Enhance your Membership with Rewards Checking*

Apply for an online checking account with no fee to open, no monthly fees, and no minimum balance requirements.†

*We are currently accepting applications from Card Members with a U.S. Basic Consumer Card issued by American Express National Bank with 3+ months tenure. Current and prior American Express Business Checking customers are not eligible to apply at this time.

High Interest

Earn a null% APY —10X higher than the national rate.†

Debit Card Rewards

Earn Membership Rewards® points on eligible Debit Card purchases.†

No Monthly Fees

No fee to open, no minimum deposit, and no monthly fees.†

Backed by Amex

24/7 world-class customer service and fraud monitoring.

Modern digital tools designed for your day-to-day

Manage your account from anywhere and more

Mobile Check Deposits: The Amex® App makes mobile deposits simple – just take pictures with your smartphone.†

Digital Transfers: It’s simple to connect your existing bank accounts, so you can transfer money when you need to from an eligible account that's connected, including the American Express® High Yield Savings account.

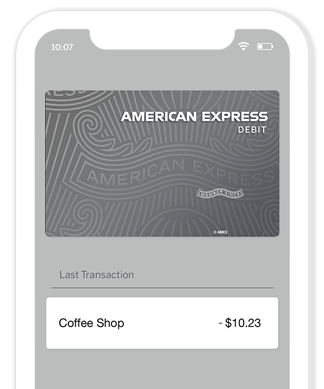

Digital Wallet: Add your American Express® Debit Card to your digital wallet to make fast and convenient payments in store and online.†

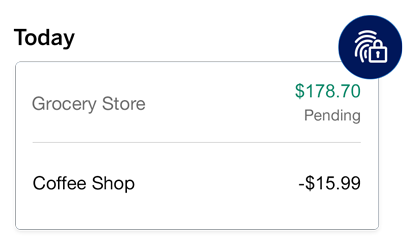

Shop with more confidence using your Debit Card

Zero Liability Fraud Protection: You won't be held responsible for fraudulent charges on your Debit Card that you report promptly.†

Purchase Protection1: Purchase Protection is an embedded benefit of your American Express Debit Card. The benefit requires no enrollment and is provided at no additional charge. It can help protect Covered Purchases made on your Eligible Card against accidental damage or theft, for up to 90 days from the Covered Purchase date. Coverage Limits Apply. Please read important exclusions and restrictions to see if your item is eligible for coverage

1Purchase Protection is underwritten by AMEX Assurance Company, Phoenix, AZ. Subject to additional terms, conditions and exclusions. For Terms and Conditions, see americanexpress.com/PPterms. If You have questions please call Us at 1-800-228-6855, if international, collect at 1-303-273-6498.

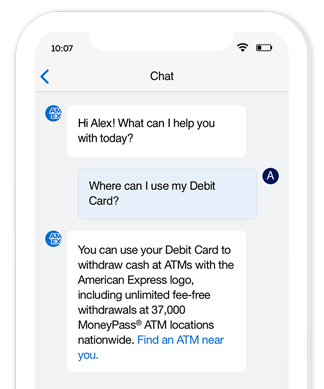

Help that’s reliable and available

Customer Care Professionals are a call or a click away. Access our 24/7 world-class customer service online or over the phone, or get real-time, personal support via Chat.

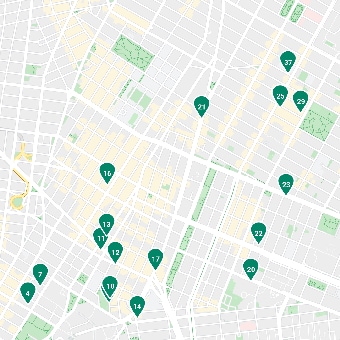

Do more with your American Express® Debit Card

ATM: You can enjoy unlimited fee-free withdrawals at 70,000+ Allpoint® and MoneyPass® ATM locations nationwide.† Visit our ATM locator to find an ATM in your neighborhood.

Contactless Payments: Look for the contactless symbol when you check out using your American Express® Debit Card so you can tap, pay, and be on your way.†

Frequently Asked Questions

Have other questions? Get more answers by reviewing our full list of FAQs.

High interest online checking for Members

† Terms and Conditions

- The Annual Percentage Yield (APY) as advertised is accurate as of 4/23/2024. APY is subject to change at any time without notice before and after a Rewards Checking Account is opened. Please see the Consumer Deposit Account Agreement and Rewards Checking Schedule for additional terms. Transaction fees may reduce APY. APY rate compared to national deposit rate from the FDIC's published Monthly Rate Information for Interest Checking deposit products. FDIC national rate is calculated as the simple average of interest rates paid by US FDIC-insured depository institutions and branches for which data is available. This national deposit rate reflects APY paid on a variety of interest-bearing checking accounts with terms, services and limitations that may differ. See the FDIC Website for details.

- iOS and Android only. See app store listings for operating system info.

- At Allpoint® and MoneyPass® locations in the U.S., you can withdraw cash and get account information with no fee. Access to ATMs outside of the Allpoint® and MoneyPass® network are subject to fees by the ATM owner and/or network. ATM withdrawal limits apply. American Express applies foreign exchange fees to withdrawals in foreign currencies. American Express does not accept ATM cash deposits into your Rewards Checking account at this time. Visit americanexpress.com/rewardscheckingterms for more information and americanexpress.com/rewardscheckingfeefreeatm/ to find participating ATMs in the U.S.

- Contactless payments are accepted at participating merchants only.

- Digital wallets are Apple Pay® and Google Pay™.

- When you open an American Express® Rewards Checking Account you will also receive a Membership Rewards® Account (a Rewards Account), in which you will earn one Membership Rewards point for every two dollars of eligible Debit Card purchases. Eligible Debit Card purchases are purchases of goods or services, minus returns and other credits, for anything except: cash withdrawals, cash equivalents, person-to-person transactions, purchases of traveler’s checks, American Express Gift Cards bought online, purchases or reloading of prepaid cards, and foreign exchange fees and fees for account services. You can redeem Membership Rewards points for a deposit into your checking account. Visit membershiprewards.com/pointsinfo to learn what other redemption options may be available. If you also have a Rewards Account in connection with a Card Account, your Rewards Accounts can be linked and you will have access to all redemption options offered with that Card Account. For more information, visit membershiprewards.com/terms.

- You may redeem Membership Rewards® points for deposits into your American Express® Rewards Checking Account. To learn more about the redemption value for Redeem for Deposits, go to membershiprewards.com/pointsinfo. American Express will deduct the number of points you select from your Membership Rewards Account and deposit a corresponding dollar amount into your checking account. Generally, deposits will post to your account within 48 hours of redemption. For more information, visit membershiprewards.com/terms.

- Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards® points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo. - Mobile Check Deposit is subject to deposit limits and other restrictions, which may change in the future. Please see our Mobile Check Deposit Agreement (go.amex/mcdterms) for limits and other restrictions. This agreement may be accessed prior to your use of this service. Please see the Rewards Checking Schedule (go.amex/checkingschedule) for information about when funds deposited through Mobile Check Deposit are made available. Mobile data rates may apply.

- No minimum balance is required to open an account or earn interest, and no minimum balance fees are charged for Rewards Checking Accounts. Inactive and/or unfunded accounts may be subject to closure. Please see the Consumer Deposit Account Agreement and Rewards Checking Schedule at americanexpress.com/rewardscheckingterms for further details.

- Purchase Protection is underwritten by AMEX Assurance Company, Phoenix, AZ. Subject to additional terms, conditions and exclusions. For Terms and Conditions, see americanexpress.com/PPterms. If You have questions please call Us at 1-800-228-6855, if international, collect at 1-303-273-6498

- If we receive a completed Incoming Wire Transfer of funds (in U.S. dollars) that includes proper identification of your Account by 6:30pm ET on a Business Day, we will consider that to be the Business Day of your deposit. Funds from Incoming Wire Transfers received by 6:30pm ET will generally be available for withdrawal on that Business Day. Funds from Incoming Wire Transfers received after 6:30pm ET will generally be available for withdrawal on the next Business Day. A $20 fee will apply to all outgoing wire transfers from an American Express Rewards Checking Account. Outgoing wire transfers are subject to a $500,000 daily limit per account. Additional terms apply to outgoing wire transfers.

- Zero Liability Fraud Protection does not include unauthorized charges made by users who you allow to use your Debit Card. You are responsible for notifying American Express promptly upon learning of an unauthorized transaction against your accounts or the loss or theft of your Debit Card or Debit Card number. Limitations apply. See the Consumer Deposit Account Agreement and Rewards Checking Schedule at americanexpress.com/rewardscheckingterms. Learn how we secure your payments at americanexpress.com/us/security-center/.