Credit Card Fraud: How to Prevent It

Have you ever seen an unfamiliar charge on your credit card statement? If you didn’t authorize it, you may have been a victim of credit card fraud. Credit card fraud can happen in a few different ways. If your physical card has been lost or stolen, a criminal could use it to buy goods or services. If your credit card number, PIN and security code have been stolen, this information could be used to buy things online. It could even be used to make a new physical card.

There are measures in place to protect you, whether you are a victim of credit card fraud already or simply want to prevent it.

November 26, 2020 in Learn

How does credit card fraud happen?

There are a few different ways a credit card or the information on it can be stolen. One way is through a scam called phishing. That’s when a fraudster contacts you pretending to be someone else from your bank or another trusted institution. They may reach out to you through email, text message, or a phone call. They could also send you a link to a fake website pretending to be a real business. The scammers may then convince you they need your credit card information to solve a problem or pay a debt. They may also trick you into thinking you are paying your bill on a legitimate website. Instead, they are stealing your credit card information.

Another way credit card fraud can happen is through skimmers. These are devices that criminals install on payment terminals. When you swipe your card, the skimmer copies all the information stored on the magnetic stripe. This is enough to make a duplicate card.

Other ways fraud can happen is if your physical card is lost or stolen, it could be used by someone else to make purchases or withdraw funds until you find out and report it.

How to identify credit card fraud

Being observant can help you spot and report credit card fraud right away. This means regularly monitoring your bank accounts for any suspicious activity and making sure the transactions match with your receipts. Review both your billing statements and your credit reports to ensure there are no errors.

You can request a copy of your credit report from Equifax and TransUnion.

You can also set up Account Alerts to be updated with key information related to your American Express® account.

6 main types of credit card fraud

Here are the 6 main types of credit card fraud you should watch out for.

1. Lost and stolen credit card fraud

If you accidentally lose or misplace your card, someone else could find it and try to use it. They might charge it online or at a physical store.

2. Card not present fraud

This type of fraud doesn’t require a physical card. A criminal could use just your credit card number and name to purchase goods and services. This could take place online or through the mail. The CVV code on your card can prevent this type of theft.

3. Counterfeit credit card fraud

By stealing your credit card details through its magnetic stripe, criminals can create a new fake card. This is typically done with the use of skimmers. This can also be prevented by the presence of a CVV number.

4. Account takeover fraud

If a criminal has enough personal information, they can contact your bank or credit card company while pretending to be you. They could change some of the details on your account, such as your address, and report your previous card as stolen. They could then ask for a new credit card to be sent to a different address.

5. Fraudulent Application

If a fraudster has details such as your name, date of birth, and Social Insurance Number (SIN), they could apply for new credit in your name.

6. Intercepting mailed card fraud

A new or replacement card could be stolen right out of your mailbox before you even realize it

How to protect yourself from credit card fraud

By taking some simple steps, you can protect yourself from credit card fraud. Here are several ways to stay proactive and keep your information safe.

Keep the card or wallet secure from threat

Keep your credit cards in a safe place to protect them from theft. Write a list of all your credit cards and numbers to call if they get lost or stolen. Keep it handy and leave it at home.

Limit the number of credit cards you carry

You can carry only the cards you know you will need when you go out. If you do this and you lose your bag or your wallet gets stolen, you will only have to cancel the credit cards that were in there.

Use only trusted websites when sharing credit card information

Websites that start with “https” are more safe for inputting your personal information.

Update computer firewall and anti-virus software regularly

Make sure you have the latest versions installed of your anti-spyware, anti-virus, and computer spyware. This will help keep you safe from hackers and any breach of personal data on your devices.

Avoid giving out credit card information over the phone in public places

Avoid sharing your credit card details around other people who may overhear you, including any public places.

Hide your PIN from others

Never share your PIN with anyone. When entering your PIN, cover the keypad with your hand or body so that no one else can see.

What to do if your credit card has been used fraudulently

If you’ve lost your card or suspect it may have been used for fraud, contact your credit card company immediately. You should cancel your card and request a new one. If it is an American Express Card, call 1-800-869-3016 or the number on the back of your card. Outside of Canada (please call collect) 905-474-0870. For Corporate Cardmembers, please call 1-800-716-6661.

Here are some other tips to consider to keep you safe:

● Change all your PIN numbers and online passwords

● Call your card issuers to stop payment on any fraudulent transactions

● Get in touch with other accounts that may have been tampered with, such as your phone company

● Check your bank statements and credit reports for signs of fraud

● File a complaint with your local police

● Keep any helpful documents for future reference, such as receipts

● Review your previous transactions, when you shared your credit card information and with whom

How American Express helps in fraud protection

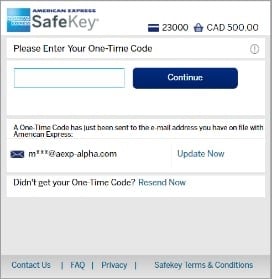

American Express has several security systems in place to help to protect you against fraud. As a Cardmember, you are automatically enrolled in American Express SafeKey® . Look for the SafeKey box when shopping online:

It’s an extra layer of authentication to ensure you are the rightful owner of your card.

Explore Our Cards

American Express Offers a range of Cards with different rewards and benefits tailored to your lifestyle and interests.