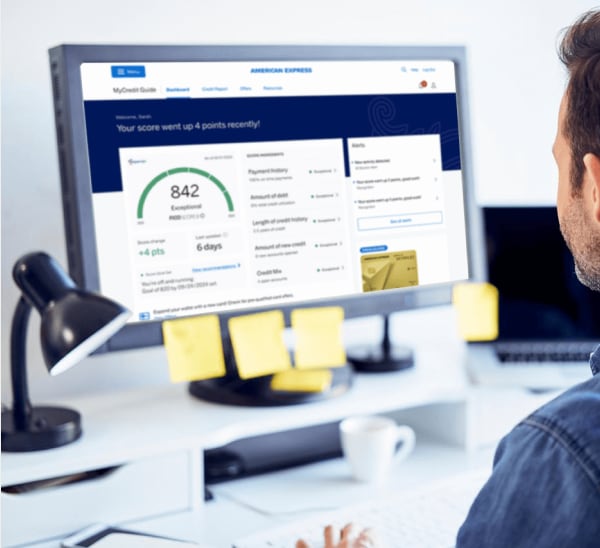

American Express® MyCredit Guide

Explore your FICO® Score and Experian® credit report with personalized insights, for free.

American Express Card Member

For easy access, sign in or enroll through your online account.

Not a Card Member?

Enroll below to create your MyCredit Guide account.

Already Enrolled? Log In Here

Why MyCredit Guide?

Using MyCredit Guide won’t impact your score, no matter how often you check it.

There is no cost to using MyCredit Guide.

Access MyCredit Guide through our website and app.

We provide a secure login that helps keep your information safe.

Expand your credit knowledge with MyCredit Guide’s tools and features.

A detailed FICO® Score and credit report based on Experian data.*

Understand how specific factors are impacting your score with FICO® Score Ingredients.

Dive into your score history and see how it’s changed over time.

Predict how different financial decisions and actions may affect your score with FICO® Score Simulator.

Get personalized alerts about activity impacting your FICO® Score and Experian® credit report.

Use FICO® Score Planner to set credit goals and get personalized recommendations to help you reach them.

Identity Monitoring keeps track of your personal information across the internet and alerts you to any compromised data.

*Credit score calculated based on the FICO® Score 8 model and is provided for educational purposes. American Express and other lenders may use a different FICO® Score version than FICO® Score 8, or another type of credit score altogether, and other information to make credit decisions.

FICO is a registered trade mark of Fair Isaac Corporation in the U.S. and other countries.

Already enrolled to MyCredit Guide?

Log In Here

Frequently Asked Questions

Yes, American Express® MyCredit Guide is a free service that allows you to view your FICO® Score and Experian® credit report for free, whether or not you are currently an American Express Card Member. Once enrolled, you can access your free credit score and credit report at any time. MyCredit Guide also provides enrolled customers with FICO® Score Simulator and FICO® Score Planner tools to help you build positive credit habits that support a healthy credit score.

No, American Express® MyCredit Guide is a free service that provides your FICO® Score and Experian® credit report, whether you hold an American Express Card or not. If you’re an American Express Card Member, you can access MyCredit Guide by logging into your American Express online account. If you don’t have an American Express Card, you can enroll by creating a free MyCredit Guide account.

MyCredit Guide provides your FICO® Score 8 based on Experian® credit report data, for free.

No, MyCredit Guide relies on “soft” credit inquires to provide your Experian® credit report. Soft inquires do not affect your credit score.

Identity (ID) Monitoring keeps an eye on your personal information across a range of internet sites. MyCredit Guide will monitor for compromise or exposure of your personal information including Social Security Number, email address, and telephone number. If we detect that your information has been exposed or compromised, MyCredit Guide will provide alerts to inform you of the specific accounts exposed, description of the exposure, and recommendations for actions you can take to help secure your data and identity.

No, checking your FICO® Score or Experian® credit report through American Express® MyCredit Guide will not impact or lower your credit score. Only "hard inquiries" of your credit report will have any potential impact against your credit score. Hard inquiries are most often made when you apply for a loan or line of credit or when a creditor or lender wants to review your credit score, credit report, or credit history. Pulling a free credit report or viewing your credit score with MyCredit Guide is a simple way for you to keep an eye on your credit history without triggering a hard inquiry, helping you monitor activity that might affect your credit report or credit score.

Yes, MyCredit Guide will work with devices such as smartphones and tablets. You can get all the MyCredit Guide features on your mobile device like your FICO® Score, Experian® credit report, alerts regarding changes to your credit report, and credit tools including the FICO® Score Simulator and FICO® Score Planner tools, all for free. You can access MyCredit Guide on a mobile device either through the Amex app, which is free and simple to use, or by visiting MyCredit Guide from Safari, Chrome, or another web browser.

The FICO® Score Planner (FSP) is a tool that allows you to set a target FICO® Score and a desired time period within which to reach that goal. These inputs, along with your credit report data, are analyzed by the FSP algorithm to provide potential actions you can take to help reach your target score.