Introducing

Bill Pay for Amex

Rewards Checking

With Bill Pay, manage and pay your bills online or in the Amex® App1. Get peace of mind knowing your recurring, fixed bills are paid on time each month.

Seamlessly manage monthly expenses with Bill Pay

Bill Pay helps you mark more off your to-do list with a variety of features and tools.

Set Up Payments Quickly

Set up recurring, fixed-amount payments for expenses like rent and utilities in minutes.

Pay More Securely

When you pay billers through Bill Pay, your account info and routing number will not be shared with them. At this time, Bill Pay is limited to U.S. billers.

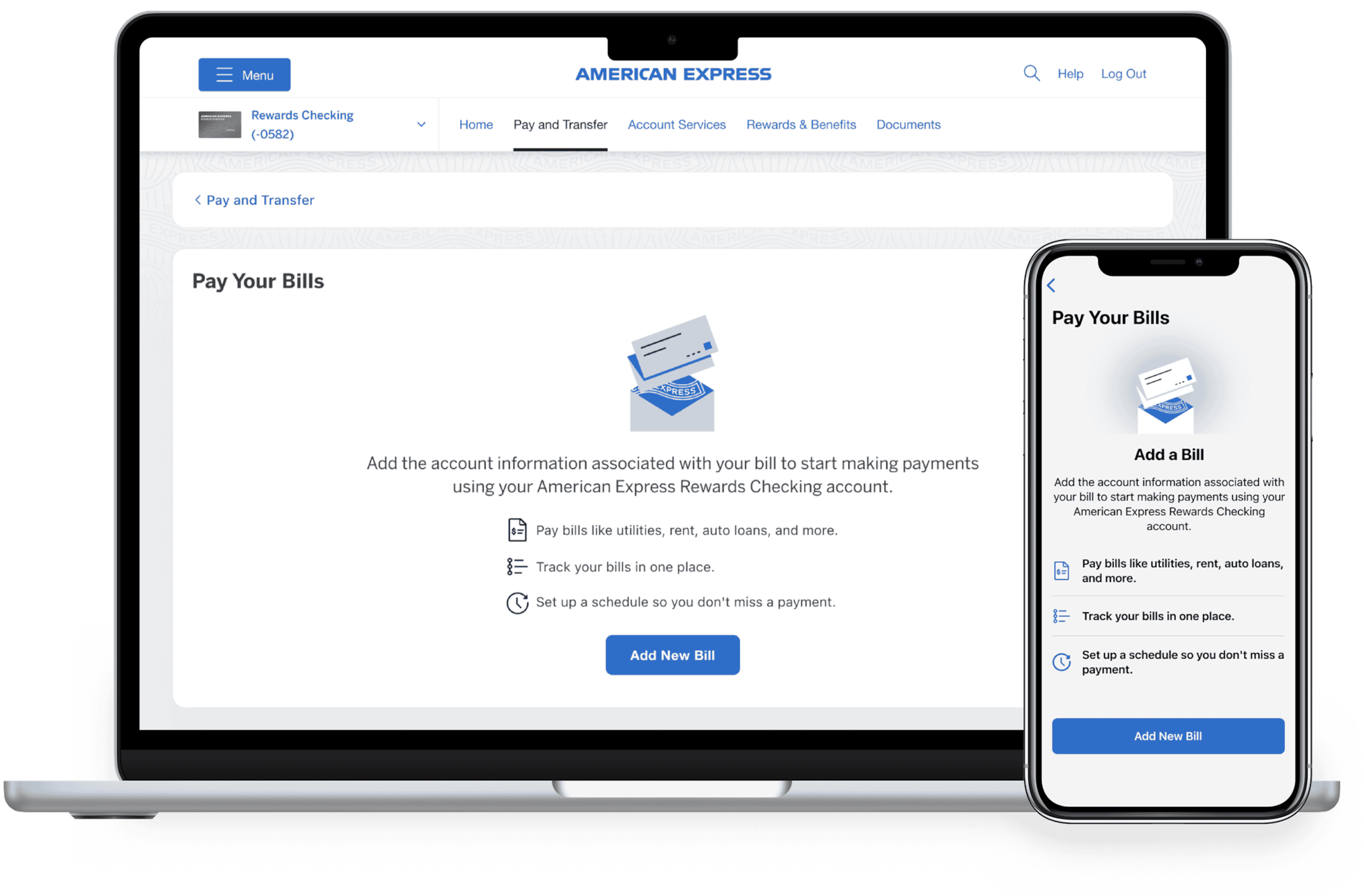

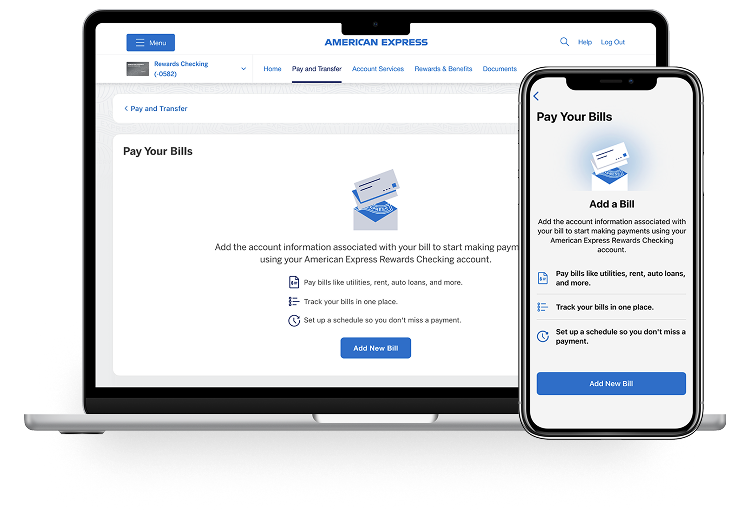

Learn how to use Bill Pay with step-by-step instructions

Ready to get started with Bill Pay?

Log into your Rewards Checking account online or in the Amex App

Select Pay to see the option to Pay Your Bills

Add your bills to track and schedule your next payments

Frequently Asked Questions

Bill Pay is an American Express® Rewards Checking account feature that allows customers to quickly manage and pay bills online or in the Amex® App. Bill Pay allows customers to send one-time or fixed recurring payments using ACH or checks without the need to share your account number or routing number with the biller.

There is no need to enroll, Bill Pay will be available upon opening your American Express® Rewards Checking account. For more information on Bill Pay, please see the Bill Pay Service section in the Rewards Checking Account Schedule at go.amex/checkingschedule.

You can use Bill Pay to send one-time or fixed recurring payments using ACH or checks without the need to share your account number or routing number with the biller.

To get started, log into the Amex® App or your account online. Go to the “Pay” section of your Amex Rewards Checking account, select “Pay Your Bills” and then “Add New Bill.”

For more information on Bill Pay, please see the Bill Pay Service section in the Rewards Checking Account Schedule at go.amex/checkingschedule.

It typically takes up to two business days for electronic (ACH) payments to be delivered to the biller and up to seven business days for check payments. We may contact you if we need additional verification, which may extend the estimated delivery date up to two business days.

If you believe you are a victim of a scam, please contact us at 1-877-221-2639.

If you don’t recognize a Bill Pay transaction or believe there has been an error, please contact us at 1-877-221-2639.

To use Bill Pay, the sender and biller must be based in the U.S. and U.S. territories including APO/FPO/DPO, Puerto Rico, U.S. Virgin Islands, Guam, American Samoa or Northern Mariana Islands.

Generally, you may cancel or stop a bill payment until 3:30 pm ET on the processing/send date. We will attempt to stop payment on a bill payment that has been sent via check after the processing date if the check has not yet been cashed by the biller. If you are having difficulty finding this option, please contact us at 1-877-221-2639 for assistance with canceling a bill payment.

American Express does not charge any fees for using Bill Pay in the Amex® App or online.

Please click here to view the Bill Pay Service per transaction and daily limits.

Don't have American Express Rewards Checking? Uncover what you're missing. Terms and eligibility apply. Learn more.

Rewards Checking accounts offered by American Express National Bank. Member FDIC.

Pay Another Way

with Zelle®

You’ve got more ways to pay people you know and trust. Rewards Checking Account Holders can use Zelle to make no-fee payments online and in the Amex App. Enrollment required.2

Terms and Conditions

- The American Express® App and app features are available only for eligible accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible.

To log in, customers must have an American Express user ID and password or create one in the app. - Enrollment in Zelle® with a Rewards Checking account is required to use the service. To send or receive money at American Express, both parties must be enrolled with Zelle directly through their U.S.-based financial institution’s online or mobile banking experience. Transactions between enrolled consumers typically occur in minutes. Select transactions could take up to three business days.

The Zelle and Zelle-related marks are wholly owned by Early Warning Services LLC and are used herein under license.