The American Express® Corporate Program

ideal for Manufacturing Operations

Explore our full suite of Corporate Products and digital tools to help meet your production needs – plus

earn the rewards of your Card‡ and to help manage cash flow for your factories.

Call 844-275-6145 to speak to a specialist

Help save time

by reducing manual

payment process

Explore a full suite of customizable digital tools that can help increase operational efficiency.

Gain a more complete picture of your business expenses with robust reporting to help facilitate reconciliation. Enrollment required and fees may apply.‡

Help reward and incentivize employees with Membership Rewards® points‡ on their Card spending, which they can redeem for travel, gift cards, and more. Terms apply.

Help reinvest in your business with Corporate Membership Rewards® points‡ that you can reedem for business travel, office supplies, utility costs, and more. Terms apply.

Take advantage of our dedicated Corporate Program Specialists as your consultative partner – to help you explore perks for your businesses.

Customizable

rewards

and benefits

Apply for any combination of Corporate Cards to

help meet your unique business needs

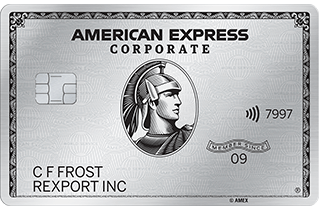

Annual Fee: $550

For senior executives and seasoned travelers who want premium business travel benefits

- $209 CLEAR+ Credit‡. Up to $209 back per calendar year after you charge your CLEAR+ Membership to your eligible Corporate Platinum Card.‡ Terms apply.

- Earn 5% Uber Cash on eligible rides with Uber and orders with Uber Eats. Enrollment required. Terms apply‡.

- American Express Global Lounge Collection®‡ Eligible Card Members only. Terms apply. Learn More.

- $200 Airline Fee Credit‡: Up to $200 each year in credits for baggage fees and more charged by one selected, qualifying airline. Terms apply.

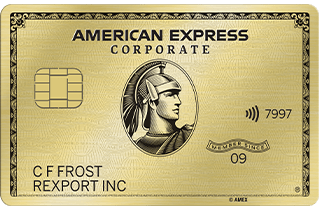

Annual Fee: $250

Benefits and features to help frequent business travelers take productivity on the road

- Earn 5% Uber Cash on eligible rides with Uber and orders with Uber Eats. Enrollment required. Terms apply‡.

- $100 Airline Fee Credit‡: Up to $100 a year in credits for baggage fees and more at one selected, qualifying airline. Terms apply.

- Hilton HonorsTM Silver Status‡. Enrollment required. Terms apply.

- Fee Credit for Global Entry or TSA PreCheck®. Receive a fee credit in the form of a statement credit for TSA PreCheck® or Global Entry (if approved, you will recieve access to TSA PreCheck® at no additional charge)‡. Terms apply.

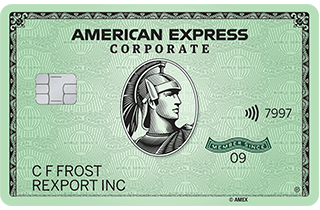

Annual Fee: $75

Best for core employees and occasional travelers

- Earn 3% Uber Cash on eligible rides with Uber and orders with Uber Eats. Enrollment required. Terms apply‡.

- Hilton HonorsTM Silver Status‡. Enrollment required. Terms apply.

- Global Assist® Hotline‡. Terms apply.

- 24/7 Customer Service

Build a program that works

as hard as you do

Customize your Corporate Program to your manufacturing management needs with

help of our industry experts – create a personalized program with Corporate Cards

and payment solutions to help maximize rewards.‡

Call our Corporate Program

specialists at 844-275-6145.

Answer a few simple questions

to see if you qualify.

If you qualify, work with us to

create a customized program.

Call 844-275-6145 to speak to a specialist

Digital tools to help keep your

lead times on track

Offers Carousel

-

Simplify Program Management with American Express @ Work®‡

-

Help Streamline Your Company’s Payment Processes with American Express vPayment™‡

-

Streamline Supplier Payments with American Express One AP®‡

Corporate Benefits designed

to help you build more

Buying Power

You can take advantage of unsecured credit that can help finance new technology and manufacturing equipment to help support and increase your operational efficiency.

Employee Rewards

Customize your rewards program to help incentivize your talent and motivate your reps. Select Cards can use Membership Rewards® points‡ that can be redeemed for gift cards, travel, and more. Terms apply.

Travel Perks

Learn how you can help your employees with a faster, easier way through airport security. With CLEAR+‡ the paid airport Membership, travelers can get to their gate faster at 55+ airports nationwide. Employees who enroll and charge an auto-renewing CLEAR+ Membership to their American Express Corporate Platinum Card® will receive up to $209 per year in statement credits. Terms apply.

Online Account Access

American Express provides 24/7 online access to Corporate Card account information‡. Card Members can view statements, pay bills, submit expense reports, set up and receive account alerts via email or text message* and dispute charges‡. Card Member enrollment required at americanexpress.com/register.

*Message and data rates may apply

The assistance you need – with the service you

deserve.

Card Account Management

With American Express @ Work®‡, Program Administrators can easily complete actions by leveraging an intuitive user interface with simple navigation and search, informational alerts, and status tracking. Enrollment required and terms apply.

Need a Hand?

Whenever you travel more than 100 miles from home, Global Assist® Hotline‡ is available for 24/7 emergency assistance and coordination services, including medical and legal referrals, emergency cash wires, and missing luggage assistance. Card Members are responsible for the costs charged by third-party service providers. Other terms and conditions apply.

Baggage Insurance Plan♦︎

Can provide coverage for lost, damaged or stolen Baggage when traveling on a Common Carrier Vehicle (e.g. plane, train, ship or bus) when the Entire Fare has been charged to your Eligible Card. Coverage limits apply. Please read important exclusions and restrictions.

A closer look at everything you can get.

Choose the Card that best meets your needs.

- Corporate Platinum: Access to premium perks and business tools for founders and CEOs

- Corporate Gold: Elevated travel experiences for employees who spend a lot of time on the road

- Corporate Green: Comprehensive benefits and rewards for employees who make company purchases

- Reconcile Employee Spending with Emburse‡. Enrollment required and fees apply. Terms apply.

- Streamlined expense reports with American Express® App‡. Terms apply.

- Save time and increase efficiency by automating supplier payments with American Express One AP®‡. Enrollment required and fees may apply (including an auto-renewing monthly platform access fee). Suppliers must be enrolled and located in the United States. Please contact your American Express® Specialist to learn more.

Choose the rewards program that works best for your company:

- Corporate Membership Rewards® Program: Consolidate points from multiple enrolled Corporate Cards and use them to help do more for your business‡. Terms apply.

- Membership Rewards® Program: Reward employees by allowing them to receive and redeem points individually on their enrolled American Express® Corporate Card‡. Terms apply.

- Employees get 24/7 access to exceptional Customer Service

- Global Assist® Hotline‡ for coordination and assistance when traveling more than 100 miles from home. Global Assist® Hotline does not perform the services but instead assists with coordinating the services. Card Members are responsible for the costs charged by third party service providers. Terms apply.

- Call us at 844-275-6145 to discuss implementing the American Express® Corporate Program for your business.

Call 844-275-6145 to speak to a specialist

Learn more about our

Corporate Program

Corporate Membership Rewards® Program

Enrollment in the Corporate Membership Rewards® program is required. Only the American Express® Corporate Green Card, American Express® Corporate Gold Card, and American Express Corporate Platinum Card® are eligible to enroll in the Corporate Membership Rewards® program. The Program Administrator is charged a $90 annual enrollment fee for each enrolled Corporate Green Card. A program fee is not applied for the Corporate Gold Card and Corporate Platinum Card®. Get one Corporate Membership Rewards® point for every dollar of eligible purchases charged on enrolled American Express® Corporate Cards. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. If the Corporate Card Member is transferring from an existing Membership Rewards® program to the Corporate Membership Rewards® program, the Card Member will have 30 days to use any existing Membership Rewards® points before they are forfeited.

The redemption value of Corporate Membership Rewards® points varies according to how you choose to use them.

For the full terms and conditions for the Corporate Membership Rewards® program, please visit americanexpress.com/corporatemrterms for more information. Participating Corporate Membership Rewards® partners, available rewards, and point levels are subject to change without notice.

Individual Membership Rewards® Program

Enrollment in the Membership Rewards® program is required. The American Express® Corporate Green Card and the Global Dollar Card – American Express® Corporate Green Card is charged a $55 annual enrollment fee. A program fee is not applied for the American Express® Corporate Gold Card, American Express Corporate Platinum Card®, Global Dollar Card – American Express Corporate Platinum Card®, and Global Dollar Card – American Express® Corporate Executive Gold Card. Some Corporate Cards are not eligible for enrollment. For a full list of eligible Corporate Cards, please see the full Membership Rewards Terms and Conditions. Card Member eligibility for enrollment is based upon the company’s participation in the Membership Rewards program. Employees with Corporate Green Cards selected to earn individual Membership Rewards® points must call the number on the back of their Card to complete enrollment. Enrolled Corporate Card Members get one Membership Rewards point for every dollar of eligible purchases charged on enrolled Corporate Green Cards, Corporate Gold Cards, and Corporate Platinum Cards®. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

The Global Lounge Collection

The American Express Global Lounge Collection®

U.S. Corporate Platinum Card Members are eligible for access to the participating lounges in the American Express Global Lounge Collection. All lounge access is subject to space availability. Each lounge program within the Global Lounge Collection has its own policies and access to any of the participating lounges is subject to the applicable rules and policies. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. To be eligible for this benefit, Card Account must not be cancelled. Please refer to each program’s terms and conditions to learn more.

The Centurion® Lounge

U.S. Corporate Platinum Card Members have unlimited complimentary access to all locations of The Centurion® Lounge. Card Members may bring up to two (2) complimentary guests into The Centurion® Lounge locations in the U.S. and select international locations (as set forth on the Centurion Lounge Website). Guest access policies (including, but not limited to, guest fees and number of complimentary guests per visit) applicable to international locations of The Centurion® Lounge may vary by location and are subject to change. Effective July 8, 2026, all guests must be traveling on the same flight as the Card Member. Please visit thecenturionlounge.com (the “Centurion Lounge Website”) to learn more about guest access policies for international locations of The Centurion® Lounge. Refer to the specific location’s access policy for more information. All access to The Centurion® Lounge is subject to space availability. To access The Centurion® Lounge, the Card Member must arrive within 3 hours of their departing flight and present The Centurion® Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier, and a government-issued I.D. Effective July 8, 2026, during a layover, Card Members must arrive within 5 hours of the connecting flight. Same-day round-trip itineraries are not considered connecting flights. Name on boarding pass must match name on the Card. Failure to present this documentation may result in access being denied. A Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Centurion® Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. Soliciting other Card Members for access into our Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion® Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates, or policies. In addition to the complimentary services and amenities in the Lounge, products or amenities may be offered for sale, and you are responsible for any purchases of such services, products, or amenities. Services provided by Member Services Desk are based on the type of American Express Card used to enter the Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by the purchaser or visitor inside The Centurion® Lounge. If we, in our sole discretion, determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion® Lounge from the Account. Use of The Centurion® Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

Sidecar by The Centurion® Lounge

U.S. American Express Corporate Platinum Card® Members have complimentary access to Sidecar by The Centurion® Lounge. Please visit thecenturionlounge.com for more information on Sidecar by The Centurion® Lounge availability. Card Members may bring up to two (2) complimentary guests into Sidecar by The Centurion® Lounge locations in the U.S. Effective July 8, 2026, all guests must be traveling on the same flight as the Card Member. All access to Sidecar by The Centurion® Lounge is subject to space availability. To access Sidecar by The Centurion® Lounge, the Card Member must arrive within 90 minutes of their departing flight (including layovers) and present the Sidecar by The Centurion® Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier, and a government-issued I.D. Name on boarding pass must match name on the Card. Failure to present this documentation may result in access being denied. A Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Sidecar by The Centurion® Lounge visitors must be of legal drinking age in the jurisdiction where Sidecar by The Centurion® Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from Sidecar by The Centurion® Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. Soliciting other Card Members for access into Sidecar by The Centurion® Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among Sidecar by The Centurion® Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates, or policies. In addition to the complimentary services and amenities in Sidecar by The Centurion® Lounge, certain services, products, or amenities may be offered for sale, and you are responsible for any purchases of such services, products, or amenities. Services provided by Member Services Desk are based on the type of American Express Card used to enter Sidecar by The Centurion® Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by the purchaser or visitor inside Sidecar by The Centurion® Lounge. If we, in our sole discretion, determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion® Lounge and to Sidecar by The Centurion® Lounge from the Account. Use of Sidecar by The Centurion® Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

Escape Lounge

This benefit is available to U.S. Corporate Platinum Members. Card Members receive complimentary access to all Escape Lounge, including Escape Lounge - the Centurion Studio® Partner locations. To access an Escape Lounge, Card Members must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Name on boarding pass must match name on the Card and the eligible flight must be booked on a U.S. issued American Express Card. For access at select locations, Card Members must arrive within 3 hours of their departing flight. Refer to the specific location’s access policy for more information. During a layover Card Members may use the Escape Lounge in the connecting airport at any time. For more information on access policies and lounge terms and conditions, see https://escapelounges.com. All access to an Escape Lounge is subject to space availability. Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Escape Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. Card Members may bring up to two complimentary guests per visit. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all the complimentary benefits and amenities afforded to the Escape Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change without notice. Additional restrictions may apply.

Delta Sky Club

This benefit is available to U.S. Corporate Platinum Card Members for access to Delta Sky Club or to the Delta Sky Club Grab and Go feature (“Grab and Go”). Corporate Platinum Card Members must present their valid American Express Card, government-issued I.D., and boarding pass to the Delta Sky Club ambassador. Boarding pass must show a reservation for a same-day Delta-operated flight (Delta or Delta connection) or Delta-marketed flight operated by WestJet (ticket number starting with 006) departing from or arriving at the airport in which a Delta Sky Club or Grab and Go is located. Corporate Platinum Card Members traveling with Delta Main Basic (Basic Economy) fare tickets do not have access to this benefit. Name on boarding pass must match name on the Card. Corporate Platinum Card Members on departing flights can only access Delta Sky Club or “Grab and Go” within 3 hours of their flight's scheduled departure time or any time during a layover. Delta reserves the right to limit access for non-revenue flyers at any Delta Sky Club. Individuals must be at least 18 years of age to access Delta Sky Club, and 21 years of age to access locations with a self-service bar, unless accompanied by a responsible, supervising adult who has access to Delta Sky Club. Benefit valid only at Delta Sky Club or Grab and Go. Delta partner lounges are not included. Note that amenities may vary among Delta Sky Club locations. Participating airport clubs and locations subject to change without notice. Corporate Platinum Card Members may bring guests into Delta Sky Club subject to the most current Delta Sky Club access and pricing policies, and must use their valid Card as the payment method for guest access. Guests also must be flying on a same-day Delta-operated flight or Delta-marketed flight operated by WestJet (ticket number starting with 006) and be accompanied by the Corporate Platinum Card Member. Guest access and fees subject to terms and conditions of participating airport clubs. Access is subject to Delta Sky Club rules. To review the rules, please visit delta.com/skyclub. Benefit and rules subject to change without notice. Additional restrictions may apply.

Lufthansa

This benefit is available to U.S. Corporate Platinum Card Members. Platinum Card Members have complimentary access to select Lufthansa Business Lounges (regardless of ticket class) and Lufthansa Senator Lounges (when flying business class) when flying on a Lufthansa Group flight. To access the Lufthansa lounges, Platinum Card Member must present their government issued I.D., a same-day departure boarding pass showing a confirmed reservation on a Lufthansa Group flight (Lufthansa, SWISS and Austrian airlines) and a valid Platinum Card. Card Members must adhere to all rules of participating lounges. Participating lounges and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating lounges. In some Lounges the Platinum Card Member must be at least 18 years of age to enter without a parent or guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. For the most current list of Lufthansa lounges, guest access requirements, rules, and pricing policy, please visit https://www.lufthansa.com/de/en/lounges.

Plaza Premium Lounges

This benefit is available to U.S. Corporate Platinum Card Members. Card Members receive complimentary access to any global location of Plaza Premium Lounges. Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Card Members may bring up to two (2) guests into Plaza Premium Lounges as complimentary guests. Must be of legal drinking age to consume alcohol. Please drink responsibly. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Plaza Premium Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Plaza Premium Lounge locations are subject to change.

Priority Pass™ Select

This benefit is available to U.S. Corporate Platinum Card Members. Corporate Platinum Card Members must enroll in the Priority Pass™ Select program through the benefits section of their americanexpress.com account or by calling the numberon the back of their Card to receive the benefit. Priority Pass is an independent airport lounge access program. You acknowledge and agree that American Express will verify your Card Account number and provide updated Card Account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass Select program and may usethis information for marketing related to the program. Once enrolled, Corporate Platinum Card Members with a valid Card Account may access participating Priority Pass Select lounges by presenting their Priority Pass Select card and airline boarding pass. If the Card Account is cancelled, you will not be eligible for Priority Pass Select and your enrollment will be cancelled. When visiting a Priority Pass Select lounge that admits guests, Corporate Platinum Card Members receive complimentary access for up to two accompanying guests. After two guests, the Card Account on file with Priority Pass Select will be automatically charged the guest visit fee of the Priority Pass Standard program for each additional guest after you have signed up for the additional guest visit and it has been reported to Priority Pass by the participating lounge. Some lounges limit the number of guests or do not admit guests. In some lounges, Priority Pass Select members must be 21 years of age to enter without a parent or guardian. Priority Pass Select members must adhere to all house rules of participating lounges and access to participating lounges is subject to all rules, terms and conditions of the applicable lounge. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for anominal fee. Priority Pass Select lounge partners and locations are subject to change. All Priority Pass Select members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com. Upon receipt of your enrollment information, Priority Pass will send your Priority Pass Select card and membership package which you should receive within 10–14 business days. If you have not received the Priority Pass card after 14 days, please contact American Express using the number on the back of your AmericanExpress® Card. To receive immediate access to lounges after your enrollment in Priority Pass Select has been processed, you can activate your membership online by using your Priority Pass Select membership details to receive a Digital Membership Card. For a step-by-step guide on the activation process, visit prioritypass.com/activation.

Additional Global Lounge Collection Partner Lounges:

American Express offers access to additional lounges in the Global Lounge Collection where U.S. Platinum Card Members have unlimited complimentary access to participating locations. Card Members must present their valid Platinum Card, a government-issued I.D., and a boarding pass showing a confirmed reservation for same-day travel on any carrier. Guest access and associated fees are subject to the terms and conditions of the participating lounge provider. Participation, locations, rates, and policies of lounges are subject to change without notice, and Card Members and their guests will not be compensated for such changes. Amenities, services, and hours may vary by participating lounge and are subject to change without notice. American Express and the participating lounge will not be liable for any articles lost or stolen, or damages suffered by the Card Member or guests inside the participating lounge. For participating lounges with a self-service bar, the Card Member may be required to be of legal drinking age in the jurisdiction where the participating lounge is located to enter without a parent or legal guardian. All Card Members and their guests must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. Each participating lounge may have their own policy allowing for children under a certain age to enter for free with the Card Member who is a parent or legal guardian. Card Member must adhere to all house rules of participating lounges. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. If American Express, in its sole discretion, determines that the Card Member or their guests have engaged in abuse, misuse, or gaming in connection with access to participating lounges in any way, or that the Card Member or their guests intend to do so, American Express may take away the access benefit from the Account. American Express and the participating lounge reserve the right to revise the rules at any time without notice. For the most currentlist of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit www.americanexpress.com/findalounge.

$209 CLEAR® Plus Credit

The benefit is available to Corporate Platinum Card Members. Card Members are eligible to receive up to $209 in statement credits per calendar year for CLEAR+ Membership when charged to an eligible Card. Enrollment in CLEAR+ is required and is subject to CLEAR’s terms and conditions. American Express has no control over the application and/or approval process for CLEAR, and does not have access to any information provided to CLEAR by the Card Member orby CLEAR to the Card Member. American Express has no liability regarding the CLEAR program. If a Card Member's application is not approved by CLEAR, CLEAR will refund the charges. If the statement credit benefit has been applied before CLEAR refunds the charges, that statement credit will be reversed. Statement credit(s) may not be received or may be reversed if the qualifying purchase is returned, refunded, canceled, or modified. For additional information on the CLEAR+ program, including information regarding the application and/or approval process and for a list of participating airports and stadiums, as well as the full terms and conditions of the program, please go to www.clearme.com. The CLEAR+ program is subject to change, and American Express has no control over those changes.

CLEAR+ Membership will automatically renew each year, subject to applicable law, unless you notify CLEAR that you want to cancel. This means that CLEAR will collect the then-applicable Membership fee and any taxes by charging acard CLEAR has on record for you without notifying you unless such notification is required by applicable law. To learn more about CLEAR+ Membership cancellation deadlines and cancellation requirements, please visit CLEAR’s Support & FAQ page.

Please allow up to 8 weeks after a qualifying CLEAR transaction is charged to the eligible Card account for the statement credit to be posted to the Card account. American Express relies on the merchant’s processing of transactions to determine the transaction date. If there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date, then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if a qualifying CLEAR transaction is made on December 31st but the merchant processes the transaction such that it is identified to American Express as occurring on January 1st, then the statement credit available in the next calendar year will be applied if available. If you have transferred to a different Card at the time the merchant submits the transaction, you may not receive the statement credit.

American Express also relies on information provided to us by the merchant to identify qualifying purchases. If American Express does not receive information that identifies your transaction as qualifying for this benefit, the Card Memberwill not receive the statement credit. Card Members may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying, if a transaction is made with an electronic wallet or through a third party (such as an app store), or if the merchant uses a mobile or wireless card reader to process it.

If the Card Account is canceled or past due at the time of statement credit fulfillment, it may not qualify to receive a statement credit. If your Card has been replaced, make sure that the most up-to-date Card information is on file with CLEAR so that you can continue to receive the statement credits. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits and may reverse any statement credits provided to you.

vPayment

vPayment can help reduce the risk of fraud with transaction-level controls which allow your company to set a specific date range and pre-authorizationamount for payments.

vPayment

Use of vPayment is subject to application approval. Upon approval, additional enrollment or technical implementationmay berequiredfor select functionality. Please contact your American Express representative to learn more.

Uber Cash Benefit for Eligible American Express Corporate Card Members

U.S. Corporate Platinum Card® from American Express and U.S. American Express® Corporate Gold Card Members are eligible to earn Uber Cash equaling 5% of eligible spend on rides with Uber and orders with Uber Eats paid for using their Gold or Platinum Card. U.S. American Express® Corporate Green Card Members are eligible to earn Uber Cash equaling 3% of eligible spend on rides with Uber and orders with Uber Eats paid for using their Green Card. Enrollment required.

Uber Cash is a payment currency for use with purchases made through Uber Services. Uber Cash earned through this benefit (i) canonly be used in the U.S. to pay for rides with Uber, orders with Uber Eats, and Lime bikes and scooter rides booked via the Uber app, (ii) will have a value of one U.S. dollar ($1) available to Card Members to pay for one U.S. dollar ($1) in eligible purchases and (iii) will be added automatically to the Card Member’s Uber Cash account.

To enroll in this benefit, Card Members must open the latest version of the Uber or Uber Eats app, and add their eligible American Express Corporate Card as a payment method. A window will pop up and the Card Member must press “Start earning Uber Cash.” If the Card Member already has their eligible Card in their Uber Wallet, the Card Member can enroll by navigating to their account, scrolling down to “Partner Rewards", selecting “Earn Uber Cash with your American Express Corporate Card,” and then selecting “Enroll Now.” A window will pop up andthe Card Member must press “Start earning Uber Cash.” If the account number of the enrolled eligible Card changes, or the Card Member wants to use a different eligible Corporate Card account as the payment method for the benefit, the Card Member would need to re-enroll in the benefit using the relevant Card account number. Card Members can contact Uber Support through the app regarding any issues they have enrolling.

Eligible spend on rides with Uber and orders with Uber Eats include total amounts paid by eligible Card Members, in the U.S.,for orders with Uber Eats, Pool/Express Pool trips, UberX, XL, WAV/Assist, Comfort, Connect, Pet and Select trips, and Green, Black and Black SUV trips, and tips to delivery people or drivers, but excludes car rentals, cancellation fees, portions of trips covered by a promotional value, portions of trips covered by another user through split fare, external trip fees such as damage and cleaning fees, upfront purchases of Uber Cash, credits, and subscription passes, and taxi, bike, and scooter rides. The eligible spend must be paid for using an eligible Corporate Card, and changes to the Card Member’s Card details must be updated in the Uber App. Cards added to an Uber account through a third party such as Apple Pay or PayPal will not be eligible. American Express reserves the right to suspend eligibility for the benefit if we suspect any violation or abuse.

If a Card Member earns Uber Cash under the benefit for a transaction and then changes the payment method for the transaction to a method that is not eligible, then Uber will remove the Uber Cash from the Card Member’s Uber Cash account. In the event an enrolled Card Member does not earn Uber Cash under the benefit for a transaction and then changes the paymentmethod for the transaction to an eligible Card, then Uber will add the Uber Cash earned under the benefit for the transaction to the Card Member’s Uber Cash account.

Terms apply. Visit https://www.uber.com/legal/en/document/?name=uber-cash-terms-of-use&country=united-states&lang=en for details on Uber Cash. Offer is subject to change at any time without notice to you. Fulfillment of the offer is the sole responsibility of Uber.

$200 Airline Fee Credit

Enrollment through American Express is required to receive the benefit. Basic Card Members on U.S. Consumer and Corporate Platinum Card Accounts can enroll in the benefit by making their airline selection in the Benefits section of their americanexpress.com online account or by calling us. Enrolled Basic Card Members on U.S. Consumer Platinum and U.S. Corporate Platinum Card Accounts are eligible to receive up to $200 in statement credits per calendar year for incidental airline fees charged by their one selected qualifying airline to the enrolledCard Account. Purchases by both the Basic Card Member and Additional Card Members on the enrolled Card Account are eligible for statement credits. However, the total amount of statement credits will not exceed $200 per calendar year, per Card Account.To receive statement credits, the Basic Card Member must select one qualifying airline through their American Express Online Account or the link for their Card below:

• American Express Corporate Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-platinum

Qualifying airlines include Alaska Airlines, American Airlines, Delta Airlines, Hawaiian Airlines, JetBlue Airways, Spirit Airlines, Southwest Airlines, and United Airlines, and are subject to change. Only the Basic Card Member or Authorized Account Manager(s) on the Card Account can select the qualifying airline. Card Members who have not chosenone qualifying airline will be able to do so at any time. Card Members who have already selectedone qualifying airline will be able to change their choice one time each year in January through their AmericanExpress Online Account or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline.Incidental airline fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s selected airline (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award ticketsare not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.

Please allow 6-8 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) tobe posted to the Account. American Express relies on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. American Express also relies on the airlines’ processing of transactions to determine the transaction date. If there is a delay in the airline submitting the transaction to us or if the airline uses another date as the transaction date then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. If you have transferred to a different Card at the time the airline submits the transaction, you may not receive the statement credit. Card Members remain responsible for timely payment of all charges.Statement credits may not be received or may be reversed if the purchase is cancelled, modified, or returned. To be eligible for this benefit, Card Account(s) must be not cancelled and not past due at the time of statement credit fulfillment.If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits andmay reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not beapplied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

$100 Airline Fee Credit

Benefit is available toAmerican Express® Corporate Gold Card Members only. To receive statement credits of up to $100 per calendar year toward incidental air travel fees, Card Member must selectone qualifying airline at https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-gold. Card Members who have not chosen a qualifying airline will be able to do so at any time. Card Members who have already selected a qualifying airline will be able to change their choice one time each year in January at https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-gold or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline.

Statement Credits: Incidental air travel fees must be charged to the Card Member on the eligible Card Account for the benefit to apply. Incidental air travel fees charged by the Card Member on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $100 per calendar year in statement credits across all Cards on the Account. Incidental air travel fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s airline of choice (e.g. wireless internetand fees incurred with airline alliance partners) do not qualify for statement credits. Incidental air travel fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee. Please allow 6-8weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. We rely on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. American Express also relies on the airlines’ processing of transactions to determine the transaction date. If there is a delay in the airline submitting the transaction to us or if the airline uses another date as the transaction date then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. If you have transferred to a different Card at the time the airline submits the transaction, you may not receive the statement credit. Card Members remain responsible for timely payment of all charges. Statement credits may not be received ormay be reversed if the purchase is cancelled, modified, or returned. To be eligible for this benefit, Card Account(s) must be not canceled and not past due at the time of statement credit fulfillment. For additional information about this benefit, call the number on the back of your Card.

Hilton Honors™ Silver Status Enrollment

As a Corporate Green/Gold Card Member you are eligible to enroll in complimentary Hilton Honors Silver status. Benefit available only to American Express Corporate Green and Corporate Gold Card Members and is not transferable. Once you request enrollment in the Hilton Honors program, American Express will share your enrollment information with Hilton. Hilton may use this information in accordance with its privacy policy available at hilton.com/en/p/global-privacy-statement. If your Corporate Green/Gold Card is cancelled for any reason, your complimentary Hilton Honors Silver status provided with the Card will be cancelled. American Express reserves the right to change, modify or revoke this benefit at any time. Hilton reserves the right to deactivate your Hilton Honors Silver status if you do not book and pay for a stay of at least one night at an eligible Hilton property between enrolling in the benefit and the end of the following calendar year. Hilton also reserves the right to deactivate your Hilton Honors Silver status if you do not book and pay for a stay of at least one night at an eligible Hilton property each calendar year thereafter. If Hilton deactivates your Hilton Honors Silver status because you have not met the aforementioned requirement in a given year, you will be able to re-enroll in Hilton Honors Silver status through American Express. Silver status benefits are subject to availability and vary by hotel; see Hiltonhonors.com/MemberBenefits, Hilton.com/en/hilton-honors/benefit-terms/, HiltonHonors.com/SLHTerms, and HiltonHonors.com/AutoCampTerms for additional details. The Hilton Honors Program, including the benefits of Hilton Honors membership, are subject to Hilton Honors Terms and Conditions; see hiltonhonors.com/terms. ©2025 Hilton

Fee Credit for Global Entry or TSA PreCheck®

The benefit is available to (i) Corporate Gold Card Members, (ii) Consumer Platinum Card® Members, Corporate Platinum Card® Members and Business Platinum Card® Members, and (iii) Centurion® Card Members. The benefit is also available to all Additional Card Members on Consumer and Business Platinum Accounts, and all Additional Card Members on Consumer and Business Centurion Accounts. To receive the Global Entry statement credit of $120 or the TSA PreCheck statement credit of up to $85, Basic or Additional Card Members on the eligible Card Account must pay for the respective application fee through a TSA PreCheck official enrollment provider with their eligible Card. Basic Card Members are eligible to receive a statement credit every 4.5 years for the TSA PreCheck® application fee (when applying through a TSA official enrollment provider) and every 4 years forthe Global Entry application fee, in each case when charged to the Basic Card or any eligible Additional Cards on the eligibleCard Account. Basic Card Members will receive a statement credit for the first program (either Global Entry or TSA PreCheck) to whichthey or their eligible Additional Cards apply and pay for with their eligible Card regardless of whether they are approved for Global Entry or TSA PreCheck. However, eligible Card Members can earn no more than one credit for up to $85 for TSA PreCheck or $120 credit for Global Entry (but not both programs), depending upon the program the Card Member first applies for, for an application fee charged to an eligible Card. American Express has no control over the application and/or approval process forGlobal Entry or TSA PreCheck, and does not have access to any information provided to the government by the Card Member or by the government to the Card Member. American Express has no liability regarding the Global Entry or TSA PreCheck Programs. U.S. Customs and Border Protection (CBP) (for Global Entry) and U.S. Transportation Security Administration (TSA) (for TSA PreCheck) charge an application fee to process each respective application regardless of whether the Card Member’s application is approved. The Department of Homeland Security may suspend acceptance of applications on any basis at its discretion. American Express will provide a statement credit for the application fee regardless of the decision made by CBP (for Global Entry) or TSA (for TSA PreCheck) but will not provide a statement credit for subsequent application fees charged to the same eligible Card within 4 years (for Global Entry) or 4.5 years (for TSA PreCheck), even if the original application is rejected.

Membership for Global Entry or TSA PreCheck is per person, and a separate application must be completed for each individual. TSA PreCheck application must be processed through a TSA official enrollment provider. Global Entry membership also includes access to the TSA PreCheck program with no additional application or fee required. For additional information on the Global Entry or TSA PreCheck programs, including information regarding the application and/or approval process and for a list of participating airlines and airports, as well as the full terms and conditions of the programs, please go to www.cbp.gov/travel/trusted-traveler-programs/global-entry for Global Entry and www.tsa.gov for TSA PreCheck. The Global Entry or TSA PreCheck programs are subject to change, and American Express has no control over those changes.

The statement credit benefit applies to the Global Entry or TSA PreCheck programs only. Other program applications including,but not limited to, NEXUS, SENTRI, FAST, and Privium are not eligible for the statement credit benefit.

Please allow up to 8 weeks after the qualifying Global Entry or TSA PreCheck transaction is charged to the eligible Card accountfor the statement credit to be posted to the Card account. American Express relies on accurate transaction data to identify eligible Global Entry and TSA PreCheck purchases. The transaction date may differ from the date you made the purchase if, forexample, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. If you do not see a credit for a qualifying purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Card Members are responsible for payment of all application charges until the statement credit posts to the Card Account. Statement credits may be reversed if an eligible purchase is returned/cancelled. If you have transferred to a different Card at the time the merchant submits the transaction, you may not receive the statement credit.

To be eligible for this benefit, the Card Account must not be cancelled and not past due at the time of statement credits fulfillment. If American Express, in it’s sole discretion, determines that you have engaged in or intend to engage in any manner ofabuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits andmay reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

Global Assist® Hotline

While Global Assist® Hotline coordination and assistance services are offered at no additional charge from American Express, Card Members are responsible for the costs charged by third-party service providers. For full Terms and Conditions, see americanexpress.com/GAterms.

American Express @ Work

Use of American Express @ Work® is restricted to employees, contractors and/or agents that the Company, and its representatives designate for the sole purpose of performing online account queries and maintenance, including accessing and/or creating reports relating to the Company's American Express® Corporate Card programs. @ Work is available to all companies with an American Express Corporate Card program.

Enrollment is required. To enroll in @ Work please contact your American Express Representative or call 1-888-800-8564.

The Rewards of Your Card

Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

American Express One AP®

American Express One AP® may not be available to all customers. To access the service, all customers will be required to enroll their eligible U.S.-issued American Express® Business, Corporate, or Corporate Purchasing Card. There is no fee to use the service for customers electing to process only Card payments. Use of additional payment methods requires activation through an American Express® Specialist and a monthly platform access fee of $200 which will automatically renew each month, unless the service is cancelled or all additional payments methods are deactivated, as applicable. If additional payment methods are being used, with the monthly platform access fee, to the extent used, the first 400 check transactions and first 400 automated ACH transactions each month are complimentary, after which point a fee of $1.00 per check and $0.35 per automated ACH transaction will apply. Fees are subject to change. Sales tax on fees may apply. All fees associated with American Express One AP® will be auto-billed monthly in arrears to the first Card enrolled for the service. The monthly platform access fee will be charged starting in the month in which the customer first uses an additional payment method and will not be pro-rated; the full monthly platform access fee will be charged regardless of when in the month a customer activates and first uses an additional payment method. Customers may cancel the service or activate/deactivate additional payment methods by contacting their American Express® Specialist. The customer will be charged the full monthly platform access fee (and any applicable transaction fees and taxes) for the month in which the service is cancelled (or all additional payment methods are deactivated), with continued access to the service for the thirty days following the cancellation date. Customer must cancel by 5:00 PM ET on the last business day of the month to avoid being charged the platform access fee for the following month. To make a Card payment to a supplier through the service, the supplier must be an American Express-accepting merchant. To learn more, please contact your American Express® Specialist.

New York: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. California: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. Georgia: The American Express One AP® service is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers. American Express Travel Related Services Company, Inc. is licensed by the Georgia Department of Banking and Finance.

For a list of our money service business licenses and information about addressing complaints and other disclosures, visit www.americanexpress.com/us/state-licensing.html.

NMLS ID # 913828

American Express® App

The American Express® App and app features are available only for eligible accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible.

To log in, customers must have an American Express user ID and password or create one in the app.

Online Account Access

Corporate Card accounts are eligible to enroll for online services. Centrally Billed Accounts, where charges on all Card accounts are billed to the company instead of the individual Card Members, may be excluded. Use of online payments and electronic expense report services are subject to your company practices and policies. Card Members must enroll at americanexpress.com/confirmcard.

Dispute Resolution

Not all disputes are resolved in the Card Member's favor.

Emburse

Card enrollment required for eligible American Express Business and Corporate Cards. Separate enrollment with each of Emburse and American Express is required to utilize combined product offering. To pay a supplier using an eligible American Express Business or Corporate Card within the Emburse platform, the supplier must be an American Express accepting merchant. Additional upgrades, features, and payment methods may require separate activation with Emburse, and fees may apply as determined by Emburse. Please contact your Emburse representative to learn more.

◆ Baggage Insurance Plan

Baggage Insurance Plan is underwritten by AMEX Assurance Company. Subject to additional terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/BIPterms. If You have any questions about a specific item, please call Us at 1-800-228-6855, if international, collect at 1-303-273-6497.