7 Min Read | Published: January 12, 2023

Do I Have to Pay My Credit Card in Full Every Month?

Paying your card balance in full keeps interest and debt at bay, but choosing to pay over time can afford financial flexibility when paying off major purchases.

At-A-Glance

Credit cards don’t need to be paid in full every month, but doing so prevents interest charges from accruing and debt from accumulating.

Even so, carrying a balance with interest can be an effective way to finance major purchases, like home renovations and car repairs.

Traditional charge cards, however, must be paid in full every month.

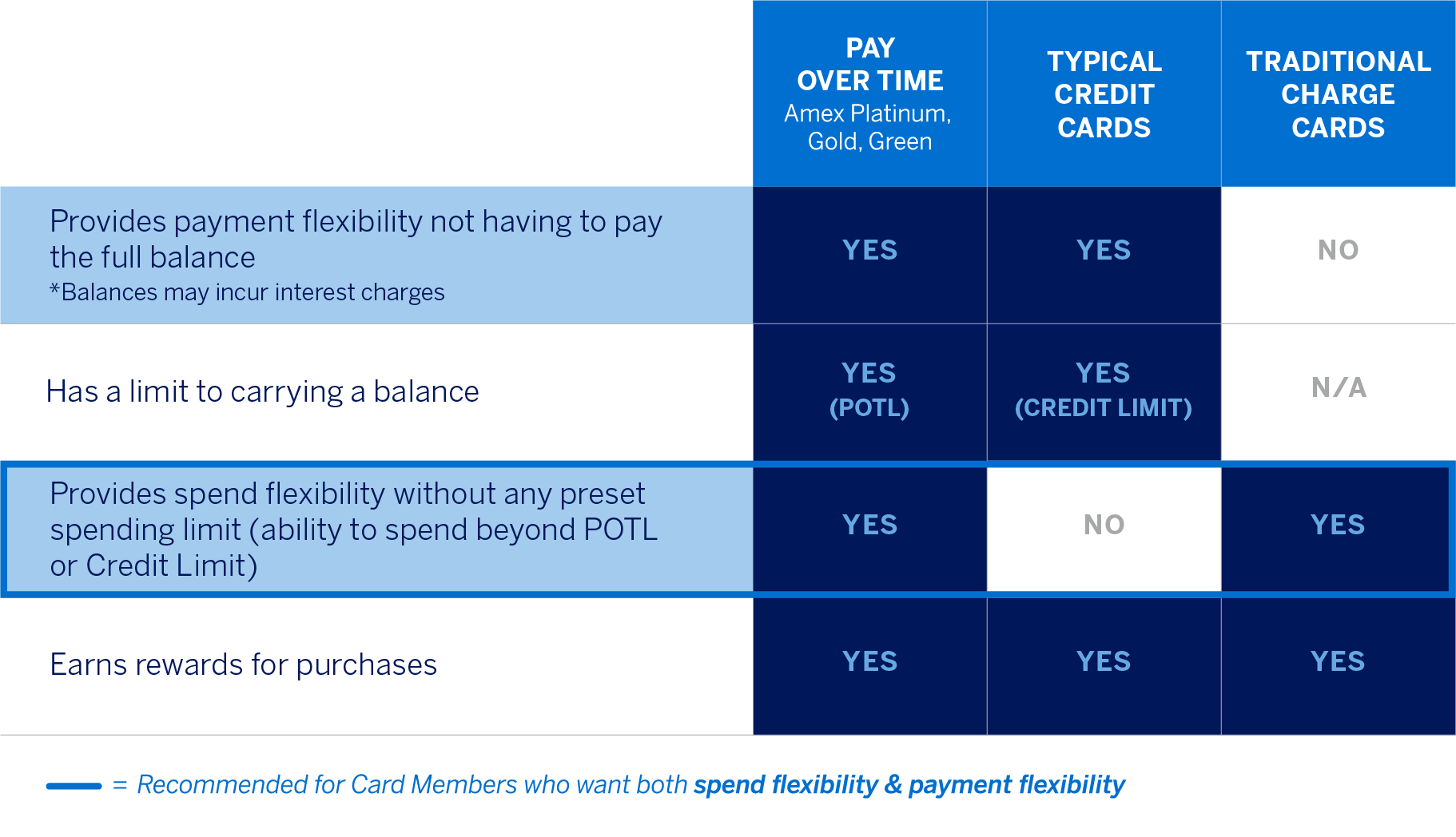

Some modern cards are bridging the gap between traditional charge cards and typical credit cards to offer card members greater payment flexibility.

Spending isn’t static. Our lives – and the economy – are constantly changing. Frustratingly, a necessary purchase may come along when money’s tight. And even when money isn’t tight, sometimes it’s better for your budget to pay off expenses over time.

Fortunately, credit cards don’t need to be paid off in full every month. You can carry a balance at the expense of interest charges. Unfortunately, that’s not the case for traditional charge cards.

But some Amex Cards, including The Platinum Card®, the American Express® Gold Card, and the American Express® Green Card, bridge the gap between traditional charge cards and typical credit cards. These Cards, like charge cards, have no preset spending limit. But thanks to the American Express Pay Over Time feature, Card Members can choose to carry a balance with interest up to their Pay Over Time Limit.

This article explores how responsibly carrying a balance can provide you with the financial flexibility to confidently make major purchases. We’ll also take a look at how Pay Over Time can be used to carry a balance on certain Amex Cards, and what makes this feature different from a typical revolving credit limit.

Should I Pay My Card in Full Every Month?

For people who use credit cards, common wisdom says that it’s best to pay off your statement balance in full every month. And for good reason: Doing so, you can avoid interest charges and help stave off debt. For those who use charge cards, a full payment at the end of every statement period is mandatory. The requirement to pay monthly statements in full is part of what defines a traditional charge card, along with having no preset spending limit.

The good news is that both credit and charge cards usually have a grace period – the time between the end of your billing cycle and your payment due date, in which interest typically won’t be charged (provided you are not carrying a balance).1 In other words, just using a credit or charge card for purchases could afford you a couple of weeks to pay them off before having to pay interest – as long as your card issuer offers a grace period and you’ve been paying your monthly statement balance in full and on time each month.

So, you should pay your card’s statement balance in full each month if you want to avoid interest charges. And, as long as you pay in full by the statement due date, you’ll enjoy the benefits of the grace period.

Carrying a Balance Can Be Helpful, But Has Costs

What happens when you want to pay off a necessary purchase over time, but the grace period isn’t long enough to match your budgeting needs? With the ability to carry a balance, credit cards can come in handy, even though they charge interest. Their payment flexibility can go a long way toward managing monthly expenses, especially if you mindfully carry the balance and make a clear plan to pay it off before debt gets out of hand. For example, car repairs can be costly and unexpected. Charging the transaction to a credit card can grant you the convenience to pay it off over two months so it takes a smaller bite out of your budget.

To help cut down on overall interest charges, you can make multiple small payments – maybe weekly – instead of waiting to make a bigger payment on the payment due date each month. That lowers your average daily balance, which is used to calculate credit card interest charges. Or use a 0% intro APR credit card, which makes it possible to carry a balance without interest for as long as the promo period lasts. This makes for a cost-effective way to finance predictable big ticket purchases, like a new furniture set or kitchen appliances.

While charge cards boast unique benefits like the ability to make bigger purchases without maxing out the card, the “catch” is that they traditionally require every statement balance to be paid off in full, on time. Otherwise, expect late payment fees and potential impacts to your credit history.

Pay Over Time Bridges the Gap Between Traditional Charge Cards and Credit Cards

The Platinum Card, the Amex Gold Card, and the Amex Green Card were originally presented as charge cards. But since Pay Over Time was introduced, these Cards can operate differently than traditional charge cards. Specifically, Platinum, Gold, and Green Card Members have the option to use their Cards like traditional charge cards, with no preset spending limit2 and the requirement to pay off their monthly statement in full. Or they can activate the Pay Over Time feature, which enables them to choose whether they want to carry a balance, with interest, up to their Pay Over Time Limit (more on that later).

In either case, Card Members will still earn rewards the way they usually do, and Card benefits don’t change. But any balance that exceeds your Pay Over Time Limit must be paid in full by your payment due date, and interest is charged only if and when you choose to carry a Pay Over Time balance.3

How Does Pay Over Time Work?

Say you typically use your Gold Card for grocery and dining purchases – and maybe the occasional flight – and always pay your statement balance in full. But you’re planning a DIY remodel of your bedroom and know it’s going to cost a pretty penny. One option is to charge those remodeling expenses – drywall, spackle, paint, furniture, bedding – to your Gold Card.

This has a few benefits. For one, you’ll get to rack up some rewards. And, like a traditional charge card, you can enjoy a flexible spending limit.2 Better yet, when it’s time to pay your bill, you can pay your balance in full, or you can carry a balance, up to your Pay Over Time Limit, and pay it off over time with interest – similar to a typical credit card. But remember: If you want to use Pay Over Time, the feature must be activated before you make the charges you intend to pay over time. If the feature wasn’t active, you can’t retroactively add charges to your Pay Over Time balance.

The good news is that Card Members are automatically enrolled in Pay Over Time, which gives you the choice to pay in full or carry a balance from the outset. But you can always deactivate the Pay Over Time feature if you’d prefer to retain a charge-only model and avoid using this Card to carry a balance with interest. Of course, it can be reactivated if and when you choose to take advantage of Pay Over Time’s additional payment flexibility in the future – perhaps you’re planning a luxurious honeymoon and want to pay it off at your own pace.

What Is the Pay Over Time Limit?

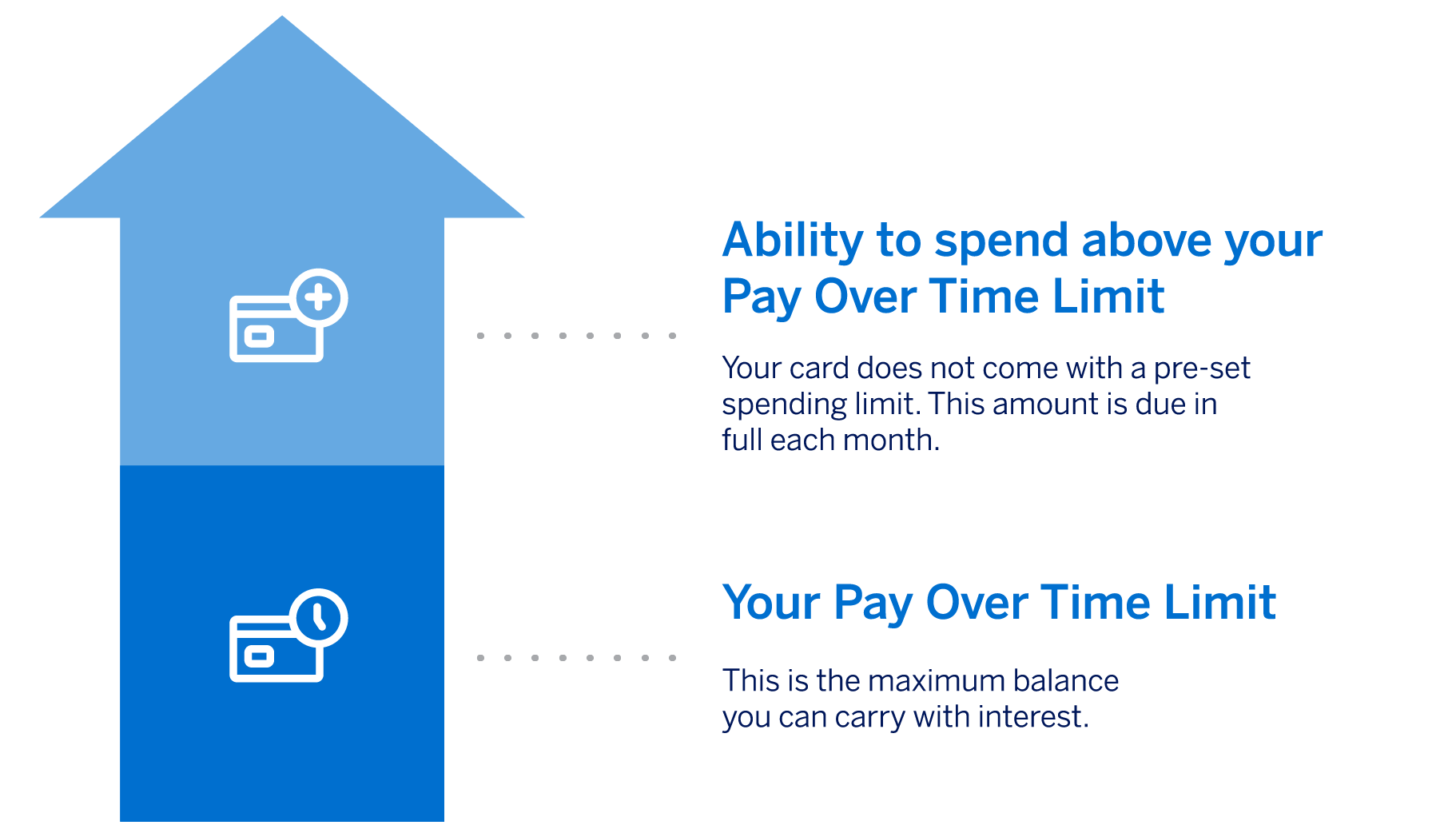

Pay Over Time does not impact your overall spending capacity. So even if you choose to pay some of your balance over time, you’ll still be able to enjoy no preset spending limit.2 However, there is a limit to the total amount that you can carry as a balance, called your Pay Over Time Limit. In other words, you may be able to spend beyond your Pay Over Time Limit while still earning rewards – you’ll just need to pay for any new purchases in full when your bill is due. Your Pay Over Time Limit is the limit on how much of a balance you can carry with interest, or how much you can put in a plan with Plan It®.

What About Plan It®?

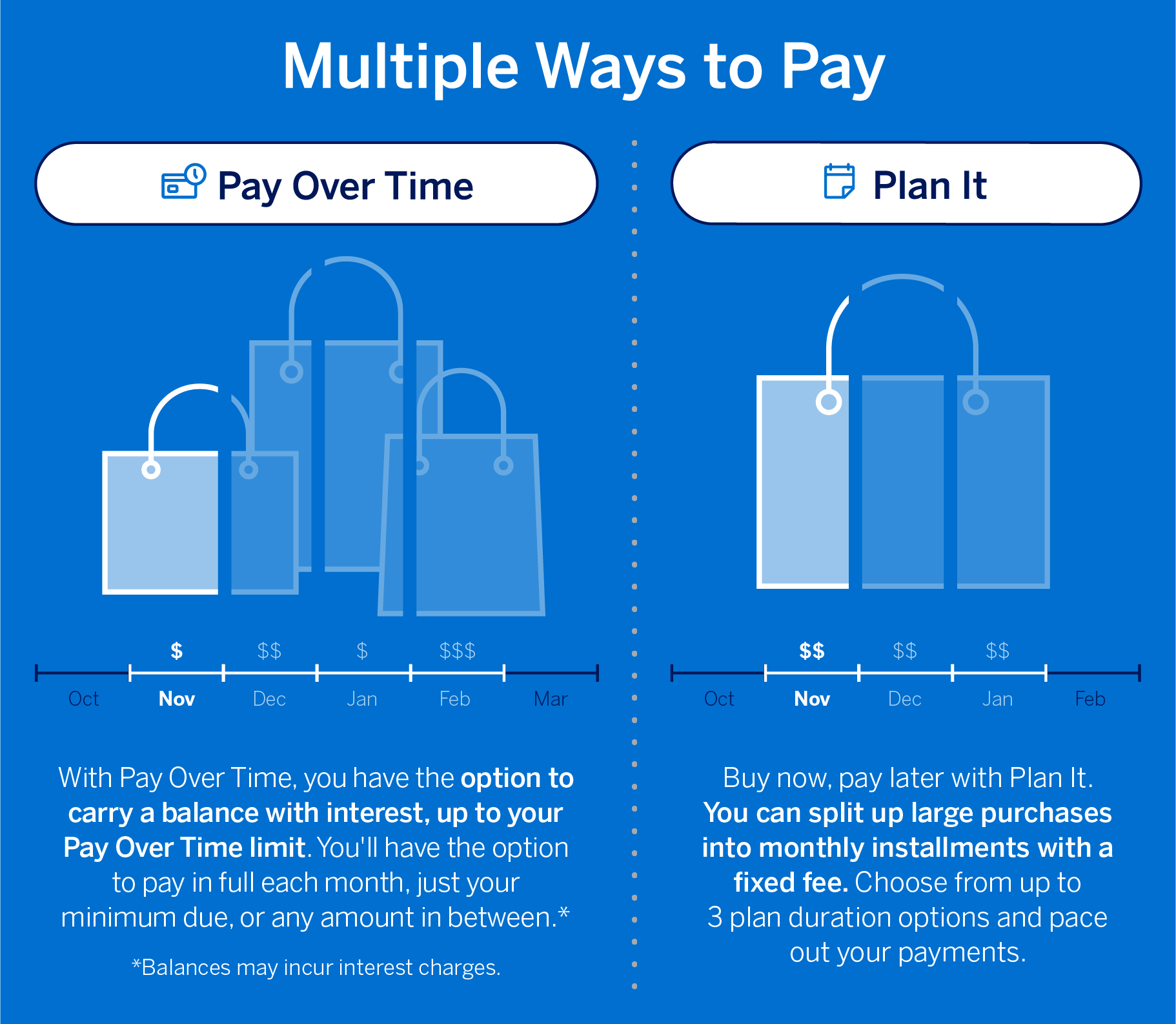

Plan It is another payment flexibility option offered by Amex, but it works a bit differently than Pay Over Time. Specifically, Plan It allows eligible Card Members to split purchases of $100 or more into equal monthly installments with a fixed fee so you can know upfront exactly how much you’ll pay and when. You can put up to 10 eligible transactions into one plan.

Before creating a Plan, Card Members will be presented with one to three different plan duration options, allowing them to choose the one that works best for their needs. This added flexibility can be a great way to get extra breathing room in your budget, while paying off a purchase in a concrete, predictable way – and still earning the rewards the way you usually do.

A key difference between Plan It and Pay Over Time is that Plan It makes it possible to pay off specific transactions – like a set of new tires, or a new refrigerator – in installments over time, similar to a buy now, pay later arrangement. Pay Over Time, on the other hand, makes it possible to carry a balance with interest, like a typical credit card revolving balance. This can be a useful way to finance larger balances at your own pace, rather than in fixed installments.

The Takeaway

While it’s generally best to pay off your credit card balance in full every month to avoid paying interest, doing so isn’t always realistic, nor is it always desirable. Typical credit cards let card members carry a balance with interest, which can afford needed payment flexibility. But unlike charge cards, they have credit limits – which can get in the way of major milestone purchases. Thanks to the Amex Pay Over Time feature, Cards like The Platinum Card, the Amex Gold Card, and the Amex Green Card offer the best of both worlds. Card Members retain no preset spending limit, but they can choose to carry a balance with interest, up to a certain limit.

1 “What is a grace period for a credit card?,” Consumer Financial Protection Bureau

2 No Preset Spending Limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

3 For charges added automatically to a Pay Over Time balance, we will charge interest beginning on the date of each charge. We will not charge interest on charges automatically added to your Pay Over Time balances if you pay the Account Total New Balance by the Payment Due Date each month. You must pay in full, by the Payment Due Date, all charges that are not added to a Pay Over Time, Cash Advance, or Plan balance. We will begin charging interest on cash advances on the transaction date.

Megan Doyle is a business technology writer and researcher whose work focuses on financial services and cross-cultural diversity and inclusion.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

Should I Pay for Dental Care with a Credit Card?

Even if you have dental insurance, you can still face out-of-pocket costs. Paying for dental care with a credit card can help, but it’s not always the best idea.

How and When to Pay Your Credit Card Bill

It’s important to pay your credit card bill in full – and on time – each month. Here’s what you need to know.

What Happens When You Pay the Minimum on Your Credit Card?

Making only a credit card’s minimum payment can greatly extend the time it takes to pay a balance, and drive up interest costs. But it can make sense—occasionally.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.