This page will help you better understand your Credit Card including your

APR and interest rate, as well as making statement payments and spreading the cost of purchases.

Understanding how my Credit Card Interest and APR work

Using a credit card is the flexible way to make payments. But remember, you may have interest applied to your Account on a monthly basis if you pay less than the full amount on your monthly statement.

Find out how interest is calculated and when you’ll be charged here.

Simply put, if you pay less than your full balance by your payment due date, interest will be applied to the amount on your Account until the balance is paid in full.1

However, if you make a cash withdrawal (also known as Cash Advances), interest is applied slightly differently. In this instance, interest is applied from the date of the transaction, up until the date it is paid in full. And interest will still be applied to your Account even if you pay your balance in full for Cash Advances.

You can see your monthly interest rates at the top of your monthly statement, or in your Cardmember Agreement. You’ll also see an estimate of the interest that will be applied to your Account, assuming you can only pay the minimum amount due. You can keep an eye on your statement at all times, via your Online Account or Amex App.

Interest can be applied differently, depending how you use your Card.

Purchases

We won’t charge interest on purchases, provided

you pay the full amount you owe on each

statement date, every month. Otherwise, we’ll

charge interest daily from the date an amount is

charged to your Account, until it’s paid in full.

Cash Advances

With Cash Advances and balance/money

transfers, we’ll charge interest daily from the date

the transaction is applied to your Account, until it’s

paid in full (subject to any promotional offers).

APR stands for Annual Percentage Rate. It is the total interest rate you’ll be charged for borrowing money over a year on a credit card. The APR could seem like a big number, but don’t be alarmed. As well as the interest rate applied to your balance, APR also includes charges you may have to pay, such as the annual Card fee that entitles you to all of your Card benefits, like travel insurance and airport lounge passes. Although other charges, like late payment fees and cash withdrawal charges are not included.

APR is a way of measuring the yearly all-in cost of credit. As an annualised percentage, APR allows you to easily compare credit products and their affordability.

Rates may also vary based on your individual circumstances.

Balance interest

Any standard fees

e.g. annual Card fee

It doesn't include:

Non-standard fees and charges, e.g. missed repayments or cash withdrawals

Learn more about APR here:

Using a credit card is the flexible way to make payments. But remember, you may have interest applied to your Account on a monthly basis if you pay less than the full amount on your monthly statement. Find out how interest is calculated and when you’ll be charged here.

How do you work out the interest I pay?

We work out your annual percentage rate of interest (APR) by adding your personal rate to the Bank of England Base Rate. We call this your ‘simple’ rate. This is the rate you’ll pay on all balances on your Card, except for cash withdrawals or any other cash transactions you make. As these have their own interest rates, that are also linked to the Bank of England Base Rate.

We convert your annual simple rate into a daily rate, by dividing it by the number of days in a year (365). We then apply the daily rate and add it to the amount you owe each day.

For example, if you owed £1,000 and had a ‘simple’ rate of 20%, the amount you would pay in interest for one year would be 20% of £1,000, which is £200.

This amount would then be divided by the number of days in a year: £200 ÷ 365, which is 55p.

The interest is added to your Account every day. So, the following day you would pay interest on a balance of £1,000.55. We call this ‘compound interest’. And it means you pay interest on the interest you’re charged, not just on the things you buy.

| Day | Amount Owned | Yearly Interest (rate 20%) | Daily Interest | TOTAL |

|---|---|---|---|---|

| DAY 1 | £1000.0 | £200 | £0.55 | £1000.55 |

| DAY 2 | £1000.55 | £200.11 | £0.55 | £1001.10 |

| DAY 40 | £1022.00 | £204.40 | £0.56 | £1022.56 |

Always remember, if you pay off your balance in full each month, you won’t pay any interest. You’ll also avoid other fees, like paying interest for late payments, returned payments, or over limit fees that can be added to your balance.

Bank of England Base Rate tracking is effective as of your statement on or after 01 October 2019.

If you pay off your entire Credit Card bill on, or before, the statement due date (within the interest-free period), you won't be charged interest. If you opt to pay off your balance over several months, interest will be charged on the amount outstanding. Interest will be applied up until the date you fully repay your balance.

We won’t charge you interest when you pay your statement in full by the due date, and did not carry a balance over from the previous statement, or on any late payment fees or returned payment fees.

If you ask us to make a cash advance or balance/money transfer in June, we’ll apply interest from the date we charge it to your Account and show it in your following statement.

The ‘simple rate’ is a variable rate comprised of two parts:

X% + 5.25%

Your Personal Rate The Base Rate

The ‘simple rate’ is the actual interest rate you will pay on your Card. It’s your personal rate and the Bank of England Base Rate added together. It moves in line with the Bank of England Base Rate – when the Base Rate changes, you’ll see your simple rate change by exactly the same amount.

You can find details of your interest on your Credit Card statement.

Bank of England Base Rate tracking is effective as of your statement on or after 01 October 2019.

*Current base rate.

If you pay the full balance every month, you won’t be charged interest, unless you have made a cash transaction. Interest on cash transactions is charged from the moment the transaction is made. These have a different rate, which is also linked to the Bank of England Base Rate.

Yes, we’ll always let you know in advance if your interest rate is changing, because the Base Rate has changed.

We’ll tell you of the change on the statement before it happens. We’ll also let you know about Base Rate changes on our website and in the press.

If your interest rate is changing for any other reason, we’ll give you at least 30 days’ notice if it’s going up. And if it’s going down, we’ll still give you notice, but might make the change sooner.

Credit Card Terms

Statement Period

The dates for which your statements

are issued and report transactions for.

Generally, your statement period will

be every 30 days, and actual dates

can vary slightly from month to month.

Interest

Type of charge incurred as a result

of borrowing money and not

repaying in full within the indicated

time. Interest is usually expressed

as an annual percentage rate, also

known as the interest rate.

Closing Balance

The amount you owe at the end of

a particular statement period.

Whatever you’re looking to purchase, by using your American Express Credit Card, you can enjoy an interest free period of up to 56 days when you pay in full and on time.

How does it work?

Purchase any item the day after your statement date and you could enjoy an interest free period of up to 56 days.

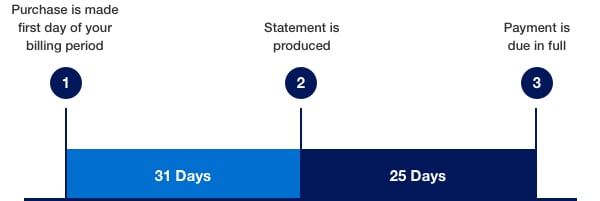

The example timeline below shows how the interest free period works.2

When your statement is produced, you have the following payment options:

- Pay the minimum amount due on your Credit Card. This is typically a small percentage of your whole

balance, plus any interest and fees. However, this can vary by product, so check the minimum due amount on

your statement by logging in here.

- Pay the Full statement balance. Paying this way ensures you will have no interest applied to your Account.

- Pay an amount of your choice, between the minimum amount due and full statement balance

Our payment options are designed to give you flexibility when you need it. Find out how to pay using these methods, here.

STAY UP-TO-DATE. TURN ON ALERTS.

Take control by setting up alerts to notify you about your

Account:

You’ve spent a certain amount in a month

You’re within a certain amount of your credit limit

A weekly balance update

You have a payment due

We’ve received your payment

You can register via the Amex App, on your Online Account here, or by speaking with one of our Customer Care Professionals by calling the number on the back of your Card.

Online Account

Our Online Account service helps you to

manage your finances to best suit you. You

can see recent purchases you have made,

pending transactions before they’re

charged to your Card, view your

statements and download past statements,

set up a Direct Debit and alerts, and make

payments when you choose.

Amex App

With the same features as our Online

Account but in a concise mobile

version, the Amex App is a great way

to help you manage your finances

when you’re on the move.3

Customer Services

Should you have a question about

your Account and you’re unable to

find the answer online, we have a

dedicated Customer Services

Team, available 24/7 to assist you.

You can call the team on

0800 917 8047.

Want to learn more about Credit Cards?

Credit Card fees and charges explained

We’ll help you to understand all the Credit Card fees

Credit Card repayments

What are Credit Card repayments and how do they work at American Express?

What is a Credit Card limit?

Understand what a Credit Card limit is, how to increase it and useful tips for staying in your limit

1Interest on all balances that result from purchases (including associated fees, such as non-sterling Transaction fees), interest charges and service charges (such as the copy statement fee), is charged at the per annum rate found in your Terms and Conditions (variable) if the statement balance is not paid in full, as per your Credit Card agreement. Cash advances, balance transfers, and the interest charged on those non-purchase balances do not accrue interest at the standard. If you do not pay your balance in full you may incur interest on your outstanding balance. You will still be required to pay your minimum due payments. If you only make minimum payments, it will take you longer and may cost you more to clear the outstanding balance.

2Interest free period - Maximum 56 days on purchases if you pay the full amount you owe on each statement date on time every month. No interest-free period on balance/money transfers or cash advances (subject to any interest-free promotional offer).

3See app store listings for operating system information.

American Express Services Europe Limited has its registered o ce at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2022. American Express Company. All Rights Reserved.