Streamline your accounts payable processes on a single solution - from the efficiencies of supplier invoice payment automation to the increased control of Virtual Cards On-Demand.

Use your existing American Express® Business Card to create a One AP account in a few simple steps and create Virtual Cards On-Demand right away — at no cost.

*AXP Specialist support required to enroll in check/ACH payment methods. Suppliers must be enrolled and located in the United States. Auto-renewing monthly platform fee applies, additional check/ACH fees may apply.

One AP is a complete payments solution – from Virtual Cards On-Demand to Invoice-backed Payments

Create

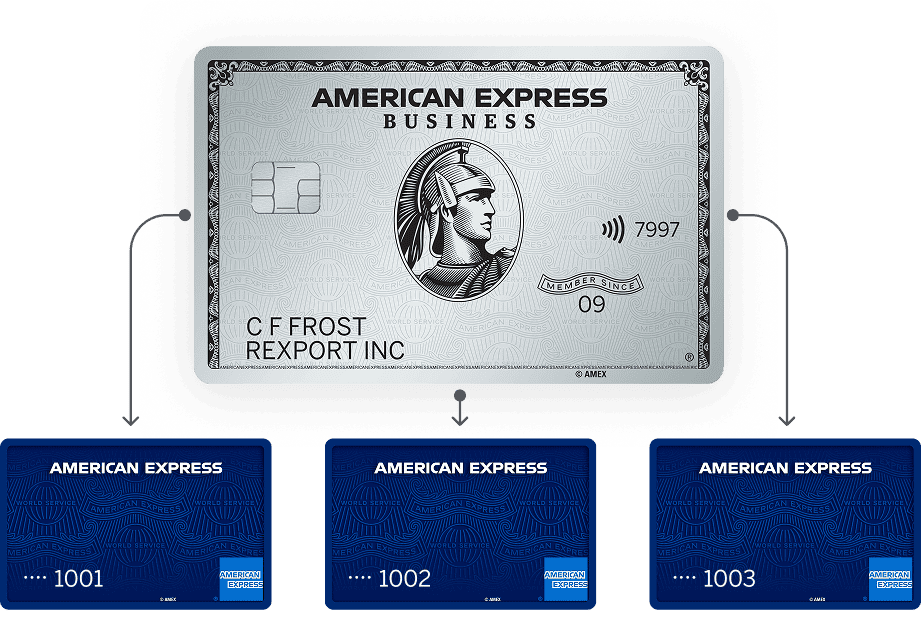

With Virtual Cards On-Demand, you can:

- Create single use, multi-use and reloadable Virtual Cards

- Set customizable spending limit

- Create, freeze or cancel at any time

- Pay without sharing your physical Card details

- Earn the rewards of your Card2

There are no fees to create a One AP account, create Virtual Cards or make Virtual Card payments.

Unlock

With Invoice-backed Payments, you can:

- Process multiple invoices simultaneously to help reduce manual errors and increase efficiency

- Keep reconciliation simple with ERP compatibility

- Streamline eligible supplier invoice payments by Virtual Card, check, and ACH all from One AP

Fees apply for check/ACH (including an auto-renewing monthly platform access fee). No fee for Virtual Cards.

Create a One AP account today and use Virtual Cards right away, then connect to a Specialist to unlock invoice payment automation

Create One AP account

Log in to your American Express account. Select your American Express® Business Card account to fund your Virtual Card transactions. Complete some basic information and submit.

Go to One AP platform

Take a brief interactive guide to create Virtual Cards On-Demand.

Follow instructions to engage a Specialist to unlock invoice payment automation and to enroll a bank account to enable check/ACH invoice payments.

Create Virtual Cards

Set up each Virtual Card On-Demand with a specific name, spending limit, expiration date, and reload amount (if any). Once created, use anywhere American Express is accepted.

Use Virtual Cards On-Demand to help suit your unique business needs

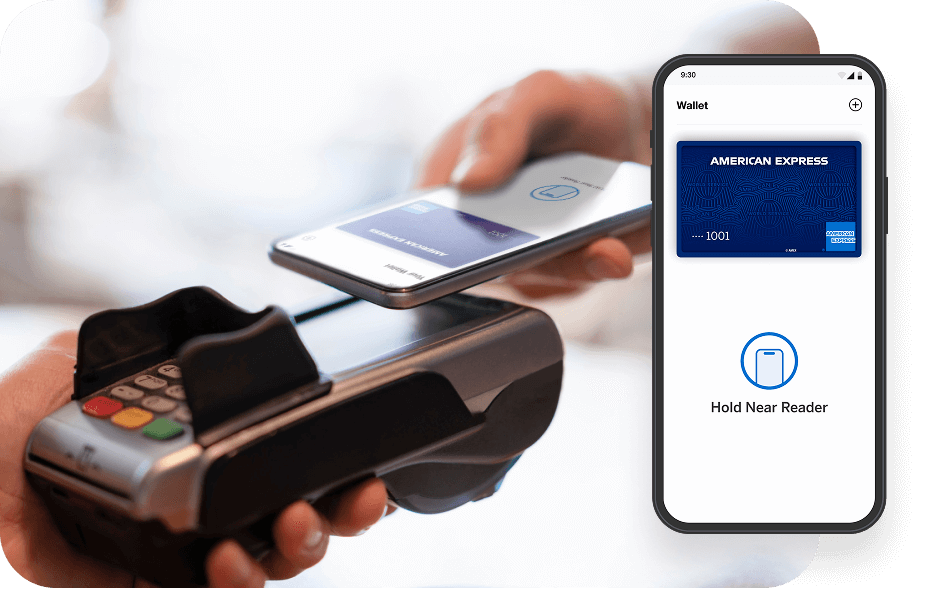

Good for on-the-go purchasing

Digital Wallet-Enabled

Empower your team with Virtual Cards that can be added to their digital wallets.* Create and assign to specific users (employees and non-employees alike) for spending with added convenience.3

*Digital Wallets are Apple Pay®, Google Pay™, or Samsung Pay.

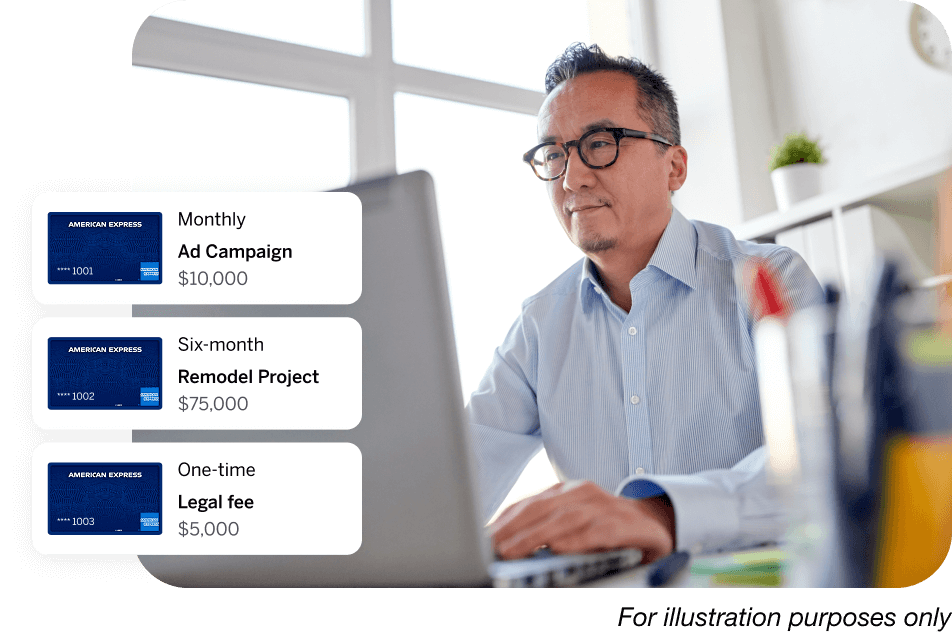

Good for recurring charges

Reloadable

Leave a reloadable Virtual Card on file with your suppliers to help keep an eye on recurring bills or subscriptions. Set the automatic reload amount and frequency (weekly or monthly) for enhanced visibility.

Good for categorized spending

Multi-Use

Manage spending by project or category by creating a Virtual Card for each. Multi-use Cards expire once their spending limit is reached, so you can pay with more confidence.

Good for one-time payments

Single-Use

Create Virtual Cards that expire after one use for ad hoc or on-line expenses. Forced expiry helps provide peace of mind with increased control.

Explore the benefits of One AP invoice payment

automation - Virtual Card, Check and ACH

Manage multiple payment types

Streamline your invoice payments on one platform and make batch payments by Virtual Card, Check and/or ACH.* Eliminate the hassle of manual check processing and help reduce the need to create ACH payment files with your bank. One AP helps simplify your processes for greater efficiency.

*Fees apply for check/ACH (including an auto-renewing monthly platform access fee). No fee for Virtual Cards.

Automate your AP processes

Help boost your team's productivity by digitizing your supplier payments for reduced manual errors and increased time savings. One AP is compatible with most business accounting software and can directly integrate with QuickBooks® Online and NetSuite®4 to reduce cross-platform entry for simplified reconciliation.

Our AP Specialists do the heavy lifting

Specialists contact your suppliers on your behalf to enroll them and help ensure a smooth payments process. Our specialists can help onboard more of your suppliers to accept Virtual Card payments, earning you more rewards of your Card.²

Real One AP Customer

“Since implementing One AP, we've grown about 50%*... by automating our vendor payments, One AP gave us the bandwidth we needed to pursue new clients...

That's why I'd put One AP in place early on, before your growth outpaces your payment processes. One AP really enables efficiencies and supports that growth.”

Jim Vaca, Founder, President & CEO, Source Alliance Network

Real American Express Card Member aware that this testimonial may be featured in marketing materials.

*This may not be a typical experience of every business. Experiences may vary.

Frequently Asked Questions

Click to create a One AP account today. Upon successful creation of an American Express One AP® account, you can create Virtual Cards On-Demand in a few clicks and use them immediately – at no cost.

Note: Customers of American Express® Corporate and Corporate Purchasing Card are not eligible for digital account creation and can click to fill out some information about your business and a Specialist will contact you to help get you started.

Only Virtual Card transactions (which are funded by your American Express® Card) can earn the rewards of your Card. Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

Check/ACH transactions are funded by an enrolled bank account (not your American Express® Card) and therefore are not eligible to earn rewards.

Upon successful creation of an American Express One AP® account, you will be directed to the One AP platform where you can follow instructions to learn more about invoice-backed payments and request a phone call from a Specialist. A Specialist can unlock and help onboard you to invoice payment automation. A Specialist can also help you enroll a bank account to enable check/ACH payments. (Your American Express® Business Card cannot fund check/ACH transactions, and those transactions are not eligible to earn rewards.)

Monthly billing is activated when your first check or ACH payment is processed in One AP. Fees will be auto-billed monthly in arrears to the first American Express® Card enrolled.

Your bill will consist of three types of fees: 1) Access: $200 monthly platform access fee is auto-renewing 2) Transactions: No fee for the first 400 check transactions and first 400 ACH transactions each month and additional transactions are $1.00 per check and $0.35 per ACH transaction, and 3) Applicable taxes. There are no fees for Virtual Cards.

1. American Express One AP® may not be available to all customers. To access the service, all customers will be required to enroll their eligible U.S.-issued American Express® Business, Corporate, or Corporate Purchasing Card. There is no fee to use the service for customers electing to process only Card payments. Use of additional payment methods requires activation through an American Express® Specialist and a monthly platform access fee of $200 which will automatically renew each month, unless the service is cancelled or all additional payments methods are deactivated, as applicable. If additional payment methods are being used, with the monthly platform access fee, to the extent used, the first 400 check transactions and first 400 automated ACH transactions each month are complimentary, after which point a fee of $1.00 per check and $0.35 per automated ACH transaction will apply. Fees are subject to change. Sales tax on fees may apply. All fees associated with American Express One AP® will be auto-billed monthly in arrears to the first Card enrolled for the service. The monthly platform access fee will be charged starting in the month in which the customer first uses an additional payment method and will not be pro-rated; the full monthly platform access fee will be charged regardless of when in the month a customer activates and first uses an additional payment method. Customers may cancel the service or activate/deactivate additional payment methods by contacting their American Express® Specialist. The customer will be charged the full monthly platform access fee (and any applicable transaction fees and taxes) for the month in which the service is cancelled (or all additional payment methods are deactivated), with continued access to the service for the thirty days following the cancellation date. Customer must cancel by 5:00 PM ET on the last business day of the month to avoid being charged the platform access fee for the following month. To make a Card payment to a supplier through the service, the supplier must be an American Express-accepting merchant. To learn more, please contact your American Express® Specialist.

New York: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. California: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. Georgia: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed by the Georgia Department of Banking and Finance.

For a list of our money service business licenses and information about addressing complaints and other disclosures, visit www.americanexpress.com/us/state-licensing.html.

NMLS ID # 913828

2. Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

3. Contactless payments are accepted at participating merchants only.

4. American Express One AP® is only currently available for integration with ERP/accounting systems, QuickBooks® Online and NetSuite®. American Express is not responsible for the accuracy, currentness, completeness or continuous availability of any data we receive from your ERP/accounting system or for any errors contained in such data, including in connection with its use to facilitate payment transactions. Customers may be required to download a third-party plug-in to enable integration with their ERP/accounting system.

Your relationship with QuickBooks® is also subject to QuickBooks® terms and conditions. Intuit and QuickBooks are registered trademarks of Intuit Inc. Your relationship with NetSuite® is also subject to NetSuite® terms and conditions. Oracle and NetSuite are registered trademarks of Oracle and/or its affiliates.