How Long Does It Take to Build Credit?

6 Min Read | Last updated: June 16, 2025

How long does it take to build credit from scratch? It may take at least six months. See tips to help build a strong foundation for your credit future.

At-A-Glance

- Having good credit means having a good credit history but building a credit history isn’t instant.

- If you haven’t used credit before, it could take at least six months to generate a credit score, and longer to establish a good or excellent score.

- It may be easier and faster to establish your first credit score than to repair one, so use those first six months to develop responsible credit habits that can set you up for long-term credit health.

Are you starting college and ready to begin building credit in your own name? A newcomer to the country who wants to establish credit in the U.S.? Looking to kick-start your credit profile after not using any debt for six months or longer? Whatever your reason for wondering how long it takes to build and improve your credit score, you can expect it to take about six months, and longer to get into the good-to-exceptional credit score range.1

Once you learn how credit scores are calculated and used, it’s easier to understand how long it takes to build credit. Lenders use your credit score to help them decide whether to lend you money. Lenders want to see more than a couple of months of on-time payments; they want you to show that you can sustain that pattern.

Let’s explore how you can build good credit effectively while developing credit habits that help sustain high scores in the long run. Keep in mind that even if building a good credit score takes a while, it may be faster and easier than rebuilding a score after a mistake.

Understand the Credit Score Calculation to Help Build Your Credit

Once you understand the principles behind credit score calculations, you can begin working toward a good credit score with greater confidence. Although there are many credit scoring models, the two leaders are FICO® and VantageScore®, both of which issue scores ranging from 300 to 850. Many consider a credit score of 670 to be a good starting point.2

The algorithms for calculating your credit score are considered trade secrets. FICO shares the following to be general guidelines, but it’s important to note that they are not exact, just estimates and can vary:3

- 35% is based on your payment record

- 30% is based on credit utilization

- 15% is based on length of credit history

- 10% is based on credit mix

- 10% is based on recent borrowing inquiries

Some of the best ways to build a good credit score are to pay your bills on time, keep your credit utilization rate low, and focus your efforts on a balanced portfolio of different types of debt.

How to Improve Your Credit

So how long does it take to build credit? Although you probably can’t cut the time it takes to get your first credit score to less than six months, focusing on the behaviors that lenders want to see can help you get to a good or excellent score sooner.

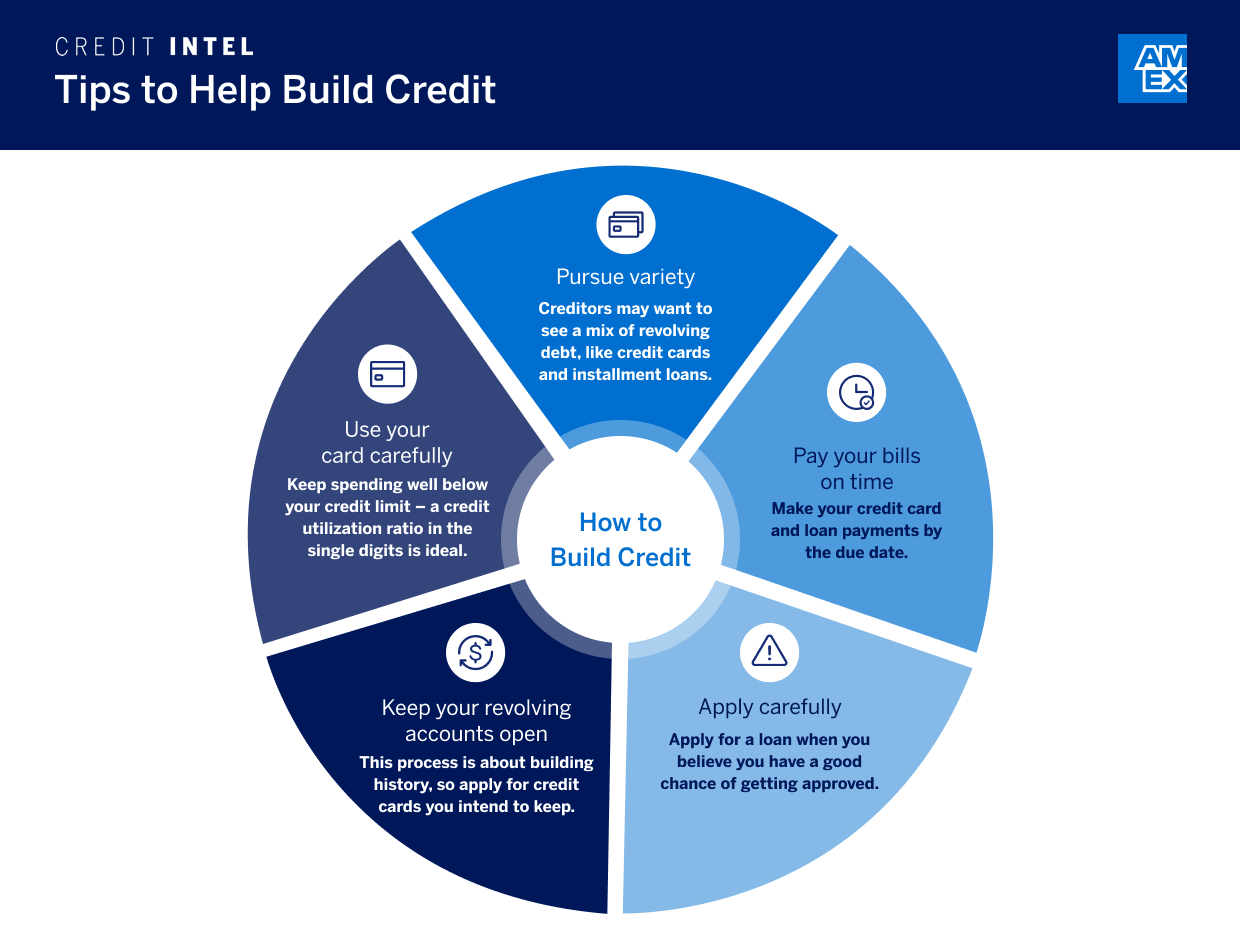

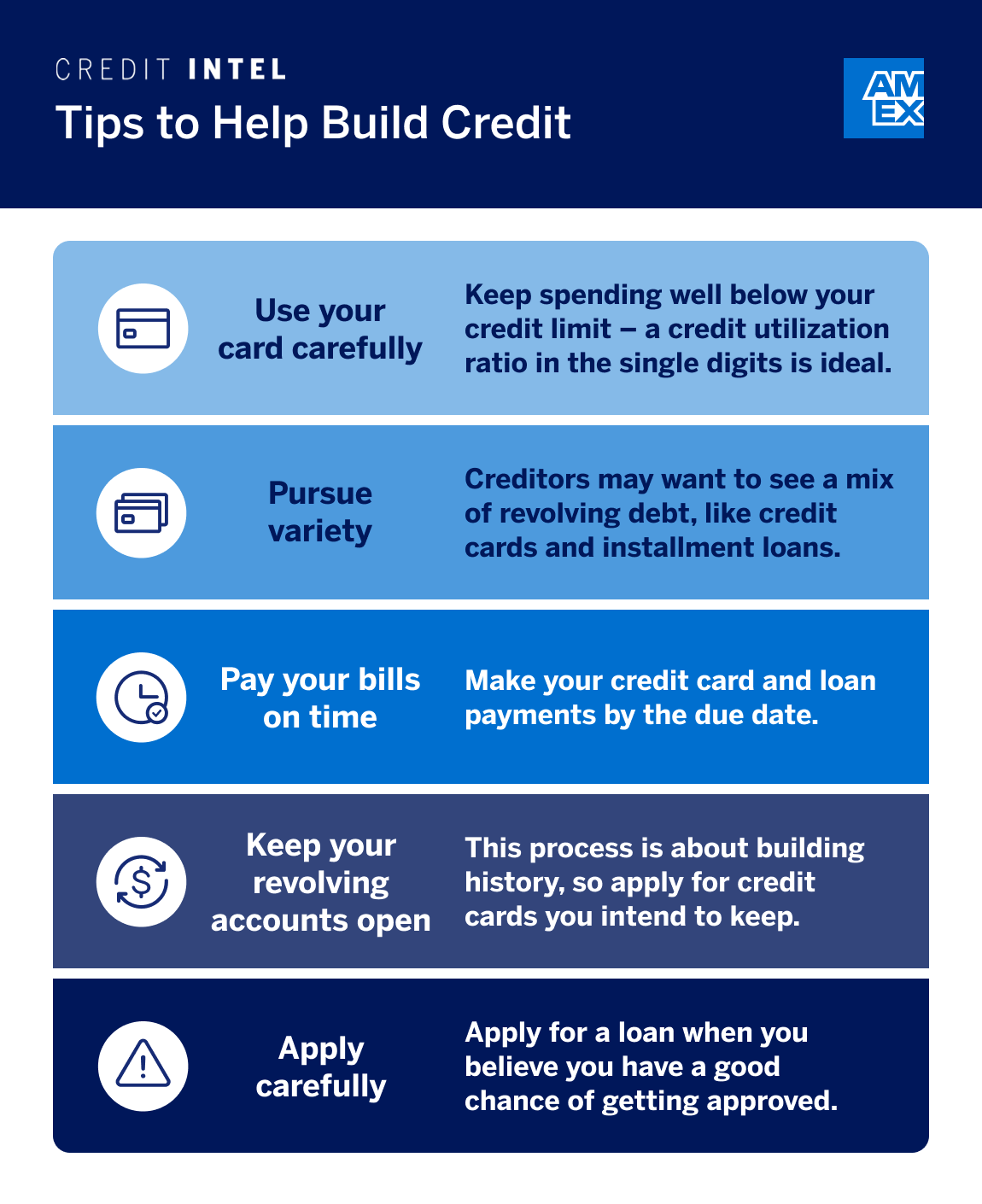

Focus on the following, which may help improve your score:

- Pay Your Bills on Time

Your debt payment history has a significant impact on your score, so it’s vital to make your credit card and loan payments by the due date, every time. - Use Your Available Credit Carefully

Keep your balance well below your credit limit. A credit utilization ratio of less than 30% of your available credit could benefit your score. But even lower utilization of less than 10% can help boost your score, as long as you keep it above zero.4 - Pursue Variety

Creditors may want to see a mix of types of credit. Having both revolving debt, like credit cards, and installment loans on your report can show that you have experience successfully managing different types of debt.5 - Keep Your Revolving Accounts Open

This process is about building history, so apply for credit cards you intend to keep and be sure you understand the impact closing a credit card can have on your credit. - Apply for the Credit You Need

Apply for a loan or credit card only as needed and when you believe you have a good shot at getting approved. If you’re denied, you’ll have to apply again. Depending on the application, it may trigger a hard inquiry that may temporarily lower your credit score by a few points.6

Did you know?

Since credit utilization could make up an estimated 30% of your FICO score, it’s an important number to know. A credit utilization ratio calculator can help you understand how much available credit you’re using.

And try to avoid:

- Falling Behind

Late payments may be reported to credit reporting agencies and could adversely affect your score.7 Above all, don’t fall so far behind that your account is charged off or assigned to a collection agency. - Overcharging

The more of your total available credit you use, the more likely it could impact your score. Maxing out your card, or even getting close, can be a red flag for lenders. - Closing Accounts

Closing one account may reduce the average length of credit history of all your accounts. From a credit score perspective, it may be better to keep your account open. - Applying Indiscriminately

It’s not a good idea to apply for a bunch of credit cards just to see whether you get approved. It takes a few points off your score every time a creditor pulls your credit report for the purpose of making a lending decision.

Frequently Asked Questions

No one starts with a credit score, and you don’t get one when you turn 18. Instead, it can take about six months of having established credit before a score is generated.

Once you have an established credit score, it may change based on your credit behavior, whether positive or negative. If you’ve taken steps to improve your credit score, you may see changes in as little as a few months.

The Takeaway

While timelines vary, it may take a minimum of six months to generate your first credit score. Establishing good or excellent credit takes longer. By practicing good credit habits, you could see your score improve in time.

1 “How Do I Go About Building My Credit History?,” myFICO

2,3,6,7 “Credit Scores,” MyCreditUnion.gov

4 “Is 0% Credit Utilization Good For Credit Scores?,” Experian

5 “What Is Credit Mix?,” Experian

SHARE

Related Articles

How to Build Your Credit from Scratch - Credit Cards Can Help

So, you have no credit history? See how to build your credit from scratch and the best credit cards to build credit to help you improve your score over time.

How to Get a Perfect Credit Score

Wondering how to get a perfect credit score? It's possible, but not always feasible. See what impacts your score and what goes into a perfect credit score.

Is Zero the Lowest Credit Score Possible?

You can’t have a zero credit score but you can have no credit score. Learn why living without a credit score can make some financial goals harder to achieve.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.