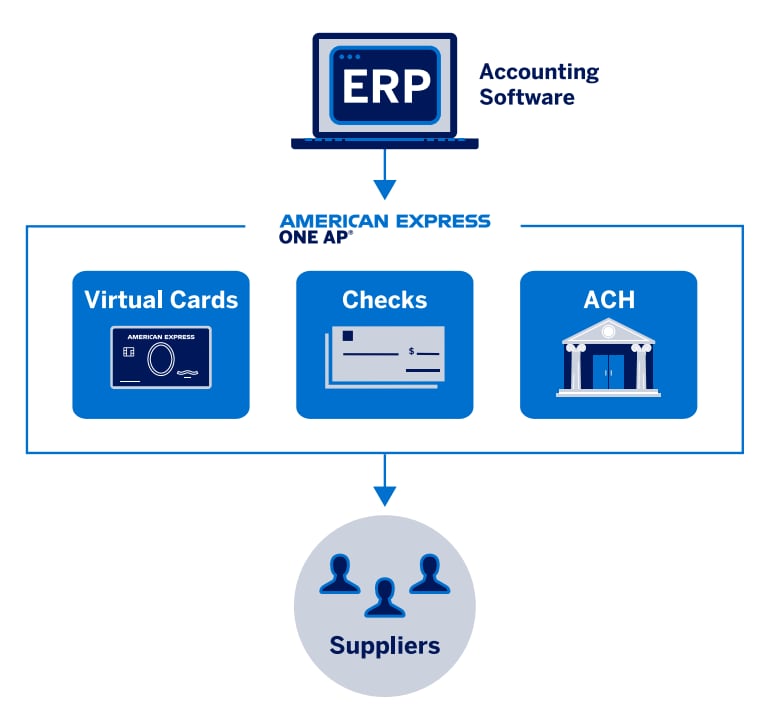

AMERICAN EXPRESS ONE AP®1

Streamline your accounts payable processes on a single solution - from the efficiencies of supplier invoice payment automation to the increased control of Virtual Cards On-Demand.

Enrollment required and fees may apply (including an auto-renewing monthly platform access fee). Suppliers must be enrolled and located in the United States. Please contact your American Express® Specialist to learn more.

One AP can help transform the way your business pays suppliers

STREAMLINED PAYMENTS

Automate and streamline supplier payments by Virtual Card, check, and ACH - all from one platform*.

*Fees apply for check/ACH (including an auto-renewing monthly platform access fee). No fee for Virtual Cards.

INCREASED EFFICIENCY

Boost your team's productivity by helping to simplify workflows, reduce manual tasks and save time.

ADDED SECURITY AND CONTROL

Create unique Virtual Cards On-Demand each with their own spending limit, security code and expiration date.

What is One AP?

Watch the video to learn how One AP can help your business streamline and simplify supplier payment processes.

One AP is a complete payments solution

– from Virtual Cards On-Demand to Invoice-backed Payments

With Virtual Cards On-Demand, you can:

- Create single use, multi-use and reloadable Virtual Cards

- Set customizable spending limit

- Create, freeze or cancel at any time

- Pay without sharing your physical Card details

There are no fees to create a One AP account, create Virtual Cards or make Virtual Card payments.

For illustrative purposes only

For illustrative purposes only

With Invoice-backed Payments, you can:

- Process multiple invoices simultaneously to help reduce manual errors and increase efficiency

- Keep reconciliation simple with ERP compatibility

- Streamline eligible supplier invoice payments by Virtual Card, check, and ACH all from One AP*

*Fees apply for check/ACH (including an auto-renewing monthly platform access fee). No fee for Virtual Cards.

How One AP helps real customers.

With One AP, you’ll receive onboarding and ongoing support from a dedicated specialist.

Here's how automated solutions can help your modern business.

DIGITAL TRANSFORMATION STRATEGIES FOR SMALL AND MID-SIZE BUSINESSES

HOW TO DRIVE SCALE WITH AUTOMATION

10 STRATEGIES FOR UNCOVERING AND OVERCOMING OPERATIONAL INEFFICIENCIES

Frequently Asked Questions

Small Business Card Members: Click to create a One AP account today. Upon successful creation of an American Express One AP® account, you can create Virtual Cards On-Demand in a few clicks and use them immediately – at no cost.

Corporate Card Members: Click to fill out some information about your business and a Specialist will contact you to help get you started. (Customers of American Express® Corporate and Corporate Purchasing Card are not eligible for digital account creation.)

Only Virtual Card transactions (which are funded by your American Express® Card) can earn the rewards of your Card. Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

Check/ACH transactions are funded by an enrolled bank account (not your American Express® Card) and therefore are not eligible to earn rewards.

A Specialist can unlock and help onboard you to invoice payment automation. A Specialist can also help you enroll a bank account to enable check/ACH payments. (Your American Express® Business or Corporate Card cannot fund check/ACH transactions, and those transactions are not eligible to earn rewards.)

To engage a Specialist:

Small Business Card Members: Click to create a One AP account today and you will be directed to the One AP platform where you can follow instructions to learn more about invoice-backed payments and request a phone call from a Specialist.

Corporate Card Members: Click to fill out some information about your business and a Specialist will contact you.

Monthly billing is activated when your first check or ACH payment is processed in One AP. Fees will be auto-billed monthly in arrears to the first American Express® Card enrolled.

Your bill will consist of three types of fees: 1) Access: $200 monthly platform access fee is auto-renewing 2) Transactions: No fee for the first 400 check transactions and first 400 ACH transactions each month and additional transactions are $1.00 per check and $0.35 per ACH transaction, and 3) Applicable taxes. There are no fees for Virtual Cards.

1. American Express One AP®

American Express One AP® may not be available to all customers. To access the service, all customers will be required to enroll their eligible U.S.-issued American Express® Business, Corporate, or Corporate Purchasing Card. There is no fee to use the service for customers electing to process only Card payments. Use of additional payment methods requires activation through an American Express® Specialist and a monthly platform access fee of $200 which will automatically renew each month, unless the service is cancelled or all additional payments methods are deactivated, as applicable. If additional payment methods are being used, with the monthly platform access fee, to the extent used, the first 400 check transactions and first 400 automated ACH transactions each month are complimentary, after which point a fee of $1.00 per check and $0.35 per automated ACH transaction will apply. Fees are subject to change. Sales tax on fees may apply. All fees associated with American Express One AP® will be auto-billed monthly in arrears to the first Card enrolled for the service. The monthly platform access fee will be charged starting in the month in which the customer first uses an additional payment method and will not be pro-rated; the full monthly platform access fee will be charged regardless of when in the month a customer activates and first uses an additional payment method. Customers may cancel the service or activate/deactivate additional payment methods by contacting their American Express® Specialist. The customer will be charged the full monthly platform access fee (and any applicable transaction fees and taxes) for the month in which the service is cancelled (or all additional payment methods are deactivated), with continued access to the service for the thirty days following the cancellation date. Customer must cancel by 5:00 PM ET on the last business day of the month to avoid being charged the platform access fee for the following month. To make a Card payment to a supplier through the service, the supplier must be an American Express-accepting merchant. To learn more, please contact your American Express® Specialist.

New York: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. California: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. Georgia: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed by the Georgia Department of Banking and Finance.

For a list of our money service business licenses and information about addressing complaints and other disclosures, visit www.americanexpress.com/us/state-licensing.html .

NMLS ID # 913828