American Express SafeKey®

Help prevent fraud and reduce friction for customers shopping online.

American Express® SafeKey 2.0

Help prevent fraud and reduce friction for customers shopping online.

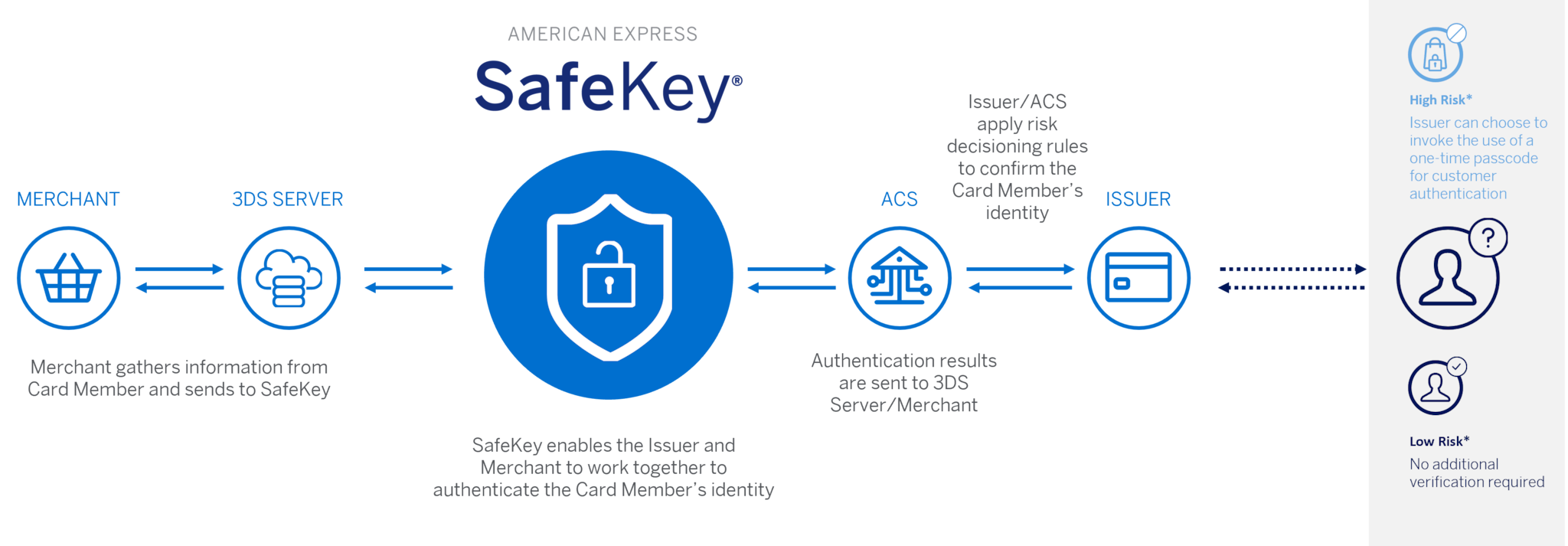

American Express SafeKey is a security solution designed to help you detect and reduce fraud on online or in-app purchases.

Leveraging the global standard, EMV®1 3-D Secure, SafeKey allows you and the Issuer to exchange detailed customer information to validate identity and provide a safe and seamless checkout experience.

Amex SafeKey offers valuable benefits for you and your customers.

Reduce fraud liability

Liability for fraud chargebacks on authenticated and attempted transactions can be transferred to the Issuer, protecting your business.

Increase spend confidence

Helps customers feel more secure about online purchases potentially increasing their confidence to spend.

Reduce shopping cart abandonment

Additional data elements from the checkout process is used to authenticate Card Members without a challenge*, reducing friction which can lead to less cart abandonment and a higher conversion of sales.

Leverage the industry standard for protection

SafeKey is based on the global industry standard, EMV 3-D Secure, to detect and reduce online fraud.

*A challenge is when an issuer can request a Card Member to prove their identity, e.g., by use of a one-time passcode (OTP).

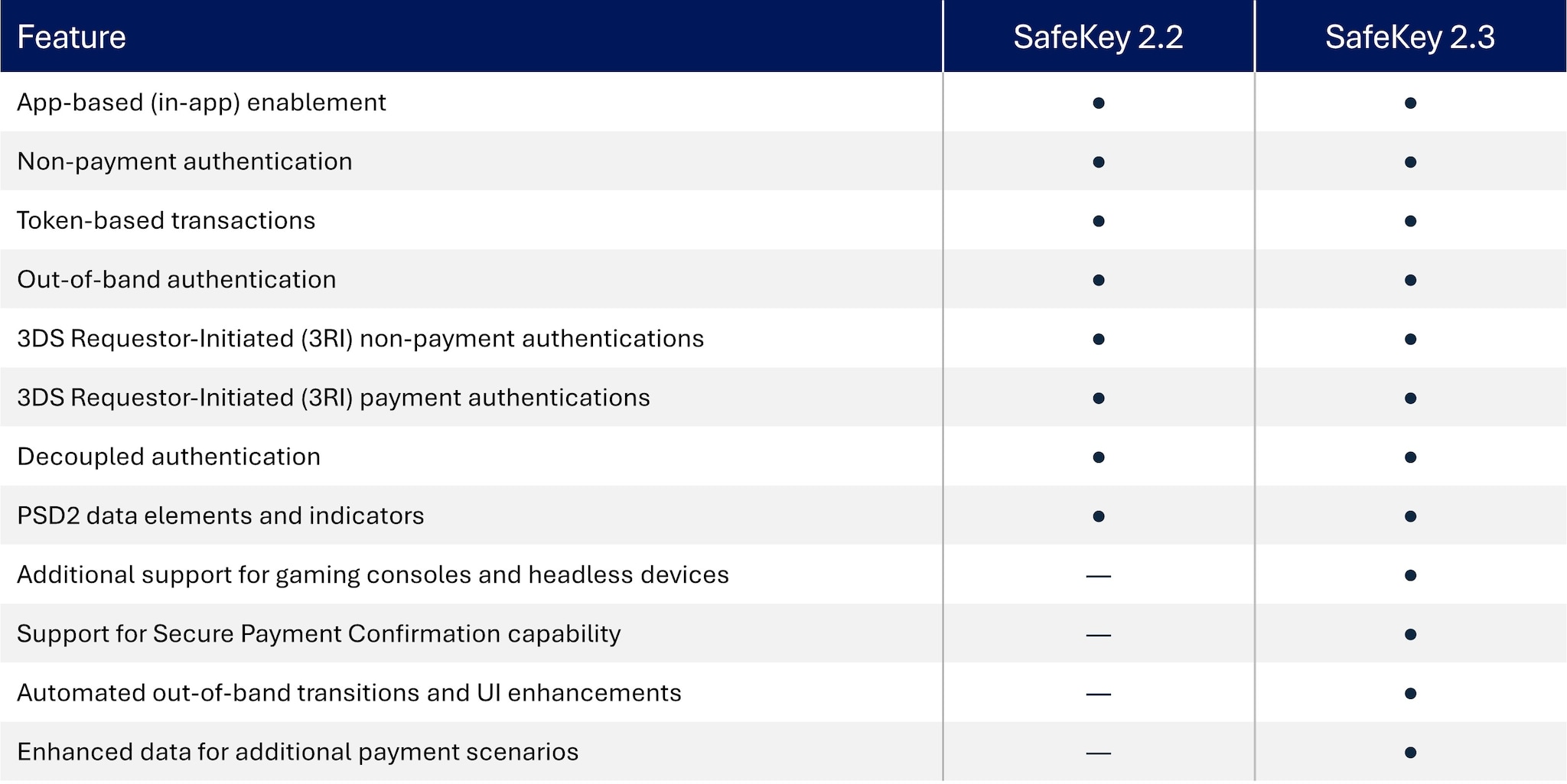

SafeKey Comparison

Ready to learn more about how to implement SafeKey from American Express?

Follow the steps below:

- Review our product guide.

- To get started with SafeKey, you must contact a certified 3DS Server Provider that can integrate with your website. View a list of certified providers.

Are you an Issuer or Acquirer?

View additional Issuer/Acquirer information.

1EMV is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo.