8 Min Read | Updated: October 15, 2023

Originally Published: December 15, 2021

How Is a Credit Score Calculated?

Understanding the factors that affect your credit score can help you to take steps to improve your score over time. Here’s what you need to know about how credit scores are calculated.

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

At-A-Glance

Your FICO® credit score is a score created by the Fair Issac Corporation (FICO). It’s calculated using your payment history, amounts owed, length of credit history, new credit, and your credit mix.Your FICO® credit score is a score created by the Fair Issac Corporation (FICO). It’s calculated using your payment history, amounts owed, length of credit history, new credit, and your credit mix.

Creditors can report your loan payment behavior to the three national credit bureaus, which create a credit report.

Credit scoring algorithms calculate your credit scores using the information in those credit reports.

A FICO credit score, which typically ranges from 300 to 850, is designed to help a creditor understand how creditworthy you are. In other words, how risky would it be to lend you money? That prediction is the result of a calculation that analyzes how well you’ve managed your credit in the past. Understanding how a credit score is determined can help you to take steps to build strong credit. With a better score, you are more likely to be able to secure better terms for loans and other forms of credit.

While this article won’t get into the actual math behind credit score calculation algorithms, we will walk you through how credit score data is collected, the major elements of the algorithms, and how your credit-management behavior influences the models – and, ultimately, the credit score that’s calculated for you.

What Information Is in a Credit Report?

A credit report is a complete record of your credit-related activities and financial history. Along with your personal details such as your name, address, date of birth, and Social Security number, a credit report details all credit accounts you hold along with your payment history, credit limits, and outstanding balances. Credit reports also show a list of creditors who have recently accessed your credit information.

Did you know? As an added security measure to help protect against fraud, American Express reports a reference number to credit bureaus – instead of your actual account number.

What Is a Credit Score Based On?

The most commonly used credit scoring models are from FICO, which is used for the majority of lending decisions, and VantageScore®, which is a collaboration of the three credit bureaus. Both companies use proprietary algorithms that result in scores ranging from 300 to 850. The average FICO credit score was 716 in 2021.1 Although the algorithms vary, the two companies consider these five factors in their calculations:

- Payment history.

- Amount of available credit used.

- Length of credit history.

- Mix of credit.

- New sources of credit.

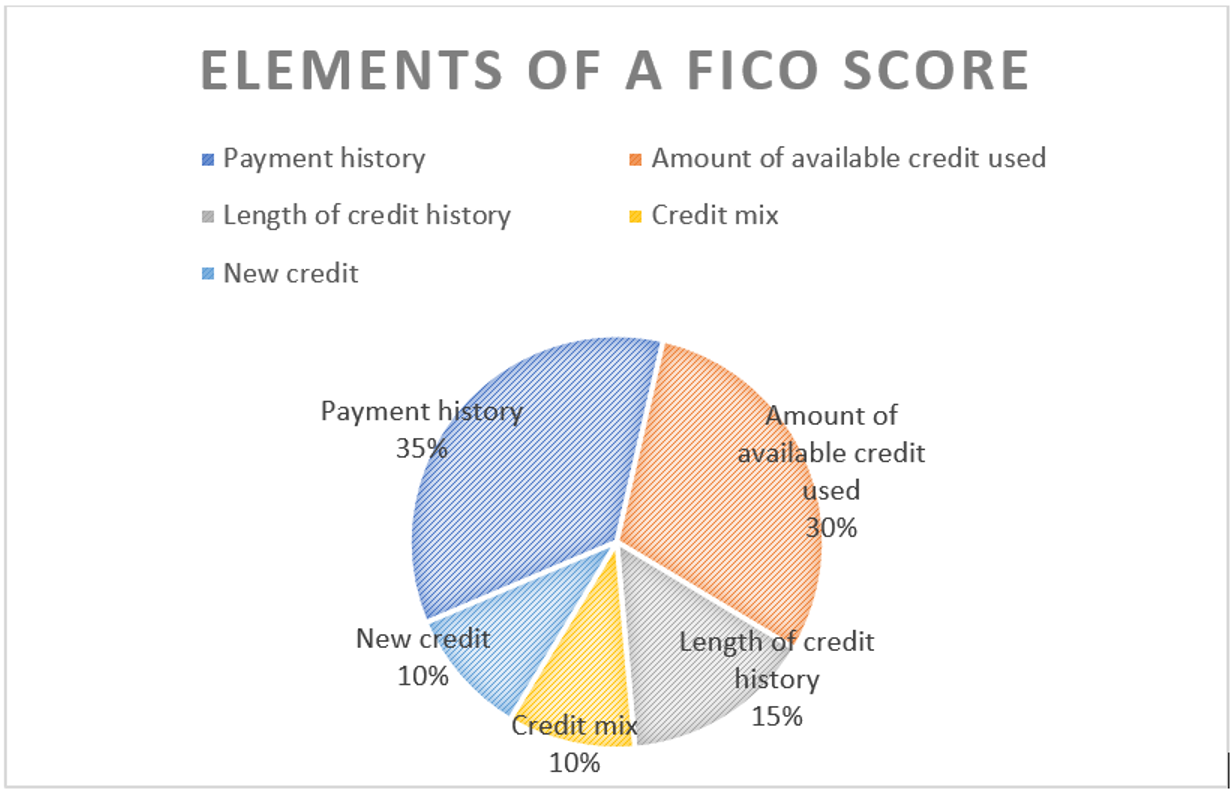

How much each these factors influence your FICO credit score is shown in the accompanying pie chart.2

Payment History

At 35%, payment history carries the most weight because it shows how well you’ve managed your credit in the past. Types of accounts considered in payment history include credit cards, auto loans, retail store credit, student loans, personal loans, mortgages, and home equity lines. If you have any bankruptcies, foreclosures, or accounts turned over to collection agencies, these will negatively affect your score. Late payments, defined as more than 30 days late, and missed payments can stay on your credit report for seven years. Because payment history plays such a large part in credit score calculations, paying at least the minimum amount, on time, for every credit card or other debt, including installment loans, auto loans, and mortgage loans, can help your credit score.

Amount Owed

The amount you owe compared to your credit limit is a close second to payment history at 30%. To see how this calculation works, consider this: if one of your credit cards has a credit limit of $5,000 and a second card has a credit limit of $7,000, your total available credit is $12,000. If you currently owe $500 on the first card and $300 on the second card, your total usage is $800, meaning that you’re using only 6.6% of your available credit. The general guideline is that it’s a good idea to avoid using more than 30% of your credit limit. This means that closing a credit card you’re not using could lower your credit score, because your total credit limit would be reduced.

Length of Credit History

The length of credit history accounts for 15% of your report and simply measures how long you’ve had credit. Particularly important is the age of your oldest active account. That means that keeping your oldest credit card account open, even if it is not used, can have a positive effect on your credit score.

New Credit and Credit Mix

New credit and credit mix are weighed equally at 10% each. These factors contribute less to your credit score but shouldn’t be ignored. New credit is a measure of the number of new accounts you’ve opened recently. Although new accounts increase your available credit, opening too many new accounts in a short period could send a red flag to creditors.

Even just looking for new sources of credit can negatively impact your credit score in some cases. When a potential lender or creditor checks your credit report before approving a new loan or other financial product, it’s called a hard credit inquiry – and it has a negative effect on your credit score. If you’re considering different lenders for a new car loan or mortgage, however, all inquiries within 14 to 45 days are typically considered as one hard inquiry. Soft inquiries – made by you or by a lender or creditor that you already do business with – are not considered in credit score calculations. Some credit card issuers will do a soft inquiry first to check your eligibility before doing a hard check, however, once you’ve accepted the card a hard inquiry will occur.

Credit mix refers to the types of loans and financial products you have. A mix of installment loans, such as an auto loan, and credit cards demonstrates that you’re able to manage different types of repayment activity. Installment loans require a fixed monthly payment, while payments to credit cards are more flexible in the amounts you can pay monthly.

What Is Not Measured in a Credit Score?

Some of what’s not measured in credit score calculations include your income, how long you’ve worked at your job, and how long you’ve lived in your house. Still, some creditors may consider these factors separately in determining your creditworthiness.

Industry-Specific Scores Are Tailored to the Type of Loan Requested

Depending on the type of loan, lenders or creditors may use an industry-specific FICO score tailored to that type of credit. For example, lenders usually use the FICO Auto Score algorithm when deciding on auto loans, while credit card companies often base decisions on the FICO Bankcard Score algorithm. These industry-specific calculations weight your success with similar loans more heavily and result in scores with a wider range – from 250 to 900 – than the base FICO score.3

Both FICO and VantageScore credit score calculations are updated regularly to reflect changes in credit reporting and average personal financial habits.

FAQs on How a Credit Score Is Calculated

What role does payment history play in credit score calculation?

When it comes to credit score calculation, your payment history impacts your score as it shows how consistently you have made payments on your credit accounts (loans, credit cards, other debts) and helps lenders and creditors assess your reliability as a borrower and your ability to manage credit responsibly.

What are the five significant factors used in calculating my credit score?

Credit score calculations can vary slightly depending on the credit scoring model used, but the most widely used model is FICO. The five significant factors used in this scoring model are: Payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

How does credit mix influence my credit score?

Having a diverse credit mix can positively influence your credit score, but its impact is generally lower when compared to factors such as payment history and amounts owed. When you manage a mix of different credit accounts responsibly, creditors may view this as a sign of creditworthiness and financial stability.

The Takeaway

FICO credit score calculations are based on five areas of credit behavior: payment history, amounts owed, length of credit history, new credit, and your credit mix. To take steps to help improve your credit score, it’s advisable to ensure that you pay credit cards and loans on time, use a sensible amount of available credit, and keep old accounts open when it makes sense to.

1 “Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic,” Fair Isaac Corp.

2 “What’s in my FICO® Scores?,” myFICO

3 “FICO® Scores Versions,” myFICO

Julie Anderson is a freelance writer with extensive writing and teaching experience in the technology field.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

Different Types of Credit Scores

You have different credit scores depending on the credit bureau and specific scoring model used by lenders. Learn more about the different types of credit scores.

What is a Credit Score and How is it Defined?

Understanding how ‘credit score’ is defined, how credit scores work, and how they’re calculated can help you establish a positive financial future.

Is It Possible to Get a Perfect Credit Score?

Getting a perfect credit score is a notable financial goal. See what impacts your credit score – and what it takes to get a perfect 850 FICO score.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.