Uncover the convenience of Flexible Payment Option

When you’re with American Express, you have access to Flexible Payment Option

– a seamless way to manage your expenses on your terms.

Choose your

payment path

With the ease, flexibility, and control of Flexible Payment Option, you get the freedom to pay off your balance over time, on your terms, while still enjoying the same benefits and features of your Card with No Pre-set Spending Limit.1

Ease

As an embedded feature on select Cards, the Flexible Payment Option is always available and instantly accessible. Avoid the effort and uncertainty of applying for a loan and be prepared in case of unexpected expenses or opportunities.

Flexibility

Decide how much you prefer to pay and how quickly your balance is paid off. This gives you flexibility to pay the way that’s most convenient to you and adjust payments to suit your circumstances. Pay your full balance, minimum amount due, or any amount in between2.

Control

You’re in the driver’s seat. Eligible charges will be added to your Flexible Payment Option balance so you can control if and when you carry a balance on your card.

Unexpected Expenses

Maybe your car broke down or an appliance needs replacing. You have the flexibility to make sure they’re covered.

Exciting Opportunities

Plan your dream getaway and make sure you don’t miss out on any exciting opportunities – without disrupting your monthly budget.

Unexpected Expenses

Plan your dream getaway and make sure you don’t miss out on any exciting opportunities – without disrupting your monthly budget.

Unexpected Expenses

Plan your dream getaway and make sure you don’t miss out on any exciting opportunities – without disrupting your monthly budget.

How Flexible Payment

Option works

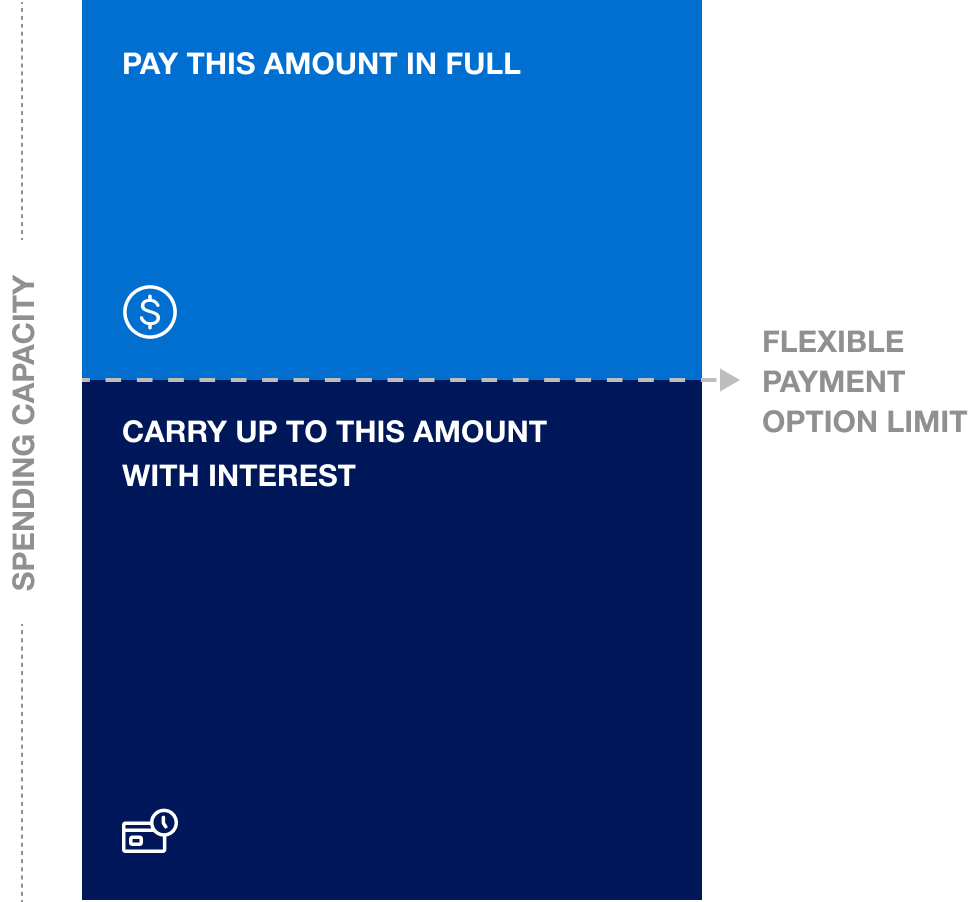

While it allows you to make payments on your terms, there are things to note when it comes to spending capacity and purchases you’re able to cover using Flexible Payment Option.

With Flexible Payment Option, you have No Pre-set Spending Limit.1 This is a unique feature that gives you flexible spending capacity. The amount you can spend adapts based on your purchase, payment, and credit history. If you’re unsure a large purchase will be approved, use the Check Spending Power tool in your online account or Amex App.

While your Card has No Pre-set Spending Limit, there is a limit to the total amount you can pay over time – your Flexible Payment Option Limit*. When you reach your limit, any amount over will be due in full by your new payment due date.

*To view your Flexible Payment Option Limit, log into your online account or the Amex App and click “Balance

Details” on the right of the screen. This is the total amount you can choose to repay over time.

Frequently Asked Questions

Flexible Payment Option is a feature on your Card, which allows you to pay a portion of your balance over time. You can choose to pay your account balance in full, the Minimum Amount Due, or any amount in between.

Flexible Payment Option is easy to use. There is nothing you need to do to enroll or activate it. As you make purchases, eligible charges will be automatically added to your Flexible Payment Option balance up to your Flexible Payment Option Limit. When you reach your Flexible Payment Option Limit, any amount over your limit will be due in full by your new Payment Due Date.

When you receive your monthly statement, you can pay the New Balance on your statement in full, the Minimum Amount Due, or any amount in between. If you choose to pay your total New Balance each month by your new Payment Due Date, you won't be charged interest.

If you do not wish to use the Flexible Payment Option, you can simply pay the total New Balance by the Payment Due Date, as indicated on your statement each month.

Flexible Payment Option allows you to pay a portion of your balance over time.

With Flexible Payment Option, you are always in control. The new feature gives you flexibility with larger purchases, like home improvements, or after a month when the little things add up.

Yes, your ability to earn points will not be impacted by the Flexible Payment Option. You will earn points, regardless of whether you pay in full or choose to carry a balance, as long as you pay at least the Minimum Amount Due by your new Payment Due Date.

Each month, you can pay your statement balance in full, the Minimum Amount Due or any amount in between by the new Payment Due Date. All charges not included in your Flexible Payment Option balance must be paid in full. You will only be billed interest if you pay less than the total New Balance on your statement. If you pay in full each month by the Payment Due Date, you will not be billed any interest.

Your monthly statement will now include additional details such as your Flexible Payment Option Limit, Minimum Amount Due, and new Payment Due Date.

You need to pay at least the Minimum Amount Due by the new Payment Due Date shown on your monthly statement.

If you are currently enrolled in the Pre-Authorized Payment program, your payment amount will not change and will remain set to New Balance, which means you will be paying your statement balance in full.

If you wish to take advantage of Flexible Payment Option, you can visit the Pre-Authorized Settings page on your Online Account to change your automatic payment setting.

Please refer to your monthly statement for your Flexible Payment Option balance annual interest rate.

Your Flexible Payment Option Limit is the maximum amount you can choose to repay over time. This limit is different from the amount you can spend on your Card. You can find your Flexible Payment Option Limit on your Amex App, Online Account or on your billing statement. Any charge that causes your balance to exceed your Flexible Payment Option Limit will be due in full by your next statement’s Payment Due Date.

Flexible Payment Option does not impact how much you can spend on your Card. Your Card has No Pre-set Spending Limit unless communicated to you otherwise.

No Pre-set Spending Limit means your spending limit is flexible. Unlike a traditional credit card with a set limit, the amount you can spend adjusts based on factors such as your purchase, payment, and credit history.

- As a charge Card, there is No Pre-set Spending Limit. No Pre-set Spending Limit on purchases does not mean unlimited spending. Your purchases are approved based on a variety of factors, including your credit history, account history, and personal resources. Proof of resources and security may be required.

- This charge Card has both Due in Full and Flexible Payment Option balances. All Due in Full balances must be paid each month. Interest rate of 30% applies to each delinquent Due in Full charge. This rate is effective from the day account is opened. The Preferred rate of 21.99% applies to your Flexible Payment Option balance. If you have 2 separate Missed Payments in a 12 month period, the Flexible Payment Option rate for your account will be 25.99%. If you have 3 or more separate Missed Payments in a 12 month period, the Flexible Payment Option rate will be 29.99%. These rates are effective from the day the Flexible Payment Option is first available on your account. If you are an existing Cardmember, please refer to your statement for more details on Annual Interest rates for Flexible payment option & Due in full balances.