The American Express® Corporate Program

The American Express advantage

Turn payment solutions into business advantages

We can partner with you to tailor a program that can help your organization’s unique payment and spending needs.

Get business done around the world

Travel and pay confidently with our payment solutions and digital tools.

Enjoy the powerful backing of American Express

Experience award-winning customer service, consultative onboarding, and global account support.

Solutions tailored to your needs

We offer proprietary, partner, and custom solutions to help large and global businesses unlock more value from supplier payments to employee spending.

Already an American Express® Corporate Program Card Member?

See Card Member benefits or call Customer Service 1-888-800-8564

Your program for payments, travel, and expenses

We work with you to create a program that meets your payment and spending needs and harnesses data to help you identify spending patterns and find opportunities to save.B2B payment solutions

Capitalize on the digitization and automation in supplier payments to help drive value now and in the long run.

Terms apply.

Travel and expense management

Help control and oversee T&E spending across your workforce with tools for efficiency, flexibility, and insights.

Terms apply.

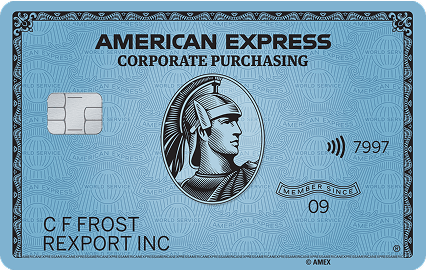

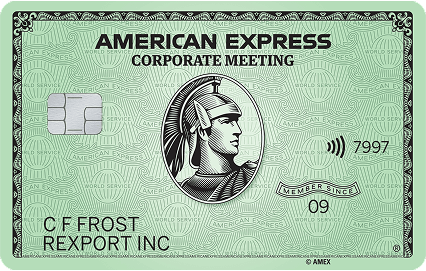

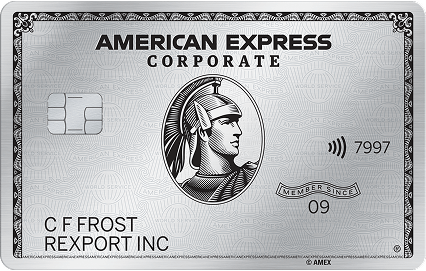

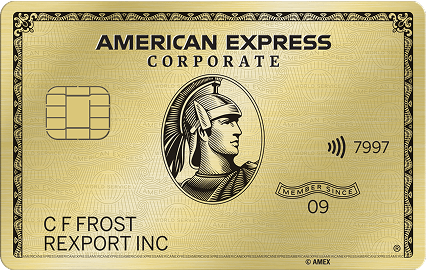

Explore American Express® Corporate Cards

Corporate Platinum Card®

- Senior executives

- Premium travel benefits

- Access to 1,550+ airport lounges worldwide†

Explore American Express® Corporate Cards

Powerful backing by the numbers

175 years of expertise

Source: American Express Newsroom - 2025 Chairman's Letter to Shareholders

99% Card acceptance

Based on the February 2024 Nilson Report

18 years of top fraud protection

Source: American Express Newsroom - Fraud Protection

Add value across your workforce

See how the American Express Corporate Program can help add efficiency and save time for the people making purchases, balancing books, and making decisions for your company.

See what we could do for your business.