Is 700 a Good Credit Score?

4 Min Read | Last updated: June 16, 2025

A 700 credit score may be considered good. See what loans and other forms of credit you may be able to get with a 700 credit score.

At-A-Glance

- Lenders view credit scores as quantifiable indicators of creditworthiness.

- By FICO® standards, credit scores in the 700s can range from “good” to “very good.”

- Having a credit score in this range can help you get approved for various types of credit.

You checked your credit score and noticed it’s somewhere in the 700s. That’s officially a “good” or “very good” thing, according to FICO® standards.1 But what exactly do those indicators mean in the context of credit?

This article explains what it means to have a credit score in the 700s and what types of credit and credit terms this range can afford you.

Is a 700 Credit Score Good?

FICO, the most widely used credit scoring model, categorizes scores into the following ranges:2

- 300–579: Poor.

- 580–669: Fair.

- 670–739: Good.

- 740–799: Very Good.

- 800–850: Exceptional.

So, a credit score in the low 700s is labeled as “good,” and a score in the mid-to-high 700s is “very good.”

In Q3 of 2024, the average FICO score was 715, which is unchanged from the same quarter in 2023, according to Experian.3 This means that if your credit score falls in the low 700s range, it’s somewhere around the U.S. average.

Take note that VantageScore® uses different credit score ranges:4

- 300–499: Very Poor.

- 500–600: Poor.

- 601–660: Fair.

- 661–780: Good.

- 781–850: Excellent.

What You Can Get with a 700 Credit Score

By checking your credit score, lenders – such as credit card issuers, landlords, banks, and other relevant financial institutions – can determine whether you qualify for new credit and what interest rate you’ll pay. Compared to fair or poor credit scores, which may make it challenging to obtain certain types of financing, a credit score in the 700 range can open up new lending opportunities with more affordable rates and favorable loan terms.5

Here are several areas where you may be able to get credit with a 700-plus credit score.

Getting a Mortgage With a 700 Credit Score

The accepted baseline credit score to get a conventional mortgage may be around 620, so any score over 700 will likely boost your chances of approval – as long as other financial factors, like debt-to-income ratio and income statements, meet lenders’ requirements.6

Getting a Car Loan With a 700 Credit Score

While the credit score you need to buy a car may fall under 700, a 700 credit score (or higher) will likely help you get approved for either new or used car financing, as long as other financial factors meet lender requirements.

Getting a Credit Card With a 700 Credit Score

Your credit score is an important factor in determining which credit cards you may be able to get. Someone with a good credit score may qualify for a credit card with desirable perks like the ability to earn cash back, travel rewards, or a 0% introductory APR offer. But it’s possible that qualifying for an exclusive card with high-end benefits, like statement credits for streaming services, complimentary airline companion tickets, or airport lounge access, might require a “very good” credit score.

Getting a Personal Loan With a 700 Credit Score

The minimum credit score required to get a personal loan may depend on the lender. Some might disclose the minimum requirement up front. Again, like most borrowing scenarios, the higher your credit score, the more likely you’ll get approved with more favorable loan terms. Thus, a credit score in the 700s could help you stand out as a worthy candidate, assuming your finances are otherwise up to snuff.

Did you know?

A credit score is just one of the many factors potential creditors may look at when analyzing a credit application. Lenders might also look at your credit report, income statements, debt-to-income (DTI) ratio, and recent credit inquiries.7

Factors That Impact Your Credit Score

There are a few different factors that may affect your credit score. Broadly speaking, these can be broken into the following categories:

- Payment History

Having a history of on-time debt payments may positively impact your credit score. Missing payments or being late could negatively impact your score.

- Your Credit Usage

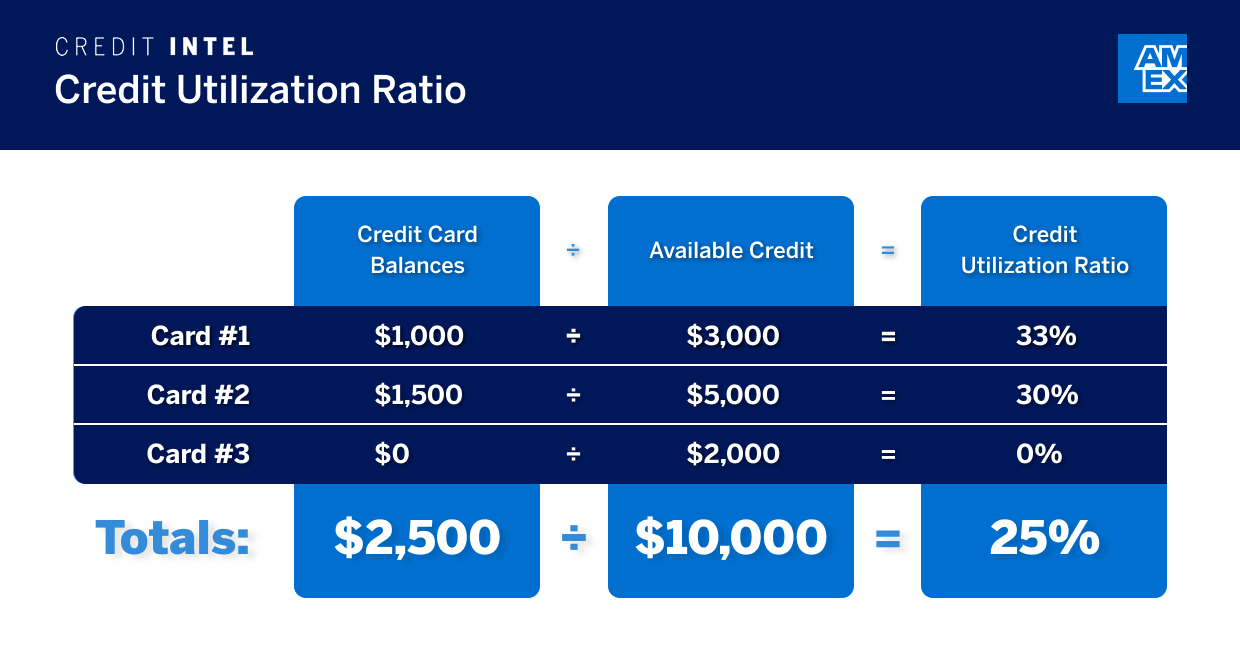

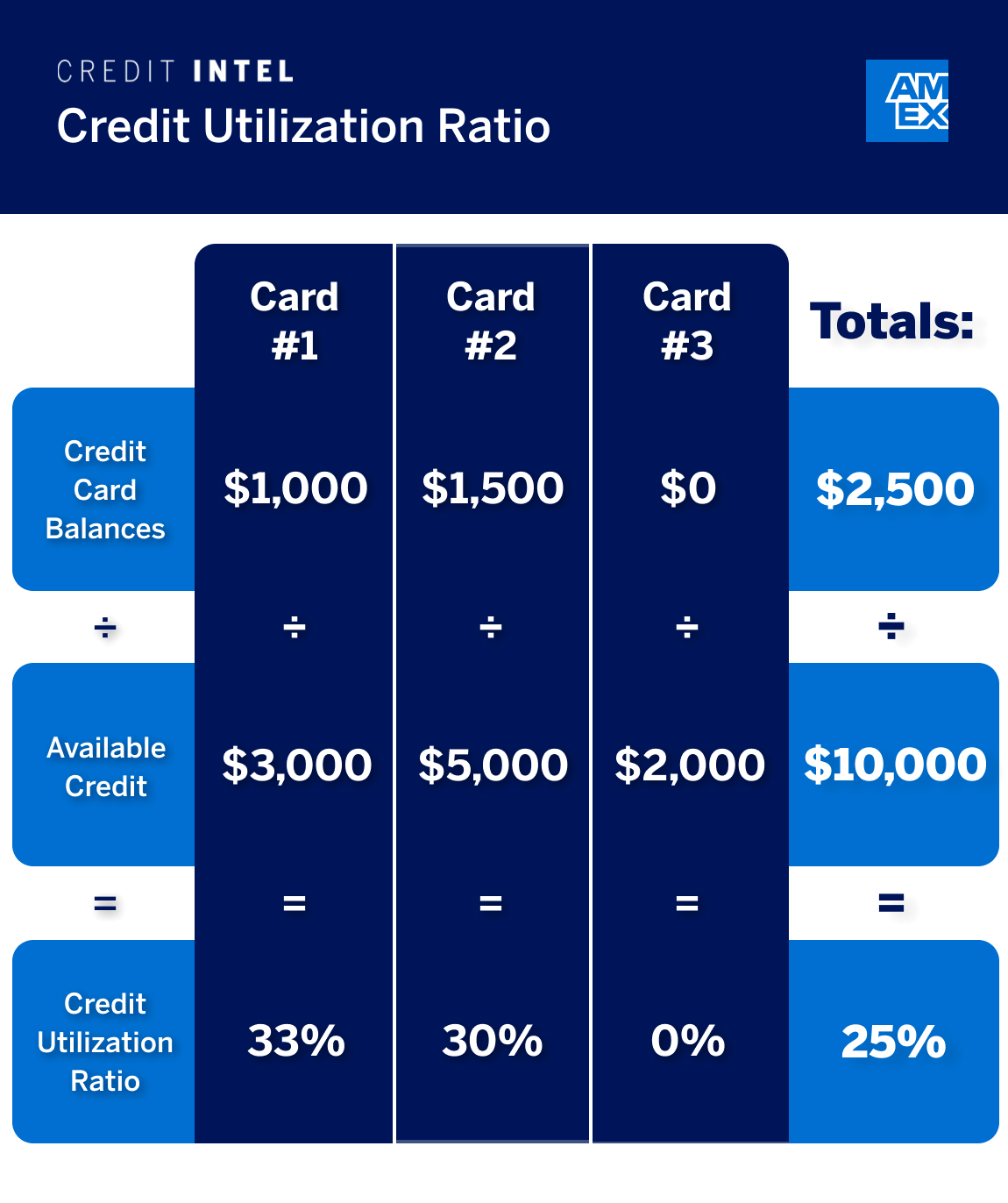

How much you owe and your credit utilization ratio, that is, the amount of your available credit that you’re using on revolving credit accounts, may also impact your credit score.

Here’s a look at how your credit utilization ratio works across credit cards:

- Pay your balance in full each month.

- Use the Pay Over Time feature to carry a balance, with interest, up to your Pay Over Time limit.

- Use Plan It® to select large purchases of $100 or more and split them into equal monthly payments with a fixed fee.

Keep in mind there is a limit on the total amount that you can carry as a balance or move into a plan with Plan It. Any purchases beyond your limit will need to be paid in full when your bill is due.5

You may want to keep your credit utilization ratio low. In fact, according to Experian, the best credit utilization ratio is usually in the single digits.8

- Credit History

Your credit history, the average age of your accounts as well as the age of your oldest and newest accounts may also impact your score. - Credit Mix

The different types of credit that you have, including revolving and installment accounts, may also impact your credit score. Being able to manage your credit responsibly may positively impact your score.

Frequently Asked Questions

A 700 credit score is slightly below the U.S. average of 715.9 According to Experian data from Q3 2023, 50% of Americans have a credit score that’s considered very good or exceptional, meaning their credit scores are over 740. An additional 21.6% of people have a good score between 670 and 739, meaning a portion of those individuals may also have a score over 700.10

A 700 credit score may help you qualify for certain types of credit, like a mortgage, auto loan, or credit card. However, since credit score is only one factor lenders use to determine eligibility, you’ll want to make sure other factors, like income and your debt-to-income (DTI) ratio, also reflect positively.

The Takeaway

A credit score in the 700s can help you get approved for a variety of credit applications. The higher the score, the better your chances of approval — and the more likely you’ll pay lower interest rates and save money over time. Practicing responsible credit management could help you improve your score over time so you can start asking a new question, “Is 800 a good credit score?”

1,2 “What is My Credit Score?,” Experian

3,9 “What Is the Average Credit Score in the US?,” Experian

4 “What Is a VantageScore Credit Score?,” Experian

5 “700 Credit Score: Is it Good or Bad?,” Experian

6,7 “Which Credit Scores Do Mortgage Lenders Use?,” Experian

8 “What Is the Best Credit Utilization Ratio?,”Experian

10 “How Many Americans Have an 800 Credit Score or Greater?,” Experian

SHARE

Related Articles

Average Credit Scores by Age, State, and Income

Average credit scores tend to change based on age, state, and income. But none of these are actually used to calculate your score. Good credit habits matter most.

How Long Does It Take to Build Credit?

How long does it take to build credit from scratch? It may take at least six months. See tips to help build a strong foundation for your credit future.

What Is an Excellent Credit Score?

Learn why a high 700-800 score qualifies as an excellent credit score, see high score benefits, and learn strategies for strengthening your credit.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.