The Different Types of Delta Credit Cards

7 Min Read | Last updated: September 4, 2025

Compare a variety of Delta SkyMiles® American Express Credit Cards to find the Card with the right travel benefits for your lifestyle.

At-A-Glance

- American Express offers four different Delta SkyMiles® American Express Credit Cards, each with its own unique benefits.

- Depending on the Card, benefits include double or triple miles in certain spending categories, complimentary Companion Certificates, airport lounge access, and more.

- Whatever your travel and spending habits are, there’s a Card to fit your needs.

Take a moment. Close your eyes. Drift off to your happy place. Maybe there’s a beach to lay on and crystal blue water to swim alongside tropical fish. Maybe there’s a mountain to climb, an exotic land to discover, or gourmet delicacies you typically only get to sample by scrolling through your social media feed.

Now, open your eyes and learn about the ways Delta SkyMiles® American Express Cards can help get you there. Whether you have a tried-and-true annual vacation destination or are crossing locations off your travel bucket list, there’s a Delta SkyMiles Card ready to help you revive your passion for adventure and experiences that take you beyond a walk around the neighborhood. Terms and conditions apply to all benefits listed below.

Which Delta SkyMiles Card Is Best?

The answer to that question differs for everyone. Perhaps the better question this: Which Delta SkyMiles Card best suits my lifestyle, personal finances, and travel dreams?

There are four different American Express Cards:

- Delta SkyMiles® Blue American Express Card.

- Delta SkyMiles® Gold American Express Card.

- Delta SkyMiles® Platinum American Express Card.

- Delta SkyMiles® Reserve American Express Card.

Each card has its own set of benefits and perks to match a variety of travel preferences. And now American Express and Delta have teamed up to help Card Members support sustainable materials sourcing: Since March 2022, new Delta SkyMiles Blue and Gold Card Members will receive Cards made from 70% reclaimed plastic, while Delta SkyMiles Platinum and Reserve Card Members have the choice between classic metal or 70% reclaimed plastic.

Read on to compare the four Delta SkyMiles Cards so you can choose the one that aligns with your needs and lifestyle.

Delta SkyMiles Blue American Express Card

The Delta SkyMiles Blue American Express Card has no annual fee.1 If you’re an occasional Delta traveler, this Card may hit all the right notes if you’re looking to earn miles without paying an annual fee.

With the Delta SkyMiles Blue Card, you can:

- Earn Miles: Earn 2X Miles on dining at U.S. restaurants (including takeout and delivery), 2X Miles on Delta purchases made directly with Delta, and 1X Miles on all other eligible purchases.

- Get 20% Back on In-Flight Purchases: Receive a 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food and beverages.

- Pay with Miles: Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.2

Infrequent travelers may find the Delta SkyMiles Blue Card ideal for their lifestyle. It can help long-haulers accumulate miles over time for that “one big trip.” Hello, 10-year wedding anniversary that you started earning miles for when you celebrated your fifth anniversary!

Delta SkyMiles Gold American Express Card

More frequent travelers may lean toward the Delta SkyMiles Gold American Express Card, as it offers ways to maximize your travel experiences while helping you earn miles along the way. Plus, there’s no annual fee in the first year, and then $150 after that.3

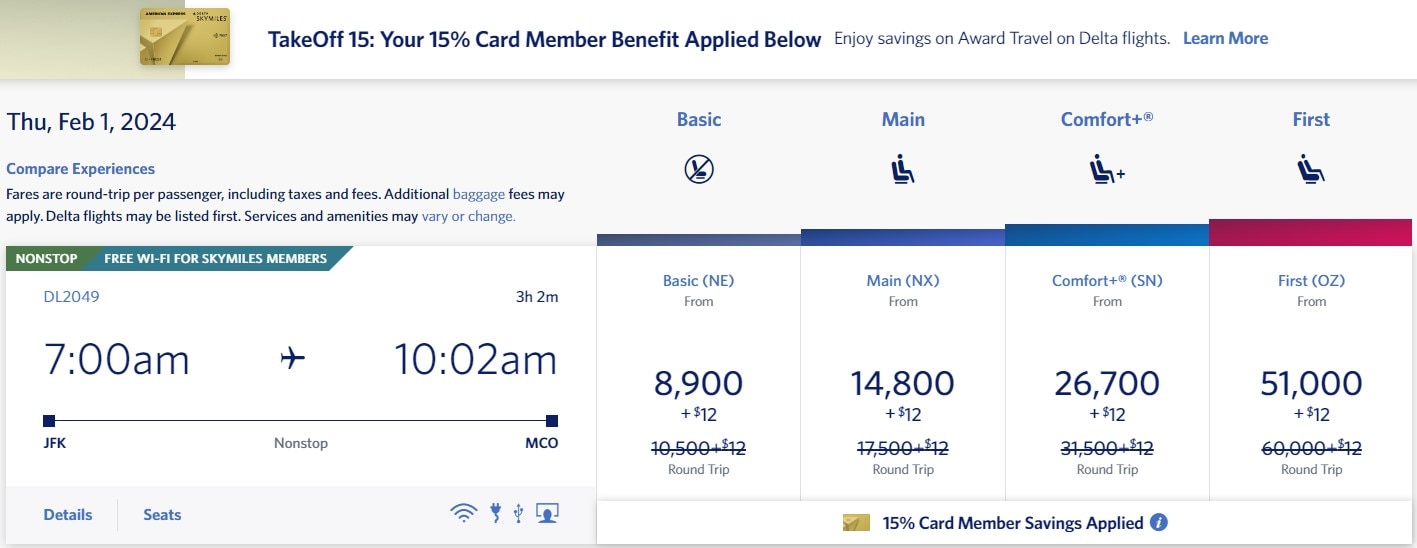

To start, Card Members can take 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. (Discount not applicable to partner-operated flights or to taxes and fees.) For example, an eligible flight of 26,000 Miles + taxes and fees would be 22,000 Miles + taxes and fees with the miles savings applied.

DELTA.COM – Example only. Actual trip prices may vary.

On top of this, Delta SkyMiles Gold Card Members can also:

- $200 Flight Credit: Earn a $200 Delta Flight Credit toward their next trip after spending $10,000 in purchases on the Card in a calendar year.

- Earn Miles: Earn 2X Miles on Delta purchases made directly with Delta.

- First Checked Bag Free: Enjoy their first checked bag free on Delta flights.

- Priority Boarding: Receive Zone 5 Priority Boarding on Delta flights.

- $100 Delta Stays Credit: Get up to $100 back per year as a statement credit after using your Card to book prepaid hotels or vacation rentals through Delta Stays on delta.com/stays.

And even when you aren’t on the go, Delta SkyMiles Gold Card Members can earn 2X Miles on dining at U.S. restaurants, including takeout and delivery, 2X Miles on groceries at U.S. supermarkets, and 1X Miles on all other eligible purchases4 – helping your everyday spend go toward your future travels.

Delta SkyMiles Platinum American Express Card

The Delta SkyMiles Platinum American Express Card has a $350 annual fee5 and offers a number of benefits that favor frequent travelers that may be looking for a more premium experience. Think bigger opportunities like complimentary upgrades and a more attainable path toward elite status.

To start, you could take a friend or partner on your next trip with a Companion Certificate. Delta SkyMiles Platinum Card Members can receive a Companion Certificate on Delta Main domestic, Caribbean, Mexico, or Central American roundtrip flights. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.6

If you’re looking to reach elevated Status faster, MQD Headstart and MQD Boost are new benefits that can help you get closer to Status next Medallion® Year.

With MQD Headstart, you can get rewarded for being a Delta SkyMiles Platinum Card Member and receive $2,500 Medallion Qualification Dollars (MQDs) deposited into your card-linked SkyMiles account each Medallion Qualification Year.

With MQD Boost, you can earn $1 MQD for each $20 of purchases made on your Delta SkyMiles Platinum Card. For example, if you made $3,000 in everyday purchases on your Card in a month, that would equate to $150 MQDs earned with MQD Boost.

To learn more about getting closer to Medallion Status with MQD Headstart and MQD Boost, read “MQD Headstart and MQD Boost: What You Need to Know.”

Delta SkyMiles Platinum Card Members can also take 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. (Discount not applicable to partner-operated flights or to taxes and fees.)

Some other benefits of the Delta SkyMiles Platinum Card include:

- Earn Miles: Earn 3X Miles on Delta purchases made directly with Delta, 3X Miles on purchases made directly with hotels, 2X Miles on dining at U.S. restaurants (including takeout and delivery), 2X Miles on groceries at U.S. supermarkets, and 1X Miles on all other eligible purchases.

- $120 Resy Credit: Discover new restaurants to book with Resy. Earn up to $10 back per month in statement credits (up to $120 back annually) on eligible Resy purchases after using your enrolled Card.

- $120 Rideshare Credit: Get rewarded to and from the airport. Earn up to $10 back per month in statement credits (up to $120 back annually) on U.S. rideshare purchases with select providers after you pay with your Card. Enrollment required.

Good to know: Purchases made towards the $120 Resy Credit and $120 Rideshare Credits are eligible for MQD Boost. Whether you’re flying, dining at your favorite restaurant, or on the road, you can get closer to Medallion Status and the benefits that come with it.

- First Checked Bag Free: Enjoy your first checked bag free on Delta flights.

- Priority Boarding: Receive Zone 5 Priority Boarding on Delta flights.

- $120 Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck. To read the full terms and conditions, visit www.americanexpress.com/expeditedtravel.

- Complimentary Upgrade List: Not a Medallion Member? Delta SkyMiles Platinum Card Members with an eligible ticket will be added to the Complimentary Upgrade List, after Delta SkyMiles Medallion Members and Delta Reserve Card Members. To be eligible to receive a complimentary upgrade, the ticket must be purchased on or after February 1, 2024.6

Delta SkyMiles Reserve American Express Card

Avid Delta travelers who want enhanced comfort need look no further than the Delta SkyMiles Reserve American Express Card. With a $650 annual fee7, the Card emphasizes luxury travel with benefits like lounge access and a boost towards elite status.

Whether you’re traveling for business or pleasure, having airport lounge access can provide a relaxing environment to unwind before or between flights. If you’re a frequent Delta traveler, you’ll want access to Delta Sky Club® lounges. Delta SkyMiles Reserve Card Members can receive 15 Visits per Medallion Year to the Delta Sky Club when flying Delta and can unlock an unlimited number of Visits after spending $75,000 in purchases on your Card in a calendar year. Plus, you’ll receive four One-Time Guest Passes each Medallion Year so you can share the experience with family and friends when traveling Delta together.

On top of this, Delta SkyMiles Reserve Card Members can also receive complimentary access to The Centurion® Lounge and Escape Lounge – The Centurion® Studio Partner when purchasing a Delta flight with their Card.

Delta SkyMiles Reserve Card Members can reach status even faster with MQD Headstart and MQD Boost: receive $2,500 MQDs each Medallion Qualification Year and earn $1 MQD for each $10 of purchases made on your Card.

Another major benefit of the Delta SkyMiles Reserve Card is the Companion Certificate, allowing Card Members to share their trip experience with a friend or partner. Delta SkyMiles Reserve Card Members can enjoy a Companion Certificate on Delta First, Delta Comfort+®, or Delta Main domestic, Caribbean, Mexico, or Central American round-trip flights each year after renewal of their Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.

The Delta SkyMiles Reserve Card extends to many other benefits, such as:

- Global Dining Access + $240 Resy Credit: With Global Dining Access by Resy, Delta SkyMiles Reserve Card Members can unlock insider access to reservations at sought-after restaurants when you add your Card to your Resy profile through the Resy app or website. You can also take advantage of your $240 Resy Credit after you enroll through your Card account to earn up to $20 per month in statement credits on eligible purchases on the Card with U.S. Resy restaurants.

- $120 Rideshare Credit: Earn up to $10 back per month in statement credits (up to $120 back annually) on U.S. rideshare purchases with select providers after you pay with your Card. Enrollment required.

- TakeOff 15: Take 15% off anytime you book Award Travel with miles on Delta flights when using delta.com and the Fly Delta app. (Discount not applicable to partner-operated flights or to taxes and fees.)

- Complimentary Upgrade List: Not a Medallion Member? Delta SkyMiles Reserve Card Members with an eligible ticket will be added to the Complimentary Upgrade List, after Delta SkyMiles Medallion Members.

- $120 Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck. To read the full terms and conditions, visit www.americanexpress.com/expeditedtravel.

- Earn Miles: Earn 3X Miles on Delta purchases made directly with Delta and 1X Miles on all other eligible purchases.8

The Takeaway

The right Delta SkyMiles Card for you depends on, well, you. Some Cards favor the casual traveler in terms of annual fees and miles-earning benefits, while others provide more exclusivity and luxury benefits for the more frequent-flier. Merge your travel desires with your spending habits to help you choose one of the four Delta SkyMiles Cards that works best for you.

1 For more on Rates and Fees for the Delta SkyMiles® American Express Blue Card, click here.

2 For more on Benefit and Offer Terms for the Delta SkyMiles® American Express Blue Card, click here.

3 For more on Rates and Fees for the Delta SkyMiles® American Express Gold Card, click here.

4 For more on Benefit and Offer Terms for the Delta SkyMiles® American Express Gold Card, click here.

5 For more on Rates and Fees for the Delta SkyMiles® American Express Platinum Card, click here.

6 For more on Benefit and Offer Terms for the Delta SkyMiles® American Express Platinum Card, click here.

7 For more on Rates and Fees for the Delta SkyMiles® American Express Reserve Card, click here.

8 For more on Benefit and Offer Terms for the Delta SkyMiles® American Express Reserve Card, click here.

SHARE

Related Articles

How to Find the Best Credit Card for International Travel

See how to find the best credit card for international travel. Consider cards with no foreign transaction fees, a rewards program, lounge access, and more.

What Are Delta Credit Card Benefits and How Do They Work?

Learn how Delta SkyMiles® American Express Card benefits can maximize every moment of your travel, from miles-boosting welcome offers to free checked bags and more.

Your Guide to the Different Types of Credit Cards

New to credit cards? Compare the different types of credit cards to find the best fit, from secured and unsecured to travel and reward cards.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.