Help protect your business

with Platinum

Feel more confident knowing help is close at hand with Business Platinum.

Get Platinum level protection

Click any of the icons below to view the different coverages or scroll down to see more.

Travel Coverage

You could be protected with up to $5,000,000 of coverage for eligible emergency medical expenses incurred (if under age 65) within the first 15 consecutive days of covered travel outside your province or territory of residence.

Call the number below if you need medical assistance when travelling. Self-managing your treatment may impact your insurance claim.

Toll-free from the US & Canada: 1-800-243-0198

Collect worldwide: +905-475-4822

Coverage for the non-refundable and non-transferable portion of travel arrangements charged to your Business Platinum Card before your departure date if you cancel your trip for a covered reason. You could be covered for up to $1,500 per insured person per trip, to a maximum of $3,000 for all insured persons combined.

Coverage for the non-refundable and non-transferable unused portion of travel arrangements charged to your Card before your departure date if your trip is interrupted or delayed for a covered reason. You could be covered for up to $1,500 per insured person per trip, to a maximum of $6,000 for all insured persons combined.

Eligible Cardmembers can access out-of-town worldwide emergency medical assistance services and legal referrals by phone, 24/7/365.

You can be covered up to $500,000 of Accidental Death and Dismemberment Insurance when you fully charge your common carrier (plane, train, ship or bus) tickets to your Business Platinum Card.

You could be covered for the theft, loss, and/or damage of your rental car with a Manufacturer’s Suggested Retail Price of up to $85,000 for rentals of 48 days or less when you charge the full cost of your rental to your Card. To use this coverage, simply decline the Collision Damage Waiver, Loss Damage Waiver, or similar option offered by the rental agency.

When your checked or carry-on baggage and personal effects are in transit, this coverage could protect you for loss or damage up to $1,000 per trip for all insured person(s) combined if you charge your airline tickets to your Card.

Coverage for when your checked baggage is delayed for 6 hours or more. When you charge your airline tickets to your Card, you could receive up to $1,000 (combined maximum with Flight Delay Insurance) for reasonable and necessary emergency purchases for essential clothing and other items within four days of arrival at your destination.

Coverage for when your flight is delayed or you are denied boarding for up to 4 hours or more and no alternate transportation is made available. When you charge your airline tickets to your Card, you could receive up to $1,000 (combined maximum with Baggage Delay Insurance) for necessary and reasonable accommodations, restaurant expenses, and essential items purchased within the period of the flight delay or denied boarding.

When you charge your accommodations to your Card, you could receive up to $1,000 in coverage against the loss of most personal items (excluding cash) if your accommodation is broken into.

Business Coverage

Your business may be covered for eligible unauthorized charges made by your employees on your Card Account if you terminate the employee and cancel their supplementary Card within 2 business days. This benefit is created specifically for business owners and provides up to $100,000 of coverage per Cardmember if an employee misuses their supplementary Card.

Purchase Coverage

This coverage could extend the manufacturer’s warranty up to one additional year when you charge the entire purchase price of an eligible new item to your Card.

When you charge eligible items to your Card, you could be insured for 90 days from the date of purchase in the event of accidental physical damage or theft for up to $1,000 per occurrence (even if the occurrence involves more than one insured item).

You could be covered for up to $1,500 per insured person in the event of the theft, loss, or accidental damage of your mobile device anywhere in the world. Simply charge or finance the eligible device to your Card. Coverage begins on the date of the first transaction related to the purchase, or on the 91st day following the purchase (to avoid overlap with the 90-day coverage available to you under your Purchase Protection® Plan) and lasts for a maximum of 2 years from the date of purchase.

Card Safety and Security

Lost, stolen, or simply misplaced – it doesn’t matter what happened, we’ll arrange for a new Card as quickly as possible..

Use your Card online or offline, and you won't be held responsible for any fraudulent charges, as long as you've taken reasonable care to protect your account details and PIN.

†: All insurance coverage is subject to the terms and conditions of their respective master policies. Certain limitations, exclusions and restrictions apply. Please read your Certificates of Insurance carefully.

Scan this

QR Code

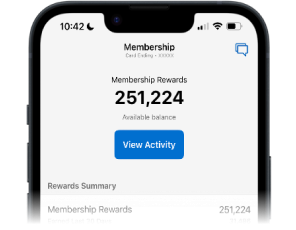

View your points

anytime, anywhere

Use the American Express® App to manage your account, check your balance and keep track of your everyday business transactions from virtually everywhere.

We’re here whenever you need us

24/7 Customer Service

Call 1-888-721-1044

(Press 1)

Platinum Card Travel Service

Call 1-888-721-1044

(Press 2)

Concierge

Call 1-888-721-1044

(Press 3)

International

Call (905) 474-1229 collect

- Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

- This is not an insurance. Costs associated with any out-of-pocket expenses related to your Travel Emergency Assistance inquiry are your responsibility. Services will be provided as permitted under applicable law and must be authorized and arranged by AXA Assistance.

- Underwritten by Chubb Life Insurance Company of Canada (“Chubb Life”). Use your Card to book tickets for your spouse, dependent children (under 23) or any Supplementary Cardmember and they can also be covered. Spouse and dependent children (under 23) of Supplementary Cardmembers can also be covered. You may contact the insurer at 1-877-777-1544 in Canada or visit www.chubb.com/ca.

- Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

- This product is administered by Belair Insurance Company Inc.

- Fraud Protection Guarantee - Use the American Express Card online or off, and you won’t be held responsible for any fraudulent charges, as long as you’ve taken reasonable care to protect your account details and PIN. Notify us at once if your Card is lost or stolen, or you suspect it is being used without your permission.

®, TM: Used by Amex Bank of Canada under license from American Express.