If you’re the Basic Card Member, it’s easy to add an Additional Card Member to your account.1

Whether you share a household or a trusting relationship, see how everyone can make the most of their Card benefits.

Want an easier way to combine expenses?

Or to discover how many rewards you can earn together?

See how perks can be twice as nice.

Earn rewards

faster

If you’re the Basic Card Member, you’ll earn rewards on your Additional Card Member’s purchases the same way you do on your own Card, so rewards can really add up.

Extend

savings

Additional Card Members can add Amex Offers2 to their Card for places they shop, and enroll in ShopRunner3.

Share

convenience

You can both breeze through checkout by making quick, secure payments with your contactless Card4 or digital wallet.†

*iOS and Android™ only. See app store listings for operating system info.

†Digital Wallets are Apple Pay™, Samsung Pay, Google Pay™, or Fitbit Pay™.

Additional Cards offer teens and young adults benefits for smart account management.

Stay on

the move

Use your contactless Card4 or digital wallet† for quick and convenient purchases, and use the American Express® App* to freeze Cards easily

if they ever get lost.

Set a strong

foundation

Children over 18 can start to establish their own credit, while everyone gets early access to financial education and practice reviewing statements.

Encourage good

spending habits

Keep everyone in the loop with spend notifications and account alerts, and teach responsibility by setting budgets and spend limits as low as $200.5

*iOS and Android™ only. See app store listings for operating system info.

†Digital Wallets are Apple Pay™, Samsung Pay, Google Pay™, or Fitbit Pay™.

Extended family members, household employees,

or trusted assistants can purchase with confidence

and share benefits with ease.

Earn rewards

faster

If you’re the Basic Card Member, you’ll earn rewards on your Additional Card Member’s purchases the same way you do on your own Card, so rewards can really add up.

Manage

on the go

Additional Card Members can add Amex Offers2 for the places they shop directly to their Card, and freeze misplaced Cards easily.

Share

convenience

Expense tracking stays streamlined with charges separated automatically, and both of you can breeze through checkout with contactless payments.4

*iOS and Android™ only. See app store listings for operating system info.

†Digital Wallets are Apple Pay™, Samsung Pay, Google Pay™, or Fitbit Pay™.

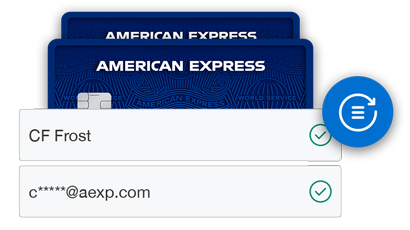

It begins with a simple update

If you’re the Basic Card Member, make sure you and your Additional Card Member can stay informed and in control of your Membership together by updating their email and communication settings.

Take account management on the go

Download the American Express® App* to track your spending and your Additonal Card Member's spending, set spending limits as low as $2005, find and add offers, freeze or replace Cards, and access it all faster by logging in with a touch of your finger or using Face ID.6

*iOS and Android™ only. See app store listings for operating system info.

Manage all your Card

account details online

Update your profile, see a year-end summary7 of your purchases, get help instantly through our chat feature, and more.

Don't have an Online Account? Create one by visiting americanexpress.com to get started.

Just received a new Card?

Ready to Add a Card?

If you’re the Basic Card Member, log in to your account.

Go to the Account Services tab.

Click on Add Someone to Your Account.1

Terms and Conditions

View the full Card Member Agreement.

1. By submitting this application, you authorize us to issue an Additional Card(s) on your Account to the individual(s) whose name(s) appear(s) on the application.

Additional Card Members do not have accounts with us but can use your Account subject to the terms of the Card Member Agreement, must be at least 13 years of age and never had a default account with American Express. You are responsible for the activity and use of your Account by Additional Card Members. You must pay for all charges they make.

You authorize us to give Additional Card Members information about your Account and to discuss it with them.

2. Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay. Only U.S.- issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird Cards may be eligible. We may consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your eligibility to access Amex Offers. You may not be eligible to access Amex Offers if we, in our sole discretion, determine that you have previously engaged in abuse, misuse or gaming of the Amex Offers program, or any other Amex program. Offers are also available to Additional Card Members and available offers may vary for each eligible Card Member. Please review the terms of each offer for details on how to redeem. For full Program Terms, visit www.americanexpress.com/us/amexoffersterms/.

3. Enrolling in the Benefit.

To get the free ShopRunner membership benefit compliments of American Express (the "benefit"), you must go to www.shoprunner.com/americanexpress and verify your eligibility for the benefit with an eligible Card account number and then complete the sign up for a ShopRunner membership account ("ShopRunner account"). For details on how the ShopRunner membership works, please see the ShopRunner Terms and Conditions at https://www.shoprunner.com/terms/sr/ which govern the use of your ShopRunner membership benefit. You may also be able to enroll in this benefit through access provided to ShopRunner at participating online stores or through an email provided by American Express if it has determined that you have an eligible Card. An "eligible Card" means an American Express U.S. Consumer or Small Business Credit or Charge Card that is not cancelled and that is issued to you by a U.S. banking subsidiary of American Express. Prepaid Cards and products, American Express Corporate Cards and American Express-branded Cards or account numbers issued by other financial institutions are not eligible. ShopRunner will verify with American Express the eligibility of your Card account number for the benefit.

Maintaining the Benefit.

To maintain this benefit on your ShopRunner account, you must maintain an eligible Card. The benefit may be cancelled on your ShopRunner account if you do not have an eligible Card. You can maintain only one benefit per eligible Card.

During your enrollment in the benefit, ShopRunner and American Express will verify your benefit eligibility.

Treatment of Existing ShopRunner Memberships.

If you enroll in the benefit and sign up with an existing ShopRunner account, ShopRunner will cancel the term of your existing ShopRunner account. If you paid a fee for any unused portion of the cancelled term of membership, ShopRunner will provide you with a pro rata refund for that portion in accordance with ShopRunner’s refund policy. The refund will be processed within 2-4 weeks after enrollment and will be issued to the payment method you used to pay the fee. If a portion of the cancelled term of membership was promotional or free, the free period will be cancelled by ShopRunner and forfeited by you. If you currently have a free or promotional membership on your ShopRunner account, you should consider whether to enroll in the benefit at this time.

General Terms.

An eligible Card can be used to verify eligibility for only one benefit enrollment. American Express may receive and use your personal data from ShopRunner, which may include personally identifiable information and Credit Card information, to determine eligibility and further develop features and services related to the benefit. American Express may send you emails regarding your enrollment in this benefit. Any information American Express collects from you or from ShopRunner shall be governed by the American Express Online Privacy Statement (https://www.americanexpress.com/privacy). American Express may change, modify, cancel, revoke, or terminate this benefit at any time.

You can review these Terms and Conditions at any time by visiting https://www.shoprunner.com/terms/amex/.

4. Participating merchants only

5. When you request that we apply a limit as described below on Charges incurred by an Additional Card Member on your Account, you agree to these terms. These terms supplement, and are incorporated by reference into, the terms of your Card Member Agreement.

At your request, we may agree to apply a limit to the total dollar amount of Purchases, during each billing period, that are charged to Card numbers associated with one or more specified Additional Card Members on your Account. At your request, we may agree to apply a limit to the total dollar amount of cash access transactions at ATMs, during each billing period, that are made using Card numbers associated with one or more specified Additional Card Members on your Account. If we agree to apply a limit, it is not a guarantee that the Additional Card Member will be able to make Purchases or cash access transactions up to the applicable limit. In applying any limit we will not take into account any credits (such as for returned merchandise or for payments), even if a credit relates to a Purchase made by the Additional Card Member. Any request that we change a limit may not be effective until a subsequent billing period. Any Charges (as defined below) incurred by the Additional Card Member prior to the date during a billing period that we apply the limit will not be subject to the limit for that billing period.

Because of systems or administrative considerations, arrangements with merchants, or for other business reasons, we may, but are not required to, treat some Purchases and/or cash access transactions (collectively, Charges) as not being subject to any such limits. You agree to pay all Charges without regard to whether any Charges exceed a limit, and you agree that we are not liable to you or any other person when a limit is not applied to any Charges and/or when Charges are incurred and billed that exceed a limit. While we typically require merchants to obtain an authorization for purchases and submit final transaction documentation for payment in a timely manner, a limit may not apply or may be exceeded when a merchant does not obtain an authorization for any reason; when a merchant obtains an authorization for a partial amount of the final charge submitted to us for payment; or when such submissions are not submitted or processed at the same time that the authorization is obtained. Examples may include, but are not limited to: Charges made outside of the U.S., in duty-free stores, or on board airplanes or cruise vessels; international airline ticket Purchases; vehicle rentals; lodging stays extended beyond original reservation period; certain mail order Purchases; Purchases billed on a recurring basis; Purchases at gas stations; telecommunications charges, including charges incurred with calling cards; taxicab charges; security deposits; late, damage or other fees in connection with rentals; Purchases billed in installments; restaurant tips and other gratuities; and Charges that occur before the end of billing period, if the Charge is posted to your Account after the Closing Date of that billing period. Any limit will not be applied to Charges for foreign currency or for travelers cheques or gift cheques obtained other than by telephone from us.

The Spending Limit for the Additional Card Member(s) is optional. If no Spending Limit is set on the Additional Card, spending capacity on this Card will be subject to the Basic Card Member's account terms and conditions.

6. Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trademarks of Google LLC.

7. The Online Year-End Summary, typically available in January, reflects charges posted to your account from January 1st through December 31st of the prior year.