Offers Carousel

-

No minimum balances and no monthly fees.1

24/7 customer support. -

Earn more interest than your average savings with a High Yield Savings Account.**

-

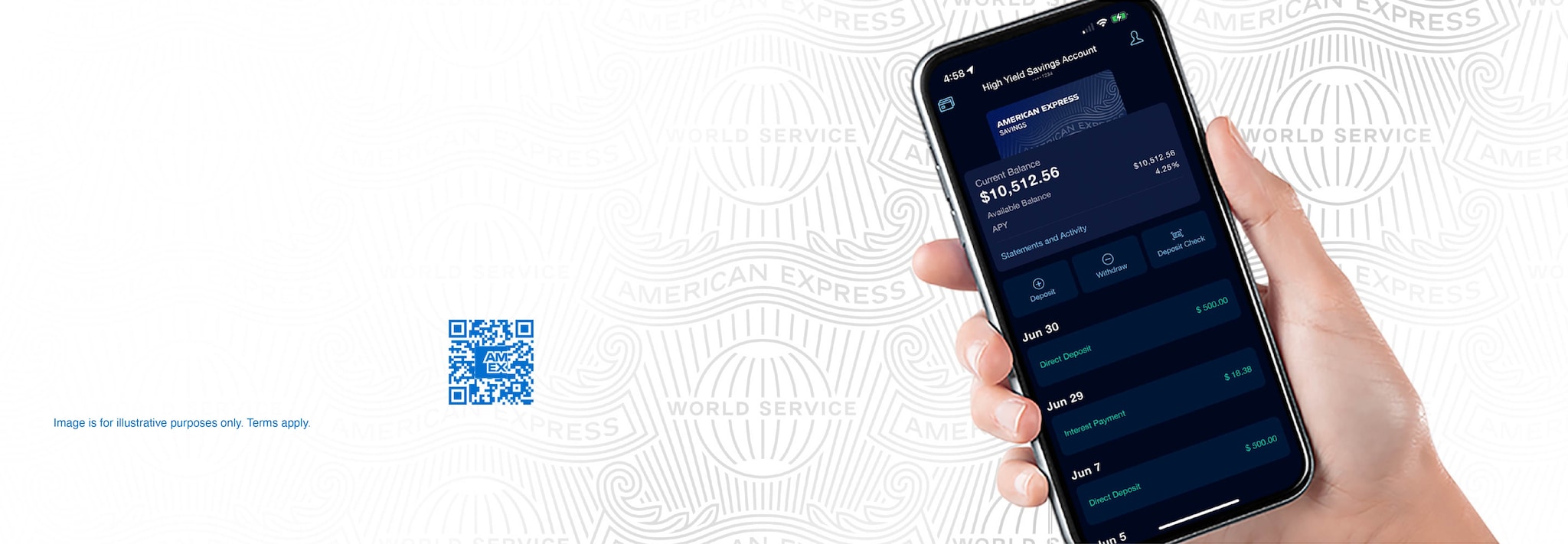

Access your Savings Account on the go

-

Lock in your fixed rate and watch your money grow with a Certificate of Deposit (CD).2

American Express has over 170 years of experience in putting the customer first.

No monthly fees + no minimum balance

Whatever your balance, you won’t get charged a fee. With no minimum balance, no deposit is too small.1

World-class customer service

Our 24/7 customer service reps are available around the clock by phone.

Member FDIC

Each depositor is insured to at least $250,000.

10 Ways to Be a Better Saver

Here are some approaches that could help you become a better saver.

How Can We Help?

Frequently Asked Questions

What is the advantage of online banking?

Do I get an ATM card, a debit card, or checks when I open a Savings account?

Does American Express offer a Checking Account?

How can I deposit/withdraw money?

How long does it usually take to transfer funds online?

Can I open an account for my trust or business?

Facts & Forms

24/7 Support

Accounts offered by American

Express National Bank. Member FDIC. Each depositor is insured to at least $250,000 per depositor, per insured bank, per ownership category.

* The Annual Percentage Yield (APY) as advertised is accurate as of . Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened. Interest Rate and APY of a Certificate of Deposit account is fixed once the account is funded.

** The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Visit the FDIC website for details.

1 There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you.

2 For a CD account, rates are subject to change at any time without notice before the account is funded. The rate received will either be (i) the rate reflected during your application process or (ii) the rate being offered when your CD is funded, whichever is higher. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after completing your account-opening deposit. After a CD is opened, additional deposits to the account are not permitted. Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. Please see the Consumer Deposit Account Agreement and Savings Schedules for additional terms and conditions and Truth-in-Savings disclosures.

3 For purposes of transferring funds to or from an external bank, business days are Monday through Friday, excluding holidays. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin processing on the next business day. Funds deposited into your account may be subject to holds. See the Funds Availability section of your Consumer Deposit Account Agreement and Savings Schedules for more information.

4 Calculations are estimates of expected interest earned. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. The first recurring deposit is assumed to begin in the second period after any initial deposit.

5 IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions. Please see IRS.gov for more information. We recommend you consult with a financial or tax advisor when making contributions to and distributions from an IRA plan account.