Tap into more Business Value

Explore all the ways we can help you to get more from business – and from life.

Employee Cards

BONUS OFFER

Bag more rewards with Employee Cards

Add Employee Cards1 and earn Membership Rewards® points on all their eligible spend. Plus, earn the following bonus points for each Card added to your Account today.

American Express® Business Gold Card: Earn 3,000 bonus points.2

American Express® Business Platinum Card: Earn 5,000 bonus points.2

Terms and Conditions apply.1 18 +, subject to status. Main Cardmember liable for all Employee Cards' spend.

How could Employee Cards help your business?

Complimentary Employee Cards1 for your trusted

colleagues can help you to enjoy even more value every

working day and to control your business spend.

This video, from the Cavendish Clinic in London, shows

how it can really help a growing business.

Consolidate

Consolidate your spending in one

Business Account, making it easier

to control and manage.

Set Limits

You have no pre-set spending limit5,

but you can set individual limits on

your colleagues Cards.

Save time

With Employee Cards you

can delegate purchasing tasks to

colleagues, saving you time.

Employee Spending. Simple.

Take control of your employee spending in just a couple of clicks - from spending limits, freezing cards or monitoring spend.

Earn more

Every Employee Card can earn

Membership Rewards© points for

you. The more they use their Cards,

the more you'll earn.

Redeem more

Use your points for virtually anything

that appears on your statement -

from office supplies to dining and

fuel. 4

Travel further

Transfer your points into airline and

hotel loyalty programmes to enjoy

reward trips even sooner.4

Sharing the benefits too

Of course, your Employee Cardmembers enjoy all

the benefits that come with their Card, including insurance

protections on purchases and on travel bought on the Card.1

BUSINESS PLATINUM

You can apply for complimentary Business Gold Employee Cards,

plus one complimentary Business Platinum Employee Card.

Add Cards, add control.

Terms apply, 18+, subject to status.

BUSINESS GOLD

You can apply for complimentary Business Gold Employee Cards

Add Cards. Add control.

Terms apply, 18+, subject to status.

Important Information

- Employee Cards, also known as “Supplementary Cards”, allow you to share the benefits of your American Express Card with others close to you. You will be the main Cardmember and you will be liable for all charges made on the Supplementary Card(s). Supplementary Cardmembers must be aged 18 or over. Written details available on request. Approval subject to status and Terms and Conditions.

- Business Gold Cardmembers will receive a bonus of 3,000 Membership Rewards® points, and Platinum Cardmembers will receive a bonus of 5,000 Membership Rewards® points, for each Supplementary Card added to your Account.

This offer is valid for the first three Supplementary Cards in which you apply for only, from 1 April 2024.

In some circumstances it may take up to 90 days after a Supplementary Card is added to your Account, for the Membership Rewards® points to be applied. This offer is subject to change and may be withdrawn at any time. At its discretion, American Express may choose to reverse Membership Rewards points where Supplementary Cards have been added with no spend in the following 90 days.

For Business Gold Cardmembers

Supplementary Cards. Subject to approval. The primary Cardmember is responsible for spend on the Card. You are entitled to up to 20 complimentary Supplementary Business Gold Cards. If you want to cancel a supplementary cardmember’s right to use your Account you must tell us.

For Business Platinum Cardmembers

Supplementary Cards. Subject to approval. The primary Cardmember is responsible for spend on the Card. You are entitled to apply for one complimentary Supplementary Platinum Business Charge Card, and up to 19 complimentary Gold Supplementary Cards. Additional Platinum Supplementary Cards beyond this will each carry an annual fee of £295. If you want to cancel a supplementary cardmember’s right to use your Account you must tell us.

- Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions. Membership Rewards: Enrolment required. Award and usage of Membership Rewards points subject to subscribed Terms & Conditions of Membership Rewards Programme. Availability is subject to local laws and regulations.

- Terms apply. All Rewards are subject to availability. Those available to you at any time will be shown on our website www.membershiprewards.co.uk. Visit www.membershiprewards.co.uk for full Membership Rewards Terms and Conditions.

- ‘No pre-set spending limit' does not mean unlimited spending. Your Card's spending power - the amount your business can spend - is dynamic and adjusts to your business needs. Discover your business card benefits. Terms and conditions apply. Subject to status. We reserve the right to apply temporary spending limits in accordance with the Cardmember agreement.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2023. American Express Company. All Rights Reserved.

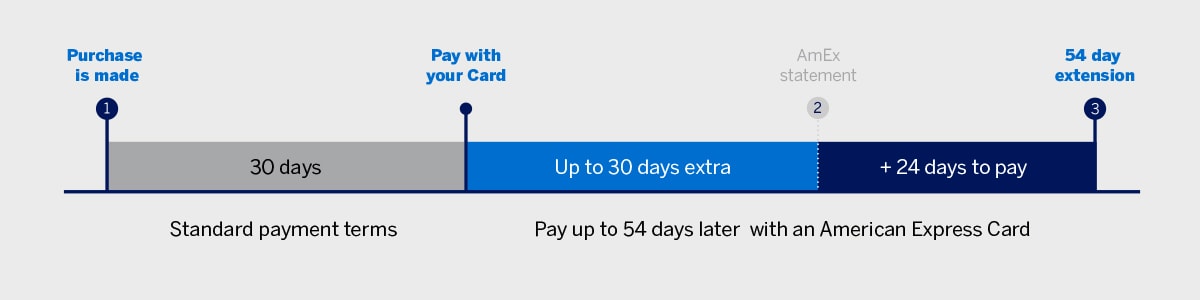

Boost your cash flow every month

Juggling cash flow is one of the biggest headaches for many businesses, so it's good to know your Card could extend your payment to suppliers by up to 54 calendar days.1

3 steps to improved cash flow

Purchase

Pay as many suppliers as you can

using your American Express®

Business Card.

Extra days

You will now have anything from 24

to 54 extra days before that item

is due for payment, depending on

when your purchase is made.1

Pay in full

Pay your Card statement in full

on the due date and you will

have boosted your cash flow

without charge.

Purchase any item the day after your Amex statement date and you could enjoy up to 54 extra days to pay.

Cash flow in action

The founders of The Hoxton Mix understood the

need for professionals to meet and seek out other

professionals to work together and improve their

business. When business rates increased they

faced cash flow challenges, as their customers are

small businesses too. See how The Hoxton Mix

managed their cash flow,while making their business

spend more rewarding.

Keeping everybody happy

Your supplier will be happy because you pay them on time. Your finance people will be delighted, because extended cash flow is always welcome. You can relax, knowing that if you pay your Card bill every month by direct debit, it makes life really easy.

So many places to use

your Business Card

It’s not all about travel and dining. You can use your Card to pay recurring bills like telecoms, utilities and digital advertising. Lots of different suppliers will accept Card payments, from couriers and office supplies, to IT companies and photo libraries.

Piling on

the rewards

As well as boosting cash flow, virtually every time you use your Card you will also be earning extra rewards you can reinvest in the business, use for your staff or for yourself.2

The Card with flexible spending power

Your Card's spending power - the amount your business can spend - is dynamic and can adjust to your business needs. Use your Card in the right way, and watch your spending power grow.3

Important Information

1. Platinum and Gold Business cards the maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. Basic Business card the maximum payment period on purchases is 42 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date.

2. Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds.Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions. Membership Rewards: Enrolment required. Award and usage of Membership Rewards points subject to subscribed Terms & Conditions of Membership Rewards Programme. Availability is subject to local laws and regulations.

3. ‘No pre-set spending limit' does not mean unlimited spending. Your Card's spending power - the amount your business can spend - is dynamic and adjusts to your business needs. Find out more here.

Terms and conditions apply. Subject to status. We reserve the right to apply temporary spending limits in accordance with the Cardmember agreement.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 andauthorised and regulated by the Financial Conduct Authority.

Copyright© 2021. American Express Company. All Rights Reserved.

Managing Rewards

Top tips to earn more points

All the time you’re building a business, you can be building your rewards at the same time. And it’s not just expenses. Essentials

like telephone or utility electricity bills can all earn you rewards too.

You earn 1 Membership Rewards point for every full £1 you spend on your Card.1 And there are lots of ways you can boost your

points balance. Just take a look at our top tips below:

You can use your Card to pay recurring bills like telecoms,

utilities and digital advertising. You may be surprised

how many of these suppliers accept American Express

Card payments, earning you extra rewards on everyday

business services.

Add your Business Card to your digital wallets or use Contactless and you can earn even more rewards on those quick

payments like coffees with colleagues or customers, and travel tickets.

You can earn 2 points for every £1 spent when you book

your flights, hotels, car hire or experiences through

American Express Travel. Why not book your next

business trip online today.2

It’s not all about travel and dining. All kinds of suppliers welcome Card payments, from couriers and office supplies, to IT companies and photo libraries. And that can help you to boost cashflow too. Why not ask your major suppliers if they accept card payments?

Give yourself extra control and the opportunity to earn more Membership Rewards® points by adding Employee Cards.3

Gold

You can request up to 20 complimentary Business Gold Cards

Platinum

You can request one complimentary Business Platinum Card, and up to 19 complimentary Business Gold Cards

So many flexible ways to spend

Membership Rewards® is one of the most flexible loyalty programmes around, making it easy for you to reinvest your points in driving your business forward, or to reward employees or yourself for all the hard work.1

You can use your points to pay for virtually anything that appears on your statement. Just use your Amex App or Online Account and select the line items which you would like to pay for using your points.4

12,000

points

A quick client lunch to the value of £54

50,000

points

A new office printer costing £225

100,000

points

Paintballing for the office staff £450

Did you know you can book flights, hotels, car hire and experiences

with your points at American Express Travel, your online travel portal.

You’ll find exclusive Cardmember deals there too. And you’ll earn more Membership Rewards points on your booking, when you pay with your Card.

From millions of work items to all kinds of events, it’s easy to pay with your points at Amazon.co.uk and Ticketmaster. Just choose your items and look for the Pay with Points option at checkout.5

You can choose from a huge range of gift cards for business purchases from places like Apple, Costco and Hertz, or choose to reward or thank people with gift cards from places like Harrods, M&S or Boots.5

Lots of major retailers like Currys PC World and Tesco allow you to use points with SafeKey when you shop online. From office consumables to catering for a staff lunch, your points can pay the way.5

Are you a member of British Airways Executive Club or Virgin Atlantic Flying Club? You can transfer your points into these and many other leading airline loyalty programmes to help you secure reward flights faster.6

You can transfer your points to Hilton Honors, Marriott Bonvoy and Radisson Rewards to help you get closer to a

complimentary night away.7

Important Information

1. Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

2. Cardmembers enrolled in the American Express Membership Rewards programme will earn one additional Membership Rewards point in addition to their standard earn rate for virtually every full £1 spent on americanexpress.co.uk/travel. This excludes cruise bookings, Fine Hotels & Resorts and The Hotel Collection bookings. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

3. Employee Cards – also known as Supplementary Cards – allow you to share the benefits of your American Express Card with others close to you. You will be the main Cardmember and you will be liable for all charges made on the Employee Card(s). Cardmembers are entitled to up to 20 complimentary Employee Cards only. Employee Cardmembers must be aged 18 or over. Written details available upon request. Approval subject to status and Terms and Conditions.

4. You can use your Points to apply a credit to your Card Account against certain eligible fees and/or purchases (Eligible Transactions). The rate at which we convert Points may vary and we will tell you what the conversion rate is when you arrange the redemption. The conversion rate is also on our website. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

5. The types of Rewards available are subject to change. Those available to you at any time will be shown on our website at membershiprewards.co.uk.

6. Enrolment is required to receive programme benefits. Individual benefits vary by partner and are subject to availability. Please refer to each airline partner’s Terms and Conditions.

7. Enrolment is required to receive programme benefits. Individual benefits vary by partner and are subject to availability. Please refer to each hotel loyalty partner’s Terms and Conditions. American Express reserves the right to instruct Hotel Partners to cancel your membership if you cease to be a Cardmember or your Account is not in good standing. Benefits are subject to availability.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2021. American Express Company. All Rights Reserved.

Business Value

Could you be getting even more value for your business?

American Express can open the door to a host of benefits and opportunities designed to help grow your business.

The Platinum Business Card Benefits

Platinum Value across the board

As the boundaries between work and home get more and more blurred, it’s good to know that Business Platinum delivers value across both.

Are you getting the most from your Card?

For an annual fee of £650 a year, Platinum brings you business, travel and lifestyle benefits that can all add up to fantastic value.

American Express Travel – your dedicated travel agency – brings you great deals on flights, hotel stays, car hire and experiences. You can pay with your points, your Business Platinum Card, or a combination of both.

With a host of other benefits that Business Platinum Cardmembership offers – from Platinum Travel Concierge to help plan your trip, to special Airfares, car hire upgrades, free travel insurance, lounge access and more – you'll experience travel in a whole new way.

£200 Annual Travel Credit

With the Business Platinum Card, you’ll get a £200 Annual Travel Credit1 each year, when you book through American Express Travel Online. Whether you’re travelling for business or pleasure, use your Credit on any single travel booking of £200 or more.

The American Express Global Lounge Collection gives you, your Business Platinum Employee Cardmember and a guest each complimentary access to more than 1,400 airport lounges across 650 cities around the world. Whether you’re looking for a place to rest and recharge or somewhere to catch up on work, enjoy our growing network of airport lounges.2

Whether it’s a quick decision to meet a client abroad, or a spur-of-the-moment family trip, sometimes you just have to get up and go.

Your comprehensive worldwide insurance benefits3 protect you, your family, and your Supplementary Cardmembers, whether travelling together or alone, on business and leisure trips of up to 120 day, with cover that includes:

- Medical Expenses And Repatriation to cover fees fordoctors or other medical professionals, medical expenses up to £2,000,000 and, if necessary, your return home

- Travel Inconvenience cover to pay for accommodation and refreshments with delayed flights/cancellations and missed connections, and compensation for delayed or lost luggage

- Personal belongings, money and travel documents forup to £2,000 of lost, stolen or damaged belongings (maximum £500 per item and £500 for money and travel documents per trip)

- Business travel accident insurance, which covers up to £450,000 travel accident insurance when travelling in a public vehicle during a business trip

- Trip cancellation that allows you to claim up to £7,500 for trips cancelled or cut short due to illness, accident or other circumstances beyond your control

- Car rental loss and damage with up to £50,000 cover for a stolen or damaged vehicle – including the excess.

- Other cover, including skiing and gap-year insurance for your children.

For almost every full £1 you spend on your Card, you’ll earn 1 Membership Rewards point4. And you can use those points to reward yourself, your clients or your employees, or to reinvest in your business.

You’ll also enjoy 10,000 additional Membership Rewards points every time you spend £10,000 in a month5. That’s up to 120,000 additional points per year.

Platinum Cardmembers have access to a dedicated website and an experienced team to help with anything travel related. Wherever you are in the world, whether you're planning in advance or stuck in a fix abroad, you can speak to us to help with your whole travel itinerary, including:

• Finding and booking the best flights

• Details on airport lounges

• Accessing Car Hire

• Booking hotels

Employee Cards

You can request one complimentary Business Platinum Card, and up to 19 complimentary Business Gold Cards, giving you extra control, and the opportunity to earn more Membership Reward points.6

AmexExpense

The perfect complement to our Employee Cards solution, AmexExpense is

our free expense management tool.

Make more time – for business and pleasure – by keeping on top of your teams’ business expenses in one place.

It’s simple to set up, and even integrates with your accounting software.

Find great candidates. Indeed's matching technology connects you with talent that matches your job criteria right away. Receive up to £300 in statement credits annually when you spend on Indeed with your American Express® Business Platinum Card. Enrol now to start saving on recruitment costs such as Sponsored Job posts or Indeed Resume services. Terms Apply.7

However fast you keep moving forward, technology often seems to move faster. Our annual Dell Technologies benefit is here to help you stay on top. You'll get up to £75 in statement credits between January and June, and the same between July and December, for United Kingdom purchases with Dell Technologies on your Amex Business Platinum Card.8

It’s not easy to keep up with the latest news when you’re busy running a business, but it’s great to have it at your fingertips. This complimentary annual digital subscription to The Times and The Sunday Times, worth £312 per year, gives you 24/7 access to the latest news and views from quality journalists, all year round.10

If you buy an eligible item on your Card and it’s stolen or damaged within 90 days, we’ll replace or repair it, or refund you up to £2,500 per eligible item.

Should you return an eligible item for any reason within 90 days, your Card’s Refund Protection means that even if the UK retailer won’t refund you, we’ll replace or refund you up to a maximum of £300.

Unlike a Credit Card, your Card has no pre-set spending limit.11 This means that your Card's spending power - the amount your business can spend - is dynamic and can adjust to your business needs. To help maximise your spending power, you can start spending and repaying the balance as soon as you get your Card, earning Rewards as you go. You can make repayments multiple times within your Billing Cycle, there’s no need to wait. You can find out more on how to maximise your spending power here.

Juggling cash flow is one of the biggest headaches for many businesses. Find out how Business Platinum Card could help you enjoy up to 54 extra calendar days to pay.12

You can manage your Business Platinum Account, online or via the Amex App, 24/7, from virtually anywhere. Simply log in to American Express online or use your Amex app to check balances, recent transactions and statements, pay your bill, check your Membership Rewards balance and register for exclusive offers and updates.

The mobile messaging feature in your Amex App puts Platinum Service and Travel Concierge in your pocket. Now you can message from anywhere, at no charge, knowing we’ll take care of it, while you get on with your day.

The Gold Business Card Benefits

Gold value for your business

As the boundaries between work and home get more and more blurred, it’s good to know Business Gold is designed to bring you value across both.

Whether you’re on a business trip or taking a break, book your travel on your Card and you’re covered with Travel Accident Insurance up to £250,000 and Travel Inconvenience Insurance up to £200.13

If you buy an eligible item on your Card and it’s stolen or damaged within 90 days, we’ll replace or repair it, or refund you up to £2,500 per eligible item.

However fast you keep moving forward, technology often seems to move faster. Our annual Dell Technologies benefit is here to help you stay on top. You'll get up to £50 in statement credits between January and June, and the same between July and December, for United Kingdom purchases with Dell Technologies on your Amex Business Gold Card.9

Should you return an eligible item for any reason within 90 days, your Card’s Refund Protection means that even if the UK retailer won’t refund you, we’ll replace or refund you up to a maximum of £300.

Unlike a Credit Card, your Card has no pre-set spending limit.11 This means that your Card's spending power - the amount your business can spend - is dynamic and can adjust to your business needs. To help maximise your spending power, you can start spending and repaying the balance as soon as you get your Card, earning Rewards as you go. You can make repayments multiple times within your Billing Cycle, there’s no need to wait. You can find out more on how to maximise your spending power here.

Juggling cash flow is one of the biggest headaches formany businesses. Find out how Business Gold Card could help you enjoy up to 54 extra calendar days topay.12

When you’re working hard to build a business, it’s good to know that you can earn rewards at the same time.4

Employee Cards

You can request up to 20 complimentary Business Gold Cards, giving you extra control, and the opportunity to earn more Membership Reward points.4

AmexExpense

The perfect complement to our Employee Cards solution, AmexExpense is our free expense management tool.

Make more time – for business and pleasure – by keeping on top of your teams’ business expenses in one place.

It’s simple to set up, and even integrates with your accounting software.

Important Information

1. The £200 Annual Travel Credit can only be redeemed at time of booking through American Express Travel Online at americanexpress.co.uk/travel. Full terms can be found at americanexpress.com/uk/platinum-travel-credit-terms

2. The Primary Business Platinum Cardmember or any Business Platinum Employee Cardmember are eligible for part of the American Express Global Lounge Collection and will be enrolled automatically. In order to access over 1400 lounges in more than 650 cities across 148 countries in the Priority Pass programme, the Cardmember must present a valid Priority Pass membership card in their name, along with a boarding pass for same day travel. The Primary Platinum Business and Supplementary Platinum Business Cardmembers who are enrolled to the programme can each bring 1 additional guest free of charge. Any additional guests will be charged a fee at the prevailing rate – per visit, to his or her American Express Platinum Card. Subsequent years’ renewal terms and conditions are at the discretion of Priority Pass. For Priority Pass Conditions of Use visit prioritypass.com. The Cardmember agrees to abide by the Conditions of Use, as detailed at prioritypass.com.

3. Description of Platinum insurance coverages are provided in this document for informational purposes only. The Terms and Conditions provide complete coverage information and supersede all other sources. For the full list of Terms and Conditions, please go to americanexpress.com/uk/business/benefits/platinum-business-card. Subject to enrolment.

4. Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

5. In any calendar month you will now receive 10,000 Membership Reward bonus points once you have spent a cumulative £10,000 in that month. The Bonus Points will be transferred to your Membership Reward account and can be viewed on your Card Account statement. You will continue to earn one Membership Reward point on eligible purchases in excess of £10,000 for each pound you spend on your Card for the rest of that month. Qualifying spend in each calendar month cannot be carried over to the following month. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges. Full Terms and Conditions for the Membership Rewards programme continue to apply. Visit americanexpress.com/en-gb/rewards/membership-rewards/terms for more information.

6. Employee Cards – also known as Supplementary Cards – allow you to share the benefits of your American Express Card with others close to you. You will be the main Cardmember and you will be liable for all charges made on the Employee Card(s). Cardmembers are entitled to up to 20 complimentary Employee Cards only. Employee Cardmembers must be aged 18 or over. Written details available upon request. Approval subject to status and Terms and Conditions.

7. Benefit Limit is capped at £75 in statement Credit; per every 3 months of the calendar year. The benefit value will reset on 1 Jan, 1 Apr, 1 Jul, 1 Oct of every calendar year until 31/12/2026. You cannot carry any unused benefit value from one period into the next. The benefit only applies to online purchases made at uk.indeed.com. Any purchases not made directly with Indeed are excluded. Excludes Indeed Events, Indeed Hire, Indeed Flex, Resume.com SimplyHired and any Indeed job seeker services. The Benefit is only available to the Primary American Express Business Platinum Cardmember using their American Express Business Platinum Card. Transactions made with a Supplementary Card or Additional Card are not eligible for this Benefit. You must first save the Benefit to your American Express Business Platinum Card before making your purchase to qualify for the benefit. Only qualified purchases made after enrolment are eligible for the benefit. If you use another card to make a purchase at any time, you will not be eligible for the benefit on that card. The benefit will expire on 31/12/2026. American Express can withdraw the benefit at any time by giving you 60 days’ notice. Your purchase must be made online at uk.indeed.com to be eligible for the benefit. If you spend in a currency other than Great British Pound (GBP), the amount paid will be converted based on the rate of exchange at the time of the transaction. A non-Sterling transaction fee of 2.99% will apply and this fee does not count towards the benefit. For more information regarding charges made in foreign currencies refer to your Card Member Agreement. If you pay using third party payment providers, such as Buy Now Pay Later providers, third party payment providers or payment processors, you will not be eligible for the benefit. Statement credit(s) should appear on your billing statement within 30 days from the date of qualified purchase but may take longer. Credit(s) are not redeemable for cash or any other payment form. Your purchase of services from Indeed is governed by their respective terms and conditions (including privacy policies). Any and all of Indeed’s online and/or mobile services and websites, and software provided by or on behalf of Indeed on or in connection with such services or websites shall be governed and subject to the terms, rules, policies, guidelines, standard and requirements, including, but not limited to, the Privacy Policy and Terms of Service, that may be posted on the Indeed site, available at uk.indeed.com/legal. American Express is not responsible in any way for the goods and/or services of the participating brands. Inquiries or complaints related to the participating brands' goods and/or services should be directed to their customer service. Our General Offer Terms also apply to the benefit and contain important additional terms.

8. Enrol to the benefit using your eligible American Express® Business Platinum Card. Only the Basic Cardmember on an American Express Business Platinum Card Account can enrol the Card Account into the benefit. Purchases by both the enrolled Basic Cardmember and Supplementary Cardmembers on the enrolled Card Account are eligible for statement credits. Regardless of the date on which the Card Account is enrolled into the benefit, each Card Account is only eligible for up to £75 in statement credits between 1 January and 31 June and up to £75 in statement credits between 1 July and 31 December for a total of £150 per calendar year in statement credits across all Cards on the enrolled Card Account. Valid only on purchases made directly with Dell Technologies in the UK at dell.co.uk/amex or phoning a dedicated Dell Advisors on 0800 169 1745. Not valid on online purchases shipped outside of the UK. Please allow [5 working days] after an eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account – however this can take up to 60 days. These are the key terms of this benefit. Please make sure you visit americanexpress.com/uk/business-platinum-benefits for the full Terms and Conditions applicable to this benefit.

9. Enrol to the benefit using your eligible American Express Business Gold Card. Only the Basic Cardmember on an American Express Business Gold Card Account can enrol the Card Account into the benefit. Purchases by both the enrolled Basic Cardmember and Supplementary Cardmembers on the enrolled Card Account are eligible for statement credits. Regardless of the date on which the Card Account is enrolled into the benefit, each Card Account is only eligible for up to £50 in statement credits between 1 January and 31 June and up to £50 in statement credits between 1 July and 31 December for a total of £100 per calendar year in statement credits across all Cards on the enrolled Card Account. Valid only on purchases made directly with Dell Technologies in the UK at dell.co.uk/amex or phoning a dedicated Dell Advisors on 0800 169 1745 . Not valid on online purchases shipped outside of the UK. Please allow [5 working days] after an eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account – however this can take up to 60 days. These are the key terms of this benefit. Please make sure you visit americanexpress.com/uk/business-gold-benefits for the full Terms and Conditions applicable to this benefit.

10. Benefit is an annual digital subscription to The Times and The Sunday Times. Benefit is available in digital form only and is not available as a paper subscription. You must enrol to access benefit. American Express reserves the right to instruct The Times and The Sunday Times to cancel your benefit if you cease to be a Platinum Cardmember. Benefit is subject to the Terms and Conditions of The Times and The Sunday Times which are available at www.thetimes.co.uk/static/terms-and-conditions/. Benefit subject to change. Please visit americanexpress.com/business/benefits/platinum-business-card for full Terms and Conditions.

11. No pre-set spending limit does not mean unlimited spending. Purchasing power can adjust with your use of the Card, your payment history, credit record, financial resources known to us, and other factors. We reserve the right to apply temporary spending limits in accordance with the Cardmember Agreement.

12. The full 54 days to pay is obtained only if you spend on individual purchases the first day of the new statement period and repay the balance in full on the due date.

13. Terms and Conditions apply. Full details of the travel protection benefits currently available can be found in the Terms and Conditions at americanexpress.com/uk/terms.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2019. American Express Company. All Rights Reserved.

To read the Privacy Statement, click here.

Travel & Lifestyle

Enjoy travel, dining, events, and more

From the convenience and comfort of airport lounges to the chance to buy tickets for events before the general public, we can help you to explore business travel and lifestyle opportunities, home and abroad.

The Platinum Business Card Travel & Lifestyle Benefits

Whether you're travelling for business or to get away from it, you and a guest can enjoy complimentary access to over 1,400 lounges across more than 148 countries around the world.1

Wherever you're headed, your benefits protect you, your family, and your Supplementary Platinum Cardmember, on business and leisure trips of up to 120 days.2

American Express Travel – your dedicated travel agency – brings you great dealson flights, hotel stays, car hire and experiences. You can pay with your points, your Business Platinum Card, or a combination of both.

£200 Annual Travel Credit

With the Business Platinum Card, you’ll get a £200 Annual Travel Credit* each year, when you book through American Express Travel Online. Whether you’re travelling for business or pleasure, use your Credit on any single travel booking of £200 or more.

You can use your Card to pay recurring bills like telecoms, utilities and digital advertising. You may be surprised how many of these suppliers accept American Express Card payments, earning you extra rewards on everyday business services. 4

When you use your Card to book travel with Platinum Concierge, you may recieve exclusive preferential fares and benefits

on First, Business, Premium, or Economy tickets with our partner airlines. Contact your Platinum Concierge direct from the

Amex app to learn more. 5

When business takes you away, staying somewhere special can transform your trip. Fine Hotels & Resorts brings you a collection

of over 1,000 hand-selected iconic 5-star properties worldwide, offering complimentary benefits worth and average total value of

£400 per stay.6

It's always good to feel extra-welcome. With Business Platinum you can fast-track to higher tier hotel loyalty programmes, enjoying benefits normally reserved for loyal customers with Hilton, Shangri-La Hotels & Resorts, Marriott BonvoyTM and more. 7

Whether you're in an urban jungle or a real one, there's always a possibility that things can go wrong. Global Assist® is here to

help. If you run into trouble, assistance is just a phone call away, 24/7.

*Average value based on Fine Hotels & Resorts bookings in 2017 for stays of two nights. Benefits include daily breakfast for two, room upgrade when available, US$100 amenity, guaranteed 4pm late check-out, noon check-in when available, and complimentary Wi-Fi. Room upgrade not guaranteed; certain room categories not eligible for upgrade. US$100 amenity varies by property. Actual value will vary based on property, room rate, upgrade availability, and use of benefits.

You can use your Card to pay recurring bills like telecoms, utilities and digital advertising. You may be surprised how many of these suppliers accept American Express Card payments, earning you extra rewards on everyday business services. 10

The Gold Business Card Travel & Lifestyle Benefits

It’s great to escape the crowds when you’re heading out on business. Your Lounge ClubTM membership card entitles you to enjoy two complimentary visits to over 1,200 lounges across more than 140 countries around the world, regardless of which airline orclass of cabin you choose.

Whether you’re on a business trip or taking a break, book your travel on your Card and you’re covered with Travel Accident Insurance up to £250,000 and Travel Inconvenience Insurance up to £200.2

Book flights, hotel stays, car hire and experiences and you’ll earn 2x Membership Rewards® points. And you can pay with your points, your Business Gold Card, or a combination of both.3

We all appreciate those little extras when we’re away from home. Stay two consecutive nights at properties in The HotelCollection and you’ll get a US$100 credit to spend on a dinner or a spa treatment, as well as a room upgrade at check-in (when available).

You can use your Card to pay recurring bills like telecoms, utilities and digital advertising. You may be surprised how many of these suppliers accept American Express Card payments, earning you extra rewards on everyday business services. 9

Have you ever got off a plane and stood in a car hire queue for what felt like almost as long as the flight? Not any more. You can join Hertz Gold Plus Rewards and enjoy fast-track service, along with a host of other benefits4:

It’s so easy to save on dining, travel, shopping and more, with exclusive offers via your online Account or Amex App.10

Whether you’re in an urban jungle or a real one, there’s always a possibility that things can go wrong. Global Assist® is here to help. If you run into trouble, assistance is just a phone call away, 24/7.

Important Information

1. The Primary Business Platinum Cardmember or any Business Platinum Employee Cardmember are eligible for part of the American Express Global Lounge Collection and will be enrolled automatically. In order to access over 1400 lounges in more than 650 cities across 148 countries in the Priority Pass programme, the Cardmember must present a valid Priority Pass membership card in their name, along with a boarding pass for same day travel. The Primary Platinum Business and Supplementary Platinum Business Cardmembers who are enrolled to the programme can each bring 1 additional guest free of charge. Any additional guests will be charged a fee at the prevailing rate – per visit, to his or her American Express Platinum Card. Subsequent years’ renewal terms and conditions are at the discretion of Priority Pass. For Priority Pass Conditions of Use visit prioritypass.com. The Cardmember agrees to abide by the Conditions of Use, as detailed at prioritypass.com.

2. Terms and Conditions apply. Full details of the travel protection benefits currently available can be found in the Terms and Conditions at americanexpress.com/uk/terms.

3. Cardmembers enrolled in the American Express Membership Rewards programme will earn one additional Membership Rewards point in addition to their standard earn rate for virtually every full £1 spent on americanexpress.co.uk/travel. This excludes cruise bookings, Fine Hotels & Resorts and The Hotel Collection bookings. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

4. Enrolment is required to access the benefits. More information on: americanexpress.com/en-gb/travel

5. Terms and Conditions apply. Please visit americanexpress.com/uk/business/platinum to view the full Terms and Conditions.

6. Available for Platinum Charge Cardmembers and excludes Platinum Credit Cardmembers who are not also Platinum Charge Cardmembers. Cardmember must travel on itinerary booked to be eligible for benefits described. Participating Fine Hotels & Resorts properties and benefits are subject to change.

7. Enrolment is required to receive programme benefits. Individual benefits vary by partner and are subject to availability. Please refer to each hotel loyalty partner’s Terms and Conditions. American Express reserves the right to instruct Hotel Partners to cancel your membership if you cease to be a Platinum Cardmember or your Account is not in good standing. Benefits are subject to availability. Call Platinum Concierge for details of each partner’s Terms and Conditions.

8. Reservations are based on a first come, first served basis. In the event of a reservation cancellation, the Cardmember will be subject to the restaurant’s cancellation policy, which will be communicated to the Cardmember by Concierge at the time of booking. Concierge is not responsible for informing the restaurant of your dietary restrictions or for the restaurant being able to accommodate the restrictions; we ask that you provide this information directly to the restaurant.

9. Events and tickets are subject to availability and to all applicable service charges and taxes. American Express and Partner Terms and Conditions apply, visit americanexpress.co.uk/welcomeplatinum or call your Platinum Concierge for a list of full Terms and Conditions.

10. Eligible Cards include Consumer or Small Business Cards issued by American Express UK. Ineligible Cards include American Express Prepaid or Corporate Cards. The account under which the Eligible Card is issued must be active and not in default or (in our reasonable opinion) at risk of default.

11. The £200 Annual Travel Credit can only be redeemed at time of booking through American Express Travel Online at americanexpress.co.uk/travel. Full terms can be found at americanexpress.com/uk/platinum-travel-credit-terms

Offer Terms and Conditions apply. Please see individual offers for details. American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2022. American Express Company. All Rights Reserved.

To read the Privacy Statement, click here.