What Is a CVV?

7 Min Read | Last updated: June 16, 2025

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Your CVV code is the 3 or 4-digit number on your credit or debit card that adds security. Learn more about how a CVV code works and tips for keeping yours safe.

At-A-Glance

- A CVV is the extra three- or four-digit number printed on your credit or debit card.

- Though CVV stands for “Card Verification Value,” you might also know this series of digits as a CVC, CSC, CVN, or CID, depending on the card issuer.

- CVV numbers may be used by online merchants to verify that the buyer has physical access to the card.

If you’ve ever made an online purchase, you’ve probably had to enter your CVV. That’s the three- or four-digit number that’s on your card. Maybe you’ve seen it written as your CVC, CVN, or CID or simply referred to as your credit card security code.

But what exactly is a CVV, and why is it important? Here’s what you need to know.

What Is a CVV Code?

CVV code stands for card verification value. This code is a three or four-digit security code that can be found on your credit card. The CVV number is used to help add a layer of security to your credit card purchases, helping to prevent people who may gain access to your card number from making purchases.

CVV stands for “Card Verification Value.” There are many other names for this card security code, including:

- CVC — Card Verification Code or Card Validation Code

- CSC — Card Security Code

- CVN — Card Verification Number

- CID — Card Identification number

CVV2 codes are the same as CVV codes, but with an added feature. These numbers were generated using a second-generation process, which makes it even more challenging for fraudsters to guess the number.

Where Can You Find the CVV Code?

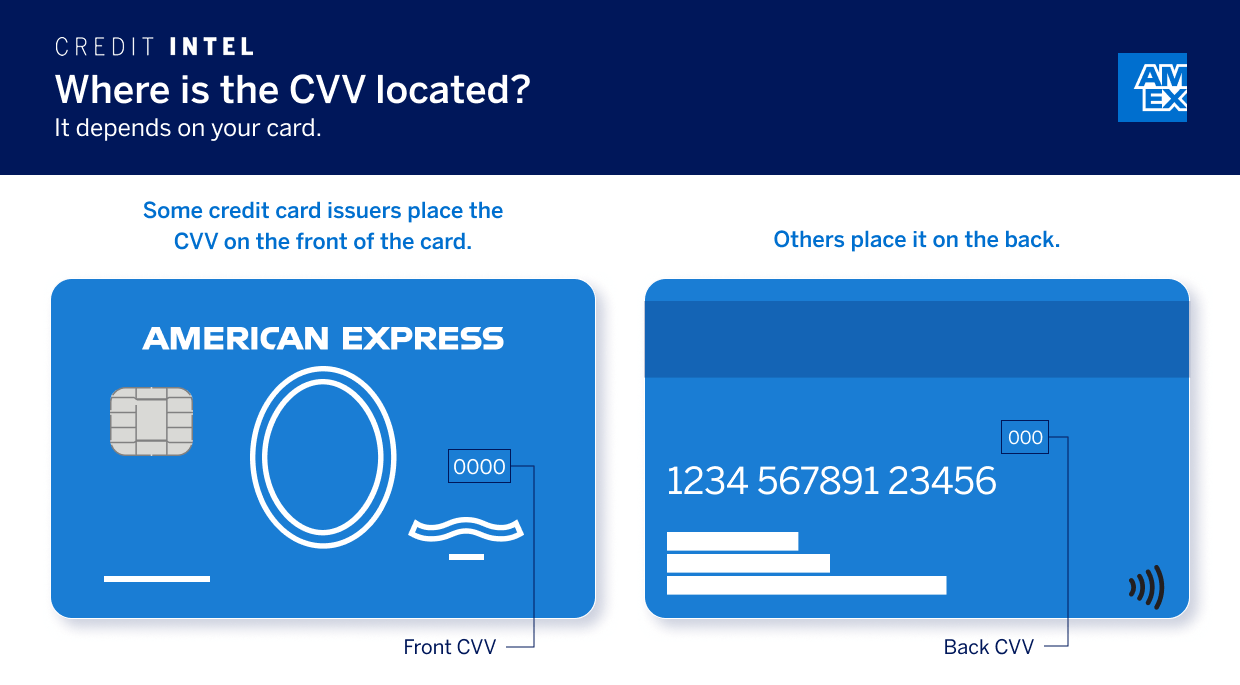

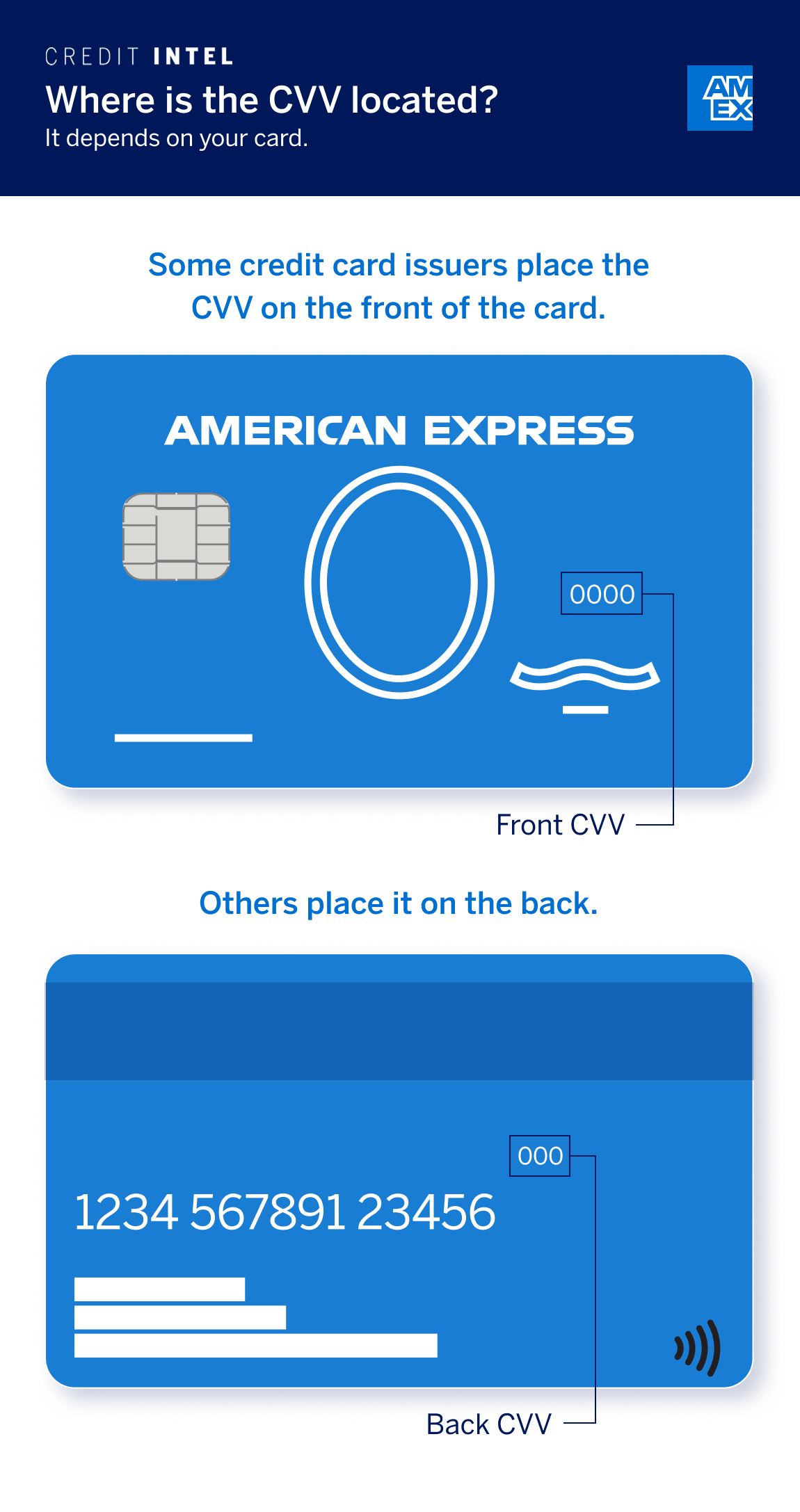

Curious where your credit card’s CVV code is located? That will depend on your card. While some credit card issuers place it on the front of the card, others place it on the back.

See the visual below for guidance on where the CVV may be located on your card:

CVV numbers may be shown in printed text, even if the credit card number itself is written in raised numerals.

What Is the Difference between a CVV and a PIN?

Your CVV number should not be confused with your personal identification number or PIN. Entered on a keypad, a PIN is used to validate in-person transactions, can be in conjunction with a chip embedded in your debit or credit card. In the U.S., it can be more common for debit cards to use PINs. Many credit cards do not, but some card issuers let you set up a credit card PIN as an added layer of protection.

Why Are CVV Numbers Important?

CVV numbers protect you. They provide an extra layer of security against someone taking your credit card number and using it in unauthorized ways. For example, retailers can store customers’ credit card numbers to make future purchases easier, but they can’t store CVV numbers after a purchase or transaction authorization.1 If a website or merchant asks you for your CVV number, they’re taking an extra step to confirm you physically have access to the card and aren’t using a number stolen from a data breach or a photo of the card (due to the fact that in many cases, the credit card number and CVV number are on opposite sides of the card).

This is why you might be asked to supply a CVV number when using a new shipping address, even if you’re using a saved card number.2 After all, stolen credit card numbers may not be used to send purchases to the rightful owner of that credit card, so an unfamiliar address may be more likely to trigger a request for additional verification.

What Can't CVV Numbers Do?

Though they play an important role in keeping your transactions secure, CVV numbers are only one component of card security: They’re merely a way to verify the purchaser has physical access to the card. Therefore, they’re primarily important in transactions that take place online and over the phone, not in person. For added in-person security, cards rely on signatures, magnetic strips, and EMV chips. For more on how credit cards work, check out “How Do Credit Cards Work? Demystifying Credit Art & Science.”

Nor do CVV numbers protect you against phishing scams in which someone tries to trick you into giving away your card number and card security code. The best way to protect your number is to disclose it only to people and businesses you trust — and only for transactions that you initiate. If you think your card number or CVV code has been compromised in some way, contact your card issuer immediately. They can get you a replacement with a new number and CVV code, if necessary.

Finally, checking CVV numbers is primarily a step merchants can take to protect transactions from fraud. However, not all retailers check CVV numbers if they have other security measures in place, like American Express’ SafeKey, for examples.

How to Keep Your CVV Code Safe

A CVV acts as built-in fraud protection for your card, but there some steps that you can take to protect your CVV code. These include:

- Shop Online Securely

Good credit card security practices, like only shopping on websites with URLs that include “HTTPS.” - Avoiding Phishing Scams

Never respond to emails or phone calls where the caller is requesting your credit card or CVV number. This can help you to avoid many phishing scams. - Don’t Write Your CVV Down

Avoid writing down your CVV, and credit card number as well. Instead, it’s a good idea to memorize it. If you must write it down, storing the information in a secure location, such as a safe is a good idea. - Consider Using a Virtual Credit Card

Using a virtual credit card, which is a temporary card number issued by your credit card issuer, could help to keep your CVV, and credit card number safe. - Monitor Your Credit Card Account

Regularly monitoring your credit card statements is a good way to check for suspicious activity that could be a sign of fraudulent activity. If you see any activity that you don’t recognize, get in touch with your credit card issuer right away.

A Brief History of the CVV

CVV numbers were created in large part to help make online shopping more secure. The rise in online shopping was likely the single biggest driver in adoption, especially for customers who had their card access interrupted any time its authenticity was mistakenly called into question. By adding another means of authentication, CVV numbers made online credit card transactions more reliable and convenient.

Frequently Asked Questions

The number of digits is a decision made by the payment network, similar to the credit card number itself. Many payment networks use three-digit numbers, but four-digit numbers work the same way and are harder to guess. American Express®, for example, uses a four-digit card identification code.

When retailers process your card payment, they can ask for your CVV number. This triggers a check to make sure your card number and CVV match. If they don’t match, it can mean one of three things: The buyer is using a stolen credit card number, the buyer is using an older card that has expired or been replaced, or the buyer made a typo. The retailer may store your credit card number for future purchases, but they won’t store your CVV after a purchase is authorized.

Not easily. By randomly guessing, there’s a 1-in-1,000 chance of guessing a three-digit code and a 1-in-10,000 chance of guessing a four-digit code. Merchants may not allow too many guesses, locking out would-be scammers after a few tries. If a fraudster guesses correctly, alert your card issuer immediately. They should send you a card with a new card number and a new CVV number.

The Takeaway

CVV numbers are the extra three or four digits on a credit card. Known by many names, they are an important element of credit card security. By using data that businesses can’t store to provide additional verification for purchases made online or over the phone, CVV numbers help keep transactions safe.

1,3 “Storing CVV: What Merchants Need to Know,” PCI Compliance Hub

2 “Card Not Present Fraud and False Declines: Understanding Risks and Ways to Protect Your Business,” Experian

SHARE

Related Articles

Do Credit Cards Have Routing Numbers?

Credit cards don’t use routing numbers like checking and savings accounts do. Instead, credit card transactions use credit card numbers.

What to Know About Credit Card Expiration Dates

All credit cards have expiration dates, but why? Here’s what to know about how long credit cards last, why they expire, and what happens after they expire.

10 Common Reasons Why a Credit Card Can Be Declined

Explore the most common reasons for a declined credit card, such as travel, credit limits, errors, or fraud, and learn how to protect your account.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.