American Express has your back from one destination to the next

As business travel evolves, we can help with tools for travel and expense management tailored to your unique business needs.

Venture beyond one-size-fits-all solutions

From occasional travelers to the people planning your meetings, conferences, or trade shows, American Express has tools and platforms to help meet a variety of needs.

Executive Travelers

American Express Corporate Platinum Cards® come with executive-level, premium benefits like access to 1,550+ airport lounges† and elevated dining experiences around the globe.

And you can also travel with peace of mind, thanks to the Premium Global Assist® Hotline† and travel insurance that can follow you almost everywhere you go.

Frequent Travelers

American Express® Corporate Green Card, Corporate Gold Card and American Express Corporate Platinum Card® come with a suite of benefits that can help ease travel frictions on the road and at hotels. You can choose which employees receive which Cards based on their travel frequency and other needs.

To help drive compliance, the Individual Membership Rewards® program† lets employees earn points on their Corporate Card spending that they can use for business or personal enjoyment on dining experiences, electronics, travel adventures and more.

Occasional Travelers

For employees who don’t travel frequently or have Corporate Cards, you can use Virtual Account Numbers to help manage airfare, hotel, and rail expenses. You can also set usage dates at the time of booking with established merchants to help decrease fraud and increase travel policy compliance.

Meeting and Event Planners

The American Express® Corporate Meeting Card† can help meeting and event planners with:

- The ability to set pre-agreed spending limits.

- Centralized tracking and reporting of event spending.

- Flexible program configurations with specialized features and controls.

- Consolidated spending data can help provideinsights to inform supplier negotiations.

†Use of Corporate Meeting Card is subject to application approval. Upon approval, additional enrollment or technical implementation may be required for select functionality. Annual fee applies. Please contact your American Express representative to learn more or to initiate the application process.

Mix and match Cards to fit your unique business needs

The Corporate Card Program offers a range of Card types with different benefits and rewards† options. After applying, the overall program can be tailored to match company needs.

Get business done around the world

Take advantage of intuitive tools to help employees manage expenses and a centralized platform where Program Administrators can gain oversight and control over company-wide travel spending.

Business Travel Accounts with Virtual Payments†

Help centralize, capture, and control more of your team’s travel spending with the Business Travel Account. It uses virtual technology that helps you set controls and drive travelers to preferred vendors. Enrollment required.

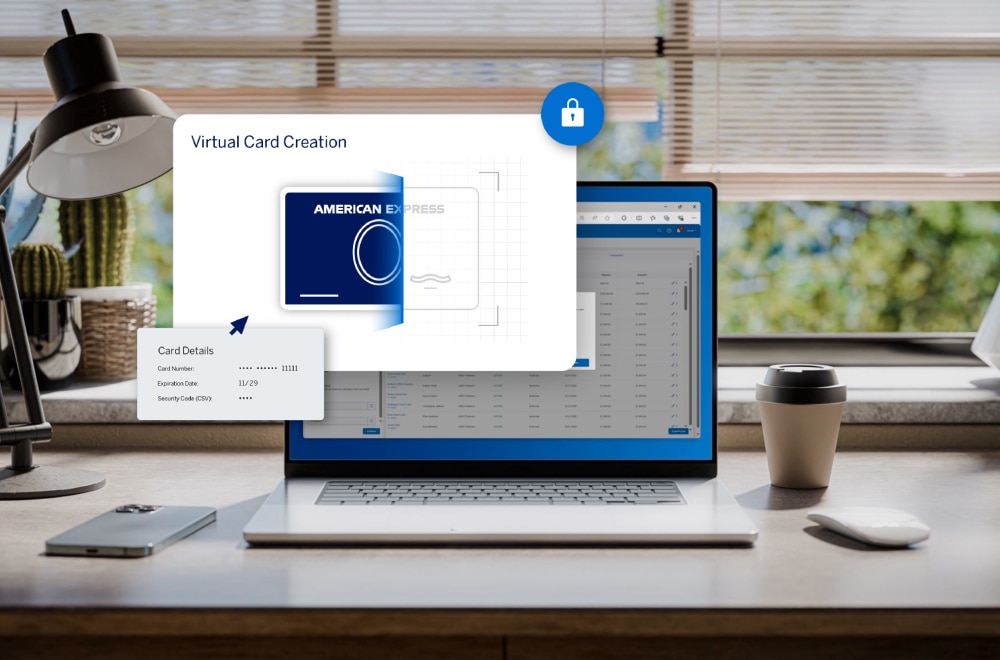

Virtual Cards

They complement your Corporate Program by:

- Enabling employee and non-employee spending or facilitating supplier payments*

- Allowing one-time and recurring use

- Supporting adherence to budget and company policy through spending controls

*Employee/Non-Employee Virtual Card use cases are not available for all solutions. Enrollment may be required, and fees may apply.

Expense Management

Seamlessly embed American Express Corporate Cards into a fully integrated Expense Management Solution that can help empower your employees to spend with more control and gives instant visibility and insight into their spending habits.

Our partners include SAP® Concur®,† Emburse,† and many others. Enrollment is required and fees may apply. Speak to a specialist to learn more about which expense management platform could work best for you.

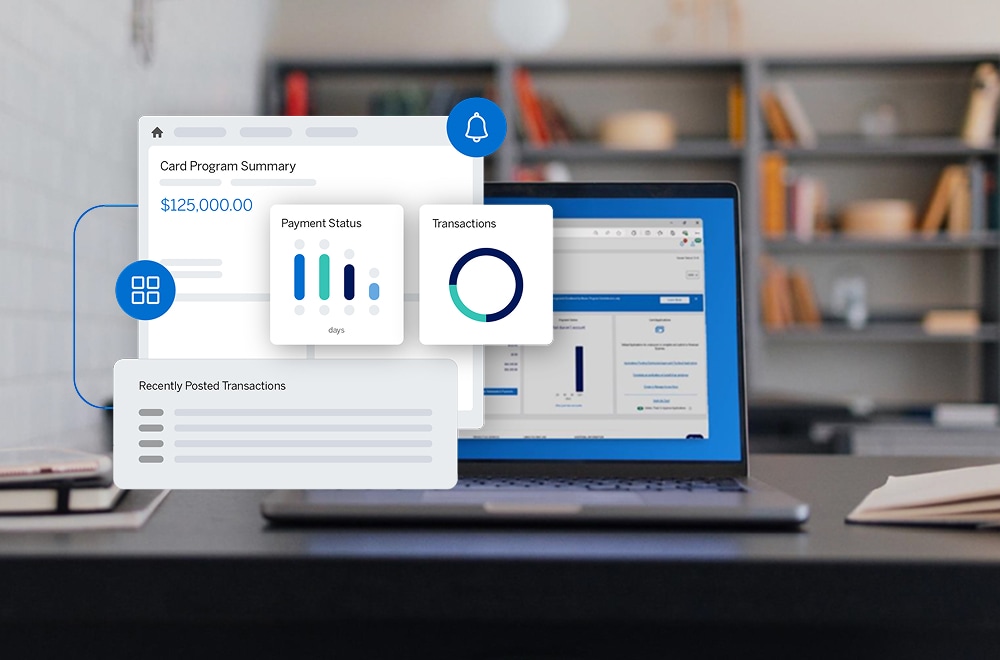

Card Management

American Express @ Work† is an integrated platform that can help businesses manage Cards and payments in a 24/7 environment. Enrollment required.

A variety of report formats monitor policy compliance, Card Member spending, forecast future spending, and more, offering valuable insights that can help improve your program and make spending more efficient.

Human-centered support is in our DNA

Helping you select and implement the right tools is only part of what we do. Whether you’re looking for consultation or support, we’re a call or click away.

24/7 Global Assist® Hotline†

Can provide emergency assistance and coordination services when employees are 100+ miles from home. Card Members are responsible for the costs charged by third-party service providers. Other terms and conditions apply.

AI-driven fraud prevention

American Express uses a machine learning-powered fraud detection model to monitor in real- time and generate a fraud decision in milliseconds every single time an American Express Card is used around the world.

Personalized onboarding and consulting

Our Onboarding Team can advise you on technology and systems, to help you build customized integrations† to meet your unique business needs. Your dedicated onboarding specialist will help you set up and maximize the value of the program.

Tailored solutions start with a consultation

Looking for something more specific? We can help source and implement the right tools to fit your needs. It all starts with a conversation.

Explore our full range of big-business solutions

From supplier payments to travel and expenses, data to digitization, explore everything we have to offer at the Large and Global Business hub.

More resources for business travel

The Key to Enhanced Corporate Travel Experiences is Not a One-Size-Fits-All Approach

Many employees crave personalized travel experiences.

Communications Essential to Program and Traveler Success

Alerting travelers just got more complicated.

B2B Payment Solutions for Large Businesses

Turn business payments into business advantages with unified solutions from American Express.

Frequently Asked Questions

You can choose to integrate our payment rails into your business directly or via our 3rd party AP Automation partners. Your options include:

1. American Express proprietary solutions that can integrate into most ERP systems.

2. “Plug and play” Amex capabilities for customers who use software from our partners. These solutions enable you to make Amex payments out of your existing ERP system.

3. Solutions from our partners that work as an add-on to your ERP system. These capabilities can make Amex payments from most ERP systems.

Yes, American Express has Virtual Cards, which offer enhanced control and visibility into your payments. Establish specific controls for each on-demand Virtual Card payment, including spending limits, expiration dates and allowed merchant categories. Approve, modify, or cancel Virtual Cards at any time. Create budgets specific to your projects and maintain visibility and control over spend.

Yes. Our Onboarding Teams can advise you on technology and systems and help build customized integrations to meet your needs. We are also here to support you and your suppliers through implementation to help make the experience as smooth as possible.

The American Express Corporate Card Program offers both Combined Liability† and Full Corporate Liability† structures. If your company is approved for corporate liability, your company is responsible for all charges. If your company is approved for Combined Liability, both your company and the individual Card Member are responsible for charges incurred on the individual Card Member account.

With Combined Liability, the company in whose name the Corporate Card Program was opened and the individual Card Member in whose name a Corporate Card was issued are jointly a severally liable for amounts due in connection with charges incurred by the Card Member on their Card account (with some exceptions, such as for cash advances or charges that were reimbursed to the Card Member or personal in nature).

With Corporate Liability (sometimes referred to as Full Corporate Liability), the company in whose name the Corporate Card Program was opened (and not the individual Card Members) is liable for all amounts due in connection with that Corporate Program, including, without limitation all charges made using any Card issued under that Corporate Program.

Individual Membership Rewards Program

Enrollment in the Membership Rewards® program is required. The American Express® Corporate Green Card and the Global Dollar Card - AmericanExpress® Corporate Green Card is charged a $55 annual enrollment fee. A program fee is not applied for the American Express® Corporate Gold Card, American Express Corporate Platinum Card®, Global Dollar Card - American Express Corporate Platinum Card®, and Global Dollar Card - AmericanExpress® Corporate Executive Gold Card. Some Corporate Cards are not eligible for enrollment. For a full list of eligible Corporate Cards, please see the full Membership Rewards Terms and Conditions. Card Member eligibility for enrollment is based upon the company’s participation in the Membership Rewards program. Employees with Corporate Green Cards selected to earn individual Membership Rewards® points must call the number on the back of their card to complete enrollment. Enrolled Corporate Card Members get one Membership Rewards point for every dollar of eligible purchases charged on enrolled Corporate Green Cards, Corporate Gold Cards, and Corporate Platinum Cards®. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

Rewards

Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

The American Express Global Lounge Collection®

U.S. Corporate Platinum Card Members are eligible for access to the participating lounges in the American Express Global Lounge Collection. All lounge access is subject to space availability. Each lounge program within the Global Lounge Collection has its own policies and access to any of the participating lounges is subject to the applicable rules and policies. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. To be eligible for this benefit, Card Account must not be cancelled. Please refer to each program’s terms and conditions to learn more.

The Centurion® Lounge

U.S. Corporate Platinum Card Members have unlimited complimentary access to all locations of The Centurion Lounge. Card Members may bring up to two (2) complimentary guests into The Centurion® Lounge locations in the U.S. and select international locations (as set forth on the Centurion Lounge Website). Guest access policies (including, but not limited to, guest fees and number of complimentary guests per visit) applicable to international locations of The Centurion Lounge may vary by location and are subject to change. Please visit thecenturionlounge.com (the “Centurion Lounge Website”) to learn more about guest access policies for international locations of The Centurion Lounge. Refer to the specific location’s access policy for more information. All access to The Centurion Lounge is subject to space availability. To access The Centurion Lounge, the Card Member must arrive within 3 hours of their departing flight and present The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Name on boarding pass must match name on the Card. Failure to present this documentation may result in access being denied. A Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Centurion Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in the Lounge, products or amenities may be offered for sale, and you are responsible for any purchases of such services, products, or amenities. Services provided by Member Services Desk are based on the type of American Express Card used to enter the lounge. American Express will not be liable for any articles lost or stolen or damages suffered by the purchaser or visitor inside The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

Sidecar by the Centurion® Lounge

U.S. American Express® Corporate Platinum Card® Members have unlimited complimentary access to the location of Sidecar by The Centurion Lounge in the Harry Reid International Airport, expected to open in 2026, and any future locations of Sidecar by The Centurion Lounge. Please visit thecenturionlounge.com for more information on Sidecar by The Centurion Lounge availability. Card Members may bring up to two (2) complimentary guests into Sidecar by The Centurion® Lounge locations in the U.S. All access to Sidecar by The Centurion Lounge is subject to space availability. To access Sidecar by The Centurion Lounge, the Card Member must arrive within 90 minutes of their departing flight (including layovers) and present the Sidecar by The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Name on boarding pass must match name on the Card. Failure to present this documentation may result in access being denied. A Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Sidecar by The Centurion Lounge visitors must be of legal drinking age in the jurisdiction where Sidecar by The Centurion Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from Sidecar by The Centurion Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into Sidecar by The Centurion Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among Sidecar by The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in Sidecar by The Centurion Lounge, certain services, products or amenities may be offered for sale, and you are responsible for any purchases of such services, products or amenities. Services provided by Member Services Desk are based on the type of American Express Card used to enter Sidecar by The Centurion Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by the purchaser or visitor inside Sidecar by The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge and to Sidecar by The Centurion Lounge from the Account. Use of Sidecar by The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

Escape Lounge

This benefit is available to U.S. Corporate Platinum Card Members. Card Members receive complimentary access to all Escape Lounge, including Escape Lounge - the Centurion Studio® Partner locations. To access an Escape Lounge, Card Members must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Name on boarding pass must match name on the Card and the eligible flight must be booked on a U.S. issued American Express Card. For access at select locations, Card Members must arrive within 3 hours of their departing flight. Refer to the specific location’s access policy for more information. During a layover Card Members may use the Escape Lounge in the connecting airport at any time. For more information on access policies and lounge terms and conditions, see https://escapelounges.com. All access to an Escape Lounge is subject to space availability. Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Escape Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. Card Members may bring up to two complimentary guests per visit. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all the complimentary benefits and amenities afforded to the Escape Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change without notice. Additional restrictions may apply.

Delta Sky Club®

This benefit is available to U.S. Corporate Platinum Card Members for access to Delta Sky Club or to the Delta Sky Club Grab and Go feature (“Grab and Go”). Corporate Platinum Card Members must present their valid American Express Card, government-issued I.D., and boarding pass to the Delta Sky Club ambassador. Boarding pass must show a reservation for a same-day Delta-operated flight (Delta or Delta connection) or Delta-marketed flight operated by West Jet (ticket number starting with 006) departing from or arriving at the airport in which a Delta Sky Club or Grab and Go is located. Corporate Platinum Card Members traveling with Delta Main Basic (Basic Economy) fare tickets do not have access to this benefit. Name on boarding pass must match name on the Card. Corporate Platinum Card Members on departing flights can only access Delta Sky Club or “Grab and Go” within 3 hours of their flight's scheduled departure time or any time during a layover. Delta reserves the right to limit access for non-revenue flyers at any Delta Sky Club. Individuals must be at least 18 years of age to access Delta Sky Club, and 21 years of age to access locations with a self-service bar, unless accompanied by a responsible, supervising adult who has access to Delta Sky Club. Benefit valid only at Delta Sky Club or Grab and Go. Delta partner lounges are not included. Note that amenities may vary among Delta Sky Club locations. Participating airport clubs and locations subject to change without notice. Corporate Platinum Card Members may bring guests into Delta Sky Club subject to the most current Delta Sky Club accessand pricing policies, and must use their valid Card as the payment method for guest access. Guests also must be flying on a same-day Delta-operated flight or Delta-marketed flight operated by West Jet (ticket number starting with 006) and be accompanied by the Corporate Platinum Card Member. Guest access and fees subject to terms and conditions of participating airport clubs. Access is subject to Delta Sky Club rules. To review the rules, please visit delta.com/skyclub. Benefit and rules subject to change without notice. Additional restrictions may apply.

Lufthansa

This benefit is available to U.S. Corporate Platinum Card Members. Platinum Card Members have complimentary access to select Lufthansa Business Lounges (regardless of ticket class) and Lufthansa Senator Lounges (when flying business class) when flying on a Lufthansa Group flight. To access the Lufthansa lounges, Platinum Card Member must present their government issued I.D., a same-day departure boarding pass showing a confirmed reservation on a Lufthansa Group flight (Lufthansa, SWISS and Austrian airlines) and a valid Platinum Card. Card Members must adhere to all rules of participating lounges. Participating lounges and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating lounges. In some Lounges the Platinum Card Member must be at least 18 years of age to enter without a parent or guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. For the most current list of Lufthansa lounges, guest access requirements, rules, and pricing policy, please visit https://www.lufthansa.com/de/en/lounges.

Plaza Premium Lounges

This benefit is available to U.S. Corporate Platinum Card Members. Card Members receive complimentary access to any global location of Plaza Premium Lounges. Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Card Members may bring up to two (2) guests into Plaza Premium Lounges as complimentary guests. Must be of legal drinking age to consume alcohol. Please drink responsibly. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Plaza Premium Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Plaza Premium Lounge locations are subject to change.

Priority Pass™ Select

This benefit is available to U.S. Corporate Platinum Card Members. Corporate Platinum Card Members must enroll in the Priority Pass™ Select program through the benefits section of their americanexpress.com account or by calling the number on the back of their Card to receive the benefit. Priority Pass is an independent airport lounge access program. You acknowledge and agree that American Express will verify your Card Account number and provide updated Card Account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass Select program and may use this information for marketing related to the program. Once enrolled, Corporate Platinum Card Card Members with a valid Card Account may access participating Priority Pass Select lounges by presenting their Priority Pass Select card and airline boarding pass. If the Card Account is cancelled, you will not be eligible for Priority Pass Select and your enrollment will be cancelled. When visiting a Priority Pass Select lounge that admits guests, Corporate Platinum Card Members receive complimentary access for up to two accompanying guests. After two guests, the Card Account on file with Priority Pass Select will be automatically charged the guest visit fee of the Priority Pass Standard program for each additional guest after you have signed up for the additional guest visit and it has been reported to Priority Pass by the participating lounge. Some lounges limit the number of guests or do not admit guests. In some lounges, Priority Pass Select members must be 21 years of age to enter without a parent or guardian. Priority Pass Select members must adhere to all house rules of participating lounges and access to participating lounges is subject to all rules, terms and conditions of the applicable lounge. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass Select lounge partners and locations are subject to change. All Priority Pass Select members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com. Upon receipt of your enrollment information, Priority Pass will send your Priority Pass Select card and membership package which you should receive within 10–14 business days. If you have not received the Priority Pass card after 14 days, please contact American Express using the number on the back of your American Express® Card. To receive immediate access to lounges after your enrollment in Priority Pass Select has been processed, you can activate your membership online by using your Priority Pass Select membership details to receive a Digital Membership Card. For a step-by-step guide on the activation process, visit prioritypass.com/activation.

Additional Global Lounge Collection Partner Lounges

American Express offers access to additional lounges in the Global Lounge Collection where U.S. Platinum Card Members have unlimited complimentary access to participating locations. Card Members must present their valid Platinum Card, a government-issued I.D., and a boarding pass showing a confirmed reservation for same-day travel on any carrier. Guest access and associated fees are subject to the terms and conditions of the participating lounge provider. Participation, locations, rates, and policies of lounges are subject to change without notice, and Card Members and their guests will not be compensated for such changes. Amenities, services, and hours may vary by participating lounge and are subject to change without notice. American Express and the participating lounge will not be liable for any articles lost or stolen, or damages suffered by the Card Member or guests inside the participating lounge. For participating lounges with a self-service bar, the Card Member may be required to be of legal drinking age in the jurisdiction where the participating lounge is located to enter without a parent or legal guardian. All Card Members and their guests must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. Each participating lounge may have their own policy allowing for children under a certain age to enter for free with the Card Member who is a parent or legal guardian. Card Member must adhere to all house rules of participating lounges. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. If American Express, in its sole discretion, determines that the Card Member or their guests have engaged in abuse, misuse, or gaming in connection with access to participating lounges in any way, or that the Card Member or their guests intend to do so, American Express may take away the access benefit from the Account. American Express and the participating lounge reserve the right to revise the rules at any time without notice. For the most current list of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit www.americanexpress.com/findalounge.

Global Assist® Hotline/Premium Global Assist

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Global Assist Hotline can direct you to medical and legal professionals, help you locate consulates and embassies for visas and passports, and assist you with emergency cash wires, missing luggage and more. Third-party service costs may be your responsibility. [Important additional terms, conditions and exclusions can be found at americanexpress.com/GAterms.]

Business Travel Account with Virtual Payments

Upon approval of your application for a BTA, additional enrollment or technical implementation may be required in order to access select functionality, including on-the-go spending. Engagement of a third-party token facilitator may be required, and in some instances, your Travel Services Provider maybe required to have a separate agreement with such token facilitator. Please contact your American Express representative to learn more or to initiate the application process.

SAP® Concur®

To learn more about SAP® Concur® offerings, please visit https://www.americanexpress.com/en-us/business/concurpartnership/. You can also contact your American Express account representative, or call American Express at 1-800-528-4800 to be introduced to an SAP Concur representative. SAP Concur program pricing, terms, and conditions will be determined during the SAP Concur sales cycle. The fee for SAP Concur programs is established solely by the SAP Concur Sales/account team. Implementation is required and implementation times vary based on a client's configuration needs and readiness. For more information regarding pricing and implementation options, please visit https://www.concur.com/en-us/get-quote-form. The SAP Concur organization is responsible for all Concur program management and maintenance of SAP Concur solutions including, all eligibility decisions, enrollment procedures and pricing decisions. If you have questions, please reach out to your American Express account representative or please contact American Express at 1-800-528-4800.

Emburse Spend

Card enrollment required for eligible American Express Business and Corporate Cards. Separate enrollment with each of Emburse and American Express is required to utilize combined product offering. To pay a supplier using an eligible American Express Business or Corporate Card within the Emburse platform, the supplier must be an American Express accepting merchant. Additional upgrades, features, and payment methods may require separate activation with Emburse, and fees may apply as determined by Emburse. Please contact your Emburse representative to learn more.

American Express @ Work®

Use of American Express @ Work® is restricted to employees, contractors and/or agents that the Company, and its representatives designate for the sole purpose of performing online account queries and maintenance, including accessing and/or creating reports relating to the Company's American Express® Corporate Card programs. @ Work is available to all companies with an American Express Corporate Card program.

Enrollment is required. To enroll in @ Work please contact your American Express Representative or call 1-888-800-8564.

Onboarding and Integrations

Depending on the product and integration, terms and fees may apply, and additional client resources may be required for implementation.

American Express One AP® ERP Integrations

American Express is not responsible for the accuracy, currentness, completeness or continuous availability of any data we receive from your ERP/accounting system or for any errors contained in such data, including in connection with its use to facilitate payment transactions. Customers may be required to download a third-party plug-in to enable integration with their ERP/accounting system. Your relationship with Quick Books® is also subject to Quick Books® terms and conditions. Intuit and Quick Books are registered trademarks of Intuit Inc. Your relationship with Net Suite® is also subject to Net Suite® terms and conditions. Oracle and Net Suite are registered trademarks of Oracle and/or its affiliates.

Combined Liability

With Combined Liability, the company in whose name the Corporate Card Program was opened and the individual Card Member in whose name a Corporate Card was issued are jointly and severally liable for amounts due in connection with charges incurred by the Card Member on their Card account (with some exceptions, such as for cash advances or charges that were reimbursed to the Card Member or personal in nature).

Corporate Liability

With Corporate Liability (sometimes referred to as Full Corporate Liability), the company in whose name the Corporate Card Program was opened (and not the individual Card Members) is liable for all amounts due in connection with that Corporate Program, including, without limitation all charges made using any Card issued under that Corporate Program.