6 Min Read | Updated: January 19, 2024

Originally Published: August 13, 2020

What Do Financial Advisors Do & How Much Do They Cost?

If you’re confused about how much financial advisors cost, you’re not alone. Here’s how to break down financial advisor fees – and avoid costly errors.

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

At-A-Glance

Financial advisors can help you preserve and grow your assets.

But their fees can actually cost you tens of thousands of dollars over time.

You need to understand the costs and benefits going into any financial advisor relationship.

Good financial advice can help you make better financial decisions, reduce your debt, or cushion your retirement.1,2 But it can also cost you more than you think. And bad financial advice can be even costlier. That’s why it’s important to choose your financial advisor carefully and understand the tradeoff between what you’re paying and what you’re getting in return. To paint the big picture of financial advisor costs, this article lays out the fees, benefits, and risks.

Understanding the Full Impact of Financial Advisor Costs

If you’re confused about what financial advisors cost, so are many people. According to a recent report by the Financial Industry Regulatory Authority (FINRA):3

- More than one in five investors (21%) believe they pay no fees for their investment activities. An additional 17% of investors don't know what fees they pay.

- Among mutual fund owners, 38% did not believe they paid fees or expenses. An additional 15% reported not knowing if they paid fees for their mutual funds.

There’s good cause for confusion and ambivalence about financial advisors’ fees. While some fees are clearly stated, others are buried, and many may seem too insignificant to bother with. But your financial advisor’s costs can actually have a big impact on your finances.4,5

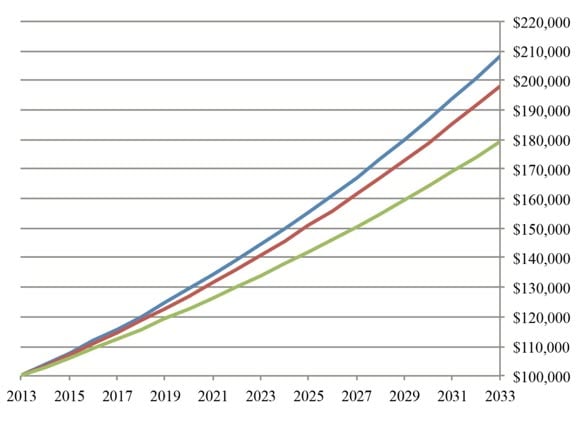

How big? Literally tens of thousands of dollars, over time. In the chart below, the Securities and Exchange Commission (SEC) compared a 1% and 0.25% ongoing fee on a sample investment portfolio. Over 20 years, the higher fee (green line) would reduce the portfolio’s value by nearly $30,000 compared with the lower fee (blue line).5

Portfolio Value from Investing $100,000 Over 20 Years

How could that be? Saving and investing are percentage games. Every fraction of a percent that you gain really counts, as it is reinvested and “compounds” over time, accelerating your investments’ growth by delivering returns on your returns.6 Financial advisory fees have the opposite effect, since they reduce the amount that you are reinvesting and compounding over time.

Financial Advisors and Their Fees Come in Many Varieties

One way to break down the types of financial advisors is to look at licensing, registration, and certifications.

- Registered investment advisors typically earn a percentage of assets under management to advise clients on their portfolios of stocks and bonds.7 Many are Chartered Financial Analysts, a certification that requires passing rigorous exams.8,9 The SEC, where most advisors are registered – although some have state licenses – provides a lot of background information about specific investment advisors and their firms.10

- Certified financial planners help clients with planning retirement, managing taxes, choosing insurance, setting up their estates, and meeting other financial objectives.11 The Certified Financial Planner Board of Standards’ website is a hub of information about them.

- Brokers make commissions to execute trades and other transactions.12 FINRA regulates brokers, and its BrokerCheck Online tool provides detailed information about them.

- Robo-advisors are digital platforms that collect financial information from clients and automatically invest their assets, for fees of up to 0.5% on assets under management.13,14 Robo-advisors must also be registered with the SEC and can often be found on BrokerCheck as well.15

All that said, it’s not uncommon to see hybrids of all four of the above, going by names including money managers, wealth managers, private bankers, and others. There are also big, medium, and small advisory firms, including giant low-cost mutual fund companies and online fintechs as well as local boutique outfits.

The Benefits and Risks of Hiring a Financial Advisor

Of course, people can save and invest without financial advisors, who neither guarantee that they will outperform the market nor that you will achieve your financial goals. Still, a financial planner can be worth far more than their costs, helping you look at the big picture and guiding you through budgeting, tax issues, retirement planning – and through major life events like paying for college, getting married, and starting a family.16

Bad financial advice is a different story. For instance, fees and commissions can pose potential conflicts of interest between an advisor and a client. Conflicts of interest can result in financial advisors making recommendations for services an investor doesn’t want or need, or it could result in higher fees.17 In addition to the federal government’s regulation of fiduciary standards, which require financial advisors to put their clients’ interests ahead of their own, and some professional and advocacy groups are stepping in with their own codes.18,19

Ultimately, one of the best ways to measure your financial advisor’s worth is to track your portfolio’s return on investment and compare it to the overall market’s growth. After all, if you’re paying someone a fee to provide financial advice, they should be able to get you a better return than the market average, which you can obtain at lower cost via a passive index fund.5,14 Online statements usually include portfolio returns minus fees, along with the capability to see how much your investments have grown over the past month, quarter, year, or other time period of your choice.

Questions to Ask a Financial Advisor

To cut through the confusion, here are questions to ask when hiring a financial advisor, from the SEC20 and the Consumer Financial Protection Bureau:21

- What are your credentials?

- Are you a fiduciary, meaning you have a formal commitment to put clients’ interests ahead of your own?

- How do you get paid – by the amount of assets you manage, by commission, or by another method?

- What are the total fees to purchase, maintain, and sell the investments you recommend?

- What are the ongoing fees to maintain my account?

The Takeaway

Financial advisor costs can be difficult to fathom, but understanding them is key to achieving your financial planning and investment goals. As the SEC says, “over time, [even small ongoing fees] can have a major impact on your investment portfolio.”19

1 “Financial knowledge and decision-making skills,” Consumer Financial Protection Bureau

2 “Financial Advisors: An Overview,” Michigan.gov

3 “Investors in the United States: The Changing Landscape,” FINRA

4 “The Fuss About Fees,” Investor.gov U.S. Securities and Exchange Commission

5 “Understanding Fees,” Investor.gov U.S. Securities and Exchange Commission

6 “Investing Basics: Compound Returns and the Power of Reinvestment,” Investment Company Institute

7 “Investment Adviser Industry Snapshot 2023,” Investment Adviser Association

8 “Subject: File No. S7-25-19,” Securities and Exchange Commission

9 “CFA Program,” CTA Institute

10 “Glossary: Jargon,” Securities and Exchange Commission

11 “Financial Planners,” FINRA

12 “What Is a Stockbroker?,” CFA Institute

13 “Robo-Adviser,” Investor.gov

14 “Short Paper: Can Robo-Advisors Replace Traditional Advisors?,” Duke University Libraries

15 “Millennial Money Mission: Robo-Advisers,” NASAA

16 “The Value of Financial Planning,” CFP

17 “Choice of Financial Adviser Can Dramatically Affect Retirement Savings,” Pew

18 “Summary and Video Series to Understand the New Code of Ethics and Standards of Conduct,” CFP

19 “Fiduciary Oath,” The Committee for Fiduciary Standard

20 “Trends in the Expenses and Fees of Funds, 2022,” Investment Company Institute

21 “Know Your Financial Adviser,” Consumer Financial Protection Bureau

Karen Lynch is a journalist who has covered global business, technology, finance, and related public policy issues for more than 30 years.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

What is Financial Planning and How Does it Work?

Personal financial planning can help protect you from life’s unpredictability. Find tips to improve your financial planning process and learn to build a budget.

What, Exactly, is “Personal Finance”?

Understand what personal finance is, why it is important and how you too can do personal finance to help you manage your money.

4 Tips for Better Financial Habits

Good financial habits can help you improve your overall financial well-being. Learn how these four tips can help jumpstart your journey to financial success.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.