Send & Split®: How It Works

4 Min Read | Last updated: September 2, 2025

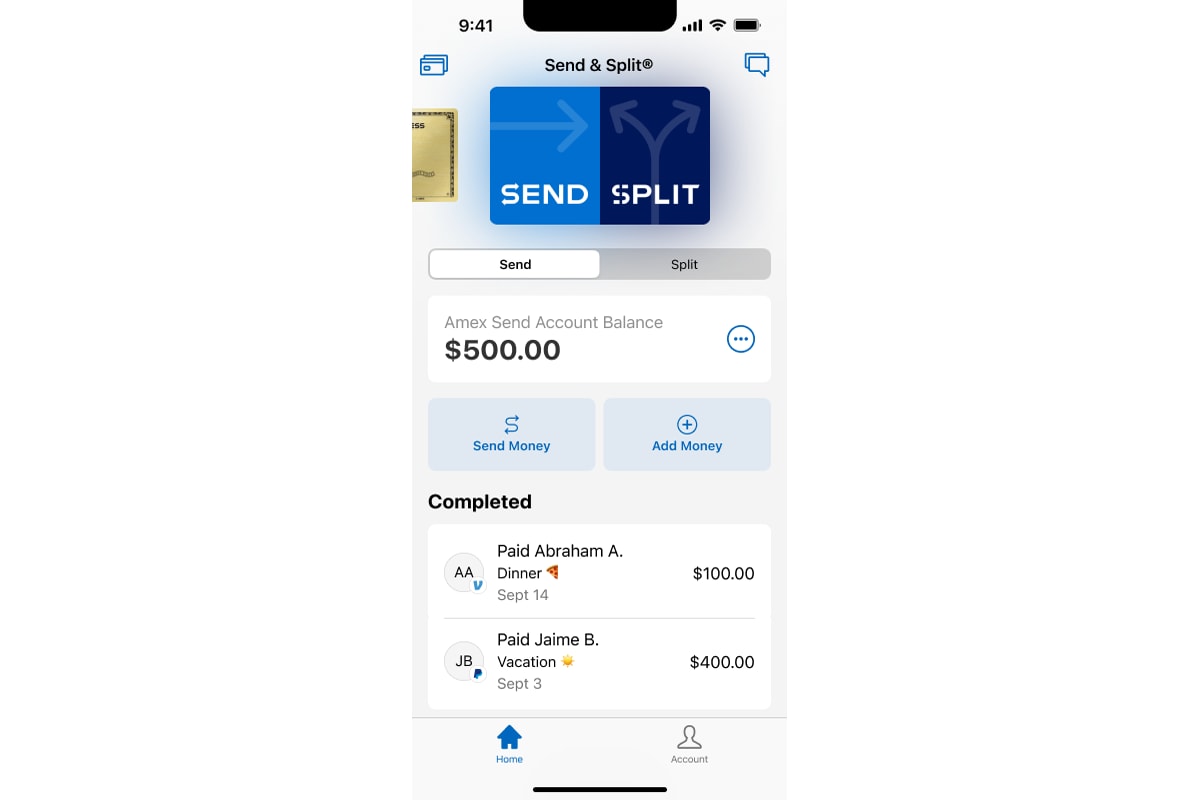

Did you know American Express Card Members can send money or split purchases with other Venmo or PayPal users right from the American Express® App? Here’s how it works.

At-A-Glance

- The Send & Split® feature offered by American Express provides a more flexible way to send money or split purchases with other Venmo or PayPal users.

- Send: When you pay friends with your Amex Send® Account, there's no standard credit card fee - and you can even do it right from the Amex® App.

- Split: You can also split purchases with other Venmo or PayPal users and get paid back directly to your Card as a statement credit. Amex will do the math, send out the requests, and keep track as you get paid back. Best part? You will be the one to earn all the rewards for the purchases you split.

If you’ve ever been the one to put your card down for a big group dinner, you understand the responsibility that comes with splitting the bill and sending out payment requests. Depending on the bill amount and the number of people you’re splitting it with, keeping track of all the payments can become a headache.

With Send & Split®, you can link your Venmo and/or PayPal accounts to send money, split purchases, and track it all – right in the Amex App.1 Here’s how it works.

Please note that enrollment is required to use Send & Split. Terms apply.

Avoid the Standard Credit Card Fee | How Send Works

Next time your friend hits you with a $500 request for that weekend rental house, you can pay them back with Amex. There are two ways to send money using your Amex Send® Account:

- Send from the Amex® App

- Send from the Venmo or PayPal App

Let’s see how each option works.

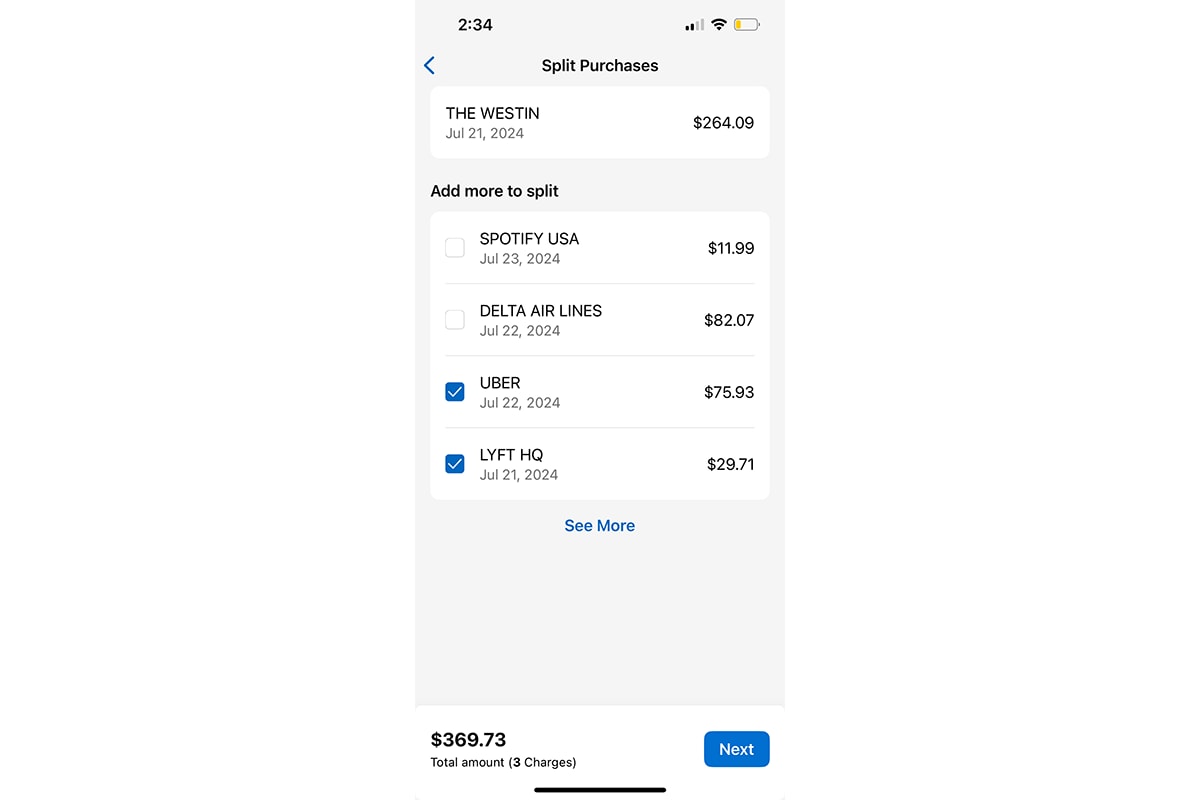

Get Paid Back Right To Your Card | How Split Works

Whether it’s a weekend getaway or a night out on the town, split any pending or posted purchase right from the Amex App when it's convenient for you. You can even choose multiple charges to split at the same time, simplifying the process for group trips and events. Plus, your friends don't even need an Amex Card.

For example:

Imagine you and your group of friends go out to dinner. The bill comes out to $200, and you put the bill on your Amex Card. You can split the bill right from the Amex App at your convenience. When your friends accept the payment request, Amex will instantly apply a statement credit to your Card. This way, you’ll only pay for your portion of the meal.

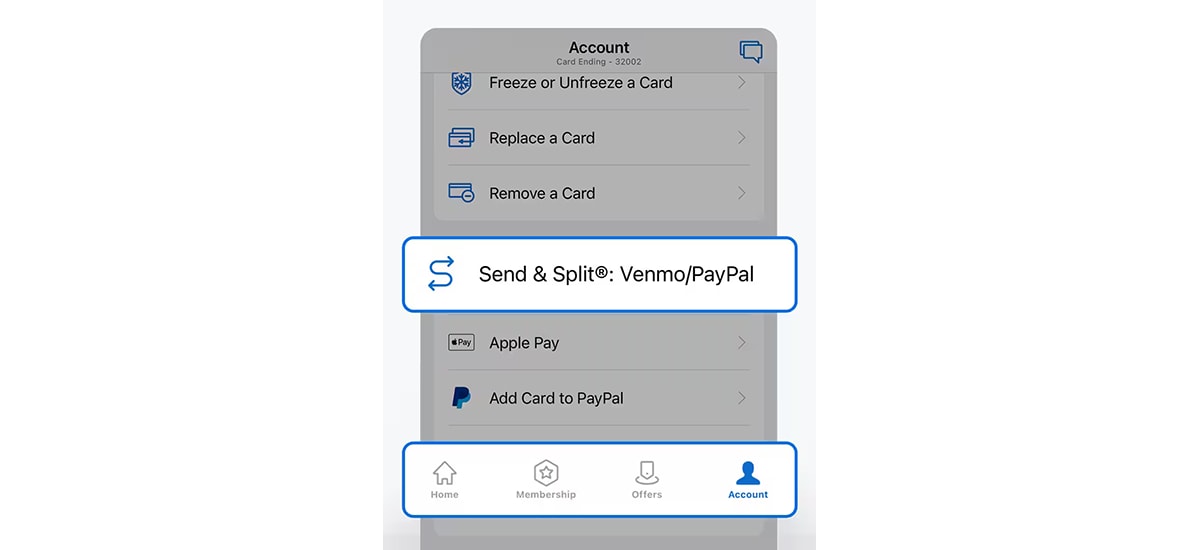

To Enroll and Get Started

- Log in to the Amex App and tap Account > Send & Split: Venmo/PayPal.

- Review the How it Works content and then tap Agree and Enroll.

- Link your Venmo and/or PayPal accounts – or create them if you don’t already have one.

To send money:

- Log in to your Amex App, tap the card icon on the top left of the Home screen, and then tap Send & Split.

- Select the contact you want to send money to, either from the contact list or by manually entering their name, email, or phone number.

- Enter the amount of money you want to send. If you don’t have enough in your Send Account balance, you’ll be prompted to instantly add money from one of your Amex Cards.

- Tap to review and complete the transaction. Once sent, the recipient will receive the money in their Venmo or PayPal account right away.

To split purchases:

- Log in to your Amex® App > tap any pending or posted purchase > Tap Split It. Select up to 20 Venmo or PayPal users to split with, either from the contact list or by manually entering in their name, email, or phone number.

- Amex will divide up the purchase evenly, but you can always change each person’s share and Amex will automatically adjust the rest.

- When your friends accept the payment request, Amex will instantly apply a statement credit to your Card. You can also get paid back on your linked Venmo or PayPal account, depending on which option you choose.

Tip:

You can keep track of your split purchases, outstanding requests, and any money you’ve received within the Amex App. Tap the card icon on the top left of the Amex App home screen, tap Send & Split®, then select the Split tab.

Frequently Asked Questions

No, Amex does not share your Card Account number with Venmo or PayPal when you link, send money, or split purchases.

No, you can send money to and split purchases with any Venmo or PayPal user(s). They do not have to be an Amex Card Member.

If you send money to a phone number or email address that is associated with a Venmo or PayPal account (the Send transaction appears in the Complete section within the Send tab of the Amex App), the money is made available to the recipient right away and you will not be able to cancel the transaction. Please see Venmo’s or PayPal’s Help Center for more information and contact Venmo or PayPal immediately to ask for assistance. As a reminder, you should only send to friends and family that you know and trust.

The Takeaway

Send & Split enhances the way you pay and get paid back with other Venmo and PayPal users, all within the Amex App. This feature makes it easy to settle up with friends and family for meals, trips, or whatever the shared expense may be.

1 Send & Split® is only available in the American Express® App (“Amex App”) to Card Members with an eligible Card. Eligible Cards are US-issued Basic Consumer Cards that are issued by American Express National Bank and are not cancelled. Prepaid Cards, American Express Corporate Cards, American Express Small Business Cards, American Express-branded cards or account numbers issued by other financial institutions and American Express Cards issued outside of the United States are not eligible Cards. To use Send & Split, you must first have an email address on file, enroll in Send & Split® in your American Express Online Account (“Online Account”) and open an Amex Send® stored balance account (“Send Account”). You must have or create an account with Venmo or PayPal and link your Online Account to your PayPal or Venmo account to use Send & Split. You must add money to your Send Account from your eligible Card(s) to use Send & Split to send a Venmo or PayPal recipient. The charge on your Card for an Add Money transaction does not earn rewards and is subject to the Card’s purchase APR. There is no fee to send funds to US recipients. PayPal charges a fee to send funds to non-US recipients. For complete details visit americanexpress.com/sendandsplitterms to view Terms & Conditions. Send Account issued by American Express National Bank, Member FDIC.

SHARE

Related Articles

Credit Card Benefits: Get the Most Out of Them

Understanding how to use your credit card benefits is a part of maintaining healthy finances and helping you achieve your financial goals.

How to Use Credit Cards

See tips on how to use credit cards responsibly for money management, to build healthy credit habits, and as a simple way to enhance your lifestyle.

What is a Contactless Credit Card?

It looks like a sideways Wi-Fi icon, but what is the contactless symbol on a card, and what makes contactless credit cards so secure? Find out today.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.