Offers Carousel

-

Travel Assistance and Insurance

-

A Card for them, Rewards for you

-

Partners Loyalty Programs

TRAVEL ASSISTANCE AND INSURANCE

We understand that added peace of mind is key when you travel. That’s why your membership provides you with Platinum Travel Assistance, with benefits and services that accompany you and your eligible Additional Members on your journeys.

PLATINUM TRAVEL SERVICES

Whether you need to book a flight or reserve a table, we are here to help you. We do our best, regardless of the time, to assist you from planning your next getaway or managing an emergency. Simply contact our team of professionals who will help with your needs 24 hours a day, 7 days a week.

Terms and Conditions apply

PRIORITY PASS

As part of The American Express Global Lounge Collection, The Platinum Card® Members can enjoy unlimited, complimentary access to Priority Pass lounges around the world.

Terms and Conditions apply

GLOBAL LOUNGE COLLECTION

You deserve choices. With the American Express Global Lounge Collection®, we give you plenty, including access to 1,400 airport lounges across 650 cities around the world. Whether you’re looking for a place to rest and recharge or somewhere to catch up on work, enjoy our growing network of lounges across 140 countries and counting.

Explore Lounges

Terms and Conditions apply

FINE HOTELS + RESORTS

Indulge even more at some of the world’s most luxurious hotels. Enjoy competitive rates and complimentary benefits that offer an average total value of US$600 at over 1,500 extraordinary properties worldwide when you book Fine Hotels + Resorts through Platinum Travel Services.

Explore Hotels

Terms and Conditions apply

THE HOTEL COLLECTION

Delight your senses when you book The Hotel Collection with Platinum Travel Services. Get a US$100 experience credit* to use during your stay**.

* Experience credit varies by property.

** 2-night minimum stay required.

HILTON HONORS GOLD ELITE STATUS

With Hiton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio and earn reward stays faster with Hilton Honors Bonus Points.

Terms and Conditions apply

MELIÁREWARDS GOLD

As a member of The Platinum Card®, we’d like to invite you to take advantage of a selection of tempting privileges at participating Meliá Hotels International properties. With a rich selection of hotels in some of the most charming corners of the world.

Terms and Conditions apply

MARRIOTT BONVOY™ GOLD ELITE STATUS

As a Platinum Card® Member, you can upgrade to Marriott Bonvoy® Gold Elite status without meeting any stay requirements. Terms and limitations apply.

Terms and Conditions apply

HERTZ GOLD PLUS REWARDS® FIVE STAR

As a Platinum Card® Member, enjoy special benefits such as discounts, upgrades, and priority service when renting with Hertz.

Terms and Conditions apply

PLATINUM CRUISE

Explore the world and sail off into the sunset; enjoy up to US$300 in savings and other benefits.

Terms and Conditions apply

MIAMI EXPERIENCES

Platinum Card Members can access special offers for experiences located in Miami, such as Miami HEAT games, select shows at Adrienne Arsht Center and more.

Go to the Offers tab in the Experiences App for upcoming experiences

Terms and Conditions apply

GLOBAL EXPERIENCES

An exclusive program that gives The Platinum Card® Members the chance to purchase tickets to some of the most desirable events, often before they go on sale to the general public.

Go to the Offers tab in the Experiences App for upcoming experiences

Terms and Conditions apply

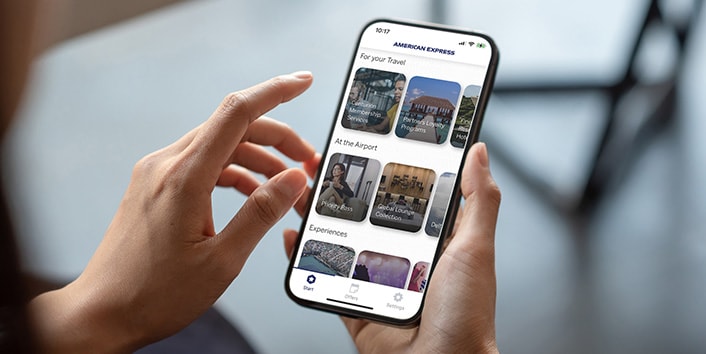

AMEX EXPERIENCES APP

Download the Experiences App and get exclusive access to Global Experiences, Miami Experiences, reserve a table at the world’s most celebrated restaurants and enroll in our Partners Loyalty Programs, all from your mobile device.

RESTAURANTS

Whether you are looking for a local hotspot or a world-famous venue, a table for two or two hundred, we can help. If you are looking for new ideas close to home or suggestions in a strange city, our experts have local knowledge around the world.

Make a reservation through the Experiences App or contact the number on the back of your Card

MEMBERSHIP REWARDS

Membership Rewards points are our way of saying ‘thank you’ for using your Card. The way we see it, you’ve earned them, so you should be able to use them however you want. There are no limits to how many points you can earn and they do not have an expiration date. Enjoy!

Terms and Conditions apply

MEMBERSHIP REWARDS

Membership Rewards points are our way of saying ‘thank you’ for using your Card. The way we see it, you’ve earned them, so you should be able to use them however you want. There are no limits to how many points you can earn and they do not have an expiration date. Enjoy!

Terms and Conditions apply

2X MEMBERSHIP REWARDS POINTS

Exclusively for you. Double reward for eating out. Our Membership Rewards® points program got tastier. The Platinum Card® gives you two points for every eligible dollar spent in restaurants* within the U.S. So dine on and start accumulating points that you can redeem for your next vacation, or to continue your gastronomical journey.

*Not valid for restaurants located within another establishment.

Terms and conditions apply

AMEX OFFERS

From in line at the store to online from the couch, add Amex Offers to your eligible Card and earn rewards on qualifying purchases.

Access Online Services to explore offers

NO PRE-SET SPENDING LIMIT

Your The Platinum® Card has no pre-set spending limit which gives you purchasing power that adjusts with the use of your Card.

Terms and Conditions apply

PURCHASE PROTECTION

When life happens, American Express® has your back. With Purchase Protection get coverage on Accidental Damage or Theft, on purchases made with your eligible Card in the USA, for up to 90 days from the date of the purchase of the Covered Item. You will be reimbursed only for the amount charged to your Account.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

EXTENDED WARRANTY

The Extended Warranty Program can provide up to one additional year on original warranties of five years or less on purchases of Covered Products. It is an embedded benefit of your membership and requires no enrollment.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

PLATINUM TRAVEL ASSISTANCE

Your covered amount for emergency medical services offered as part of Platinum Travel Assistance [– Medical Assistance] can provide up to US$250,000 per trip.*

*Benefit limits apply. Members whose permanent address of residence is in Spain or Switzerland are not eligible for Platinum Travel Assistance. Please read important exclusions, restrictions and Terms and Conditions.

BAGAGGE ASSISTANCE

We understand that added peace of mind is key when you travel. With your Platinum Card, you have access to Baggage Assistance, which can provide services in the case of a loss of checked baggage while on an eligible trip.*

*Benefit limits apply. Please read important exclusions, restrictions and Terms and Conditions.

LEGAL REFERRAL AND ASSISTANCE

Should you need legal defense, Platinum Travel Assistance will provide legal assistance in the form of advanced legal and bail fees, up to US$10,000 per trip. All legal assistance funds advanced will be charged to your Platinum Card account automatically.*

*Benefit limits apply. Please read important exclusions, restrictions and Terms and Conditions.

TRAVEL INCONVENIENCE

The Travel Inconvenience Insurance Plan provides benefits in the event of: Missed Departures and Missed Connections; Delay, Cancellation or Overbooked Flights; and Luggage delay when the Covered Trip is purchased and charged to your account.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

TRAVEL ACCIDENT INSURANCE

You may have coverage of up to US$500,000 in case of loss of life or dismemberment while traveling on a Common Carrier Conveyance (air, land or water vehicle other than a rental), when the entire fare has been charged to the Card.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

CAR RENTAL LOSS & DAMAGE INSURANCE

When you use your eligible Card to reserve and pay for the entire rental and decline the Collision Damage Waiver (CDW) at the Rental Company counter, you can be covered for Damage to or Theft of a rental vehicle for up to US$50,000 in a Covered Territory up to 30 days.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms. Not all vehicle types or rentals are covered. Coverage is not available in all territories. This product provides excess coverage and does not include liability coverage.

EXTENDED WARRANTY

The Extended Warranty Program can provide up to one additional year on original warranties of five years or less on purchases of Covered Products. It is an embedded benefit of your membership and requires no enrollment.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

PURCHASE PROTECTION

When life happens, American Express® has your back. With Purchase Protection get coverage on Accidental Damage or Theft, on purchases made with your eligible Card in the USA, for up to 90 days from the date of the purchase of the Covered item. You will be reimbursed only for the amount charged to your Account.*

*Terms, conditions, exclusions, and limitations apply. Please see full terms

AMEX APP

Access your American Express® account from virtually anywhere with the Amex® App. Take advantage of what your account has to offer. Download the Amex® App on Apple Store or Google Play.

Terms and Conditions apply

ONLINE SERVICES

Check your balance, pay your account, view recent transactions, redeem Membership Rewards points, and much more.

Terms and Conditions apply

AMEX EXPERIENCES APP

Download the Experiences App and get exclusive access to Global Experiences, Miami Experiences, reserve a table at the world’s most celebrated restaurants and enroll in our Partners Loyalty Programs, all from your mobile device.

ADDITIONAL CARDS

Request Additional Cards to your account and earn greater rewards by sharing the multiple benefits and exceptional service with your loved ones.

Terms and Conditions apply

CARD REPLACEMENT

Because your peace-of-mind comes first, in the event of theft or loss of your Card, our Card RepIacement and Protection service will send you a new one within 3 to 5 business days. Simply call the number on the back of your Card.

EXPRESS CASH

Express Cash allows you to use your Charge Card to withdraw cash from your designated bank account in more than 500,000 participating ATM locations worldwide in an easy and secure way.

Terms and Conditions apply

NO PRE-SET SPENDING LIMIT

The Platinum® Card has no pre-set spending limit which gives you purchasing power that adjusts with the use of your Card.

Terms and Conditions apply

SAFEKEY®

Shopping online is convenient and safe when you have American Express SafeKey®, an extra layer of protection. For your convenience, you're automatically enrolled in SafeKey and don't need to take any additional steps other than making sure that your email address is up to date.

TRAVEL ASSISTANCE AND INSURANCE

We understand that added peace of mind is key when you travel. That’s why your membership provides you with Platinum Travel Assistance, with benefits and services that accompany you and your eligible Additional Card Members on your journeys.

Card Agreements I Contact Us I Privacy center I Terms of Service I Security Center

Users of this site agree to be bound by the terms of the American Express Web Site Rules and Regulations.

© 2023 American Express Travel Related Services. All rights reserved