How to understand your Card Statement

Your statement is like a snapshot of your card. It includes important

information like the amount you owe, the transactions you’ve made

and also the minimum payments due. Let’s break it down.

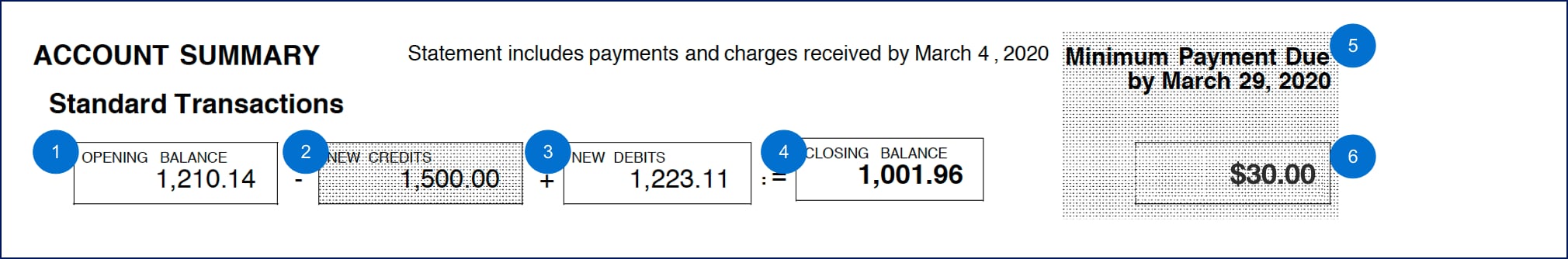

Your Account Summary

A summary of your credit card balance and transactions. Includes credits and debits.

|

Opening Balance |

|

|

|

|

|

Closing Balance |

|

Minimum Payment Due Date |

|

Minimum Payment |

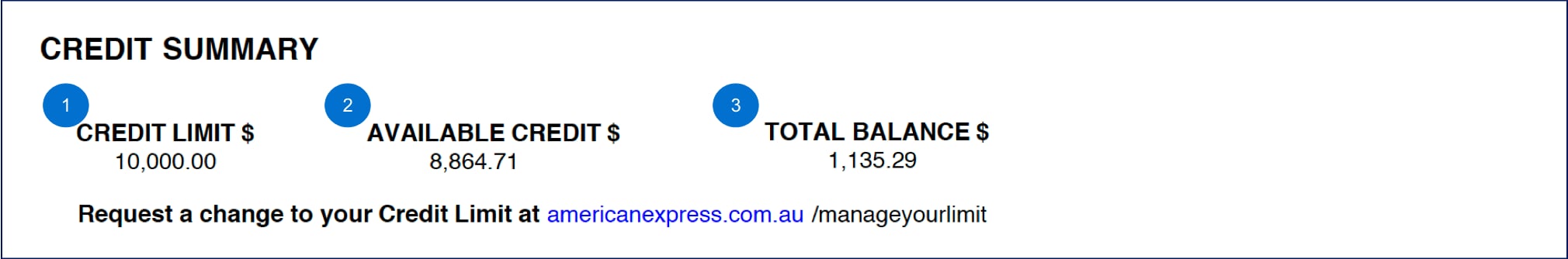

Your Credit Summary

An overview of the credit position of your card, including how much you owe and how much more you can spend.

|

Credit Limit |

|

|

|

Total Balance |

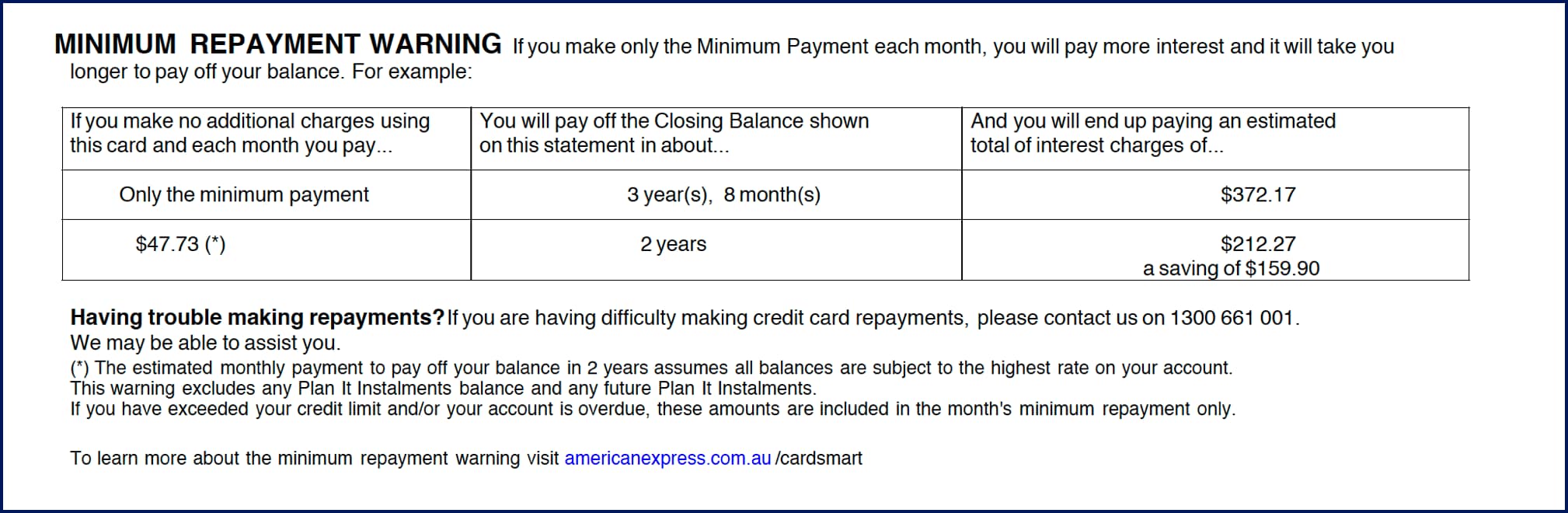

Minimum Payment Warning

This shows you how long it would take to repay your balance and the interest you would be charged over that period, should you elect to pay the minimum payment each month. This warning also shows the amount you need to pay off each month to clear your balance in 2 years, the total interest you would pay, and how much you would save compared to only making minimum repayments. Please note the Minimum Payment Warning is only presented to Personal Card Members and not Business Card Members.

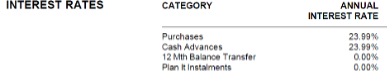

Your Interest Rates

These are the rates of interest that apply to different types of charges on your Card. Below example is for illustration purposes only and you should refer to your own statement for actual annual interest rates.

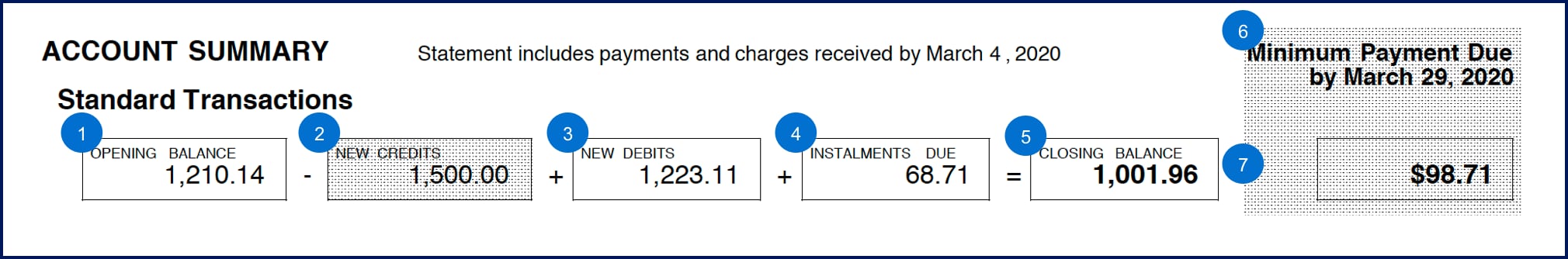

Your Account Summary

A summary of your credit card balance and transactions. Includes credits, debits and any instalments due.

|

Opening Balance |

|

New Credits |

|

New Debits |

|

Instalments Due |

|

Closing Balance |

|

Minimum Payment Due Date |

|

Minimum Payment |

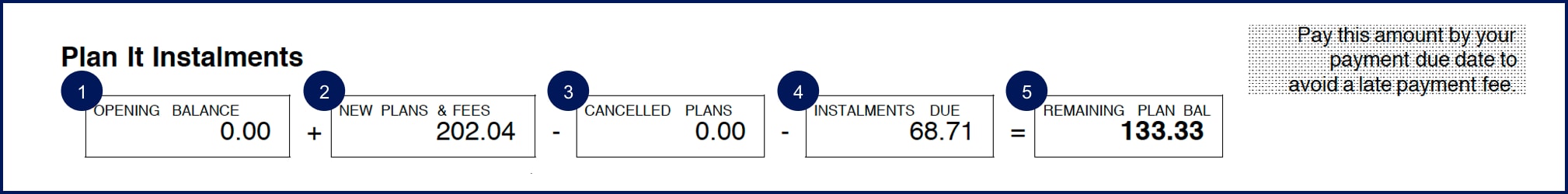

Your Plan It Summary

A summary of any Plan It Instalment plans, including the original and remaining balance, plus any instalments due that month.

Opening Balance |

|

New Plans and Fees |

|

Cancelled Plans |

Instalments Due |

|

Remaining Plan Balance |

Your Credit Summary

An overview of the credit position of your card, including how much you owe and how much more you can spend.

|

Credit Limit |

|

Available Credit |

|

Standard Closing Balance |

|

Remaining Plan Balance |

|

Total Balance |

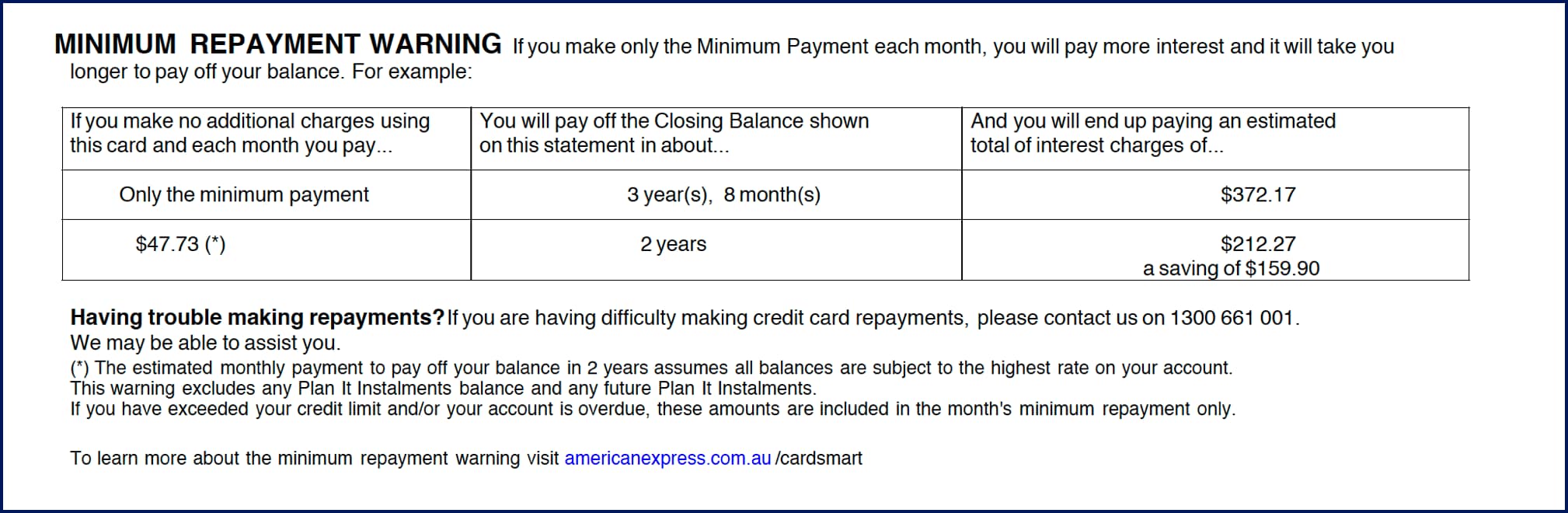

Minimum Payment Warning

This shows you how long it would take to repay your balance and the interest you would be charged over that period, should you elect to pay the minimum payment each month. This warning also shows the amount you need to pay off each month to clear your balance in 2 years, the total interest you would pay, and how much you would save compared to only making minimum repayments. Please note the Minimum Payment Warning is only presented to Personal Card Members and not Business Card Members.

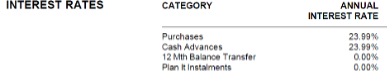

Your Interest Rates

These are the rates of interest that apply to different types of charges on your card. Please note the Plan It Instalments has a 0.00% Annual Interest Rate but carries a Monthly Fee as specified within the ‘Plan It Summary’ section but carries a fixed Monthly Fee as disclosed to you when you created the Plan. The Monthly Plan Fees are included in the Instalments Due. Below example is for illustration purposes only and you should refer to your own statement for actual annual interest rates.

Need some more help?

You can contact our team any time either online or over the phone.

Call Us

Select your product below for the fastest way to solve your query

Start Live Chat

To use Live Chat you must be registered to manage Card Account online. Please note, travel queries cannot be handled via live chat.

We're available 24/7

Lost & Stolen