Close

Close

Activate your Card

Simply scan the QR code and download the American Express App.

- Download the American Express App in the App Store (iOS) or Google Play Store (Android);

- Open the American Express App;

- Accept the terms and conditions;

- Click on ‘Nieuw bij Amex?

- Enter your 15-digit Card number

- Enter your 4-digit Card ID. details to set up your new Card.

- Click on the button ‘Doorgaan’

- Answer your verification question.

- Enter your details to create your Online Account and register your Card.

As a Cardmember, you can view your recent transactions, download account statements, view/change your PIN code, set contact preferences, manage your personal information and much more via the American Express App or your online account on our website.

Close

Close

Activate your Card

Simply scan the QR code and download the American Express App.

- Download the American Express App in the App Store (iOS) or Google Play Store (Android);

- Open the American Express App;

- Accept the terms and conditions;

- Click on ‘Nieuw bij Amex?

- Enter your 15-digit Card number

- Enter your 4-digit Card ID. details to set up your new Card.

- Click on the button ‘Doorgaan’

- Answer your verification question.

- Enter your details to create your Online Account and register your Card.

As a Cardmember, you can view your recent transactions, download account statements, view/change your PIN code, set contact preferences, manage your personal information and much more via the American Express App or your online account on our website.

Close

Close

Ready to use

After the first purchase with PIN, your Card is also activated for contactless payment up to a maximum of 50 euros. With Apply Pay you pay amounts of both under and above 50 euros even more securely contactless.

Close

Close

Card alerts

Get notifications whenever your Card is used and set up a 'spend tracking alert' to manage your balance effectively. You can change your Card alert preferences using the button below.

Close

Close

Secure payments, Apple Pay & Safekey

With your Business Green Card you can always pay safely, also online.

Secure payments

- Small amounts up to €50 can be paid contactless. Did you know you can also pay with Apple Pay? Add your card to your Wallet for even more secure no-touch payments.

- If your card is lost or stolen and transactions have been made with it these will be covered by American Express.

- Register with our Customer Service Team to withdraw cash at ATMs with our Express Cash service.

Read all about safe (online) payments here. (NL only)

Apple Pay

- Add your card to Apple Pay and enjoy even safer contactless payments.

- You can use Apply Pay with all businesses that accept contactless payments from American Express.

- It is also possible to use Apple Pay for payments in apps and online.

Read all about Apple Pay here. (NL only)

Safekey

Safekey is a functionality made possible by the newest 3D Secure technology. Safekey protects against fraudulent purchases through ID verification with online purchases.

Read all about Safekey here. (NL only)

Close

Close

Express Cash

The activation of cash withdrawal is possible from 1 year after receipt of the card. You owe us 3.5% of the cash withdrawal amount (with a minimum of EUR 4.5) for each cash withdrawal you make. The spending limit is determined by your personal profile, membership duration and spending pattern. For more information or to send an Express Cash application form, please call +31 (0)20-504 8000.

Close

Close

Earn Membership Rewards points

With your Business Green Card you earn 1 Membership Rewards (MR) point for every euro you spend.

- You can use MR points to pay recent transactions on your Account statement.

- You can also redeem your points earned for various gift cards, for instance to reward your staff or gifts for business partners.

- Use your points for flights or hotel stays, or transfer your points to other savings or loyalty programmes from airline and hotel partners, such as the AIR FRANCE-KLM Flying Blue programme.

You can earn points on purchases such as:

- Computers and software subscriptions

- Do you advertise online ? Then link your card to Google Ads, Facebook and LinkedIn

- Business lunches and dinners

- Fuel and parking

- Flights, train travel, taxi rides and hotel stays for business purposes

Close

Close

Protection against fraud, loss and theft

In the case of fraud, our fraud protection guarantee means you won’t be held responsible for any fraudulent charges, provided you’ve taken reasonable care to protect your Account details, PIN and any device you store your Account information on.

Is your Card lost, stolen or under suspicion of fraud?

Please contact the Fraud Prevention Desk immediately.

Please note: this phone number can only be used for lost or stolen Cards or fraud. If you have another question, we kindly request you to contact the Customer Service Team via the number on the back of your Card (Mon. to Fri. 8 am to 6pm).

Call Fraud Prevention Desk: +31 (0)20-504 8196

You will be answered directly. We will block your Card and send you a replacement Card.

Close

Close

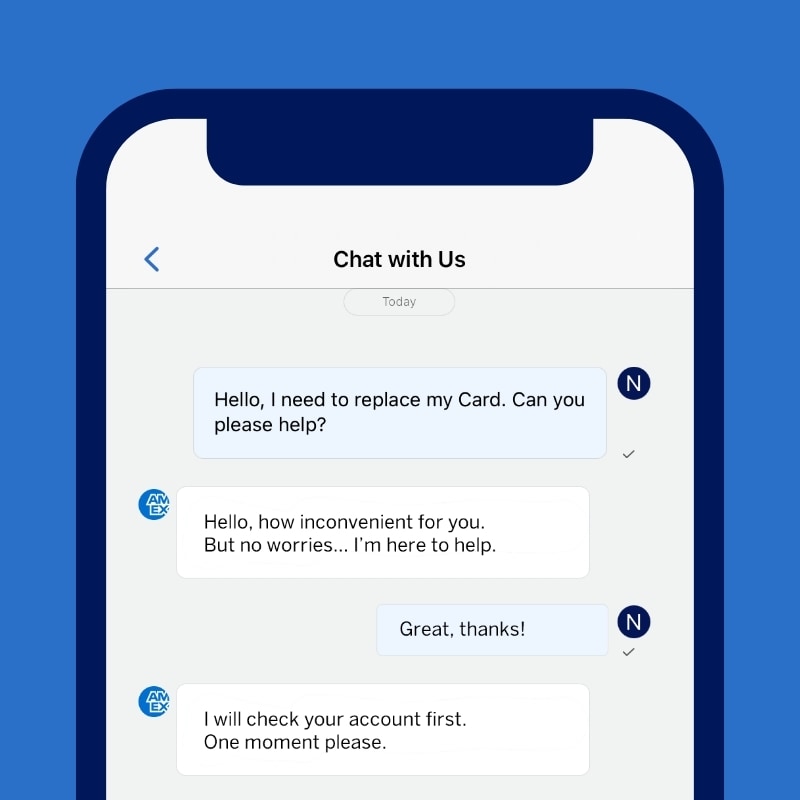

World-Class Service

We are ready to help you. Do you have questions about, for example, a transaction or a replacement Card? Then please call our Customer Service between 8 am and 6 pm on the phone number on the back of your Card. We can be reached 24/7 in case of lost or stolen Cards.

Online Services:

Review your recent transactions, download monthly statements and view and/or modify your PIN via the American Express App or your online account on our website.

Supplementary insurances*

Business Travel Inconvenience:

- Missed or delayed connection (max. €125 per person per trip)

- Delayed or lost luggage (max. €175 per person per trip)

- Has your checked luggage not arrived at the destination airport within 48 hours of arrival? Then you have supplementary cover for this (max. €125 per person per trip)

Business Travel Accidents:

- You are covered for the consequences of an accident while travelling on public transport, in case the trip has been paid for with the Business Green Card.

- Maximum cover of €175,000 in the event of death or permanent disability as a result of an accident.

* Please note: Insurance terms and conditions apply. See the Insurance Terms and Conditions (Dutch) for more information.

English / Nederlands

Welcome to American Express®

Get the most out of your Business Green Card

We would be happy to assist you. Activate your Card if you have not done so already. Already activated your Card? Click on manage your account.

It’s quick and easy to get started.

By following the steps below, you can start enjoying many membership benefits right away, such as collecting Membership Rewards® and opting for deferred payment.

Step 1. Activate your Card and create an account

You cannot use your Card until you have activated it. Haven't you done that yet? Then do that first and immediately create an account to manage your Card account via our mobile App or online.

Activate Card

Step 2. Set Card Alerts

Go to your online account to set your preferences for the Card Alerts you wish to receive. This will help you manage your spending.

Set Card Alerts

Step 3. Ready to use

Your Card has been successfully activated and ready to use.

Ready to use

Stay in control, wherever you are

Download the mobile App

With the Amex App you can easily manage your Card account and you have insight into your expenses anytime, anywhere.

American Express App

Easily manage your account and always have insight into your expenses. Pay for all or part of your purchases with your Membership Rewards points and introduce business friends directly from the App.

- Transaction overview and pay with points

- Activate your Card

- View and change PIN

- Temporarily (de)freeze your Card

- Always control your expenses with push notifications

Your business green Card in a nutshell

Card benefits at a glance

Secure payment

Link your card to Apple Pay, ensure safe online payments with Safekey and learn more about secure payment methods.

More about secure payment

Express Cash

Use Express Cash to withdraw cash at ATMs 24 hours a day, 7 days a week.*

Read more about Express Cash

Earn Earn Membership Rewards points

Earn points with every euro you spend with your Business Green Card.

More about earning Membership Rewards points

Protection against fraud, loss and theft

If you suspect fraud or have lost your Card, contact the Fraud Prevention Desk at +31 (0)20-504 8196 right away. You will be forwarded to the right department immediately.

More about fraud

Deferred payment and individual limit

Use the deferred payment option to postpone payment from 30 to 50 days after purchase. The limit is determined by your spending habits. Please phone our Customer Service Team if you are planning to make a large transaction in the near future.

World-class service and supplementary insurance

Replacement cards within 24 hours and gain access to supplementary insurance for travel accidents and inconveniences.

View all supplementary insurance options

Need help? Ask Amex.

Live chat in the Amex App. 24/7. English only.

Chat live with our Customer Service for any Card or account related questions.

Help us keep your data up to date

As a financial service provider, we are legally obligated to keep our cardmembers' data up to date and check it regularly.

Additional Business Green Cards

Apply online for additional Business Green Cards for your employees or business partner. Expenses made by the additional Cardmembers are added to the basic Cardmember’s Account statement. With the spend on additional Cards you also earn Membership Rewards points.

The first year the additional Business Green Card is free of charge. After that you pay € 50 per year for each additional Business Green Card.

Card acceptance

American Express is accepted by millions of companies around the world, so you can pay for practically all of your business expenses with the Business Card, not only in shops but also online and in apps.

- Important documents

- Business Green Card Agreement (Dutch)

- Insurance Terms & Conditions (Dutch)

FAQ and help

Here is an overview of the most frequently asked questions. If you can’t find your question here, call our Customer Service Team on +31 (0)20-504 8000

(Mon. to Fri. from 8am to 6pm).

Want to request an extra Business Green Card for your business partner or employees?

It is possible to request an extra Business Card within your account for, for example, your business partner or employees. For this, please contact our Customer Service Team on +31 (0)20-504 8000 (Mon. to Fri. 8am to 6pm).

Are you looking for a Card to use for personal purchases as well?

If your Business Card is lost or stolen, please contact American Express immediately via the Fraud Prevention Desk at +31 (0)20-504 8196. You will be forwarded to the right department immediately. Our Customer Service Team will quickly arrange for a replacement Card or other suitable solution, if possible within 24 hours.

American Express is accepted by millions of companies around the world, so you can pay for practically all of your business expenses with the Business Green Card, not only in shops but also online and in apps.

To list just a few of the places where you can pay with your Card:

- Car rental: Avis, Europcar, Hertz, Sixt

- Online advertising: Facebook, Google, LinkedIn

- Petrol & Car services: BP, Esso, Profile Tyrecenter, Shell, Total

- Retail: BCC, de Bijenkorf, bol.com, Fonq.nl, IKEA, MediaMarkt

- Travel: easyJet, Emirates, KLM, NS, Transavia, Uber, Vueling

You can also use the Card for your daily business spending on things like hardware and software, professional services and parking

Have you recently moved? Update your information by changing your address below. Please note that you will need to have your Card to hand. You will be asked for the following:

Security questions, as well as your four-digit CVC code and/or your three-digit CSC code. Please keep in mind: If you are planning to move abroad and would like to inform us of an international change of address, please phone our Customer Service Team using the number on the back of your Card (Mon. to Fri. from 8am to 6pm).

Paying with Apple Pay

Apple Pay lets you make contactless payments with even better security. Add your American Express Card to Apple Pay and earn Membership Rewards® points on all your purchases.

Read more about Apple Pay (Dutch only)

Contactless payments

Contactless payment with American Express is an easy and secure way to pay for purchases under €50.

Read more about contactless payments (Dutch only)

Chip and PIN payments

For chip and PIN payments, simply insert your American Express Card into the card reader and authorise the transaction with your PIN.

Viewing your PIN

You can see your current PIN by simply logging into the American Express App.

Read more about viewing your PIN (Dutch only)

Changing your PIN

You can also easily change your PIN by logging into the American Express App.

Read more about changing your PIN (Dutch only)

Unfreezing your PIN

You can easily unfreeze your PIN in the American Express App.

» Read more about unfreezing your PIN (Dutch only)

Personal code

The purpose of the personal code is to verify your identity for digital requests and telephone requests.

You can pay your monthly statement by direct debit or choose to pay it manually.

Read more