Important information for existing

Platinum Cardmembers

(Credit and Charge).

If you are an existing Platinum Cardmember (Charge) it is important to be aware of the similarities and differences between the Charge and Credit products and consider this when making the decision to apply for the Platinum Card® (Credit).

If approved for the new Credit Card, please note as an existing Charge Cardmember:

- You will not be eligible for any Membership Rewards® welcome bonus.

- Should you continue to be a Charge Cardmember your two Cards will be different products and as such you will pay for two separate annual fees.

- Your existing Charge Card will not be cancelled automatically and will still be available for you to use. If you would prefer to only keep the Credit Card you can cancel your Charge Card by calling 0800 917 8054, or the number on the back of you Card.

- Unlike the Charge Card, the Credit Card is regulated by the Consumer Credit Act, which gives you a range of rights. For example, if you buy goods or services on your Credit Card, Section 75 of the Consumer Credit Act can give you extra protection if things go wrong. This is because the Credit Card company is jointly and severally liable for any breach of contract or misrepresentation by the retailer. This means you can also put a claim to the Credit Card company. You don’t get this protection with a Charge Card.

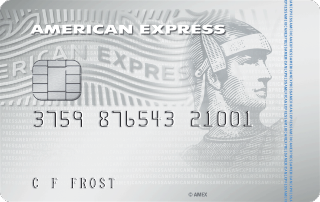

- Except for your Card number on the back of the Card, both Credit and Charge metal Cards look the same and you must ensure when using your Card products you are confident your are using the correct Card.

To find out more about Credit Cards and how interest is charged please click here

If you hold an American Express® Card that looks like this, you have a Platinum Credit Card that we offered some time ago.

This Card was generally offered with no fee and no additional benefits and is substantially different to the new Platinum Card® (Credit)