Close

Close

Activate your Card

Simply scan the QR code and download the American Express App.

- Download the American Express App in the App Store (iOS) or Google Play Store (Android);

- Open the American Express App;

- Accept the terms and conditions;

- Click on ‘Nieuw bij Amex?

- Enter your 15-digit Card number

- Enter your 4-digit Card ID. details to set up your new Card.

- Click on the button ‘Doorgaan’

- Answer your verification question.

- Enter your details to create your Online Account and register your Card.

As a Cardmember, you can view your recent transactions, download account statements, view/change your PIN code, set contact preferences, manage your personal information and much more via the American Express App or your online account on our website.

Close

Close

Activate your Card

Simply scan the QR code and download the American Express App.

- Download the American Express App in the App Store (iOS) or Google Play Store (Android);

- Open the American Express App;

- Accept the terms and conditions;

- Click on ‘Nieuw bij Amex?

- Enter your 15-digit Card number

- Enter your 4-digit Card ID. details to set up your new Card.

- Click on the button ‘Doorgaan’

- Answer your verification question.

- Enter your details to create your Online Account and register your Card.

As a Cardmember, you can view your recent transactions, download account statements, view/change your PIN code, set contact preferences, manage your personal information and much more via the American Express App or your online account on our website.

Close

Close

Ready to use

After the first purchase with PIN, your Card is also activated for contactless payment up to a maximum of 50 euros. With Apply Pay you pay amounts of both under and above 50 euros even more securely contactless.

Close

Close

Card alerts

Get notifications whenever your Card is used and set up a 'spend tracking alert' to manage your balance effectively. You can change your Card alert preferences using the button below.

Close

Close

Secure payments, Apple Pay & Safekey

With your Business Gold Card you can always pay safely, also online.

Secure payments

- Small amounts up to €50 can be paid contactless. Did you know you can also pay with Apple Pay? Add your card to your Wallet for even more secure no-touch payments.

- If your card is lost or stolen and transactions have been made with it these will be covered by American Express.

- Register with our Customer Service Team to withdraw cash at ATMs with our Express Cash service.

Read all about safe (online) payments here. (NL only)

Apple Pay

- Add your card to Apple Pay and enjoy even safer contactless payments.

- You can use Apply Pay with all businesses that accept contactless payments from American Express.

- It is also possible to use Apple Pay for payments in apps and online.

Read all about Apple Pay here. (NL only)

Safekey

Safekey is a functionality made possible by the newest 3D Secure technology. Safekey protects against fraudulent purchases through ID verification with online purchases.

Read all about Safekey here. (NL only)

Close

Close

Express Cash

You owe us 3.5% of the cash withdrawal amount (with a minimum of EUR 4.5) for each cash withdrawal you make. The spending limit is determined by your personal profile, membership duration and spending pattern. For more information or to send an Express Cash application form, please call +31 (0)20-504 8000

Close

Close

Earn Membership Rewards points

With your Business Gold Card you earn 1 Membership Rewards (MR) point for every euro you spend.

- You can use MR points to pay recent transactions on your Account statement.

- You can also redeem your points earned for various gift cards, for instance to reward your staff or gifts for business partners.

- Use your points for flights or hotel stays, or transfer your points to other savings or loyalty programmes from airline and hotel partners, such as the AIR FRANCE-KLM Flying Blue programme.

You can earn points on purchases such as:

- Computers and software subscriptions

- Do you advertise online ? Then link your card to Google Ads, Facebook and LinkedIn

- Business lunches and dinners

- Fuel and parking

- Flights, train travel, taxi rides and hotel stays for business purposes

Close

Close

Protection against fraud, loss and theft

In the case of fraud, our fraud protection guarantee means you won’t be held responsible for any fraudulent charges, provided you’ve taken reasonable care to protect your Account details, PIN and any device you store your Account information on.

Is your Card lost, stolen or under suspicion of fraud?

Please contact the Fraud Prevention Desk immediately.

Please note: this phone number can only be used for lost or stolen Cards or fraud. If you have another question, we kindly request you to contact the Customer Service Team via the number on the back of your Card (Mon. to Fri. 8 am to 6 pm).

Call Fraud Prevention Desk: +31 (0)20-504 8196

You will be answered directly. We will block your Card and send you a replacement Card.

Close

Close

World-Class Service

We are ready to help you. Do you have questions about, for example, a transaction or a replacement Card? Then please call our Customer Service between 8 am and 6 pm on the phone number on the back of your Card. We can be reached 24/7 in case of lost or stolen Cards.

Online Services:

Review your recent transactions, download monthly statements and view and/or modify your PIN via the American Express App or your online account on our website.

Supplementary insurances*

Business Travel Accidents:

- For the entire duration of your business trip, you are insured against the consequences of any accidents.

- The maximum cover is €50,000 in the event of death or permanent disability as a result of an accident.

Business Travel Inconvenience:

- Flight delays (max. €150 per person per trip)

- Missed connection (max. €275 per person per trip)

- Delayed or lost luggage (max. €275 per person per trip)

Travel and Cancellation Insurance:

- Required medical assistance and costs related to illness during your trip (max. €1,500,000 per trip)

- Cover for theft, loss or damage to personal possessions (max. €700 per trip)

- Cancellation costs, in case of cancellation due to illness or death of a loved one (max. €4,500 per trip)

Purchase Protection

- If your purchase is stolen or accidentally damaged, we pay for the cost of replacement or repair up to 180 days after purchase (max. coverage €1,400 per event).

Refund Protection:

- If you decide to return your purchase within 90 days, but the merchant does not agree, we reimburse the purchase amount (till max €400).

* Please note: Insurance terms and conditions apply. See the Insurance Terms and Conditions (Dutch) for more information.

Close

Close

New: Four times per year airport lounge access

With the Business Gold Card, you can comfortably travel on business with four free lounge visits per year, in one of the over 1,300 affiliated airport lounges of Priority Pass™.You can use these four entries for yourself and any accompanying persons. The participating lounges have excellent facilities such as: Wi-Fi, comfortable seating, TV, newspapers and magazines, and a wide range of drinks. Upon approval of your card, you will automatically receive notification from Priority Pass.View all airport lounges, including three lounges at Schiphol:

Priority Pass terms and conditions

These terms and conditions apply to the Business Gold Card membership and the use of the Priority Pass™ program. Priority Pass is an independent program for accessing airport lounges. American Express provides four entries per year for you. For entries not paid for by American Express, the applicable fee as listed on www.prioritypass.com will be charged. By agreeing, you acknowledge responsibility for the payment of all entries not covered by American Express. Your card will be automatically charged upon registration for access, with notification to Priority Pass via the participating lounge. Additionally, you acknowledge and agree that American Express may verify your card account number and provide updated card account information to Priority Pass, who will use this information to fulfill the Priority Pass program. Business Gold Card holders whose card accounts have not been canceled have access to participating Priority Pass lounges upon enrollment by presenting their Priority Pass card and a confirmed boarding pass. In some lounges, a Priority Pass member must be 21 years old to enter without a guardian. Priority Pass members must comply with the rules and regulations of the participating lounges. Facilities may vary depending on the location of the airport lounge. Conference rooms, if available, can be reserved for a small fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the terms of use of Priority Pass, which can be found at www.prioritypass.com and for which American Express is not responsible.

Close

Close

New: Loungebox On the go

Are you flying from Schiphol? Starting July 1, 2024, we offer you a breakfast, lunch, or light dinner on presentation of your Business Gold Card.

What is it?

Loungebox On the go offers you the opportunity to create your own breakfast or lunch/dinner at the GRAB&FLY shops at Schiphol Airport. You have a choice of a diverse assortment, conveniently packaged and made fresh daily!

Where can I get Loungebox On the go?

Loungebox On the go is available at all GRAB&FLY shops at Schiphol upon presentation of your boarding pass and your American Express Business Gold Card.

You can create your own menu by combining the three options below:

- Yogurt, a salad, a sandwich, or a wrap;

- One croissant or one piece of fruit;

- A hot or cold beverage.

Important information:

The offer is valid once per day and a maximum of two times per month for Business Gold main cardholders and additional Business Gold Card members.

Terms and conditons

- Valid for both the main cardholder and additional Business Gold Card members.·

- Upon collection at the GRAB&FLY, you will be charged € 0.10 administrative fee per Loungebox for picking up your breakfast, lunch, or dinner.

- If you choose a soft drink, you will be charged a € 0.15 deposit.

- If you choose a hot beverage, you will be charged a € 0.01 single-use plastic surcharge.·

- The benefit is personal and the name on your boarding pass must match the name on your American Express card.·

- The benefit can be used twice per month.·

- Please note that your physical card is required to enjoy the benefit; mobile payment methods and digital wallets are not valid.·

- If you collect more Loungebox On the go packages per day than allowed, you will be charged € 20 per extra package collected on your card

- The benefit is not valid upon arrival or if you have also chosen to visit one of the lounges.

- Loungebox On the go is available at all GRAB&FLY locations at Schiphol Airport.·

- Offer is subject to the opening hours of the Grab&Fly shops.·

- Loungebox On the go is only available for American Express Business Gold Cards issued in the Netherlands.

English / Nederlands

Welcome to American Express®

Get the most out of your Business Gold Card

We would be happy to assist you. Activate your Card if you have not done so already. Already activated your Card? Click on manage your account.

It’s quick and easy to get started.

By following the steps below, you can start enjoying your many membership benefits right away, such as Airport lounge access, Loungebox On the go, supplementary insurance and deferred payment, and can start earning Membership Rewards®.

Step 1. Activate your Card and create an account

You cannot use your Card until you have activated it. Haven't you done that yet? Then do that first and immediately create an account to manage your Card account via our mobile App or online.

Activate Card

Step 2. Set Card Alerts

Go to your online account to set your preferences for the Card Alerts you wish to receive. This will help you manage your spending.

Set Card Alerts

Step 3. Ready to use

Your Card has been successfully activated and ready to use.

Ready to use

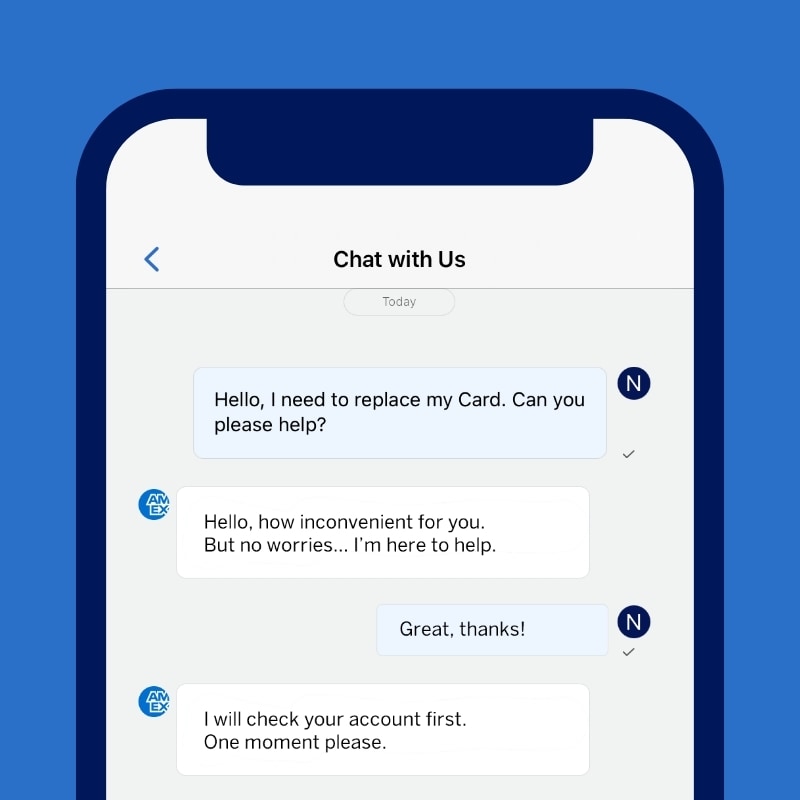

Stay in control, wherever you are

Download the mobile App

With the Amex App you can easily manage your Card account and you have insight into your expenses anytime, anywhere.

American Express App

Easily manage your account and always have insight into your expenses. Pay for all or part of your purchases with your Membership Rewards points and introduce business friends directly from the App.

- Transaction overview and pay with points

- Activate your Card

- View and change PIN

- Temporarily (de)freeze your Card

- Always control your expenses with push notifications

Amex Experiences App

In the Amex Experiences App you will find upcoming events, access to presales and more. From now on, you won’t miss a thing.

- All benefits conveniently in one App

- Stay up to date on the latest events

- Register with just one click or phone call

- Always have the most important phone numbers at hand

- Download the Amex Experiences App now (Dutch only)

New

Airport lounge access four times a year via Priority Pass™

Enjoy the comfortable Priority Pass airport lounges with four free access passes per year. You can use these four passes for yourself and any accompanying individuals.

New

Loungebox On the go

Are you flying from Schiphol? Then we offer you breakfast, lunch, or a light dinner at the GRAB&FLY shops at Schiphol airport, upon presentation of your Business Gold Card. This benefit also applies to holders of an additional Business Gold Card.

Your Business Gold Card in a nutshell

Card benefits at a glance

Secure payment

Link your card to Apple Pay, ensure safe online payments with Safekey and learn more about secure payment methods.

More about secure payment

Earn Membership Rewards points

Earn points with every euro you spend with your Business Gold Card.

More about earning Membership Rewards points

Express Cash

Use Express Cash to withdraw cash at ATMs 24 hours a day, 7 days a week.*

More about Express Cash

Protection against fraud, loss and theft

If you suspect fraud or have lost your Card, contact the Fraud Prevention Desk at +31 (0)20-504 8196 right away. You will be forwarded to the right department immediately.

More about fraud

World-class service and supplementary insurance

Replacement cards within 24 hours and access to supplementary insurances for travel accidents, inconveniences, and cancellations.

View all supplementary insurance options

Deferred payment and individual limit

Use the deferred payment option to postpone payment from 30 to 50 days after purchase. The limit is determined by your spending habits. Please phone our Customer Service Team if you are planning to make a large transaction in the near future.

Need help? Ask Amex.

Live chat in the Amex App. 24/7. English only.

Chat live with our Customer Service for any Card or account related questions.

Help us keep your data up to date

As a financial service provider, we are legally obligated to keep our cardmembers' data up to date and check it regularly.

Additional Business Gold Cards

Apply online for additional Business Gold Cards for your employees or business partner. Expenses made by the additional Cardmembers are added to the basic Cardmember’s Account statement. With the spend on additional Cards you also earn Membership Rewards points.

You can request four additional cards free of charge, so you don’t pay a separate annual fee.

Card acceptance

American Express is accepted by millions of companies around the world, so you can pay for practically all of your business expenses with the Business Card, not only in shops but also online and in apps.

- Important documents

- Business Gold Card Agreement (Dutch)

- Insurance Terms & Conditions (Dutch)

FAQ and help

Here is an overview of the most frequently asked questions. If you can’t find your question here, call our Customer Service Team on +31 (0)20-504 8000

(Mon. to Fri. from 8am to 8pm).

Are you looking for a Card to use for personal purchases as well?

If your Business Card is lost or stolen, please contact American Express immediately via the Fraud Prevention Desk at +31 (0)20-504 8196. You will be forwarded to the right department immediately. Our Customer Service Team will quickly arrange for a replacement Card or other suitable solution, if possible within 24 hours.

American Express is accepted by millions of companies around the world, so you can pay for practically all of your business expenses with the Business Gold Card, not only in shops but also online and in apps.

To list just a few of the places where you can pay with your Card:

- Car rental: Avis, Europcar, Hertz, Sixt

- Online advertising: Facebook, Google, LinkedIn

- Petrol & Car services: BP, Esso, Profile Tyrecenter, Shell, Total

- Retail: BCC, de Bijenkorf, bol.com, Fonq.nl, IKEA, MediaMarkt

- Travel: easyJet, Emirates, KLM, NS, Transavia, Uber, Vueling

You can also use the Card for your daily business spending on things like hardware and software, professional services and parking

Have you recently moved? Update your information by changing your address below. Please note that you will need to have your Card to hand. You will be asked for the following:

Security questions, as well as your four-digit CVC code and/or your three-digit CSC code. Please keep in mind: If you are planning to move abroad and would like to inform us of an international change of address, please phone our Customer Service Team using the number on the back of your Card (Mon. to Fri. from 8am to 6pm).

Paying with Apple Pay

Apple Pay lets you make contactless payments with even better security. Add your American Express Card to Apple Pay and earn Membership Rewards® points on all your purchases.

Read more about Apple Pay (Dutch only)

Contactless payments

Contactless payment with American Express is an easy and secure way to pay for purchases under €50.

Read more about contactless payments (Dutch only)

Chip and PIN payments

For chip and PIN payments, simply insert your American Express Card into the card reader and authorise the transaction with your PIN.

Viewing your PIN

You can see your current PIN by simply logging into the American Express App.

Read more about viewing your PIN (Dutch only)

Changing your PIN

You can also easily change your PIN by logging into the American Express App.

Read more about changing your PIN (Dutch only)

Unfreezing your PIN

You can easily unfreeze your PIN in the American Express App.

» Read more about unfreezing your PIN (Dutch only)

Personal code

The purpose of the personal code is to verify your identity for digital requests and telephone requests.

You can pay your monthly statement by direct debit or choose to pay it manually.

Read more