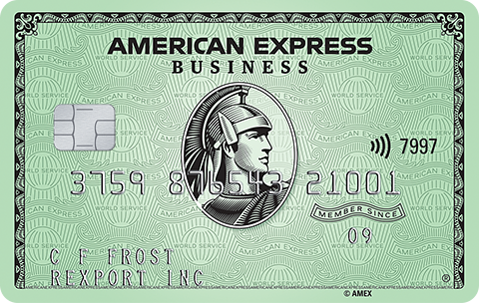

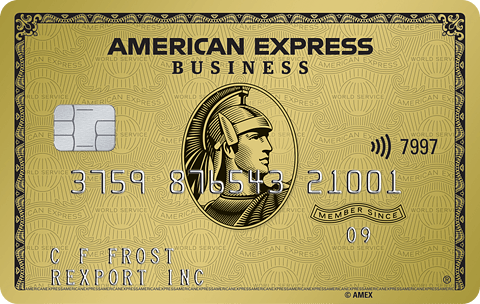

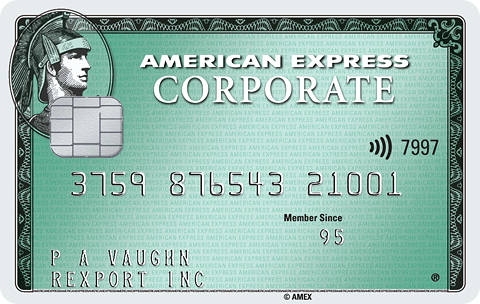

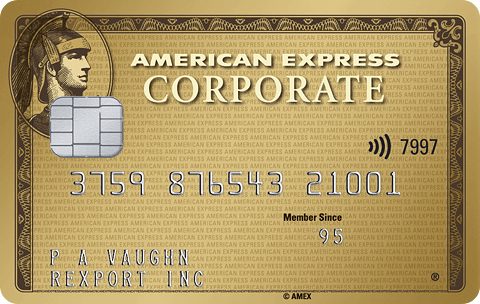

The American Express Corporate Card

Convenient and rewarding expense management.

The American Express Corporate Card provides your employees with a flexible and safe payment method virtually everywhere in the world, while supporting cost control and helping to deliver savings.

The annual fee for the Corporate Card is €60.1

Convenient and rewarding expense management.

The American Express Corporate Card provides your employees with a flexible and safe payment method virtually everywhere in the world, while supporting cost control and helping to deliver savings.

The annual fee for the Corporate Card is €60.1

Control over your finances and cashflow management

-

Insight and control over company expenses with extended management information.

-

Benefit from an extended payment period of up to 58 calendar days.

-

The American Express Corporate Card offers a flexible and safe payment method for your employees worldwide.

-

The card can be used for a wide range of business expenses, such as flights, hotels, restaurants, office supplies, parking costs, etc.

Safe (online) payments

-

You can pay safely everywhere with the Corporate Card. You are fully protected in the event of fraud or theft of the card, with no excess.

-

Small amounts up to € 50 can be paid contactless.

-

Pay with American Express and Apple Pay for even more secure no-touch payments.

-

If authorised by the company, the Cardmember can use Express Cash* to withdraw cash at ATMs with the American Express logo worldwide.

Be rewarded for your expenses**

-

The Membership Rewards programme is optional for the Corporate Card and the company must first approve participation. The annual contribution is €25 per card per year. When participating in the programme, the Cardmember can earn one point for each euro spent with the card.

-

Membership Rewards can be redeemed for, for example, hotel stays and flight. Points can also be transferred to loyalty programs from airline and hotel partners (e.g. the Flying Blue programme from KLM).

-

Learn more about the Membership Rewards programme (in Dutch).

World-class service

-

Several service teams are at your disposal to help manage your Corporate Card programme.

-

Lost or stolen card? Wherever you are, we will take care of your replacement card, usually within 24 hours.

-

Online Services - Review recent transactions, download statements and view and/or modify your PIN.

Additional insurances***

-

Business Travel Accident Insurance - coverage up to €350,000 for the consequences of an accident while travelling on public transport paid with the Corporate Card.

-

Business Travel Inconvenience Insurance - cover for flight delays, missed connections and delayed or lost luggage with a maximum cover of €1,050 on flights paid with the Corporate Card.

-

Baggage and Personal Possessions - cover for theft, loss or damage to luggage during trips abroad. Maximum total cover of €5,000 per trip.

Yes, I'm interested.

Criteria for applying for a Corporate Card programme:

- Your company has a minimum revenue of €1 million.

- Your business must have been registered with the Chamber of Commerce for at least two years.

- Your company has a current bank account in euros with a Dutch bank.

Complete your details and we will contact your within two working days.

Or call us for more information on: +31 (0)20-504 8707.

Conditions

1 The standard annual fee for a Corporate Card is €60. The number of cards that you need determines the annual fee per card.

* Express Cash. After approval of the company, Cardmemebrs can register separately for the Express Cash service. Up to €700 in local currency can be withdrawn per week. Click here to find ATMs.

** Enrolment for Membership Rewards is required. Participating Membership Rewards partners, available rewards, and point levels are subject to change without notice. Eligibility is based upon the company's participation in the Membership Rewards programme.

*** You can read all about the various insurance benefits in the Insurance Terms below.

Travel Accident Insurance Travel Inconvenience Insurance Baggage and Personal Possessions Insurance