Organizations have improved visibility of spend to assist in building compliance, meeting duty of care obligations, and driving cost savings. But all of this doesn’t work by itself.

One of the most notable improvements in business travel over the past 20 years has arguably been the automation of expense reimbursement. Gone are the days of fumbling with receipts and guessing what will be approved/paid or rejected. From capturing expenses, setting boundaries, paying employees, and maintaining the books, the cumbersome expense process is now, thankfully, almost seamless -- if you have the right tools. But is automated expense reimbursement widely adopted and well-integrated into other enterprise systems? According to The Business Travel Trends & Insights survey conducted by BTN Group Content Solutions in August, there are still some gaps.

Expense reimbursement software has freed both the traveler and finance teams from the onerous task of collecting and processing receipts and other travel & entertainment (T&E) spend. With one tap of a phone business expenses are now captured, categorized, allocated to departments and sent through to payments. Organizations have improved visibility of spend to assist in building compliance, meeting duty of care obligations, and driving cost savings. But all of this doesn’t work by itself – organizations must make the right connections for all these steps to fall into place. Are they ready?

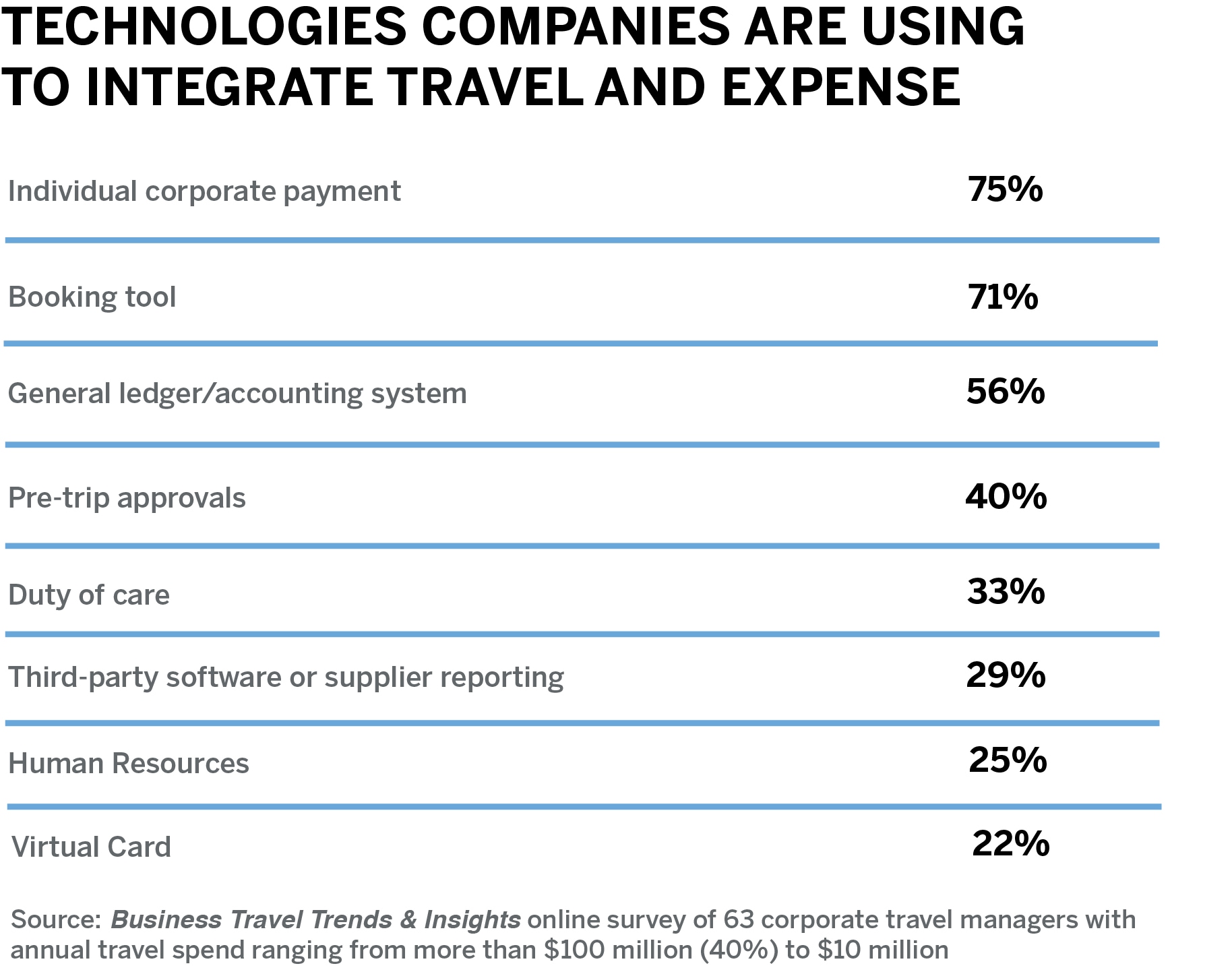

Most Organizations Have Integrated Expenses into Payment, Accounting and Booking Tool

Three-quarters of travel managers surveyed said their companies integrate their travel expense reporting system with individual corporate payments. Seven in 10 also integrate expenses into the booking tool, making for a streamlined process for travelers and giving companies visibility into total costs of a trip. Most respondents (56%) also integrate their reporting system into general accounting systems.

From there, however, the percentages dwindle. Only four in 10 have integrated expenses into pre-trip approvals, and one-third into duty of care. That means that two of the biggest initiatives on the part of organizations – spend authorization and traveler health & safety – are not usually linked to expense systems. If they were, it would be much easier to understand which expenses are out of set limits but, perhaps, related to traveling or remote work during the COVID pandemic. Linking expenses to duty of care would also allow organizations to track employee activity during a disruption or situation when on the road.

Other areas that need work in terms of travel expense integration are third-party software or supplier reporting, human resources and the virtual card. Here, fewer than 3 in 10 respondents said those systems were linked to expense reporting.

Corporations looking to upgrade their expense reporting processes need to look at their own to-do list. Roughly seven in 10 said it’s a bigger priority to have greater transparency in the expense process as well as real-time reporting capability. Nearly two-thirds said it’s also a priority to increase integration to achieve one view of all expenses. Interestingly, only four in 10 want more integration with booking data despite the advantages of combining the booking process with resulting expenses. That could be because that goal has already been achieved for many (one half said the priority level is the same) or because travel and expense management have found that travelers too frequently change trips, thus making such integration more cumbersome than helpful.

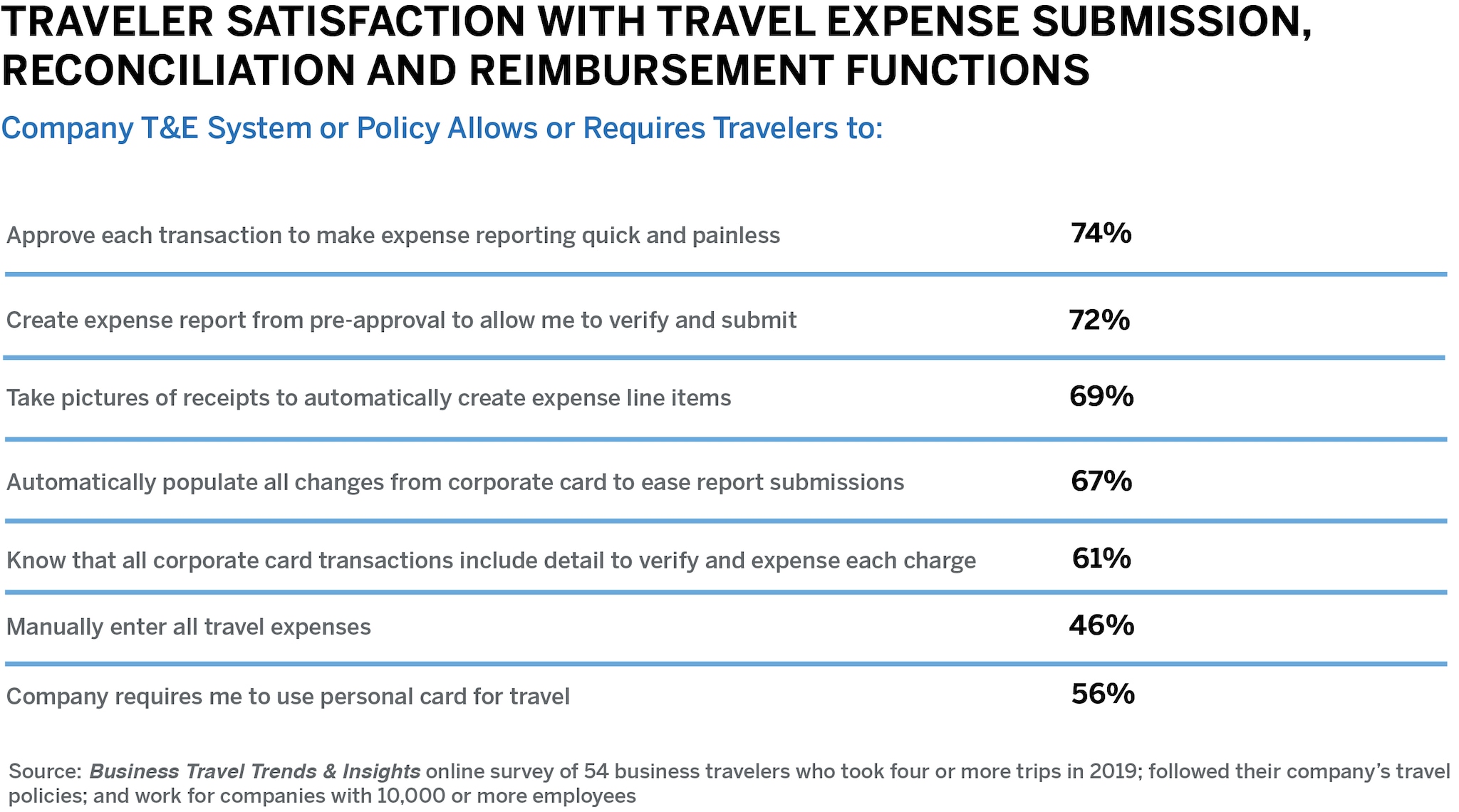

Business Travelers Are Satisfied with T&E Processes

Fortunately, business travelers are generally pleased with their company’s expense systems; this is especially good news during COVID when many expenses are related to remote work versus actual travel. In most cases, two thirds or more of business travelers are satisfied with the ease of entering, reconciling, and getting reimbursed for travel expenses.

Seven in 10 are satisfied that the system automatically creates an expense report from preapprovals to allow them to verify and submit expenses – and to take pictures of each receipt which automatically creates expense line items. Two thirds like that the system automatically populates all changes from their corporate card to ease report submissions. What gives business travelers the most satisfaction? Nearly three quarters are happy that the system allows them to approve each transaction to make expense reporting quick and painless.

There is one area of concern, indicating that expense processes are still not fully automated in some organizations: one in five respondents are not satisfied that their system requires them to manually enter all travel expenses. Surprisingly, however, only 13% are dissatisfied that their company requires them to use personal credit cards for travel.

The bottom line is that as corporations continue to update their expense reporting systems both employee and finance team benefit. Clearly most companies have systems in place now to take the pain out of getting reimbursed, but there are gaps. Now is a good time to ensure that expense reporting is integrated into the right systems, before the next resurgence of business travel takes hold.