4 Min Read | Published: December 12, 2023 | Updated: October 27, 2025

How to use the Cash Flow tab in American Express Business BlueprintTM

The Cash Flow tab uses real-time data from your select American Express products and linked external business checking accounts to organize, display, and calculate the money in and out of your business over a select period that suits your business needs.

The Cash Flow tab's graphs can help you organize and display your data in several ways to help you plan for potential financial highs and lows:

Cash flow. View the money in and money out of your business over a selected period, such as month, year, or a custom timeframe, to identify potential gaps.

Net Cash flow. Use this metric to see the difference between the money flowing in and out of your select American Express and linked business checking accounts over a certain period of time.

Money in. Track money coming into your business over a selected period.

Money out. See the flow of money out of your business over a selected period.

This guide will help you understand the many ways that Business Blueprint Insights can help you make more confident cash flow management decisions.

After logging into your Business Blueprint platform, select the Cash Flow tab within “Insights” on the top of the page.

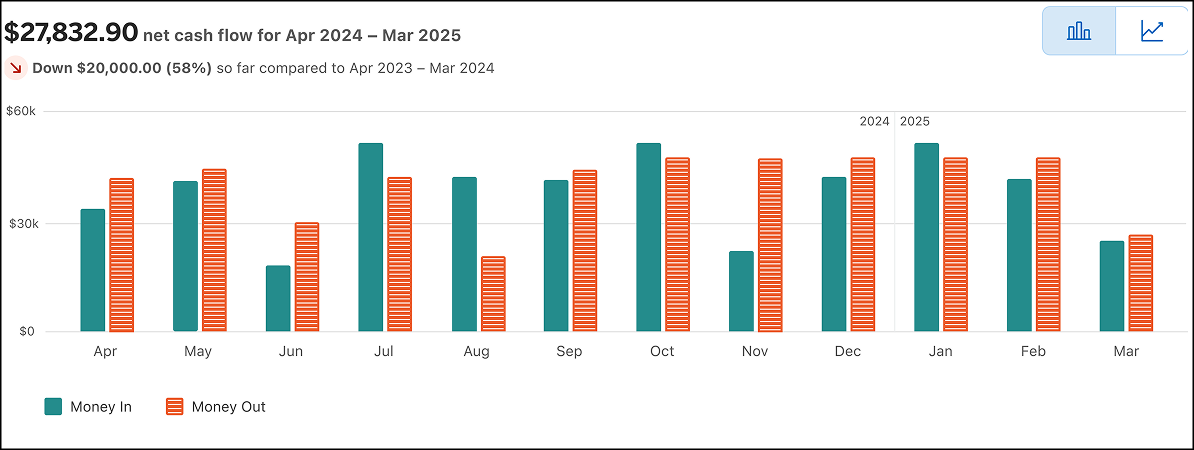

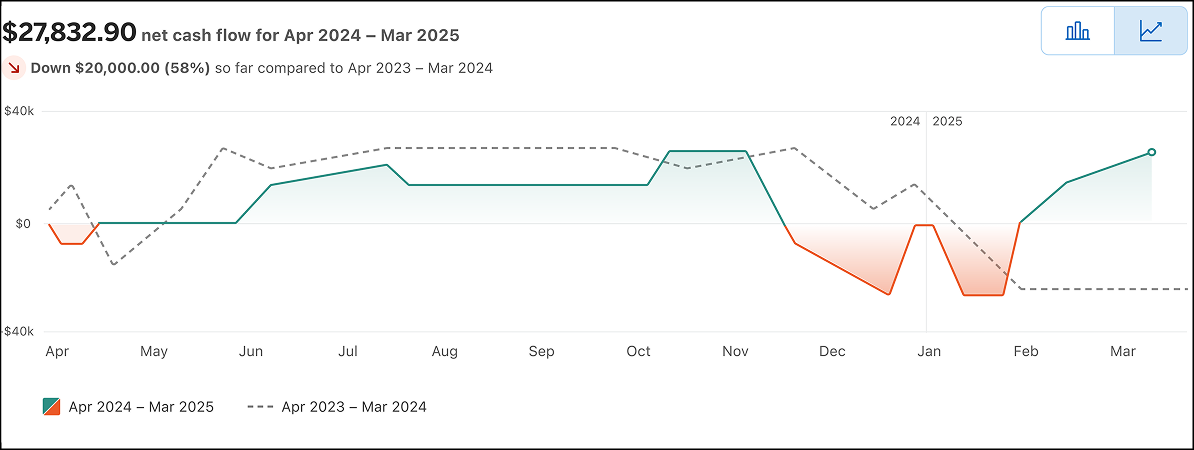

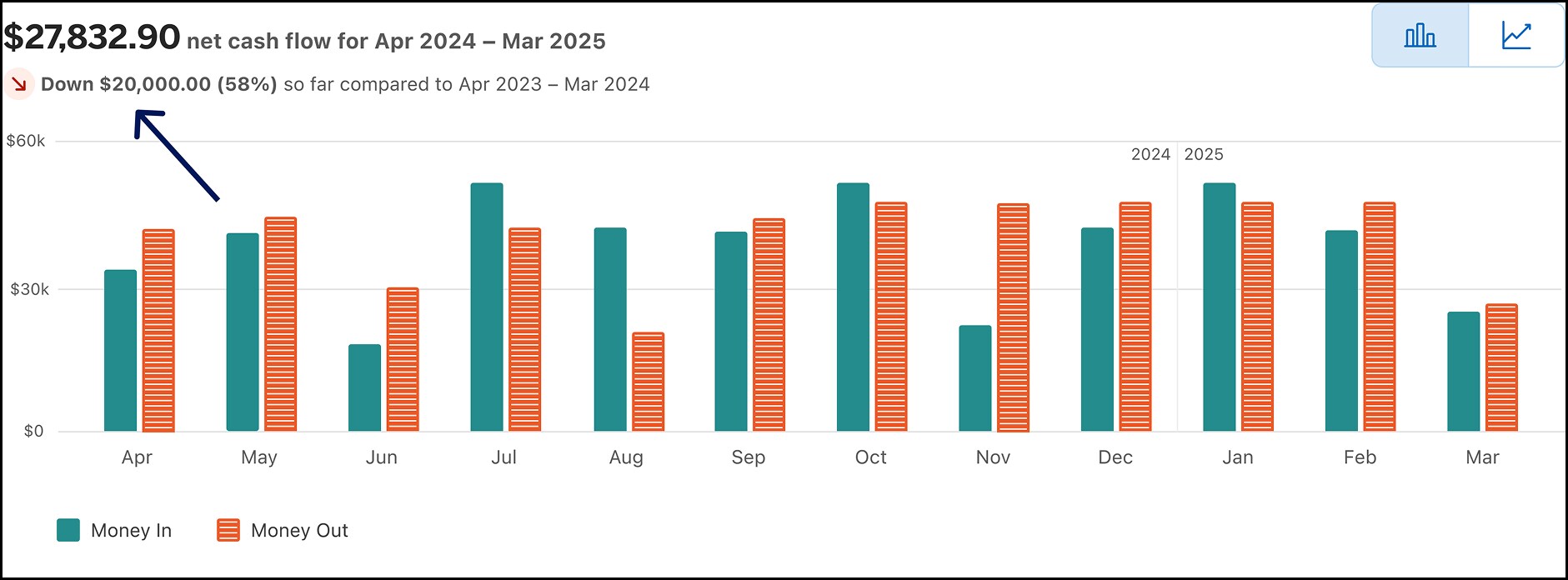

By default, you will see a bar graph showing your last 12 months of net cash flow across all your cash accounts. At the top of the page, you will find a few high-level pieces of information such as the net cash flow, comparisons of cash between time periods, and percentage change in cash flow for the selected periods (numbers are rounded to the nearest dollar amount). The green bars will show the money coming into your business, while the orange bars will represent the money going out. There is also an option to view your cash flow in line graph form. When viewing in line graph form, positive cash is represented in green while negative cash is in red.

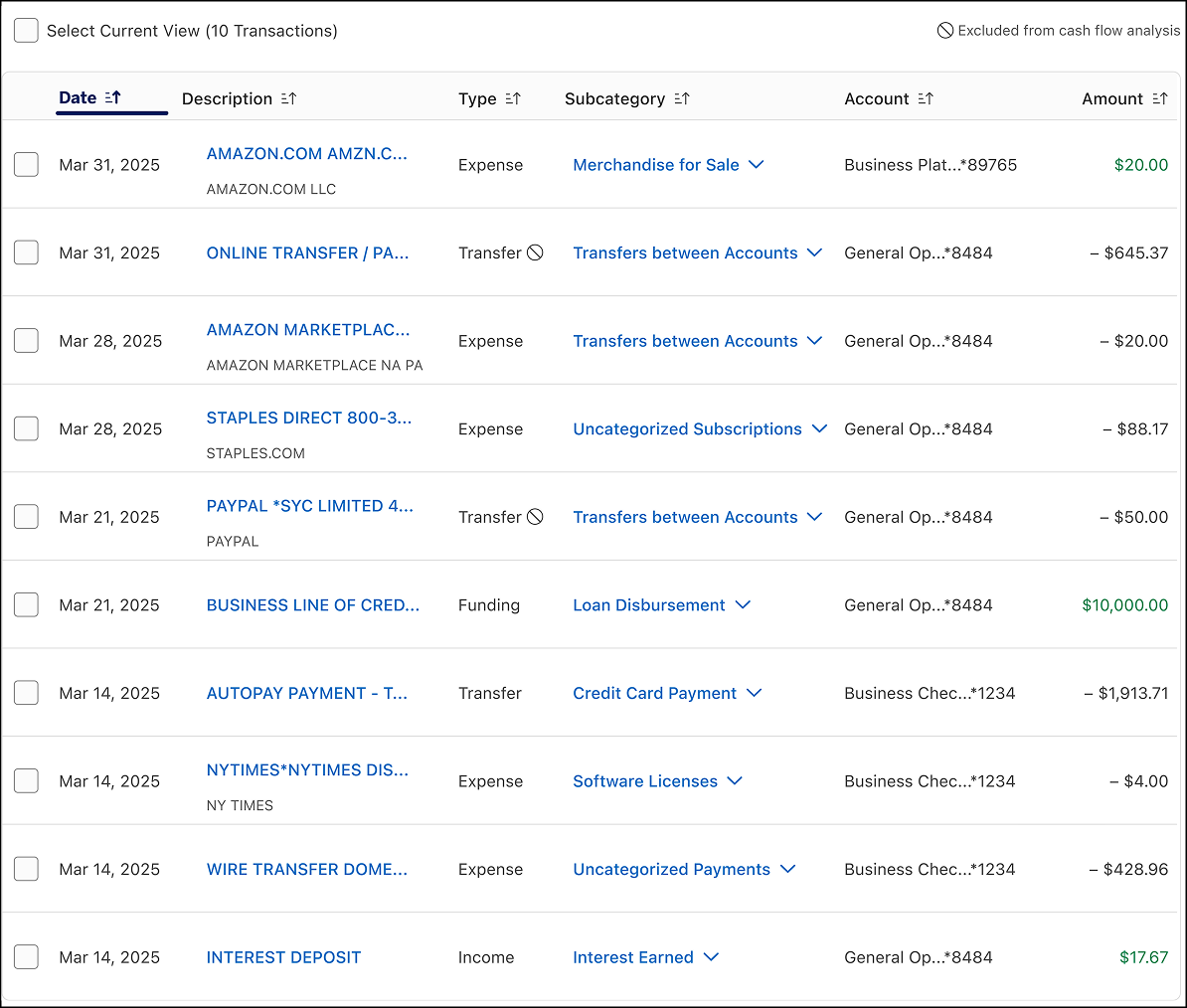

An itemized list of your transactions will appear below the bar or line graph.

For illustrative purposes only

For illustrative purposes only

For illustrative purposes only

What is cash flow?

It’s a term you’ve probably seen around. Cash flow is the amount of cash that comes into and goes out of a business, and it’s an important indicator of financial health.

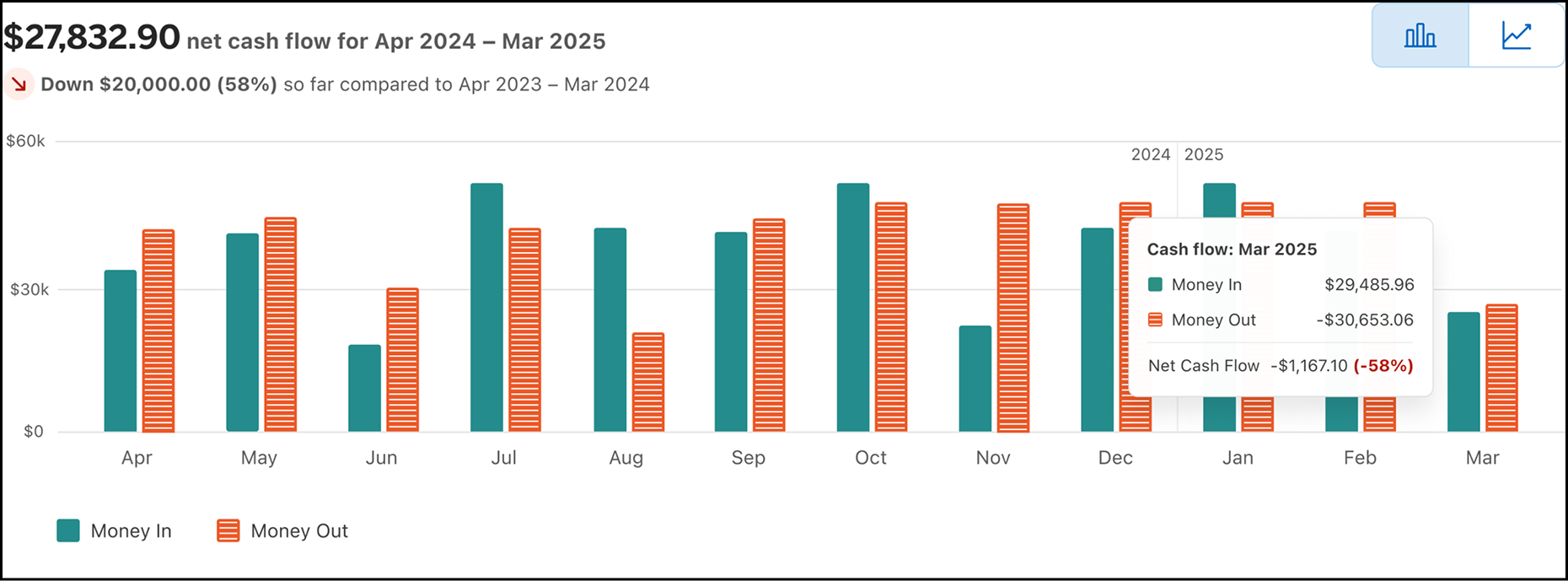

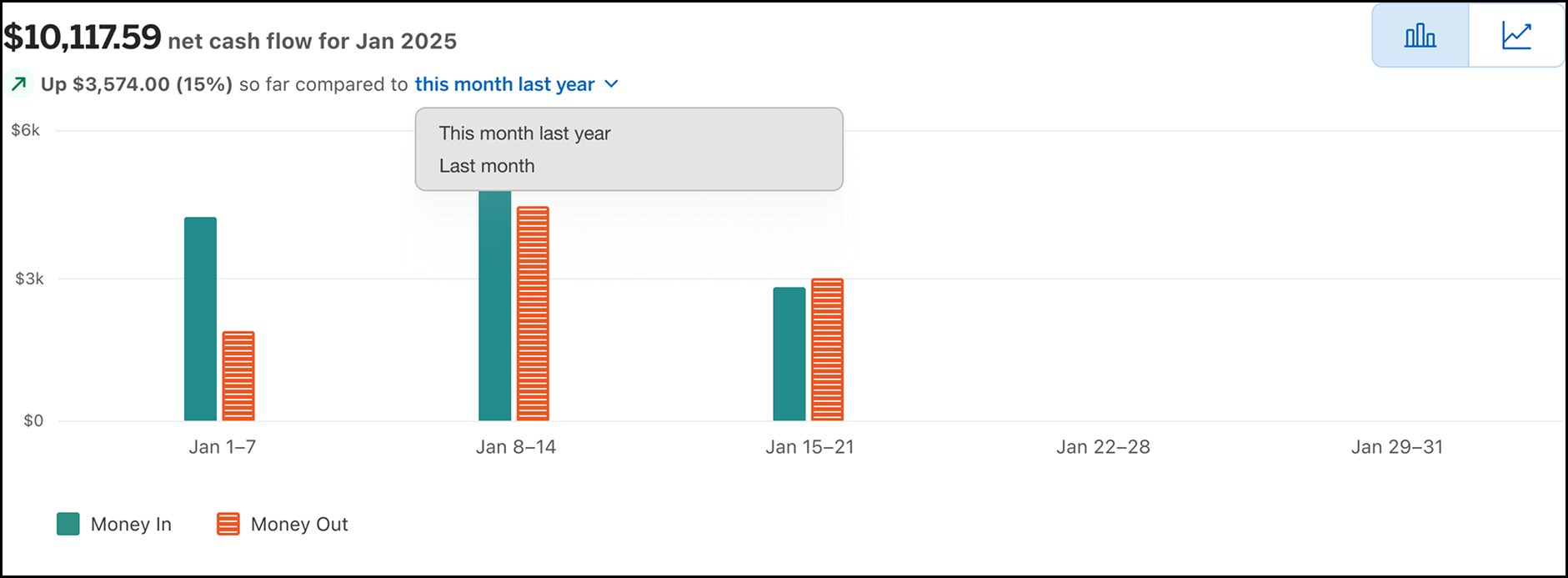

Step 1: Hover over any point of the graph

Hovering over any month on the bar graph will cause a small box to appear on the graph, showing your net cash flow for that time period.

For illustrative purposes only

To view information for a different month, select the desired month from the View by Date dropdown. If you want to review this information as a line graph, you can toggle to the line graph icon found under the View by Account dropdown.

Above the graph, you will find a net cash flow total. Within this area, you can see a comparison between the same period of time last year and how much it has changed in both dollar amount and percentage. The percentage will be rounded to the next whole number.

For illustrative purposes only

Step 2: Choose which data is displayed on the graph

You can change what data is displayed on the graph by using the dropdown boxes on the right side above the graph.

For illustrative purposes only

These allow you to change the time period , as well as which accounts are included. Your options include monthly, quarterly, yearly, and all time periods, as well as the ability to view a custom date range.

Why don’t I see any data?

At the start of a new month, you may not have any transactions yet. In this case, the Cash Flow page will show a zero-dollar balance, and there will be no transactions listed below the chart. Data will begin to appear as new transactions are posted.

If you do not have a business checking account currently linked to Business Blueprint, there will not be any data to display, and you will see a message indicating “No linked accounts.”

To add data sources to your account, follow these instructions to link a new account.

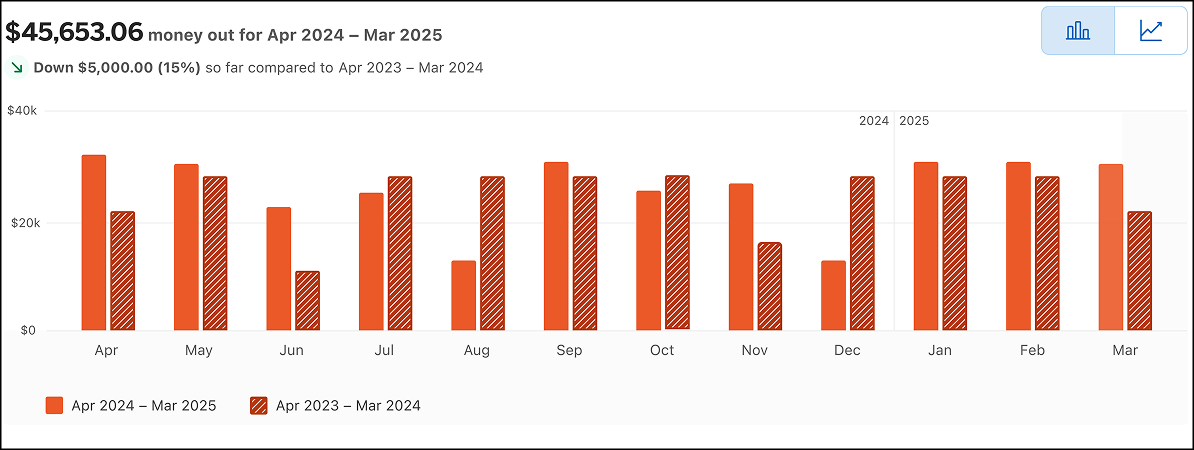

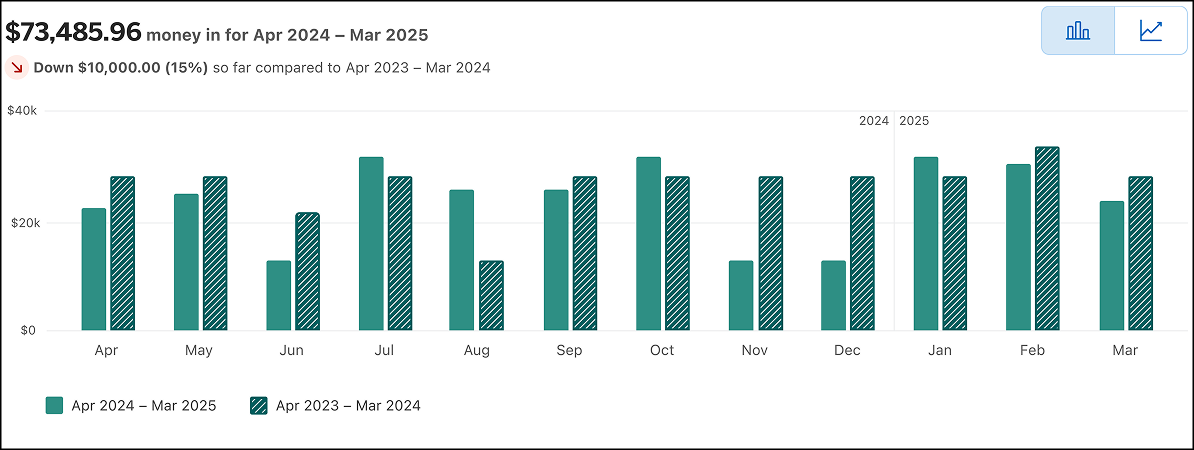

To view either set of data individually, select either “Money In” or “Money Out” on the left side above the graph.

Just like the “Cash Flow” graph, you have the option to view data from different periods or individual accounts, and can review them as bar or line graphs. All the same functionalities exist on each view.

For illustrative purposes only

For illustrative purposes only

STILL NEED HELP?

Reach out to us for further guidance.

Deposit accounts offered by American Express National Bank. Member FDIC.

TERMS AND CONDITIONS

American Express Business Blueprint™

American Express Business Blueprint™ is the small businesses digital experience that allows a customer to view on one digital dashboard summary account information for the following American Express small business products: American Express® Business Cards, American Express® Business Line of Credit, and American Express® Business Checking. The customer can also choose to link their third-party issued business bank accounts and business credit cards to Business Blueprint. Not all third-party accounts or cards can be connected to Business Blueprint. Business Blueprint allows the customer to view data insights and track their business cash flow and expenses by viewing reports that American Express prepares using the customer’s linked account information. While the cash flow management service from Business Blueprint is currently free, each of the business products from American Express that are visible in Business Blueprint has its own fees, eligibility criteria, application process and approval requirements. The Business Blueprint service (including any data insights provided to the customer) does not constitute legal, tax, financial or accounting advice, and is not a substitute for obtaining competent personalized advice from a licensed professional. You should seek professional advice before making any decision that could affect the financial health of your business. American Express makes no representations as to the accuracy, completeness or timeliness of the reports, data or account information that are available to the customer from Business Blueprint.™

American Express® Business Line of Credit

American Express® Business Line of Credit offers access to a commercial line of credit ranging from $2,000 to $250,000; however, you may be eligible for a larger line of credit based on our evaluation of your business. Each draw on the line of credit will result in either a separate installment loan or a single repayment loan. All loans are subject to credit approval and are secured by business assets. Every loan requires a personal guarantee. For single repayment loans, we charge a total loan fee that ranges from 0.95%-1.80% of the amount you borrow for 1-month loans, 1.90%-3.75% for 2-month loans, and 2.85%-6.05% for 3-month loans. Single repayment loans incur a loan fee at origination and the principal and total loan fee are due and payable at loan maturity. There are no required monthly repayments for a single repayment loan. Repaying a single repayment loan early will not reduce the loan fee we charge you. For installment loans, we charge a total loan fee that ranges from 3-9% of the amount you borrow for 6-month loans, 6-18% for 12-month loans, 9-27% for 18-month loans, and 12-18% for 24-month loans. Installment loans incur a portion of the total loan fee for each month you have an outstanding balance. If you repay the total of the principal of an installment loan early, you will not be required to pay loan fees that have not posted for subsequent months. For each loan that you take, you will see the applicable loan fee before you take the loan. Once you take the loan, the loan fees that apply to that loan do not change. We reserve the right to change the loan fees that we offer you for new loans at any time. American Express reserves the right to offer promotions to reduce or waive loan fees from time to time. Not all customers will be eligible for the lowest loan fee. Not all loan term lengths are available to all customers. Eligibility is based on creditworthiness and other factors. Not all industries are eligible for American Express® Business Line of Credit. Pricing and line of credit decisions are based on the overall financial profile of you and your business, including history with American Express and other financial institutions, credit history, and other factors. Lines of credit are subject to periodic review and may change or be suspended, accompanied with or without an account closure. Late fees may be assessed. Loans are issued by American Express National Bank.

Single repayment loans may become available to eligible existing and new Business Line of Credit customers at different times.

American Express® Business Checking

We are currently accepting applications from eligible U.S. businesses. Not all applicants will be approved for a Business Checking account. To learn more about Business Checking, including eligibility, visit https://www.americanexpress.com/en-us/business/checking/.

Membership Rewards® Program

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards® points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo

American Express and Amex are registered trademarks of American Express.