5 Min Read | Updated: February 16, 2024

Originally Published: May 11, 2020

What is Zero-Based Budgeting?

In a zero-based budget, you assign a “job” to every dollar you earn, every month—whether you’re spending or saving that dollar.

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

At-A-Glance

A zero-based budget puts you in charge of assigning every dollar of every month’s income a specific job—no dollar goes unaccounted.

The goal is that at the end of each month your income minus all your spending and saving equals zero. (No more, no less.)

Constant monitoring is required. The payoff for that effort is it lets you take real control of your money.

Many consider budgeting the personal finance equivalent of eating your least favorite vegetable: Definitely good for you, but not something you look forward to. But that perspective can be limiting. Following a spending and saving plan—such as the zero-based budgeting system—can be your ticket to making real progress toward reaching your financial goals. Now that sounds appetizing!

How Does Zero-Based Budgeting Work?

The core principle of a zero-based budget is that at the start of every month you assign every dollar of income you will collect for that month a specific job.1 No dollar goes unused, or unaccounted for.1 The goal is that each month the income you bring in, minus the expenses you pay during the month, will net out to … wait for it … zero. You don’t spend/save a dollar more of that month’s income (or a dollar less) than what gets you to zero at the end of each month. Note, with zero-based budgeting, money you save is considered an expense: You assign those dollars to be “spent” on helping you reach your savings goals.2

The Advantage of Zero-Based Budgeting

One of the core features of a zero-based budget, which is sometimes called a zero-sum budget, is the personal accountability it calls for. To make sure you hit your zero target, you’ll need to assign every dollar at the top of each month.1 Then you need to monitor your spending throughout the month, and make necessary tweaks, so you hit your zero target at month’s end. Each month you rinse and repeat this process.

Sound a bit intense? Well, it’s true that this budget requires some elbow grease, but that’s the point. The frequent monitoring embedded in the system serves as guardrails that keep you moving toward your goals rather than crashing into the land of unmet good intentions.

The mechanics of how you create and track your zero-based budget are up to you. Prefer old-school penciling it out paper? Go right ahead. Or you can build your own spreadsheet if that’s how you roll. For app lovers, there may be many choices to fit your style and needs.

Steps for Creating and Following a Zero-Based Budget

Step 1: Add up your monthly revenue.3 In addition to your monthly gross income, be sure to add in any one-offs of extra income that you expect in a given month. Perhaps it’s a tax refund in April or May, or a performance bonus that gets paid out 4x a year, that extra income from a side gig, or the sweet birthday check your grandparents send.

Step 2: List your monthly expenses.3 Time for a deep breath. Slow down and make sure you do a thorough job accounting for all your expenses. This is where the reality behind the old saying, “garbage in, garbage out,” can undermine your good intentions. To make sure you capture everything, consider pulling up a few months of credit card and bank statements and creating line-items in your budget for every type of expense you run into.4 For more on building a budget, read “How to Make a Monthly Budget, One Step at a Time.” Meanwhile, here are examples of common/frequent expense line items to consider for your zero-based budget:

- Housing (rent, mortgage)

- Utilities (including internet and cell phone plan)

- Transportation (gas, public transport, ride sharing)

- Food (groceries, dining/drinking out)

- Health insurance premium and copays

- Clothing

- Debt payments (student loans, car loan, credit cards, personal loan)

- Childcare (if paid as a regular monthly expense)

- Savings and investments (emergency fund, retirement, home down payment, college, etc.)

- Entertainment (streaming, cable, movies, theater, concerts)

- Miscellaneous

Some expenses don’t hit every month, such as vacation spending, or the bi-annual auto insurance premium payment. Or your kid’s travel-team fees that you cough up at the start of a new season. You still have to account for them in your zero-based budget. For example, let’s say your auto insurance premium is $800 a year, and you make a $400 payment twice a year. One option is that in the two months you owe the $400 you will assign $400 of income in each of those months to cover the payment.

Nothing wrong with that, but if making a big payment in a given month is the sort of thing that gives you financial night terrors, a zero-based budget gives you an elegant workaround. You could instead assign one-twelfth of $800 ($66.67) each month to cover your car insurance costs. In months you aren’t actually making the payment, you can tuck that money into a savings account. Then every six months you know you will have the money waiting for you. Here are some examples of infrequent expenses you may want to account for in your zero-based budget with one of these approaches:

- Insurance premiums (auto, life, homeowners/renters)

- Property tax (for homeowners)

- Vacation

- Childcare (school tuition, tutors, after-school programs, sports/traveling team fees/equipment/training, summer camp)

- Gifts

- Charitable donations

- Miscellaneous

Step 3: Subtract your monthly expenses from your income.2 This is where zero-based budgeting begins to work its magic. You are the manager of a team of dollars. You decide what dollars go where. If you’re not yet set up to land at zero at month’s end, you are in charge of making the changes to get you there.2 What expenses might you trim or eliminate? Or maybe a solution could be to pick up some gig work to bring in more income.

Step 4: Track your spending during the month. Once you have your monthly assignments in place, it can be helpful to check in once a week (or more frequently) to make sure you’re still on target to land at zero.5 A quick scan of your online bank and credit card accounts will give you a real-time reality check. For example, if you gave yourself $200 this month for drinking and dining out (ahem: that includes any coffee fix) and you’ve already used up $100 in the first week, you may need to course-correct to not overshoot by the end of the month.

Step 5: Enjoy the Process. Yep, enjoy. It may take a few months to get the hang of zero-based budgeting. In the beginning, there might be a fair amount of tweaking you need to do during the month to keep you on track for reaching zero. Or you might not hit your target. That’s okay. This is a learning process. The great feature of a zero-based budget is that every month is a fresh start, where you can take what you learned last month and apply it to your spending assignments for this month.

The Takeaway

In zero-based budgeting, you assign a specific “job” to every dollar you make, and monitor their progress throughout the month.1 It can be a lot of work, but it can help you take control of your finances, month by month.

1 “Top 4 Budgeting Methods to Try,” YLAI

2 “How Does Zero-Based Budgeting Work?,” Experian

3 “How to Find the Best Budget for Your Spending Personality,” Experian

4 “Making a Budget,” Consumer.gov

5 “Budgeting: How to create a budget and stick with it,” Consumer Financial Protection Bureau

Carla Fried is a freelance journalist who has spent her entire career specializing in personal finance. Her work has appeared in The New York Times, Money, CNBC.com, and Consumer Reports, among many other media outlets.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

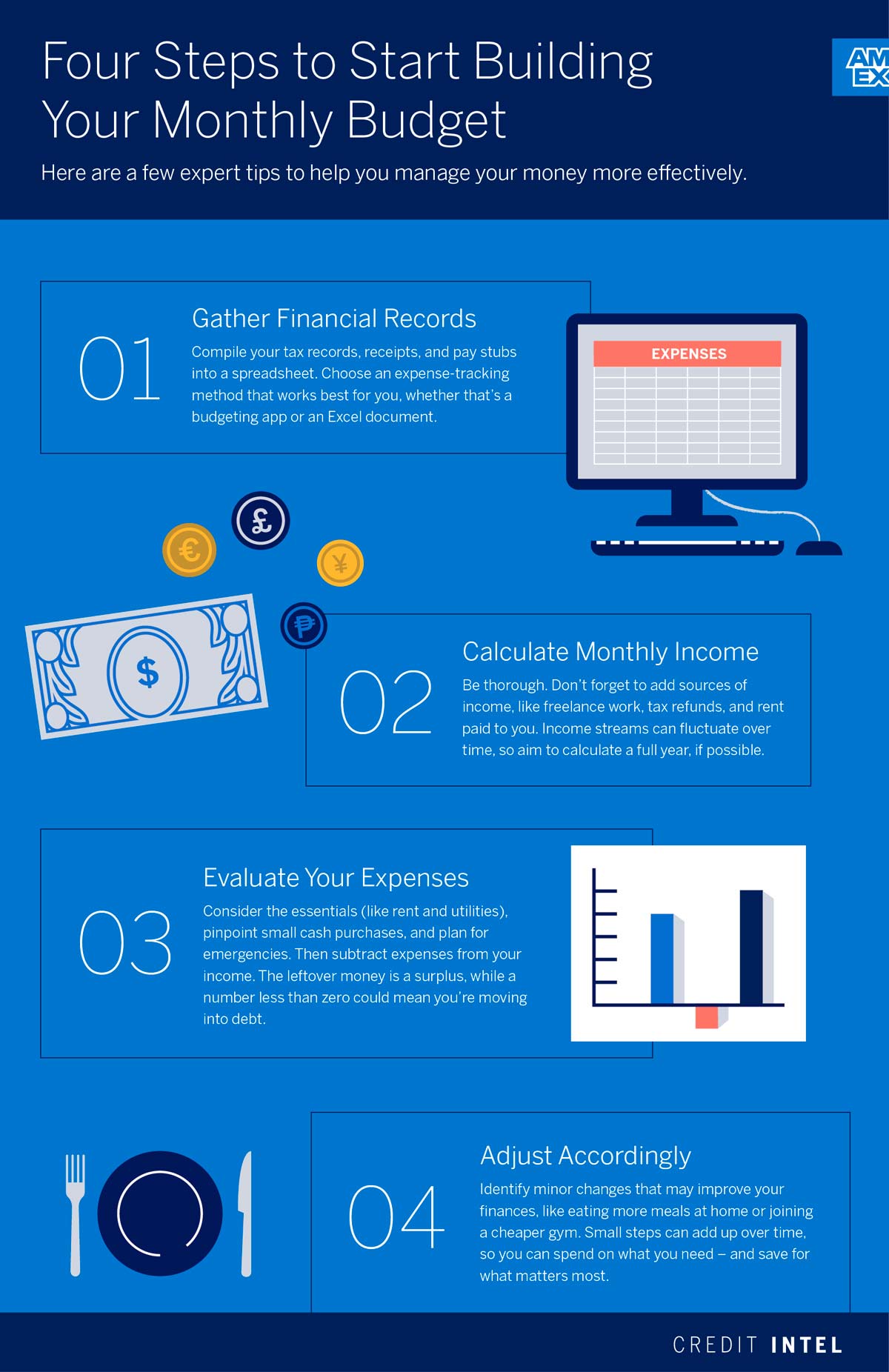

How to Make a Monthly Budget in 4 Steps

Take control of your personal finances: Here are some expert budget-building tips and a 4-step guide to help you achieve your budgeting goals.

A guide for how to get out of debt this year, whether it’s from a student loan, auto loan, credit card spending – or all of the above.

What, Exactly, is “Personal Finance”?

Understand what personal finance is, why it is important and how you too can do personal finance to help you manage your money.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.