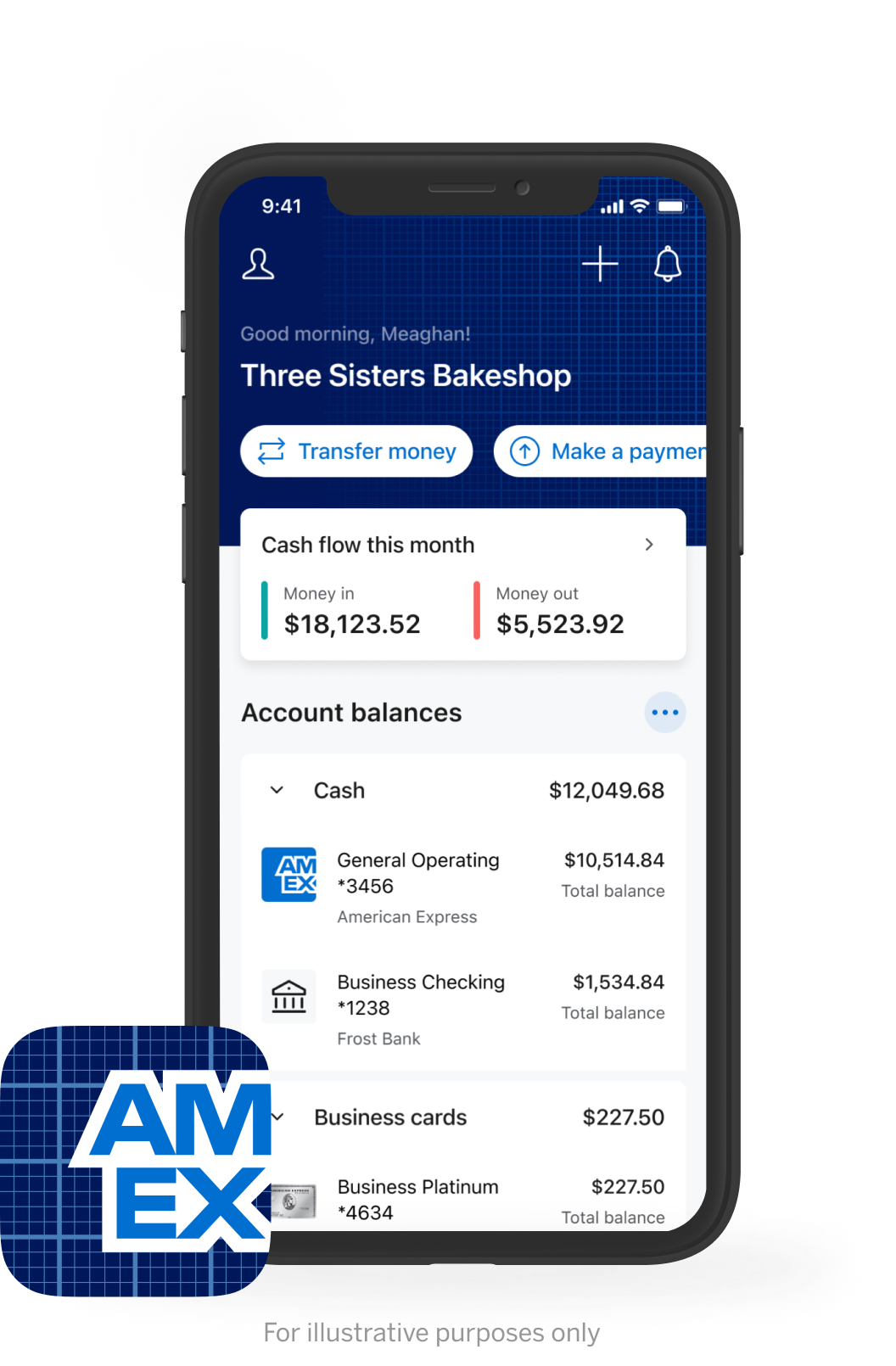

American express business blueprint™

The dashboard to help you manage your business' cash flow.

View your select business products and accounts1 in one place for more efficient cash flow management.

With American Express Business Blueprint, I save so much time from having to log in to different products and tools, but instead have access to my cash-flow tools and data from one place — from my line of credit to my American Express cards.

Julie Matzen,

CEO of Team MayDay,

a digital advertising agency

Real American Express® Business Line of Credit customer aware that this testimonial may be featured.

Free feature of Business Blueprint

My Insights

With My Insights2, get personalized data3 based on your select business products and accounts.

Use this data to help you track your business' cash flow and make more informed financial decisions with increased confidence.

Apply for the growth-focused products that match your business' needs.

If approved, these products automatically appear on your dashboard.

Focus on growth with flexible access to business funding.‡

Learn more >Earn 1.30% APY4 on balances up to $500,000. Terms apply. Member FDIC.

Learn more >“My perception of American Express has greatly expanded from a card company to a true partner that offers products that help me with the tasks needed to run my business,”

Julie Matzen, CEO of Team MayDay, a digital advertising agency

Real American Express® Business Line of Credit customer aware that this testimonial may be featured.

Trusted by business owners like you.