Flying Blue - American Express

Platinum Card

- Voordeel 1

- Voordeel 2

- Voordeel 3

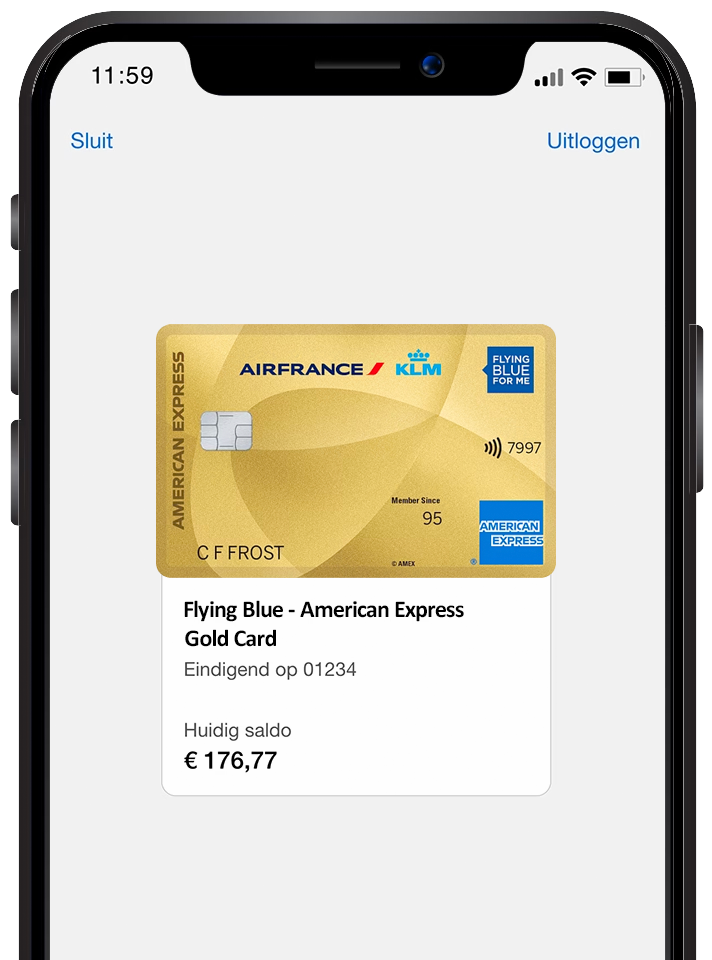

Flying Blue - American Express

Gold Card

- Voordeel 1

- Voordeel 2

- Voordeel 3

Flying Blue - American Express

Silver Card

- Voordeel 1

- Voordeel 2

- Voordeel 3

Flying Blue - American Express

Entry Card

- Voordeel 1

- Voordeel 2

- Voordeel 3

Flying Blue - American Express Gold Card

Discover new worlds

- Now 5,000 Miles welcome bonus

- Earn 1 Mile per €1 spent

- Earn 1,5 Mile per euro by KLM & Air France

- Receive 30 XP each year

€16,50 per month

Terms & Conditions →

Tijdelijk 20.000 Miles én eenmalig 15 XP bovenop de jaarlijkse 30 XP cadeau

BENEFITS AND EXCLUSIVE PRIVILEGES

The world of Flying Blue Gold

Your Flying Blue - American Express Gold Card is more than just a payment card. Enjoy valuable benefits, extensive insurance coverages and privileges within the world of Flying Blue Gold. Here are some of the highlights:

Earn Miles with all your purchases

With every euro you spend, you earn at least 1 Mile. Redeem Miles for reward tickets, lounge access and more ways to travel comfortably.

Receive 30 XP each year

As a Flying Blue Gold Cardmember you receive 30 XP annually. These XP increase your membership level and give you access to even more benefits within the Flying Blue programme.

Fly now Pay later

Pay for your KLM or Air France tickets in three equal monthly instalments with no interest or extra fees. Ideal if you book frequently.

Comprehensive travel and purchase insurance

Travel and shop with peace of mind thanks to extensive purchase protection, travel insurance and cancellation insurance.

World-class Service

We are here for you and your Supplementary Cardmembers: call our Customer Service, visit our Service pages or chat 24/7 via Ask Amex in the Amex App.

Looking to earn even more Miles and XP?

Discover the world of Platinum. Receive a welcome bonus of 10,000 Miles and 60 XP annually.

Automatic membership

Flying Blue benefits

- Earn at least 1 Mile for every €1 spent

- 5,000 Miles welcome bonus and 30 XP annually

- Extensive purchase and additional travel insurance

- Share Miles with Share & Fly

- Pay tickets in 3 instalments with Fly now Pay later

TRAVEL IN COMFORT

Well protected on your journey

With the Flying Blue - American Express Gold Card you, your family and your Supplementary Cardmembers always travel with comprehensive insurance coverage.

In addition to travel and cancellation insurance, the Gold Card offers additional travel inconvenience and travel accident insurance. With worldwide emergency assistance, American Express is by your side wherever you are.

American Express

World-class Service

With your Flying Blue - American Express Gold Card you enjoy the daily convenience and peace of mind that American Express provides.

Be the first to buy tickets for concerts. Shop with Purchase Protection and a Money-Back Guarantee in case of theft, loss or damage. Request Supplementary Cards. Adjust your personal spending limit. Track your expenses online and in the Amex App. Make the most of your Flying Blue Gold Card.

Amex Apps

Amex App: Easily manage your account and track your spending. Pay for purchases with Membership Rewards points, contact us via Ask Amex 24/7 and stay in control with push notifications.

Amex Experiences App: Discover exclusive events from dining experiences to concerts. Sign up with just one click and receive push notifications so you never miss out.

FOR FAMILY AND FRIENDS TOO

Request two Supplementary Gold Cards free of charge

As the Primary Cardmember you can request up to two Supplementary Gold Cards at no extra cost for adult family members or friends. They enjoy the same convenience and service as you do and you earn Miles faster.

The Primary Cardmember remains responsible for all charges made with the Supplementary Cards.

Discover new worldsFlying Blue - American Express Gold Card

Close

Close

Benefits of the Flying Blue membership

With the Flying Blue - American Express Gold Card you automatically become a member of Flying Blue, KLM’s frequent flyer programme. Earn Miles on flights with KLM, Air France and partner airlines. You also earn Miles on everyday spending, from refuelling to online shopping and purchasing flight tickets.

Earn and redeem

Miles

With the Gold Card you earn 1 Mile per €1 spent. If you spend directly at KLM, Air France or Hertz, you earn 1.5 Miles per €1. Redeem Miles for tickets, upgrades, lounge access or products and services from more than 100 partners.

Higher membership level

Experience Points

Within the Flying Blue programme you also earn Experience Points (XP) with every flight. XP determine your membership level. With the Gold Card you receive 30 XP annually, without flying. This helps you maintain your level or reach a higher one faster.

Security

Extend your Miles balance

Normally Miles in Flying Blue remain valid only if you take at least one flight with KLM, Air France or another SkyTeam partner every 2 years. Otherwise, they expire. Flying Blue - American Express Cards offer a solution: every purchase with your Card extends the validity of your entire Miles balance by 2 years. This way you secure your Miles even if you do not fly for a while.

Share Miles

Share & Fly

Share Miles with Supplementary Cardmembers linked to your account through Share & Fly. Save faster for reward tickets together. Supplementary Cardmembers can transfer Miles to and from the Primary Cardmember free of charge.

Spread payments

Fly now Pay later

Pay for KLM and Air France tickets in 3 equal instalments at no extra cost (excluding package deals).

Close

Close

Well protected on your journey

With the Flying Blue - American Express Gold Card you are covered by additional travel and cancellation insurance, travel accident insurance and travel inconvenience insurance. And wherever you are, we are here for you with worldwide emergency assistance.

PEACE OF MIND WHILE TRAVELLING

Additional travel and cancellation insurance

With the Gold Card you, your family and your Supplementary Cardmembers are covered by travel and cancellation insurance when the trip or stay is paid for with the Card. Coverage includes medical assistance, emergency dental treatment and cancellation of your trip. Theft, loss or damage of personal belongings, cash and travel documents are also covered.

TRAVEL ACCIDENTS

Additional travel accident insurance

With the Gold Card you, your partner and your children are covered worldwide in case of travel accidents, provided your trip or stay is paid for with the Card. Coverage up to €50,000 in the event of death during your trip.

TRAVEL INCONVENIENCE

Additional travel inconvenience insurance

With the Gold Card you are reimbursed for necessary additional expenses caused by baggage or flight delays of at least 4 hours, provided your trip or stay is paid for with the Card.

World-class Service

Worldwide emergency assistance

From medical or legal assistance abroad to replacing a lost or stolen Card. Services include rapid replacement Cards and emergency cash advances.

Hulp onderweg

Global Assist

Of het nu gaat om advies over het aanvragen van een visum voordat u op reis gaat, of een verwijzing naar een Engelstalige dokter of advocaat in het buitenland, Global Assist staat 24 uur per dag, 7 dagen in de week voor u klaar. Neem telefonisch contact met ons op via +31 (0)20 - 574 5718.

Close

Close

World-class Service

Your Flying Blue - American Express Gold Card is more than just a payment card. Our World-class Service guarantees the convenience and protection you expect: Supplementary Cards, safe and insured purchases and real-time updates via our apps. American Express has it all.

SAFE PAYMENTS

Purchase protection

If your purchase is stolen or accidentally damaged within 180 days of purchase, we will reimburse the replacement or repair costs up to €1,400 per incident, maximum two claims per 12-month period.

EXTRA PEACE OF MIND

Money-back guarantee

If you decide to return your purchase within 90 days but the retailer does not accept it, you will be refunded through our Money-Back Guarantee up to €400 per claim, maximum two claims per 12-month period.

IN CONTROL

Not delivered, no charge

If your order is not delivered, you can reverse the payment to avoid unjustified charges.

PRESALES

Access to presales and concerts

Enjoy exclusive presales with access to tickets before the general sale starts.

TAILORED

Personal spending limit

Your Card has no pre-set spending limit. Your spending capacity builds over time and is based on your profile, membership duration and spending history.

COST-EFFECTIVE

No interest

With American Express you pay your balance in full each month. That way you avoid financial difficulties, high interest costs and your application will not lead to a BKR registration.

Close

Close

Stay up to date with the American Express Apps

We offer two apps for Cardmembers: the American Express App for personal financial management and the Amex Experiences App for exclusive access to events and offers.

FINANCIAL MANAGEMENT & SUPPORT

American Express® App

Manage your account and track your expenses anytime. Pay with Membership Rewards points and chat with our Customer Service via Ask Amex, 24/7.

- View transactions and pay with points

- Activate your Card

- View and change your PIN

- Temporarily block and unblock your Card

- Stay in control with push notifications

EXPERIENCES & EVENTS

Amex Experiences App

Access all your benefits and events in one place. Find concerts, presales and much more, so you’ll never miss out again.

- All your benefits in one app

- Stay up to date on the latest events

- Register with one click or a quick call

- Key contact numbers at hand

- Never miss a moment with the Amex Experiences App

Close

Close

Vraag uw Flying Blue - American Express Gold Card aan:

Het aanvragen van uw kaart kost maar enkele minuten. Houd een geldig identiteitsbewijs bij de hand (paspoort of identiteitskaart), uw bruto jaarinkomen en de inloggegevens van uw eigen bank. De Flying Blue - American Express Gold Card aanvragen kan al als u:

- 18 jaar of ouder bent;

- geen negatieve BKR-registratie heeft;

- een Nederlands woonadres heeft;

- beschikt over een bruto jaarinkomen van minimaal € 20.000.

- Vul het online aanvraagformulier in.

- Identificeer uzelf via iDIN1.

- Upload een geldig ID-document.

- Wij controleren uw aanvraag en nemen eventueel contact met u op voor aanvullende informatie.

- Aanvraag goedgekeurd? Dan heeft u de kaart binnen 10 werkdagen in huis.

- Activeer de kaart online.

1 iDIN is een initiatief van de Nederlandse banken. Een snelle, veilige en gemakkelijke manier voor online identificatie via de veilige en vertrouwde inlogmethode van uw eigen bank. Lees meer over online identificeren

Close

Close

Vraag uw Flying Blue - American Express Gold Card aan:

Het aanvragen van uw kaart kost maar enkele minuten. Houd een geldig identiteitsbewijs bij de hand (paspoort of identiteitskaart), uw bruto jaarinkomen en de inloggegevens van uw eigen bank. De Flying Blue - American Express Gold Card aanvragen kan al als u:

- 18 jaar of ouder bent;

- geen negatieve BKR-registratie heeft;

- een Nederlands woonadres heeft;

- beschikt over een bruto jaarinkomen van minimaal € 20.000.

- Vul het online aanvraagformulier in.

- Identificeer uzelf via iDIN1.

- Upload een geldig ID-document.

- Wij controleren uw aanvraag en nemen eventueel contact met u op voor aanvullende informatie.

- Aanvraag goedgekeurd? Dan heeft u de kaart binnen 10 werkdagen in huis.

- Activeer de kaart online.

1 iDIN is een initiatief van de Nederlandse banken. Een snelle, veilige en gemakkelijke manier voor online identificatie via de veilige en vertrouwde inlogmethode van uw eigen bank. Lees meer over online identificeren