Limited-Time Offer

Earn $250 after you open a new American Express® Rewards Checking account by 01/31/2026 and receive a total of $5,000 or more of Qualifying Direct Deposit(s) within 90 days of account opening.†

No monthly fees.1

No minimum balance requirement.1

High Yield

Debit Card Rewards

No Monthly Fees

Backed by Amex

Modern digital tools designed for your day-to-day

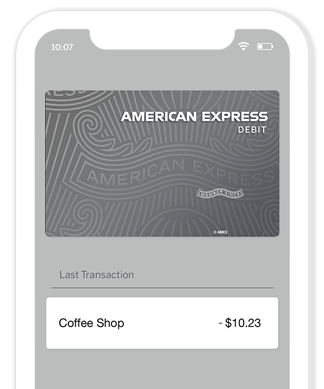

Manage your account and more from wherever you are

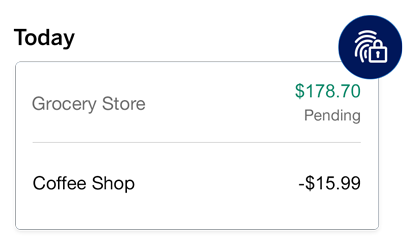

Shop with more confidence using your Debit Card

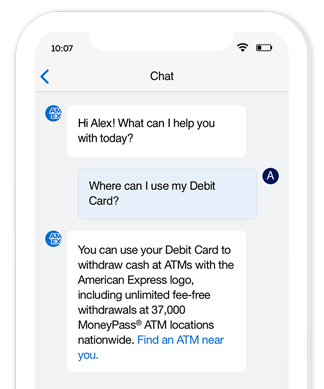

Help that’s reliable and available

Do more with your American Express® Debit Card

Frequently Asked Questions

Have other questions? Get more answers by reviewing our full list of FAQs.

High-yield online checking account for Members

Terms and Conditions

†Welcome Bonus Terms

Earn a Welcome Bonus of $250 after you complete each of the following qualifying criteria:

- Open your first American Express Rewards Checking Account in your name by 01/31/2026, which is subject to approval; and

- Have a total of $5,000 or more of Qualifying Direct Deposit(s) posted to your American Express Rewards Checking Account within the first 90 days of account opening.

After you have completed the above qualifying criteria, American Express will deposit the Welcome Bonus into your Rewards Checking Account within 8-12 weeks.

A Qualifying Direct Deposit is a single ACH transfer from an employer or the government for a paycheck, pension, government benefit (such as Social Security), or tax refund. Qualifying Direct Deposit(s) totaling at least $5,000 or more are required to qualify for this offer. The following are not Qualifying Direct Deposits: person to person transfers (P2P) such as money transfer apps, deposit account to deposit account transfers (for example, from a checking account to another checking account or from a savings account to a checking account), deposits or ACH transfers not from an employer or the government (for example, online transfers or bank transfers), internal transfers from your American Express® Savings account, deposits made via check, and Membership Rewards® points redemption for deposits.

You are not eligible for the Welcome Bonus if you have an existing or previously have had a Rewards Checking Account. Each individual customer may only have one Rewards Checking Account. The Welcome Bonus is only available to customers who were solicited for it and cannot be forwarded or used more than once. The Welcome Bonus may not be transferred, sold, traded, or combined with other Welcome Bonuses. Limit one Welcome Bonus per American Express Rewards Checking Account.

You must keep your account open and in good standing until we award you the Welcome Bonus. If your account is closed for any reason prior to such time, including being closed by us, you will not be eligible for the Welcome Bonus. If we determine, in our sole discretion, that you have violated the Consumer Deposit Account Agreement or Rewards Checking Schedule or have engaged in abuse, misuse, or gaming in connection with your account, we may determine that you are not eligible for the Welcome Bonus. In such circumstance, we may rescind or decline to award you the Welcome Bonus. American Express reserves the right to modify or revoke this Welcome Bonus offer at any time without notice.

The Welcome Bonus may be taxable income to you and may be reported on IRS Form 1099. You are responsible for any federal or state taxes resulting from the Welcome Bonus. Please consult your tax advisor if you have questions about the tax treatment of the Welcome Bonus.

You can access these Welcome Bonus Terms by visiting go.amex/nov25offer- 1No Monthly Account Fees and No Minimum Balance Requirements

- No minimum balance is required to open an account or earn interest, and no minimum balance fees are charged for Rewards Checking Accounts. Inactive and/or unfunded accounts may be subject to closure. Please see the Consumer Deposit Account Agreement and Rewards Checking Schedule at americanexpress.com/rewardscheckingterms for further details.

- 2Annual Percentage Yield (APY)

- The Annual Percentage Yield (APY) as advertised is accurate as of 12/15/2025. APY is subject to change at any time without notice before and after a Rewards Checking Account is opened. Please see the Consumer Deposit Account Agreement and Rewards Checking Schedule for additional terms. Transaction fees may reduce APY. APY rate compared to national deposit rate from the FDIC's published Monthly Rate Information for Interest Checking deposit products. FDIC national rate is calculated as the simple average of interest rates paid by US FDIC-insured depository institutions and branches for which data is available. This national deposit rate reflects APY paid on a variety of interest-bearing checking accounts with terms, services and limitations that may differ. See the FDIC Website for details.

- 3Membership Rewards® Program for Checking and Debit

- When you open an American Express® Rewards Checking Account you will also receive a Membership Rewards® Account (a Rewards Account), in which you will earn one Membership Rewards point for every two dollars of eligible Debit Card purchases. Eligible Debit Card purchases are purchases of goods or services, minus returns and other credits, for anything except: cash withdrawals, cash equivalents, person-to-person transactions, purchases of traveler’s checks, American Express Gift Cards bought online, purchases or reloading of prepaid cards, and foreign exchange fees and fees for account services. You can redeem Membership Rewards points for a deposit into your checking account. Visit membershiprewards.com/pointsinfo to learn what other redemption options may be available. If you also have a Rewards Account in connection with a Card Account, your Rewards Accounts can be linked and you will have access to all redemption options offered with that Card Account. For more information, visit membershiprewards.com/terms.

- Membership Rewards® Program

- Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards® points varies according to how you choose to use them. To learn more, go to membershiprewards.com/pointsinfo. - 4American Express® App

- The American Express® App and app features are available only for eligible accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible.

To log in, customers must have an American Express user ID and password or create one in the app. - 5Membership Rewards® Program - Redeem for Deposits

- You may redeem Membership Rewards® points for deposits into your American Express® Rewards Checking Account. To learn more about the redemption value for Redeem for Deposits, go to membershiprewards.com/pointsinfo. American Express will deduct the number of points you select from your Membership Rewards Account and deposit a corresponding dollar amount into your Rewards Checking account. Generally, deposits will post to your account within 48 hours of redemption. For more information, visit membershiprewards.com/terms.

- 6Mobile Check Deposit

- Mobile Check Deposit is subject to deposit limits and other restrictions, which may change in the future. Please see our Mobile Check Deposit Agreement (go.amex/mcdterms) for limits and other restrictions. This agreement may be accessed prior to your use of this service. Please see the Rewards Checking Schedule (go.amex/checkingschedule) for information about when funds deposited through Mobile Check Deposit are made available. Mobile data rates may apply.

- 7Digital Wallet

- Digital wallets are Apple Pay® and Google Pay™.

- 8Zelle

- Enrollment in Zelle® with a Rewards Checking account is required to use the service. To send or receive money at American Express, both parties must be enrolled with Zelle® directly through their U.S.-based financial institution’s online or mobile banking experience. Transactions between enrolled consumers typically occur in minutes. Select transactions could take up to 3 business days.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. - 9Zero Liability Fraud Protection

- Zero Liability Fraud Protection does not include charges made by users who you allow to use your Debit Card. You are responsible for notifying American Express promptly upon learning of an unauthorized transaction against your accounts or the loss or theft of your Debit Card or Debit Card number. Limitations apply. See the Consumer Deposit Account Agreement and Rewards Checking Schedule at americanexpress.com/rewardscheckingterms. Learn how we secure your payments at americanexpress.com/us/security-center/.

- 10ATM Withdrawals

- At Allpoint® and MoneyPass® locations in the U.S., you can withdraw cash and get account information with no fee. Access to ATMs outside of the Allpoint® and MoneyPass® network are subject to fees by the ATM owner and/or network. ATM withdrawal limits apply. American Express applies foreign exchange fees to withdrawals in foreign currencies. American Express does not accept ATM cash deposits into your Rewards Checking account at this time. Visit americanexpress.com/rewardscheckingterms for more information and americanexpress.com/rewardscheckingfeefreeatm/ to find participating ATMs in the U.S.

- 11Contactless Payments

- Contactless payments are accepted at participating merchants only.

- 12Wire Transfers

- If we receive a completed Incoming Wire Transfer of funds (in U.S. dollars) that includes proper identification of your Account by 6:45pm ET on a Business Day, we will consider that to be the Business Day of your deposit. Funds from Incoming Wire Transfers received by 6:45pm ET will generally be available for withdrawal on that Business Day. Funds from Incoming Wire Transfers received after 6:45pm ET will generally be available for withdrawal on the next Business Day. A $20 fee will apply to all outgoing wire transfers from an American Express Rewards Checking Account. Outgoing wire transfers are subject to a $500,000 daily limit per account. Additional terms apply to outgoing wire transfers.