Protecting Your Account

Help protect your Rewards Checking account and your information with a suite of tools and resources available to you.

Protecting

Your Account

Help protect your Rewards Checking account and your information with a suite of tools and resources available to you.

What Amex Provides to You

24/7 FRAUD MONITORING

Backed by Amex. 24/7 world-class customer service and fraud monitoring.

ZERO LIABILITY PROTECTION1

You won't be held responsible for unauthorized charges on your debit card that you report promptly.

MULTI-FACTOR

AUTHENTICATION

Two-step verification adds an extra layer of security to your account. If someone tries to log in using a new device, we’ll send you a unique code. Amex will never call you asking for this code.

FDIC INSURANCE

Accounts offered by American Express National Bank. Member FDIC.

Maximize Your Account Security

Here are some things you can do to maximize your account security.

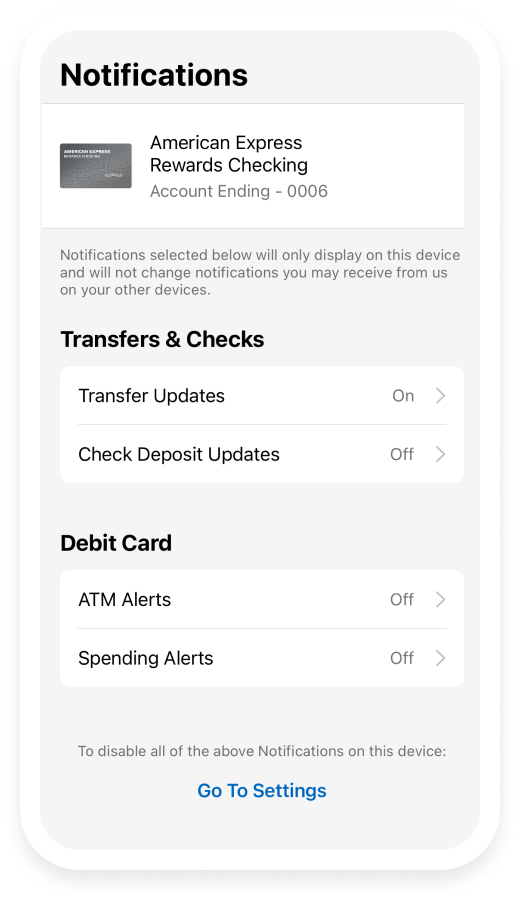

OPT-IN TO ACCOUNT NOTIFICATIONS

Keep a closer eye on your transaction history. On the Amex® app, go to your Rewards Checking account, select the three dots to navigate to Account Management, and then go to Notifications to opt in.

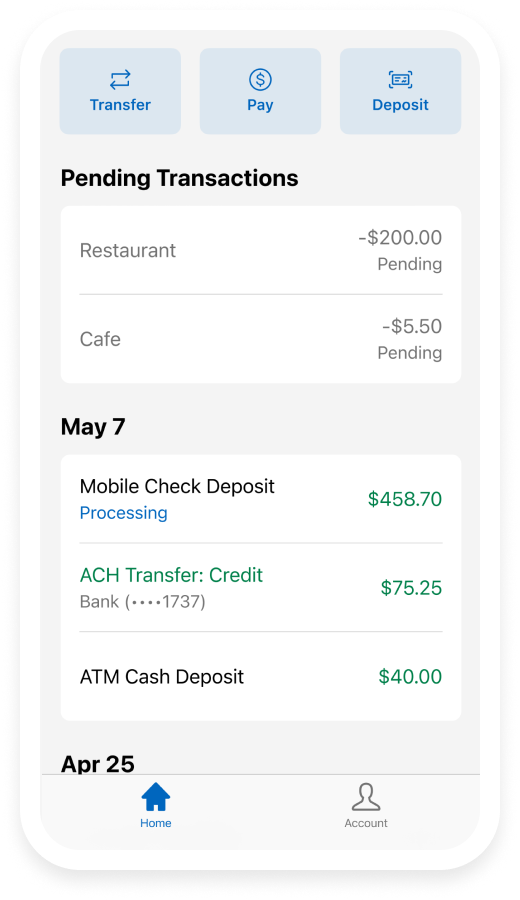

REGULARLY REVIEW YOUR

TRANSACTION HISTORY

When you’re aware of your transaction history, you may find it easier to notice unusual history. Log in to your Amex® account and select your Rewards Checking account to review your recent transactions.

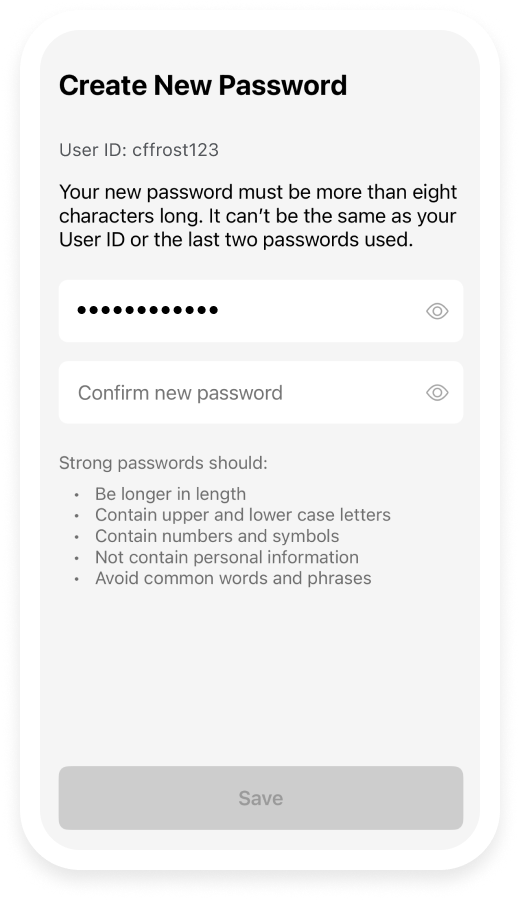

UPDATE PASSWORD STRENGTH

A strong password usually contains lower- and upper-case letters, numbers, and symbols, and avoids using easily guessed phrases or information like birthdays. Log in to your online account and navigate to Account Services to adjust your security and privacy settings.

Be Aware of Common Scams

Be mindful of these common scams to help protect yourself from these scenarios.

PAY YOURSELF

Scammers may try to gain access to your accounts by asking you to make a deposit into your own account. This is a common way to sidestep identity verification.

BANK IMPOSTER

Scammers may pose as bank representatives to gain your personal information. Scammers then try to trick you into transferring money or granting access to your accounts.

OVERPAID PURCHASE

A scammer poses as a buyer and “overpays” for a product or service. The scammer then requests the seller to refund the overpaid amount.

WIRE TRANSFER

A wide range of scams where scammers attempt to trick individuals into transferring money to the scammer’s account.

If you suspect you’re talking to a scammer, do not click on any links, provide any personal information, or respond to messages. Call American Express immediately to report the situation. Learn more about how to protect yourself from scams like these in the Amex Security Center.

Take Action Against Scams

Now that you’re more familiar with common scams, there are several ways you can protect yourself.

VALIDATE THE SOURCE

Always confirm the identity of the person or organization contacting you before taking any financial actions. If you’re not sure you’re talking to Amex, hang up and call the number on the back of your Debit Card.

TAKE YOUR TIME

Scammers often pressure their targets by creating a false sense of urgency. Ask yourself questions, like “Do I feel pushed to take immediate action?” Never give out sensitive information if someone calls you.

STAY INFORMED

Educate yourself about emerging scams and tactics. By staying aware, you can identify red flags and protect yourself.

What to Do if You Suspect Fraud or a Scam

If you believe you may be a victim of fraud or a scam, we’re here to help.

![]() Contact us at 1-877-221-2639 to take the next steps to help protect your account and personal information.

Contact us at 1-877-221-2639 to take the next steps to help protect your account and personal information.

You can also report any scams and unsolicited communications to the U.S. Federal Trade Commission, and you can report confirmed cases of identity theft at identitytheft.gov.

Terms and Conditions

- Zero Liability Fraud Protection does not include charges made by users who you allow to use your Debit Card. You are responsible for notifying American Express promptly upon learning of an unauthorized transaction against your accounts or the loss or theft of your Debit Card or Debit Card number. Limitations apply. See the Consumer Deposit Account Agreement and Rewards Checking Schedule at americanexpress.com/rewardscheckingterms. Learn how we secure your payments at americanexpress.com/us/security-center/.