Rewards up in the air?

Earn Airpoints DollarsTM and Status Points, fast.

WELCOME OFFER

300 Bonus Airpoints DollarsTM

Get rewarded with 300 bonus Airpoints Dollars™ when you apply, are approved and spend $1,500 on your new Amex Airpoints Platinum Card within the first 3 months. New Amex Card Members only1.

| Annual Fee: | $195 p.a. |

| Card Type: | Credit Card |

| Interest Free Period: | Up to 55 days5 |

| Interest Rate: | 22.95% p.a. on purchases6 |

| View key information for this Card and American Express Airpoints Platinum Card Terms and American Express Credit Card Terms and Conditions |

| Learn more about Credit Cards to ensure its right for you |

Featured Benefits

Earn fast! $70 spend = 1 Airpoints Dollar2

The fastest Airpoints Dollar earning Platinum Card in NZ.

Earn your way to the next tier. $250 = 1 Status Point8

Earn status points to climb tiers and enjoy benefits such as priority service, lounge access, seat upgrades and extra baggage allowance.

Non-expiry of Airpoints Dollars16

Your Airpoints Dollars will never expire as long as you hold a current Card16.

Airport Lounge Access

Also enjoy 2 complimentary passes per year into VIP lounges with Priority Pass™ including the Strata Lounge at Auckland International Airport9. Enrolment required.

The Centurion® Lounge

Enjoy 2 complimentary entries per calendar year to the Centurion Lounge at Sydney or Melbourne International Airport the next time you cross the Tasman7

Koru Lounge Discount

Save $255 on your Koru joining fee when you become an Air New Zealand Koru member and a Koru annual fee discount (save $145 p.a.) for as long as you hold the Card10.

Experience more with Airpoints Platinum

NZ and International Travel Insurance

Receive complimentary domestic and international Travel Insurance when you use your Card to pay for your return trip. Terms, conditions and exclusions apply (such as maximum age limits, pre-existing medical conditions and cover limits)3.

Smartphone Screen Cover

Smartphone screen repair insurance comes complimentary when you pay for your smartphone outright, or your monthly smartphone contract or SIM only plan with your Card. You’ll be covered for up to $500 towards front screen repairs and an excess of 10% of the claimed amount applies3.

Additional Cards are $0

Earn more Airpoints Dollars by getting Additional Cards for family members at no extra fee4, up to 4 Additional Card Members.

Apple Pay

Make easy and secure purchases with American Express and Apple Pay®. With a quick setup on your Apple device, you can make payments on the go15.

Example Monthy household spend:

$800

Groceries

$480

Utilities/Bills

$240

Petrol

$300

Shopping

$120

Entertainment

$260

Home

$300

Dining and Cafe's

At the Platinum rate

$2,500 |

= A 42 |

= A 508 |

| spend per month | per year |

$2,500 |

= A 42 |

= A 508 |

| spend per month | per year |

See how fast everyday

spend could earn you rewards

Get the most out of your Amex Card

Now accepted in more places

75,000 places across NZ now welcome American Express Cards since the start of 2019*.

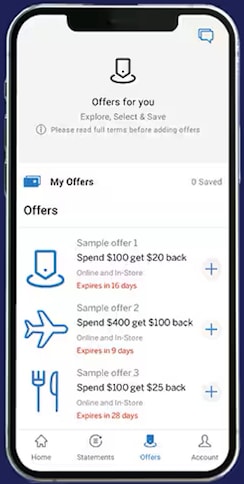

Outstanding Amex App

See how the Amex App makes having an Amex Card a breeze

So many ways to use Airpoint Dollars

Use your Airpoints Dollars for adventures or shop at the Airpoints Store.

Interested? Check the eligibility criteria.

To apply for an American Express Airpoints Platinum Card, you’ll need to be able to meet the following criteria:

- Be aged 18 or over

- Have no history of bad debt or payment default

- Have the right to work in New Zealand, and

- If self-employed, have been trading for at least 18 months (or 12 months if I hold an existing American Express issued Card)

Documents and information to have ready:

- NZ Driver’s Licence number (if you have one)

- Details of your income, expenses and debts

- Proof of your annual income and employment details (e.g. Inland Revenue Department (IRD) Statement, payslips)

Ready to apply ?

The American Express Airpoints Card

WELCOME OFFER

$0 Annual Card fee.

Be rewarded with 50 bonus Airpoints DollarsTM11.

The American Express

Gold Rewards Card

WELCOME OFFER

Get $200 back when you apply, are approved and spend $1,500 on your new Card within the first 3 months.

New Card Members only. T&Cs apply12.

Our fastest earn rate. Earn 2 Membership Rewards points per $1 spent13

Get up to $200 Dining Credit14

*Source: Internal American Express data based on Merchant locations setup between 1 January 2019 and 31 May 2023

- Bonus & Eligibility. Offer only available to new American Express Card Members who apply, are approved and spend $1,500 or more on eligible purchases on their new Card in the first 3 months from Card approval date. Eligible purchases do not include purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Card Members who currently hold or who have previously held any other Card product offered by American Express International (NZ), Inc in the preceding 18 month period are ineligible for this offer. 300 bonus Air New Zealand Airpoints Dollars will be awarded to the eligible Card Member’s Account 8-10 weeks after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- Airpoints Terms & Conditions. Subject to the American Express Airpoints Platinum Card Benefits Terms and Conditions available here. Status Points and Airpoints Dollars are not earned on purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Air New Zealand Airpoints Programme terms and conditions also apply. Airpoints Dollars and Status Points earning rates are subject to change with reasonable notice.

- Insurance. For all non-emergency insurance claims, please follow the link www.americanexpress.com/newzealand/claims. This insurance is subject to Terms, Conditions and exclusions – see the full insurance Terms and Conditions for your American Express Airpoints Platinum Card available at here. You must use your American Express Airpoints Platinum Card to pay for your return trip or eligible items to be covered under the insurance or pay for your smartphone or monthly contract in order to be covered under the Smartphone Screen Insurance. Maximum of 2 claims per 12 month period, per Account, maximum cover of $500 per claim and an excess of 10% of the claimed amount applies. Waiting periods may apply. The insurance is underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) under a group policy held by American Express International (NZ), Inc. (Company Number 867929). Card Members are not a party to the group policy, but may be able to claim under it as third party beneficiaries. This communication does not take into account your objectives or financial situation. You should read the full Terms and Conditions to decide if this insurance meets your needs. Domestic & International Travel Insurance. American Express Airpoints Platinum Card Insurances are underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) (Chubb) and are subject to the terms, conditions and exclusions contained in the American Express Airpoints Platinum Card Insurances policy of insurance between American Express International (NZ) Inc. (Company No. 867929) (American Express) and Chubb. This product page does not take into account your objectives, financial situation or needs. It is important for you to read the terms and conditions and consider the appropriateness of that insurance in relation to your individual requirements.

- Additional Cards. Additional Card Members must be 18 years of age or older. The basic Card Member will be liable for all spending on Additional Cards.

- 55 Days Interest Free. You will have up to 55 days interest free on purchases provided you pay the full closing balance of your monthly statement by the due date each month. There is no interest free period on balance transfers or if you carry forward a balance from the previous statement period. The total of interest free days will depend on when you make the purchase and when your statement is issued.

- Interest Rate. Interest rate does not apply for Cash Advances and associated fees and charges. Visit here for more information.

- The Centurion® Lounges. Entry into The Centurion® Lounges is governed by the full Terms and Conditions available here. All entrants must adhere to the General Conditions of Entry. To access lounge, present your American Express Airpoints Platinum Card and government issued ID. American Express Airpoints Platinum Card Members are entitled to a total of two (2) entries into The Centurion® Lounges in Australia, per calendar year (1st January to 31st December). Complimentary access is available for the Card Member’s children 17 years and younger. Card Members wishing to bring additional guests may be subject to a charge that is to be processed on the Card Member’s American Express Card.

- Status Points. You can earn up to half the Status Points you need to reach or maintain your Silver or Gold Airpoints tier status by making purchases on your Credit Card. You need to earn at least 900 Status Points on Air NZ operated flights to change from Gold to Gold Elite, and 810 Status Points on Air NZ operated flights to maintain Gold Elite, and the balance can be earned by making purchases on your Credit Card. Visit airnewzealand.co.nz/airpoints for details of the number of Status Points required. For full list of exclusions, please refer to The American Express Airpoints Platinum Card Benefits Terms and Conditions available here.

- Priority Pass. Enjoy access to over 1,300 lounges in 148 countries, please visit www.prioritypass.com and log in for a list of available lounges. Subject to the Terms and Conditions of the Priority Pass™ program. Priority Pass is an independent airport lounge access program. Basic American Express Airpoints Platinum Card Members are entitled to two complimentary visits within each 12-month membership period, after which every visit would be charged to your American Express Card as per the prevailing rates available at www.prioritypass.com. Some lounges do not admit guests. To access participating Priority Pass lounges, present your Priority Pass card and confirmed airline boarding pass. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, including house rules of participating lounges, and can be viewed at www.prioritypass.com. Enrolment required. Please allow 4-6 weeks from enrolment to receive your Priority Pass card and membership package. To enrol click here (upon Amex Card receipt). Once you are successfully enrolled, your physical membership card, membership number and online PIN will be sent to you.

- Koru Membership. The Basic Card Member shall be entitled to a waiver of the Koru joining fee and a discount of $145 on one-year, individual Koru membership. The Koru joining fee waiver and the discount on the Koru annual membership fee only applies to Card Members and may only be used in conjunction with one-year Koru memberships for individuals. The Koru joining fee and/or Koru annual membership fee will not be refunded if it has already been paid to Air New Zealand. Koru terms and conditions apply.

- Bonus and Eligibility. Offer only available to new American Express Card Members who apply online, are approved and spend $750 on their new Card in the first 3 months from Card approval date. Card Members who currently hold or who have previously held any other Card product offered by American Express International (NZ), Inc in the preceding 18 month period are ineligible for this offer. 50 bonus Air New Zealand Airpoints Dollars will be awarded to the eligible Card Member’s Account 8-10 weeks after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- Bonus and Eligibility. To receive $200 Credit, you must apply online, be approved and spend $1,500 or more on eligible purchases on your new Card in the first 3 months from the Card approval date. Please allow 8–10 weeks for the credit to be credited to your Account after the spend criteria has been met. Card Members who opt in to receiving payment alerts, may receive a payments received email once the $200 Credit has been applied to their Account. The credit is not redeemable for cash or other payment form. The credit will not be applied to your Account if it has been suspended or cancelled. The Statement Credit may be reversed if your qualifying purchase is refunded or cancelled. Card Members who currently hold or who have previously held any Card product issued by American Express International (NZ), Inc. in the preceeding 18 month period are ineligible for this offer. Eligible purchases do not include annual Card fees, cash advances, interest, balance transfers, fees and charges for traveller’s cheques and foreign currencies. This advertised offer is not applicable or valid in conunction with any other advertised or promotional offer and may be removed at any time.

- Membership Rewards Points. Subject to the Terms and Conditions of the Membership Rewards Programme available at www.membershiprewards.co.nz/termsandconditions

- Annual Dining Credit. Valid at participating Dining Collection restaurants only. Limited to one $100 credit each defined calendar period, per Gold Rewards Card Account. The defined calendar periods are between 1 January and 30 June, and between 1 July and 31 December. Limited to a maximum of two credits at a total of $200 each year, per Gold Rewards Card Account. Your Card must be charged prior to the end of each defined calendar period to be eligible for the credit in the defined calendar period. Spend on Additional Cards will count towards the offer. Excludes transactions where you do not spend directly with your Card at a participating Dining Collection restaurant. Credit should appear on your billing statement within 5 business days from qualifying spend but may take up to 90 days from the end of the defined calendar period. Excludes transactions made through a third-party establishment or payment processor. Credit is not redeemable for cash or other payment form. Credit will not be applied to your Gold Rewards Card Account if your Card has been suspended or cancelled. Credit may be reversed if your qualifying purchase is refunded or cancelled. If you hold multiple American Express Cards linked to one Membership Rewards® account, the Credit will be credited to the Primary Card Account only.

- Apple Pay is a trademark of Apple Inc.

- Non-expiry of Airpoints Dollars. As long as you are the nominated earner (or primary Card Member). Air New Zealand Airpoints Programme Terms and Conditions apply.

Do you want Wānaka,

or less Wānaka?

Get the fastest Airpoints DollarTM️ earning Platinum Card, and start dreaming of your next travel adventure.

The American Express®

Airpoints Platinum Card

400 bonus Airpoints DollarsTM️

Get rewarded with 400 bonus Airpoints DollarsTM when you apply online by 26 May 2025, are approved and spend $1,500 on your new Amex Airpoints Platinum Card within the first 3 months. New Amex Card Members only1.

The faster you earn Airpoints, the sooner you can spend your Airpoints Dollars to get even more out of your next trip.

Key Information

| Annual Fee: | $195 p.a. |

| Card Type: | Credit Card |

| Interest Free Period: | Up to 55 days2 |

| Interest Rate: | 22.95% p.a. on purchases3 |

View key information for this Card and American Express Airpoints Platinum Card Terms and Learn more about Credit Cards to ensure its right for you

Fastest earn rate

Earn fast! $70 spend = 1 Airpoints Dollar5. The

fastest Airpoints Dollar earning Platinum Card in

NZ.

Lounge Access

Get discounts and exclusive entry passes to a selection of airport lounges, so you can relax in luxury while you wait for your next flight to arrive4.

Complimentary Travel Insurance

Complimentary domestic and international apply. Travel Insurance when you use your Card to pay for your return trip6.

with Airpoints Platinum

More Lounge Benefits

Koru Lounge Discount

Save $255 on your Koru joining fee when you become an Air New Zealand Koru member and a Koru annual fee discount (save $145 p.a.) for as long as you hold the Card7.

Airport Lounge Access

Also enjoy 2 complimentary passes per year into VIP lounges with Priority PassTM including the Strata Lounge at Auckland International Airport4.

The Centurion® Lounge

Enjoy 2 complimentary entries per calendar year to the Centurion Lounge at Sydney or Melbourne International Airport the next time you cross the Tasman8.

Earn your way to the next tier. $250 = 1 Status Point8

Earn status points to climb tiers and enjoy benefits such as priority service, lounge access, seat upgrades and extra baggage allowance.

More Protection

Smartphone Screen Cover

Complimentary Smartphone screen repair insurance when you pay for your smartphone outright, or your monthly smartphone contract or your SIM-only plan with your Card. You’ll be covered for up to $500 towards front screen repairs and an excess of 10% of the claimed amount applies6.

More Rewards

Apple Pay

Make easy and secure purchases with American Express and Apple Pay®. With a quick setup on your Apple device, you can make payments on the go15.

$0 Additional Cards

Get Additional Cards for family members at no extra fee11, for up to 4 Additional Card Members.

Koru Lounge Discount

Save $255 on your Koru joining fee when you become an Air New Zealand Koru member and a Koru annual fee discount (save $145 p.a.) for as long as you hold the Card7.

Airport Lounge Access

Also enjoy 2 complimentary passes per year into VIP lounges with Priority PassTM including the Strata Lounge at Auckland International Airport4.

The Centurion® Lounge

Enjoy 2 complimentary entries per calendar year to the Centurion Lounge at Sydney or Melbourne International Airport the next time you cross the Tasman8.

Earn your way to the next tier. $250 = 1 Status Point8

Earn status points to climb tiers and enjoy benefits such as priority service, lounge access, seat upgrades and extra baggage allowance.

Smartphone Screen Cover

Complimentary Smartphone screen repair insurance when you pay for your smartphone outright, or your monthly smartphone contract or your SIM-only plan with your Card. You’ll be covered for up to $500 towards front screen repairs and an excess of 10% of the claimed amount applies6.

Apple Pay

Make easy and secure purchases with American Express and Apple Pay®. With a quick setup on your Apple device, you can make payments on the go15.

$0 Additional Cards

Get Additional Cards for family members at no extra fee11, for up to 4 Additional Card Members.

earning Platinum Card

Set your Amex Card as the default payment method for online subscriptions and payments, shops, restaurants and even groceries and petrol. It all helps towards your total balance. Every $70 spent = 1 Airpoints Dollar5.

From groceries, fuel, to shopping online, earn rewards in the places you spend the most. We’ve added thousands of new places where American Express is welcome across NZ since 2019* .

making transactions

Insurance

Pay for return travel with your American Express Platinum Card, or Membership Rewards points, and you’ll be covered with a range of insurance.

Rental Vehicle Excess Cover

Receive vehicle insurance excess cover when you pay for car hire with your Card6.

Transport Accident Cover

Be covered if you have an accident while travelling6.

Travel Insurance Cover

Receive complimentary cover for you and your family6.

Medical Emergencies Expenses Cover, including Repatriation

Have peace of mind with cover (including repatriation)6.

Personal Liability Cover

Your Card also includes Personal Liability Cover6.

Baggage, Money and Documents Cover

Your bags, money and documents will be covered6.

Travel Inconvenience Cover

You’ll also be covered for travel cancellations6.

For covers included and sub-limits, refer to the benefits section of the American Express Airpoints Platinum Card Insurances Terms and Conditions.

Service and protection

Global Card support

Amex support is there for you with help, wherever you are in the world, for whatever you need and whenever you need it. You can call our Customer Service Centre anytime, day or night. Just call the number on the back of your Card.

Enjoy safety and security

You’ll also be protected against fraudulent transactions made using your Card details with our Fruad Protection Guarantee12.

Card purchases are protected

Use your Card to make purchases and our Purchase Protection will cover eligible items that are damaged or stolen within 90 days of purchase11. Plus, the Buyer’s Advantage Cover extends the manufacturer’s original warranty by up to 12 months on eligible products.

Pay for return travel with your American Express Platinum Card, or Membership Rewards points, and you’ll be covered with a range of insurance.

Rental Vehicle Excess Cover

Receive vehicle insurance excess cover when you pay for car hire with your Card6.

Transport Accident Cover

Be covered if you have an accident while travelling6.

Travel Insurance Cover

Receive complimentary cover for you and your family6.

Medical Emergencies Expenses Cover, including Repatriation

Have peace of mind with cover (including repatriation)6.

Personal Liability Cover

Your Card also includes Personal Liability Cover6.

Baggage, Money and Documents Cover

Your bags, money and documents will be covered6.

Travel Inconvenience Cover

You’ll also be covered for travel cancellations6.

For covers included and sub-limits, refer to the benefits section of the American Express Airpoints Platinum Card Insurances Terms and Conditions.

Global Card support

Amex support is there for you with help, wherever you are in the world, for whatever you need and whenever you need it. You can call our Customer Service Centre anytime, day or night. Just call the number on the back of your Card.

Enjoy safety and security

You’ll also be protected against fraudulent transactions made using your Card details with our Fruad Protection Guarantee12.

Card purchases are protected

Use your Card to make purchases and our Purchase Protection will cover eligible items that are damaged or stolen within 90 days of purchase11. Plus, the Buyer’s Advantage Cover extends the manufacturer’s original warranty by up to 12 months on eligible products.

Ready to apply? Check your eligibility first.

To apply for an American Express Airpoints Platinum Card, you’ll need to be able to meet the following criteria:

- Be aged 18 or over

- Have no history of bad debt or payment default

- Have the right to work in New Zealand, and

- If self-employed, have been trading for at least 18 months (or 12 months if I hold an existing American Express issued Card)

Documents and information to have ready:

- Air New Zealand Airpoints™ Number

- NZ Driver’s Licence number (if you have one)

- Details of your income, expenses and debts

- Proof of your annual income and employment details (e.g. Inland Revenue Department (IRD) Statement, payslips)

The American Express Airpoints Card

$0 Annual Card fee $100 spend = 1 Airpoints DollarTM13

The American Express Gold Rewards Card

Earn 2 Membership Rewards® points per $1 spent14. Get up to $200 Dining Credit15.

Make it easy with

the Amex App

From purchase alerts, 24/7 chat, paying with

points to amazing offers, the Amex App makes

having an Amex Card a breeze.

- Bonus & Eligibility. Offer only available to new American Express Card Members who apply online, are approved and spend $1,500 on their new Card in the first 3 months from Card approval date. Card Members who currently hold or who have previously held any other Card product offered by American Express International (NZ), Inc in the preceding 18 month period are ineligible for this offer. 300 bonus Air New Zealand Airpoints Dollars will be awarded to the eligible Card Member’s Account 8-10 weeks after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- 55 Days Interest Free. You will have up to 55 days interest free on purchases provided you pay the full closing balance of your monthly statement by the due date each month. There is no interest free period on balance transfers or if you carry forward a balance from the previous statement period. The total of interest free days will depend on when you make the purchase and when your statement is issued.

- Interest Rates.Interest rate does not apply for Cash Advances and associated fees and charges. Visit here for more information.

- Priority Pass. Enjoy access to over 1,300 lounges in 148 countries, please visit www.prioritypass.com and log in for a list of available lounges. Subject to the Terms and Conditions of the Priority PassTM program. Priority Pass is an independent airport lounge access program. Basic American Express Airpoints Platinum Card Members are entitled to two complimentary visits within each 12-month membership period, after which every visit would be charged to your American Express Card as per the prevailing rates available at www.prioritypass.com. Some lounges do not admit guests. To access participating Priority Pass lounges, present your Priority Pass card and confirmed airline boarding pass. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, including house rules of participating lounges, and can be viewed at www.prioritypass.com. Enrolment required. Please allow 4-6 weeks from enrolment to receive your Priority Pass card and membership package. To enrol click here (upon Amex Card receipt). Once you are successfully enrolled, your physical membership card, membership number and online PIN will be sent to you

- Airpoints Terms & Conditions. Subject to the American Express Airpoints Platinum Card Benefits Terms and Conditions available here. Status Points and Airpoints Dollars are not earned on purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Air New Zealand Airpoints Programme terms and conditions also apply. Airpoints Dollars and Status Points earning rates are subject to change with reasonable notice.

- Insurance. For all non-emergency insurance claims, please follow the link www.americanexpress.com/newzealand/claims. This insurance is subject to Terms, Conditions and exclusions – see the full insurance Terms and Conditions for your American Express Airpoints Platinum Card available at here. You must use your American Express Airpoints Platinum Card to pay for your return trip or eligible items to be covered under the insurance or pay for your smartphone or monthly contract in order to be covered under the Smartphone Screen Insurance. Maximum of 2 claims per 12 month period, per Account, maximum cover of $500 per claim and an excess of 10% of the claimed amount applies. Waiting periods may apply. The insurance is underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) under a group policy held by American Express International (NZ), Inc. (Company Number 867929). Card Members are not a party to the group policy, but may be able to claim under it as third party beneficiaries. This communication does not take into account your objectives or financial situation. You should read the full Terms and Conditions to decide if this insurance meets your needs. Domestic & International Travel Insurance. American Express Airpoints Platinum Card Insurances are underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) (Chubb) and are subject to the terms, conditions and exclusions contained in the American Express Airpoints Platinum Card Insurances policy of insurance between American Express International (NZ) Inc. (Company No. 867929) (American Express) and Chubb. This product page does not take into account your objectives, financial situation or needs. It is important for you to read the terms and conditions and consider the appropriateness of that insurance in relation to your individual requirements.

- Koru Membership. he Basic Card Member shall be entitled to a waiver of the Koru joining fee and a discount of $145 on one-year, individual Koru membership. The Koru joining fee waiver and the discount on the Koru annual membership fee only applies to Card Members and may only be used in conjunction with one-year Koru memberships for individuals. The Koru joining fee and/or Koru annual membership fee will not be refunded if it has already been paid to Air New Zealand. Koru terms and conditions apply.

- The Centurion® Lounges. Entry into The Centurion® Lounges is governed by the full Terms and Conditions available here. All entrants must adhere to the General Conditions of Entry. To access lounge, present your American Express Airpoints Platinum Card and government issued ID. American Express Airpoints Platinum Card Members are entitled to a total of two (2) entries into The Centurion® Lounges in Australia, per calendar year (1st January to 31st December). Complimentary access is available for the Card Member’s children 17 years and younger. Card Members wishing to bring additional guests may be subject to a charge that is to be processed on the Card Member’s American Express Card.

- Apple Pay is a trademark of Apple Inc.

- Status Points. You can earn up to half the Status Points you need to reach or maintain your Silver or Gold Airpoints tier status by making purchases on your Credit Card. You need to earn at least 900 Status Points on Air NZ operated flights to change from Gold to Gold Elite, and 810 Status Points on Air NZ operated flights to maintain Gold Elite, and the balance can be earned by making purchases on your Credit Card. Visit airnewzealand.co.nz/airpoints for details of the number of Status Points required. For full list of exclusions, please refer to The American Express Airpoints Platinum Card Benefits Terms and Conditions available here.

- Additional Cards Additional Card Members must be 18 years of age or older. The basic Card Member will be liable for all spending on Additional Cards.

- Fraud Protection Guarantee. Provided that you do not contribute to or unreasonably delay reporting any misuse of your Account and you have complied with your Card Conditions, you will not be held liable for any unauthorised charges.

- Airpoints Terms & Conditions. Airpoints Dollars are earned in accordance with the American Express Airpoints Card Terms and Conditions. Exclusions apply. Eligible purchases do not include cash advances, interest, balance transfers, fees and charges for Traveller's Cheques, Gift Cheques and Foreign currencies or annual Card fees or other fees and charges billed to the account. These do not earn Airpoints Dollars. For the full list of exclusions, please refer to the American Express Airpoints Card Terms and Conditions available here.

- Membership Rewards Points. Subject to the Terms and Conditions of the Membership Rewards Programme available at www.membershiprewards.co.nz/termsandconditions

- Annual Dining Credit. Valid when dining in at participating location Dining Collection restaurants only. Some locations are excluded, please refer to the full list of participating restaurant locations before dining (amex.co.nz/golddining). Limited to one $100 credit each defined calendar period, per Gold Rewards Card Account. The defined calendar periods are between 1 January and 30 June, and between 1 July and 31 December. Limited to a maximum of two credits at a total of $200 each year, per Gold Rewards Card Account. Your Card must be charged prior to the end of each defined calendar period to be eligible for the credit in the defined calendar period. Spend on Additional Cards will count towards the offer. Excludes spend on gift vouchers, online orders for pick up or delivery and transactions where you do not spend directly with your Card at a participating location Dining Collection restaurant. Credit should appear on your billing statement within 5 business days from qualifying spend but may take up to 90 days from the end of the defined calendar period. Excludes transactions made through a third-party establishment or payment processor, apart from Windcave. Credit is not redeemable for cash or other payment form. Credit will not be applied to your Gold Rewards Card Account if your Card has been suspended or cancelled. Credit may be reversed if your qualifying purchase is refunded or cancelled. If you hold multiple American Express Cards linked to one Membership Rewards® account, the Credit will be credited to the Primary Card Account only.