Freedom to manage

your cashflow

Benefit from a range of cashflow flexibility features: a spending limit designed for your business, up to 54 days to pay interest free and a Flexible Payment Option for those times you don't want to pay in full.

Annual fees and terms apply, 18+, subject to status.

Discover how to maximise your cashflow

Flexible Spending Limit

A spending limit that adjusts with your Card usage and grows with your business means you can spend how you need to.

Boost cashflow with no interest

Instead of paying for business costs immediately, your Card gives you more time to pay so you can boost your cashflow.

Flexible Payment Option

You can pay part of your balance over time, so when cashflow fluctuates your repayments can too– giving you peace of mind.

How Flexible Payment Option works

Not yet an FPO Cardmember? This feature is available on new Business Cards. View all Business Cards and apply here.

Your Flexible Spending Limit

Your Card has no pre-set spend limit, a unique feature that gives you the ability to unlock more purchase power as you use your Card. This means your spending limit is flexible. Unlike a traditional credit card with a set limit, the amount you can spend is personalised to you and based on factors such as your purchase, payment and credit history.

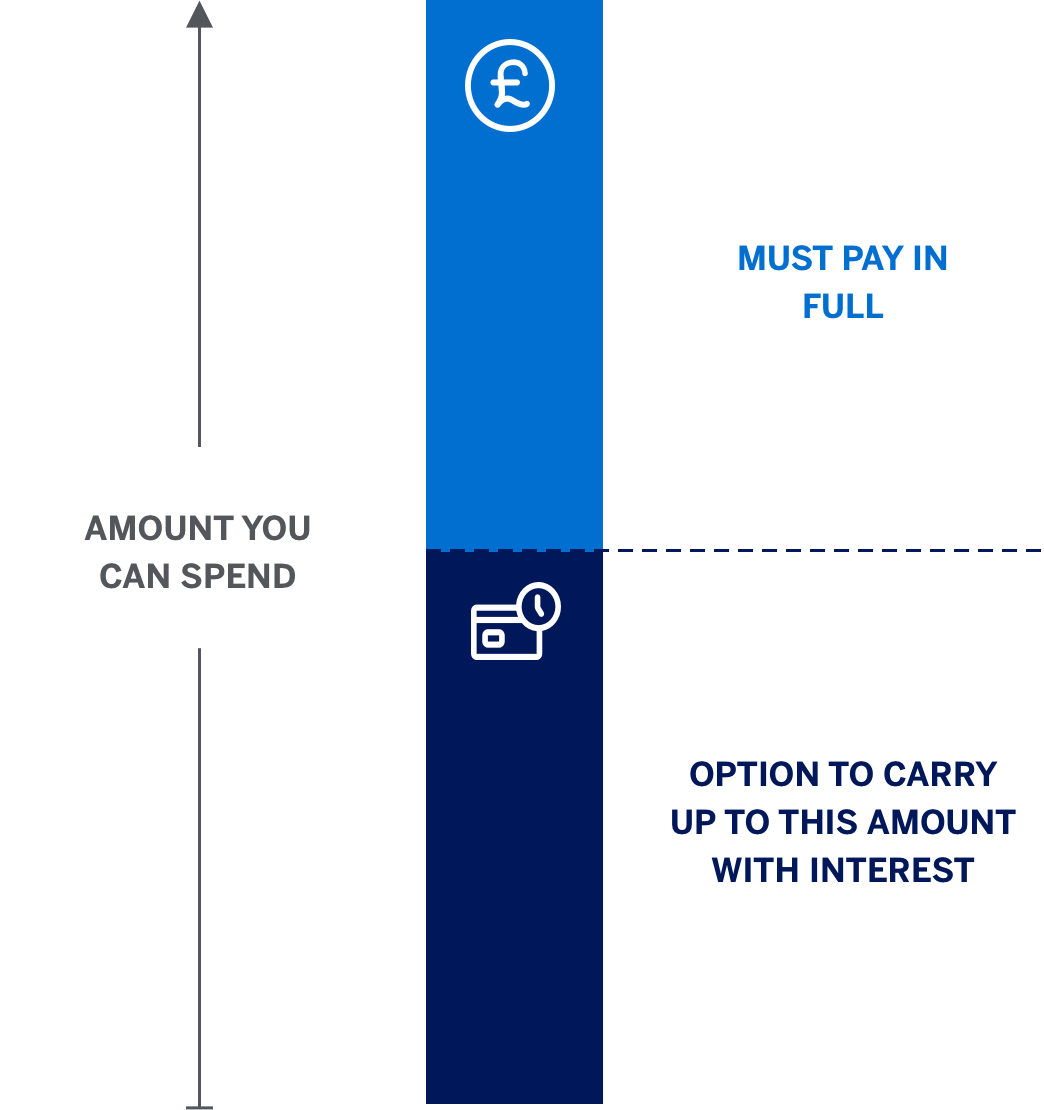

Your Flexible Payment Option (FPO) Credit Limit* is the maximum you may carry as a balance. It does not impact how much you can spend on your Card. You can decide to pay your statement balance in full, the Minimum Payment Due or any amount in between with interest. Any amount above your FPO Credit limit must be paid in full each month.

*You can find your Flexible Payment Option Credit Limit on your mobile App, Online Account or on your billing statement. From the Amex home page, select 'Balance details' on the righthand side of the screen. From there you can view your Flexible Payment Option Credit Limit.

Explore ways to manage your Card with confidence

How does interest work?

Learn about the Flexible Payment Option (FPO), including howyou can spread the cost of your purchases and make interest-free payments.

How to pay your Business Card balance

Card repayments pay back the money you've spent on your Card – and when it comes to making these payments, you've got choices.

What is a Flexible Payment Option Credit Limit?

Explore Flexible Payment Option, including everything you need to know about a FPO Credit Limit.

Card fees and charges

From annual fees to late payment penalties, here's what you should know to encourage good financial health.

Not yet an FPO Cardmember? This feature is available on new Business Cards. View all Business Cards and apply here.

FAQs

Flexible Payment Option is a feature that gives your business the option to pay part of your balance, up to the Flexible Payment Option (FPO) Credit Limit, over time with interest. It’s completely optional, if you don’t want to pay interest simply pay your balance in full each month according to your statement.

Balances up to your FPO Credit Limit can be paid overtime with interest. Any amounts spent over and above your FPO Credit Limit will need to be repaid in full.

You will not be charged any interest on the due in full balance.

Flexible Payment Option (FPO) is a feature included on your Card.

It provides you with the option to take additional time to repay your statement balance if you choose to.

When you receive your statement it will detail your total balance and the minimum repayment required to keeps your account in good standing.

Your options are to pay your balance in full, pay only the minimum due or pay any amount in between the minimum due and total balance.

If you choose to utilise your Flexible Payment Option and pay less than the full balance interest charges will apply.

The Minimum Payment Due includes all Pay In Full charges, any interest accrued on your account and a portion of your Flexible Payment Option balance.

If you don’t want to use the Flexible Payment Option, you can pay your statement balance in full each month. If you do this, you will not be charged any interest.

No, your FPO Credit is not a spending limit.

The amount you can spend adapts to your transaction patterns and other factors.

The way you use your Card can help your spending power grow – particularly within the first few months.

You will normally be able to spend more than your FPO Credit Limit. Spend that exceeds your FPO Credit Limit will be due in full each month and no interest will be charged on this portion of your balance.

You can check your spending power online, just log-in to your Account and the 'Check Spending Power' tool is on your home page right below 'Payment Due'. Or simply open the American Express® App and tap 'Check Spending Power'.

We won't charge interest if you always pay the total balance on your Account in full by the payment due date shown on your statement.

If you do not pay the balance off in full by that date, we will charge interest on your Flexible Payment Option Credit Limit balance from the date an amount is charged to your account until it is paid in full.

We won’t charge interest on late payment fees or returned payment fees. We collectively refer to these fees as ‘default fees.

Each month, you can either pay your statement balance in full, the Minimum Payment Due, or any amount in between. If you do not pay your statement balance in full you will incur interest.

You must pay in full any charge or a portion of a charge that is not added to the Flexible Payment Option Credit Limit

The minimum payment will be calculated by adding together (1) your Due in Full Balance (which may include any unpaid due amounts from the previous statement) at the time your monthly statement is produced and (2) the minimum amount payable in relation to your Flexible Payment Option Credit Limit Balance .

The minimum amount payable in relation to your Flexible Payment Option Balance will be the higher of the following amounts:

- £50 (or the total Flexible Payment Option Credit Limit Balance, if this is less); or

- an amount equal to the total of:

- any interest and default fees applied to your current month’s statement;

- 1/12th of any annual Cardmembership fee or the full monthly fee (if applicable to the product you hold );

- plus 4% of the Flexible Payment Option Credit Limit Balance.

Yes. You will earn points in accordance with your current rewards programme.

You cannot add Flexible Payment Option to your existing Business Card if you don’t have it already. Flexible Payment Option is only a feature on new Business Cards applied for after 28/01/2026. If you would like Flexible Payment Option, you will need to apply for a new Business Card following this link: Apply here.

Please carefully read the terms and exclusions before applying. You may be required to cancel your existing Business Card following your successful application.