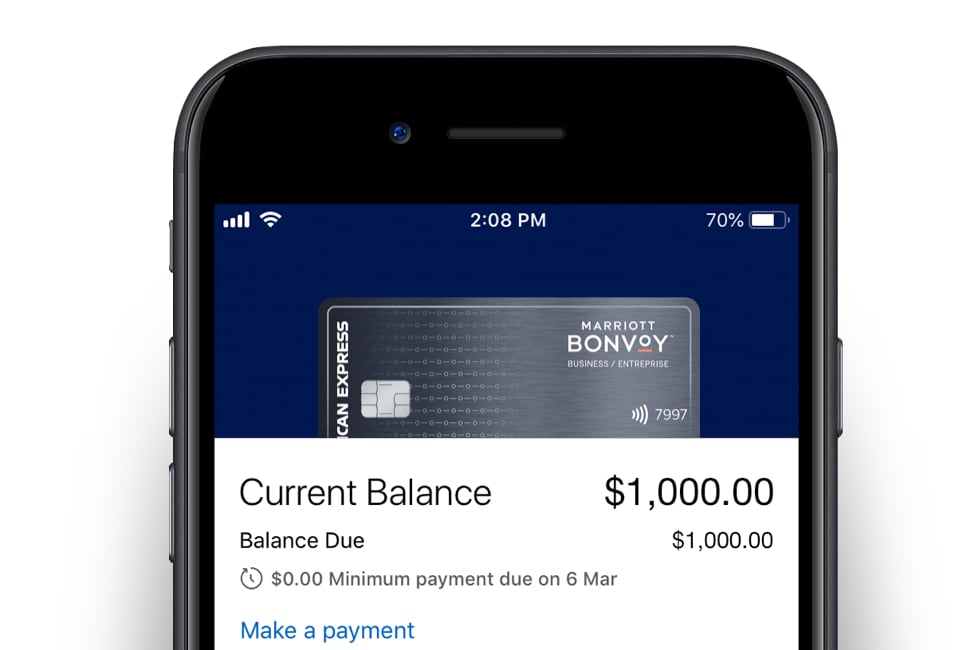

Online Services lets you take care of business anytime, anywhere

Get fast, safe access to your account

information. It’s easy to set up so you can:

- View your current balance

- Register for text message and e-mail Account Alerts3

- Get online-only statements

- Update your contact details

- Make a payment

Access online expense

management reports and benefit from:

- The convenience of simpler tax preparation

- The ability to sort by vendor or spend category

- The ability to separate personal expenses from business expenses

- The flexibility to track and manage expenses more easily

1. When you create an installment plan, you will be charged a monthly installment fee. The monthly installment fee percentage will be disclosed to you during plan creation. This is not a promotional or special rate offer. The fee charged is comparable to the interest you would have paid if you carried this balance on your account, without being in an installment plan. In order to create a new installment plan, your account must be in good standing and you must have a minimum $100 purchase or statement balance on your eligible card. Please see the Plan It (American Express Installment Program) section in your Cardmember Agreement or the program Terms and Conditions for more details. Plan It is currently not available in Quebec, Nova Scotia, PEI or Nunavut.

2. Maximum of 99 Supplementary Cards per account. Supplementary Card applicant must be the age of majority. Supplementary Cards have an annual fee of $50 each.

3. Account Alerts is a free service for American Express Cardmembers. However, your mobile phone service provider may apply fees for incoming text messages. Please contact your provider for further details.

§ The Marriott Bonvoy program is operated by or on behalf of Marriott International, Inc. and is subject to terms, conditions and restrictions. For details, please see marriottbonvoy.com/terms.

TM; ®: 2025 Marriott International, Inc. All Rights Reserved. All names, marks and logos are the trademarks of Marriott International, Inc., or its affiliates, unless otherwise noted.

TM*, ®: Used by Amex Bank of Canada under license from American Express.

Manage your account on the go

Use the American Express® App to keep track of your everyday business transactions from virtually anywhere.

From the best seats in the house to special offers for you and your business, discover how your Card can help make any moment unforgettable

Amex ExperiencesTM

Get access to Front Of The Line® Amex Presale Tickets™1 and Amex Reserved Tickets™1 to some of the most in-demand concerts, theatre productions, and special events often before the general public.

- Front Of The Line® Amex Reserved Tickets™1

- Front Of The Line® Amex Presale Tickets™1

- Front Of The Line® Emails

Find all your Card offers in one place with Amex Offers2

Log in to Online Services or the American Express® App to see all of your tailored offers, including merchant offers and special savings for your business.

With Amex Offers, you can:

- See and filter your offers

- Save offers to your Card easily so they’re ready to use

- Use your location to find offers available nearby3

- Track all your saved offers so you know when they expire

1. Purchase must be charged in full to an American Express Card. Subject to availability and to event and ticketing terms, restrictions, verification procedures and fees. Tickets and packages may not be transferable and should not be resold. No refunds and no exchanges subject to merchant's obligations under applicable law.

2. Eligible cards will vary by offer and are subject to change. Select Canadian American Express Cards issued by Amex Bank of Canada or another participating American Express card issuer other than Amex Bank of Canada (as applicable) are eligible cards for the offer. The following cards are not eligible: American Express Corporate Cards, American Express® Gift Cards and Prepaid Cards. Offers are subject to terms and conditions and full program terms.

3. You must enable location services on your mobile device to take advantage of the nearby offers feature on the Amex App. For Online Services, nearby locations are based on your billing postal code.

§ The Marriott Bonvoy program is operated by or on behalf of Marriott International, Inc. and is subject to terms, conditions and restrictions. For details, please see marriottbonvoy.com/terms.

TM; ®: 2025 Marriott International, Inc. All Rights Reserved. All names, marks and logos are the trademarks of Marriott International, Inc., or its affiliates, unless otherwise noted.

®: Used by Amex Bank of Canada under license from American Express.

Special programs and offers for your business – at your fingertips

With the American Express® App, you’ll always be the first to know about exclusive offers or new ways to take advantage of your benefits.

Because you’re focused on moving your business forward, you can feel confident knowing assistance is always close at hand

Travel Coverage

You can be covered up to $500,000 of Accidental Death and Dismemberment Insurance when you fully charge your common carrier (plane, train, ship or bus) tickets to your Marriott Bonvoy Business® American Express®* Card.

You could be covered in the event of the theft, loss, and/or damage of your rental car with a Manufacturer’s Suggested Retail Price of up to $85,000 for rentals of 48 days or less. To use this protection, be sure to charge the full cost of your rental to your Card and decline the Collision Damage Waiver, Loss Damage Waiver, or similar option offered by the rental agency.

Coverage for when your flight is delayed or you are denied boarding for up to 4 hours or more and no alternate transportation is made available. When you charge your airline tickets to your Card, you could receive up to $500 (combined maximum with Baggage Delay Insurance) for necessary and reasonable accommodations, restaurant expenses, and essential items purchased within the period of the flight delay or denied boarding.

Coverage for when your checked baggage is delayed for 6 hours or more. When you charge your airline tickets to your Card, you could receive up to $500 (combined maximum with Flight Delay Insurance) for reasonable and necessary emergency purchases for essential clothing and other items within four days of arrival at your destination.

When you charge your airline tickets to your Card, you could be covered for up to $500 per trip for all insured person(s) combined if your checked or carry-on baggage and personal effects are lost or damaged while in transit.

When you charge your accommodations to your Card, you could receive up to $500 in coverage against the loss of most personal items (excluding cash) if your accommodation is broken into.

Eligible Cardmembers can access out-of-town worldwide emergency medical assistance services and legal referrals by phone, 24/7/365.

Business Coverage

Your business may be covered for eligible unauthorized charges made by your employees on your Card Account if you terminate the employee and cancel their supplementary Card within 2 business days. This benefit is created specifically for business owners and provides up to $100,000 of coverage per Cardmember if an employee misuses their supplementary Card.

Purchase Coverage

This coverage could extend the manufacturer’s warranty up to one additional year when you charge the entire purchase price of an eligible new item to your Card.

When you charge eligible items to your Card, you could be insured for 90 days from the date of purchase in the event of accidental physical damage or theft for up to $1,000 per occurrence (even if the occurrence involves more than one insured item).

Card Safety & Security

Lost, stolen or simply misplaced – it doesn’t matter what happened, we’ll arrange for a new Card as quickly as possible.

Use your Card online or offline, and you won't be held responsible for any fraudulent charges, as long as you've taken reasonable care to protect your account details and PIN.

† All insurance coverage is subject to the terms and conditions of their respective master policies. Certain limitations, exclusions and restrictions apply. Please read your Certificates of Insurance carefully.

Visit the Online Claims Portal to submit a claim for Buyer’s Assurance, CDW (Car Rental Theft & Damage Insurance) & Purchase Protection Insurance.

For all other claims, visit the Travel Insurance Claims Center.

1. Underwritten by Chubb Life Insurance Company of Canada (“Chubb Life”). Use your Card to book tickets for your spouse, dependent children (under 23) or any Supplementary Cardmember and they can also be covered. Spouse and dependent children (under 23) of Supplementary Cardmembers can also be covered. You may contact the insurer at 1-877-777-1544 in Canada or visit www.chubb.com/ca

2. Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

3. This is not an insurance. Costs associated with any out-of-pocket expenses related to your Travel Emergency Assistance inquiry are your responsibility. Services will be provided as permitted under applicable law and must be authorized and arranged by AXA Assistance.

4. This product is administered by Belair Insurance Company Inc.

5. Use the American Express Card online or off, and you won't be held responsible for any fraudulent charges, as long as you've taken reasonable care to protect your account details and PIN. Notify us at once if your Card is lost or stolen, or you suspect it is being used without your permission.

§ The Marriott Bonvoy program is operated by or on behalf of Marriott International, Inc. and is subject to terms, conditions and restrictions. For details, please see marriottbonvoy.com/terms.

®: 2025 Marriott International, Inc. All Rights Reserved. All names, marks and logos are the trademarks of Marriott International, Inc., or its affiliates, unless otherwise noted.

®*: Used by Amex Bank of Canada under license from American Express.

Secure, easy account access wherever business takes you

Use the American Express® App to manage your account, check your balance and track your transactions.

We’re here whenever you need us

24/7 Customer Service

1-888-721-1046

Marriott Bonvoy Personal Service

marriottbonvoy.com/support

International

(905) 474-1271

(Please call collect)