How to Reduce Debt

7 Min Read | Last updated: January 29, 2024

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

A guide for how to get out of debt this year, whether it’s from a student loan, auto loan, credit card spending – or all of the above.

At-A-Glance

- If you’re ready to take action to get out of debt this year, this guide can help.

- Whether you use one or all of these strategies, the key to getting out of debt remains the same: the discipline to follow your plan.

So, you've decided to get out of debt starting right now—this year.

The good news is that there are many well-known strategies for doing so, and any of them can work if you stay motivated and stay the course. The challenge is that staying the course isn’t easy—it takes a lot of planning and, most importantly, discipline. But you can do this.

The following could be used as a step-by-step plan for getting out of debt starting this year. At the same time, a few—or even one—of these steps can help get you onto the right track.

Step 4: Factor in both lower interest rates and longer repayment terms.

Here are some things to consider when analyzing how to consolidate debt:

- Secured vs. Unsecured

You can save money on interest charges if you consolidate credit card debt through a secured loan, such as a personal loan, “cash-out” mortgage refinancing, or a home equity line of credit (HELOC) because they generally have lower interest rates.7 - Short Term, Lower Interest

You may also save money on interest charges by taking out the shortest-term debt consolidation loan with a monthly payment you can afford.8 - Long Term, Lower Monthly Cost

Because you pay interest over a longer period, longer terms can sometimes push total loan costs higher, not lower, than the debt you were facing at the outset.9 This gives you a trade-off to consider: Is lowering your monthly expenses by taking out a longer-term debt consolidation loan worth the higher total cost in the long run?

Online calculators are available to crunch your specific numbers and estimate total costs.10

Step 1. Budget to Get Out of Debt

How much money can you afford to allocate for paying off debt? There are several ways you can figure out the number that’s best for you. You can gather your monthly income and expenses via your bank's online system. Then separate the essential costs—groceries, housing, utilities, transportation, and so on—from discretionary spending, such as entertainment, dining out, and impulse buys.1 When you’re done, you should have three lists of monthly financial data going back 12 months:

- Income

- Essential expenses

- Discretionary expenses

To simplify, create monthly averages for your income and both expense categories.

Now, how much discretionary spending do you think you can do without? It can be helpful to allocate a monthly amount of money you can afford for paying off your debt. That may mean some lifestyle changes, but it also should include a reality check. If you know the most you’ll be able to realistically commit to is $450, it’s best to start with that rather than a higher number that will be more challenging to maintain long term. It may be easier to stay on the right track when you have the satisfaction of successfully following your plan. So, as you're building your budget, pick a debt-paydown amount that is meaningful and that you can live with. If you find that the amount you can live with won’t have a meaningful impact on your debt, you may consider a personal loan for debt consolidation (see Step 6).2

Step 2. Gather Debt Information

The next step is to catalog all the debt you're carrying, such as student loans, month-to-month credit card balances, retail store balances, and auto loans. For each loan or creditor on your list, gather the following information:

- Lender's name

- Payoff amount

- Interest rate

- Expected payoff date

- Amount you're already paying each month

You can exclude or de-prioritize any loan that has zero percent interest.

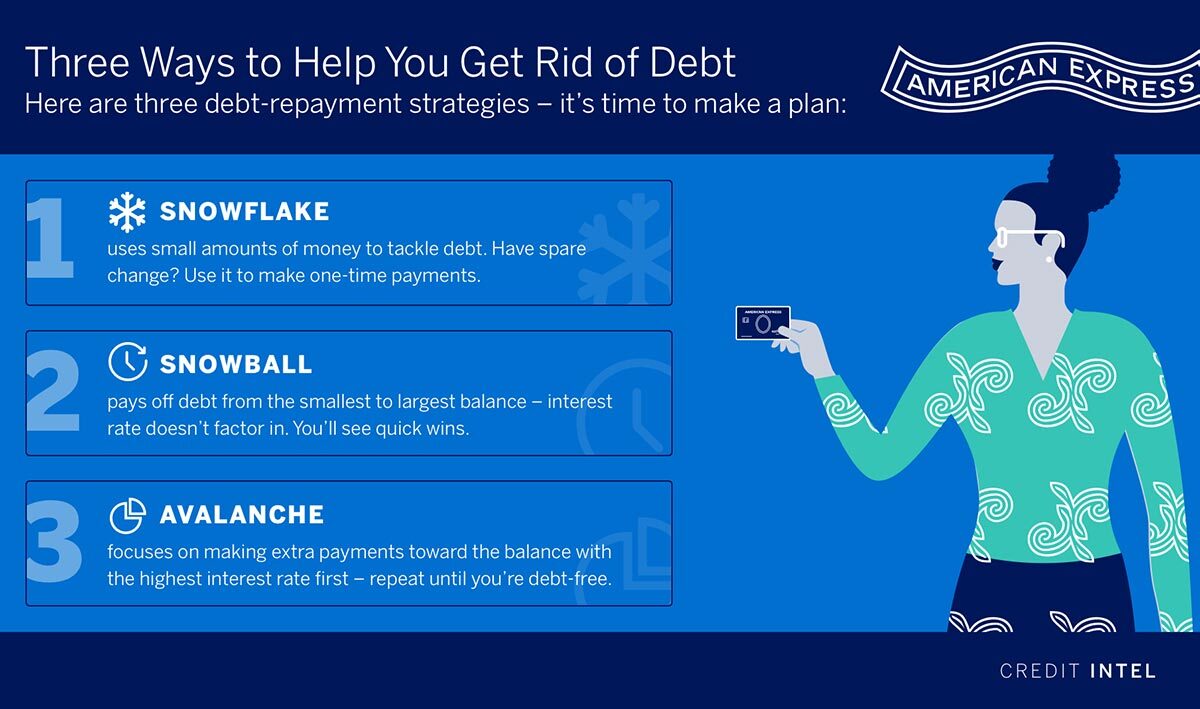

Step 3. Consider the Wintry Mix: Snowflake, Snowball & Avalanche

Now that you've gathered information about your loans, your income, and your spending, it's time to make a plan. Here are three popular strategies I like to think of as the “wintry mix”:

- Snowflake uses small bits of “found money”—the forgotten $20 bill in a jacket pocket and the change at the bottom of your couch—to pay down your debt.3 It may sound a little silly, but it works.

- Snowball targets paying off debt from smallest amount to largest, regardless of interest rate.4 The idea is that the satisfaction of eliminating an entire debt motivates you to maintain your getting-out-of-debt discipline.

- Avalanche is my favorite. It targets the loan or credit card balance with the highest interest rate first. Once that's paid off, you refocus on the balance or loan with the next highest interest rate. Since interest charges are accruing on all outstanding debt every month, choosing the highest interest rate debt to pay off first can save you money.5

Of course, you can also employ the snowflake method with either of the other strategies. (See Step 6 for a way to supercharge any of them.)

Step 4. Follow the Golden Rule of Credit Card Management

Experts suggest using only as much credit as you can afford to pay off in full each month.6 If you really want to get out of debt, you can start that right away. Heeding these experts’ advice will help you stop adding to your credit card debt while you’re trying to become debt free.

Step 5. Consider a Personal Loan to Consolidate

Personal loans generally have a lower interest rate than credit cards, although they may be higher than certain auto loans and home equity loans, which are secured by cars and houses, respectively.7,8 Regardless, however, taking out a personal loan to consolidate your debt has an important advantage: Chances are your monthly payment will be lower, potentially quite a bit lower, than your combined payments are today. The flip side to that advantage is that the consolidation loan will probably have a later payoff date, which means you could wind up paying more interest than you would have before.2 (For more detail on personal consolidation loans, see “Should You Take Out a Personal Loan to Pay Off Credit Card Debt?”)

A practical approach for a debt consolidation loan is to pay more than the minimum payment to shorten the life of the loan. Let’s say you consolidate all or most of your loans and balances, ending up with a 40% reduction over your previous monthly payments. You could apply a portion of that freed cash flow—say, half—to paying down the consolidation loan faster.

Step 6. Speed Up the Plan

Think of this as boosting that wintry mix into a blizzard. Most of us have items of value that we no longer use or appreciate, such as jewelry, electronics, tools, furniture, collectibles, exercise equipment, and so on. Depending on how much unneeded stuff you have accumulated, you could find that it generates additional income each month selling via auction, classified ads, or other online e-commerce marketplaces.

The Takeaway

You can start getting out of debt this year—and take control of your financial destiny. The tips outlined in this plan can help you do so, as long as you have the motivation and discipline to stay the course.

1 “4 Steps to Better Budgeting,” American Institute of CPAs

2 “What do I need to know about consolidating my credit card debt?,” Consumer Financial Protection Bureau

3 “What Is the Debt Snowflake Method?,” Experian

4 “Debt Snowball Strategy: How Does It Work?,” Experian

5 “The Debt Avalanche Method: How It Works and When to Use It,” Experian

6 “Paying Off Credit Cards,” MyCreditUnion.gov

7 “30-Year Fixed Rate Mortgage Average in the United States,” Federal Research Bank of St. Louis

8 “Consumer Credit - G.19,” The Federal Reserve

SHARE

Related Articles

How Do Debt Relief Programs Work

Wondering how debt relief works? Learn more about debt relief programs, important risks to keep in mind, and alternatives before you qualify for one.

How to Use the Debt Snowball Method to Pay Off Debt

Take a strategic approach to pay off your debt by using the debt snowball method—find out if the debt snowball method is right for you.

Using a Personal Loan to Pay Off Credit Card Debt

Sometimes, consolidating your debt with a personal loan could be a smart idea. See how to pay off credit card debt using a personal loan and what to expect.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.