Payment Flexibility

That Can Fit Your Everyday

For those times you don't want to pay in full, find out how Plan It®1 and Pay Over Time2 can give you the flexibility to choose how you pay—all while earning Membership Rewards® Points3. It's another way American Express Card Membership supports your everyday life.

Which Card is right for you?

Select a Card to learn more.

Explore Payment Options for Card Members

Get more payment flexibility with features built into American Express Cards.

Plan It

With Plan It, split large purchases into equal monthly installments with a fixed fee, up to your

Pay Over Time Limit. You'll always know upfront exactly how much you'll pay each month.

HERE'S HOW IT WORKS

1

Pick your

purchases

Choose up to 10 purchases of $100 or more to combine into a plan in your online account, or select one purchase if using the American Express® App‡ or Mobile Site.

2

Select the length

of your plan

You will have up to three plan duration options to choose from.*

3

Review and

confirm plan

Your monthly plan payment will automatically be included in your Minimum Payment Due each month.

Pay Over Time

With Pay Over Time, you can choose if and when to carry a balance on

your Card with interest, up to your Pay Over Time Limit.

HERE'S HOW IT WORKS

1

Find the Card that best

fits your lifestyle

Pay Over Time is an easy-to-use feature built into select American Express Cards, so Card Members can use it when they want—all while earning rewards. Using Pay Over Time has no impact on how Card Members earn and redeem Membership Rewards® points.3

2

Make purchases

with your Card

Eligible charges will be added to your Pay Over Time balance, up to your Pay Over Time Limit.

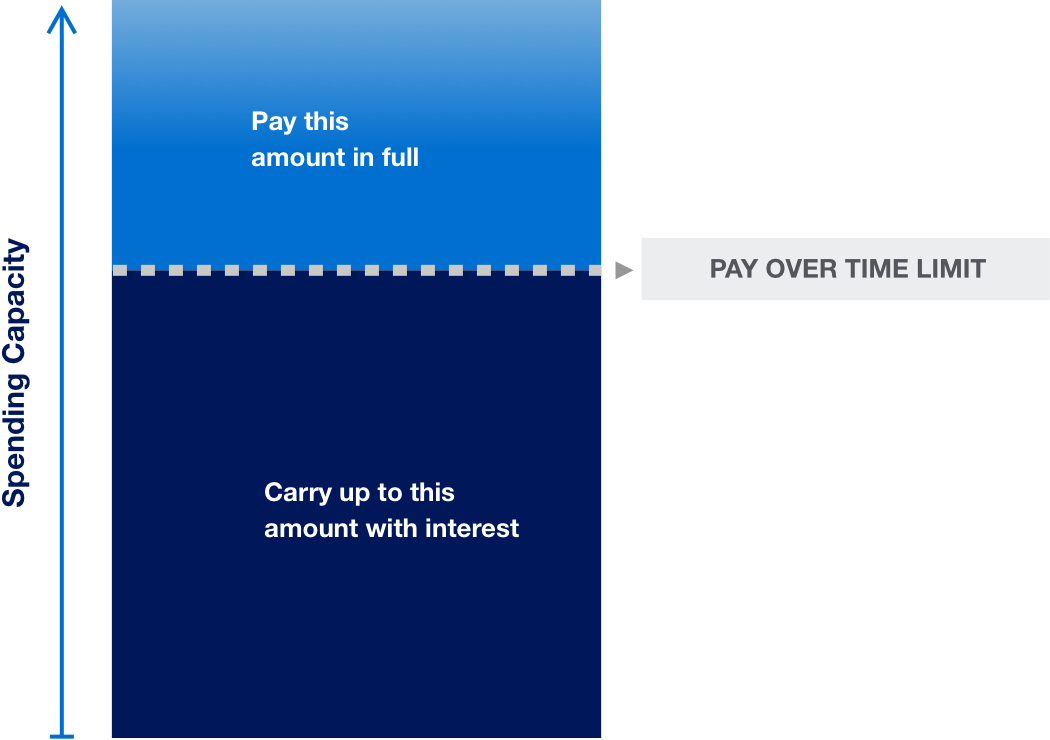

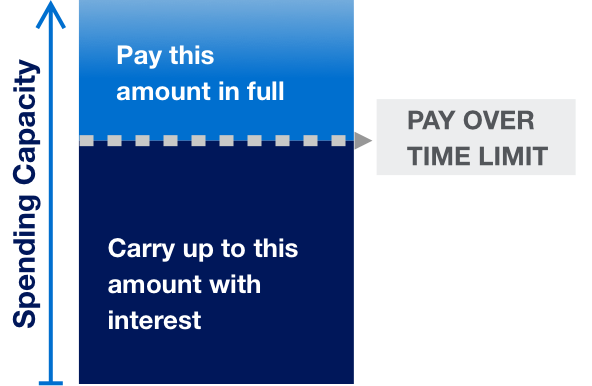

The Pay Over Time Limit is the maximum amount you can carry as a balance with interest or put into a plan, using Plan It®†. It is not a spending limit. Any charges you make above the Pay Over Time Limit will be due in full each month.

†The Pay Over Limit applies to the total of your Pay Over Time, Cash Advance, and Plan It® balances. Plan It® lets you split up large purchases into monthly payments with a fixed fee.

3

Choose how you pay

Each month, you can decide to pay your balance in full, the minimum due, or any amount in between. Any amount not paid in full will incur interest.

Understanding Pay Over Time Limit and Spending Capacity

SPENDING CAPACITY**

These Cards have no preset spending limit, a unique feature that gives you the ability to unlock more purchase power as you use your Card. This means the spending limit is flexible. In fact, unlike a traditional credit card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

**In a small number of cases, we may assign a specific spending limit to a Card Member’s account. This can be due to a variety of factors such as credit score, past due payments with us or other creditors, or high balances on revolving credit accounts. If a preset spending limit is placed on your account, we will notify you, tell you why, and explain how it impacts how much you can spend.

PAY OVER TIME LIMIT

The Pay Over Time Limit is the maximum amount you can carry as a balance with interest or put into a plan, using Plan It®†. It is not a spending limit. Any charges you make above the Pay Over Time Limit will be due in full each month.

†The Pay Over Limit applies to the total of your Pay Over Time, Cash Advance, and Plan It® balances. Plan It® lets you split up large purchases into monthly payments with a fixed fee.

Frequently Asked Questions

These payment options are available on all Consumer Green, Gold and Platinum Card Accounts.

The Pay Over Time Limit is the maximum amount you can carry as a balance with interest or put into a plan, using Plan It®, by splitting up large purchases into monthly payments with a fixed fee. It is not a spending limit. This limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. This is not a spending limit. Your Pay Over Time balance cannot exceed your Pay Over Time Limit. When there is a delay in posting cash advances or plans to your Account, the total of your Pay Over Time, Cash Advance, and Plan balances may exceed your Pay Over Time Limit.

While you may be able to spend beyond your Pay Over Time Limit, keep in mind charges that are not added to a Pay Over Time, Cash Advance, or Plan balance must be paid in full by your Payment Due Date. If the addition of a charge would cause your Pay Over Time balance to exceed your Pay Over Time Limit, that charge will be added to your Pay In Full balance. In addition, a charge or a portion of a charge may be eligible to automatically move to your Pay Over Time balance on your Closing Date if the charge has a transaction date when Pay Over Time was set to active and your Pay Over Time setting is set to active at 8:00 pm ET on your Closing Date.

If you have previously been notified that you have a spending limit and it is less than your Pay Over Time Limit, you may not be able to use all of your Pay Over Time Limit.

No. Unlike the Credit Limit on a traditional credit card, the Pay Over Time Limit is the maximum amount you can carry as a balance with interest or put into a plan, using Plan It®, by splitting up large purchases into monthly payments with a fixed fee. It is not a spending limit. The Pay Over Time Limit includes your Pay Over Time balance, as well as Cash Advance and Plan It® balances. Any charges you make above the Pay Over Time Limit will be due in full each month when your bill is due. Your Pay Over Time balance cannot exceed your Pay Over Time Limit. When there is a delay in posting cash advances or plans to your Account, the total of your Pay Over Time, Cash Advance, and Plan balances may exceed your Pay Over Time Limit.

While you may be able to spend beyond your Pay Over Time Limit, keep in mind charges that are not added to a Pay Over Time, Cash Advance, or Plan balance must be paid in full by your Payment Due Date. If the addition of a charge would cause your Pay Over Time balance to exceed your Pay Over Time Limit, that charge will be added to your Pay In Full balance. In addition, a charge or a portion of a charge may be eligible to automatically move to your Pay Over Time balance on your Closing Date if the charge has a transaction date when Pay Over Time was set to active and your Pay Over Time setting is set to active at 8:00 pm ET on your Closing Date.

If you have previously been notified that you have a spending limit and it is less than your Pay Over Time Limit, you may not be able to use all of your Pay Over Time Limit.

Pay Over Time and Plan It both provide added payment flexibility by allowing you to pay for eligible purchases over time, up to your Pay Over Time Limit. You can choose to use Pay Over Time, Plan It, or both depending on which option works best for you and your budget.

- With Pay Over Time you can pay for eligible purchases over time with interest. You might consider using this option when you need payment flexibility, without a predetermined timeframe to fully repay your balance.

- With Plan It you can split up large purchases into equal monthly payments with a fixed fee. This option may be best when you want the added structure of knowing upfront exactly when you’ll pay off large purchase amounts and how much it will cost.

- With both options, you’ll need to pay at least your Minimum Due each month when your bill is due.

You can plan purchases of $100 or more except for purchases of cash or cash equivalents, purchases subject to foreign transaction fees, or any fee owed to us including Annual Membership Fees. Qualifying purchases include recent purchases posted to your account and purchases shown on your most recent billing statement.

Purchases made by you or any Additional Card Member on your account (along with any associated foreign transaction fees) and Annual Membership Fees are eligible. For some accounts, a charge must also be equal to or more than a specified dollar amount (not including any foreign transaction fees) in order to be eligible. To obtain that amount, if there is one for your account, please check the Account Services tab or call the number on the back of your Card. The following types of charges are ineligible: Cash Advances, including cash and other cash equivalents, certain insurance premiums, and any other fees owed to American Express. Also, every month on your Closing Date, if your Pay Over Time feature is set to Active, we will automatically move any eligible charges from your Pay In Full balance to your Pay Over Time balance up to your Pay Over Time Limit. If the addition of a charge to your Pay Over Time balance on your Closing Date would cause the total of your Pay Over Time, Cash Advance, and Plan balances to exceed your Pay Over Time Limit, we will only move a portion of that charge to your Pay Over Time balance up to your Pay Over Time Limit. The remaining portion of the charge will remain in your Pay In Full balance. In addition, some charges may not be eligible to be moved to your Pay Over Time balance on your Closing Date. Please refer to your Card Member Agreement for more information about how Pay Over Time works.

The plan fee is a fixed fee you’ll pay each month when you have an outstanding balance in a plan. The monthly plan fee is part of your monthly plan payment which is automatically included in the Minimum Payment Due each month.

Terms and Conditions

*You will be offered 1–3 plan duration options. The plan duration options can vary based on a variety of factors such as the purchase amount, your account history, and your creditworthiness. If you are enrolled in an intro or promotional APR, you may see limited plan duration options during the intro or promotional period when you use Plan It on your account.

3Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

1 Plan It®

With Plan It®, you can create up to 10 active payment plans, each subject to a plan fee. The plan fee is a fixed finance charge that will be charged each month that the corresponding plan is active. You will be offered 1-3 plan duration options for the qualifying purchase. The plan duration options can vary based on a variety of factors such as the purchase amount, your Account history and your creditworthiness. If you are enrolled in an intro or promotional APR, you may see limited plan duration options during the intro or promotional period when you use Plan It on your Account. If you create a plan during an introductory or promotional APR period, your plan fee will be based on the introductory or promotional APR as long as the plan is created before 11:59pm MST on the last day of the introductory or promotional period.

To create a plan, select qualifying purchases of $100 or more and a plan duration. If you have a Card with a Credit Limit, you may also be able to select a qualifying amount of $100 or more and a plan duration. When creating a plan for purchases, you may select up to 10 qualifying purchases for each plan that you create in your American Express online Account. However, you may select only one qualifying purchase for each plan that you create in the American Express App. Qualifying purchases will be identified in your American Express online Account and American Express App. Qualifying purchases (or a qualifying amount, if you have a Card with a Credit Limit) do not include purchases of cash or cash equivalents, balance transfers (if offered), purchases subject to Foreign Transaction Fees, or any fee owed to us, including Annual Membership fees. Unless you are creating a plan at checkout, please allow 2-3 days for your purchase to post to your Account. Once your purchase posts and is no longer pending, you can create a plan for that purchase.

Your ability to create plans will be based on a variety of factors such as your creditworthiness, and your Credit Limit or Pay Over Time Limit, as applicable. The Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. You may not be able to create a plan if it would cause you to exceed your Pay Over Time Limit or cause your Plan balance to exceed 95% of your Account Total New Balance on your last billing statement. You will not be able to create plans if your Pay Over Time feature is suspended or your Account is canceled. You will also not be able to create plans if one or more of your American Express Accounts is enrolled in a payment program, has a payment that is returned unpaid, or is past due. The number and length of plan duration options offered to you, the number of active plans you can have at a time, and your ability to include multiple qualifying purchases in a single plan, will be at our discretion and will be based on a variety of factors such as your creditworthiness, the purchase amount(s), and your Account history. After a plan is paid in full, it will be removed from your Account in the next billing period.

Plan It is available on Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Only the Basic Card Member or Authorized Account Managers on the Account can create a plan. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or Account numbers issued by other financial institutions are not eligible.

2 Pay Over Time

Eligible charges

Purchases made by you or any Additional Card Member on your account (along with any associated foreign transaction fees) and Annual Membership Fees are eligible. For some accounts, a charge must also be equal to or more than a specified dollar amount (not including any foreign transaction fees) in order to be eligible. To obtain that amount, if there is one for your account, please call the number on the back of your Card. The following types of charges are ineligible: Cash Advances, including cash and other cash equivalents, certain insurance premiums, and any other fees owed to American Express.

Pay Over Time

Pay Over Time has two settings: active and inactive. You can change or view your Pay Over Time setting at any time through your online account or by calling the number on the back of your Card. (If you are enrolled in Pay Over Time Select, call the number on the back of your Card for information on eligible purchases, available limit and APR, and assistance moving purchases into your Pay Over Time Select balance.) Purchases made and Annual Membership Fees charged when Pay Over Time is set to inactive will be added to your Pay In Full balance, which will be due in full each month.

On the Transaction Date, if Pay Over Time is set to active at 8 pm ET on the transaction date provided by the merchant for an eligible charge, or on the date when an eligible Annual Membership Fee is charged to your Account, the charge will automatically be added to your Pay Over Time balance, subject to your Pay Over Time Limit. If the addition of an entire charge to your Pay Over Time balance would cause the total of your Pay Over Time, Cash Advance, and Plan balances to exceed your Pay Over Time Limit, that charge will be added to your Pay In Full balance. The transaction date provided by the merchant may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses the shipping date as the transaction date. Charges with the same transaction date will be added to your Pay Over Time balance in any order we choose.

On the Closing Date, if 1) the total of your Pay Over Time, Cash Advance, and Plan balances is less than your Pay Over Time Limit, 2) Pay Over Time is set to active at 8 pm ET and 3) there are eligible new charges in your Pay In Full balance with a transaction date when Pay Over Time was set to active, you authorize us to automatically move all or a portion of those charges to your Pay Over Time balance, subject to your Pay Over Time Limit. If the addition of a charge to your Pay Over Time balance would cause the total of your Pay Over Time, Cash Advance, and Plan balances to exceed your Pay Over Time Limit, we will move a portion of that charge to your Pay Over Time balance, up to your Pay Over Time Limit. The remaining portion of the charge will remain in your Pay In Full balance. Eligible charges will be moved to your Pay Over Time balance in order of the transaction dates. Charges with the same transaction date will be added to your Pay Over Time balance in any order we choose. A new charge, or a portion of a new charge, will not be eligible to be moved to your Pay Over Time balance on your Closing Date if:

- that charge is subject to a Foreign Transaction Fee;

- that charge or a portion of that charge is disputed (for a reason other than fraud) and that dispute is not resolved in the same billing period in which it was opened;

- that charge or a portion of that charge is reported as fraudulent and either (i) we determined the charge is fraudulent in the same billing period in which it was posted to your account, or (ii) we have not yet determined if the charge is fraudulent in the same billing period in which it was posted to your account;

- you have created a plan for that charge using Plan It;

- Pay Over Time is suspended on your Account; or

- your Account is cancelled or enrolled in a payment program.

Pay Over Time Limit

We assign a Pay Over Time Limit to your Account. The Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. Your Pay Over Time balance cannot exceed your Pay Over Time Limit. If the addition of a charge would cause your Pay Over Time balance to exceed your Pay Over Time Limit, that charge will be added to your Pay In Full balance. When there is a delay in posting cash advances or plans to your account, the total of your Pay Over Time, Cash Advance, and Plan balances may exceed your Pay Over Time Limit. The Pay Over Time Limit is not a spending limit. We may approve or decline a charge regardless of whether your Card Account balance is greater or less than your Pay Over Time Limit. We may increase or reduce your Pay Over Time Limit at any time. We may do so even if you pay on time and your Account is not in default. We will tell you if we change your Pay Over Time Limit. You must pay at least the Minimum Payment Due, which includes your Pay In Full balance, by the Payment Due Date each month. The Minimum Payment Due includes all charges that were not added to a Pay Over Time and/or Cash Advance or Plan balance, plus a portion of your Pay Over Time and/or Cash Advance balance, any interest accrued, and any Plan Payment Due.

Interest on Your Pay Over Time Balance(s)

For charges added automatically to a Pay Over Time balance at the time they post to your account, we charge interest from the transaction date. For charges that we automatically move from your Pay In Full balance to your Pay Over Time balance on your Closing Date, we charge interest from the day after they are added to your Pay Over Time balance. We will not charge interest on charges automatically added to your Pay Over Time balances if you pay your Account Total New Balance by the Payment Due Date each month. If at the time you activate Pay Over Time, you’re already carrying a Pay Over Time balance from your last billing period, we will charge interest on new eligible charges added to a Pay Over Time balance from the transaction date. However, for charges that we move from your Pay In Full balance to your Pay Over Time balance on your Closing Date, we will charge interest from the day after they are added to your Pay Over Time balance. We will begin charging interest on cash advances on the transaction date. You must pay in full, by the Payment Due Date, any charge or a portion of a charge that is not added to a Pay Over Time, Cash Advance, or Plan balance.

‡ American Express® App

The American Express® App and app features are available only for eligible accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible.

To log in, customers must have an American Express user ID and password or create one in the app.