Tap into more Business Value

Explore all the ways we can help you to get more from business – and from life.

Boost your cash flow every month

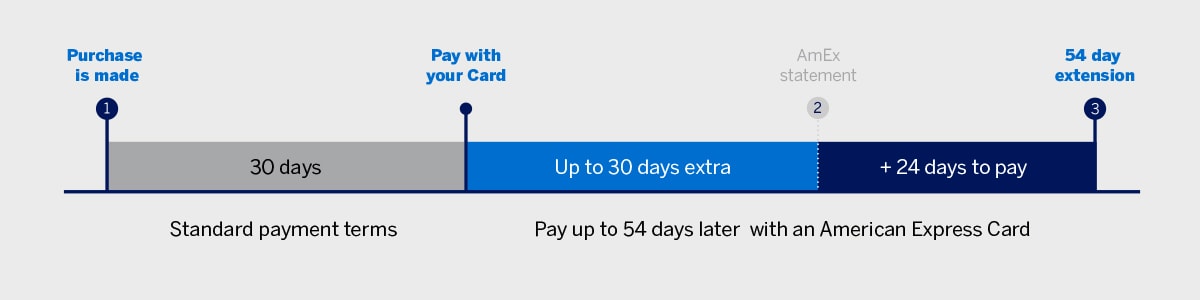

Juggling cash flow is one of the biggest headaches for many businesses, so it's good to know your Card could extend your payment to suppliers by up to 54 calendar days.1

3 steps to improved cash flow

Purchase

Pay as many suppliers as you can

using your American Express®

Business Card.

Extra days

You will now have anything from 24

to 54 extra days before that item

is due for payment, depending on

when your purchase is made.1

Pay in full

Pay your Card statement in full

on the due date and you will

have boosted your cash flow

without charge.

Purchase any item the day after your Amex statement date and you could enjoy up to 54 extra days to pay.

Cash flow in action

The founders of The Hoxton Mix understood the

need for professionals to meet and seek out other

professionals to work together and improve their

business. When business rates increased they

faced cash flow challenges, as their customers are

small businesses too. See how The Hoxton Mix

managed their cash flow,while making their business

spend more rewarding.

Keeping everybody happy

Your supplier will be happy because you pay them on time. Your finance people will be delighted, because extended cash flow is always welcome. You can relax, knowing that if you pay your Card bill every month by direct debit, it makes life really easy.

So many places to use

your Business Card

It’s not all about travel and dining. You can use your Card to pay recurring bills like telecoms, utilities and digital advertising. Lots of different suppliers will accept Card payments, from couriers and office supplies, to IT companies and photo libraries.

Piling on

the rewards

As well as boosting cash flow, virtually every time you use your Card you will also be earning extra rewards you can reinvest in the business, use for your staff or for yourself.2

The Card with flexible spending power

Your Card's spending power - the amount your business can spend - is dynamic and can adjust to your business needs. Use your Card in the right way, and watch your spending power grow.3

Important Information

Effective 28 January 2026, American Express introduced the Business Gold Card and Business Platinum Card with Flexible Payment Option.

- If you applied on or before 27 January 2026, your Card remains a Business Charge Card and must be paid in full each month. The existing joint and several liability structure continues to apply.

- If you applied on or after 28 January 2026, your Card is the Business Platinum Card which includes the Flexible Payment Option and operates under Company Liability supported by a business personal guarantee.

To access the Flexible Payment Option, existing Cardmembers who applied before 27 January 2026 must submit a new application.

You can confirm which Card you hold by checking your online Account, where the Card name is displayed.

1a. Platinum and Gold Business Charge Card: The maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. Basic Business Card the maximum payment period on purchases is 42 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date.

1b. Platinum and Gold Business Card: You have up to a 54 day payment period interest free to pay back any charges on your Account in full. If you need additional time to pay, you can use Flexible Payment Option, which allows you to extend your cashflow window. The maximum payment period on purchases is up to 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. Visit www.americanexpress.com/en-gb/business/get-started/how-does-interest-work/ for more information.

2. Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds.Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions. Membership Rewards: Enrolment required. Award and usage of Membership Rewards points subject to subscribed Terms & Conditions of Membership Rewards Programme. Availability is subject to local laws and regulations.

3. ‘No pre-set spending limit' does not mean unlimited spending. Your Card's spending power - the amount your business can spend - is dynamic and adjusts to your business needs. Find out more here.

Terms and conditions apply. Subject to status. We reserve the right to apply temporary spending limits in accordance with the Cardmember agreement.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 andauthorised and regulated by the Financial Conduct Authority.

Copyright© 2021. American Express Company. All Rights Reserved.

Managing Rewards

Top tips to earn more points

All the time you’re building a business, you can be building your rewards at the same time. And it’s not just expenses. Essentials like telephone or utility electricity bills can all earn you rewards too.

You earn 1 Membership Rewards point for every full £1 you spend on your Card.1 And there are lots of ways you can boost your

points balance. Just take a look at our top tips below:

You can use your Card to pay recurring bills like telecoms,

utilities and digital advertising. You may be surprised how many of these suppliers accept American Express Card payments, earning you extra rewards on everyday business services.

Add your Business Card to your digital wallets or use Contactless and you can earn even more rewards on those quick

payments like coffees with colleagues or customers, and travel tickets.

You can earn 2 points for every £1 spent when you book your flights, hotels, car hire or experiences through American Express Travel. Why not book your next business trip online today.2

It’s not all about travel and dining. All kinds of suppliers welcome Card payments, from couriers and office supplies, to IT companies and photo libraries. And that can help you to boost cashflow too. Why not ask your major suppliers if they accept card payments?

Give yourself extra control and the opportunity to earn more Membership Rewards® points by adding Employee Cards.3

Gold

You can request up to 20 complimentary Business Gold Cards

Platinum

You can request one complimentary Business Platinum Card, and up to 19 complimentary Business Gold Cards

So many flexible ways to spend

Membership Rewards® is one of the most flexible loyalty programmes around, making it easy for you to reinvest your points in driving your business forward, or to reward employees or yourself for all the hard work.1

You can use your points to pay for virtually anything that appears on your statement. Just use your Amex App or Online Account and select the line items which you would like to pay for using your points.4

12,000

points

A quick client lunch to the value of £54

50,000

points

A new office printer costing £225

100,000

points

Paintballing for the office staff £450

Did you know you can book flights, hotels, car hire and experiences

with your points at American Express Travel, your online travel portal.

You’ll find exclusive Cardmember deals there too. And you’ll earn more Membership Rewards points on your booking, when you pay with your Card.

From millions of work items to all kinds of events, it’s easy to pay with your points at Amazon.co.uk and Ticketmaster. Just choose your items and look for the Pay with Points option at checkout.5

You can choose from a huge range of gift cards for business purchases from places like Apple, Costco and Hertz, or choose to reward or thank people with gift cards from places like Harrods, M&S or Boots.5

Lots of major retailers like Currys PC World and Tesco allow you to use points with SafeKey when you shop online. From office consumables to catering for a staff lunch, your points can pay the way.5

Are you a member of British Airways Executive Club or Virgin Atlantic Flying Club? You can transfer your points into these and many other leading airline loyalty programmes to help you secure reward flights faster.6

You can transfer your points to Hilton Honors, Marriott Bonvoy and Radisson Rewards to help you get closer to a

complimentary night away.7

Important Information

Effective 28 January 2026, American Express introduced the Business Gold Card and Business Platinum Card with Flexible Payment Option.

- If you applied on or before 27 January 2026, your Card remains a Business Charge Card and must be paid in full each month. The existing joint and several liability structure continues to apply.

- If you applied on or after 28 January 2026, your Card is the Business Platinum Card which includes the Flexible Payment Option and operates under Company Liability supported by a business personal guarantee.

To access the Flexible Payment Option, existing Cardmembers who applied before 27 January 2026 must submit a new application.

You can confirm which Card you hold by checking your online Account, where the Card name is displayed.

1. Membership Rewards points are earned on every full £1 spent and charged, per transaction. Membership Rewards points are not earned on interest, fees (including default fees), balance transfers, cash advances (including transactions treated as cash), loading of pre paid Cards, American Express Travellers Cheque purchases or foreign exchange transactions; and any amounts that are subsequently re-credited to your Card Account by way of refunds. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

2. Cardmembers enrolled in the American Express Membership Rewards programme will earn one additional Membership Rewards point in addition to their standard earn rate for virtually every full £1 spent on americanexpress.co.uk/travel. This excludes cruise bookings, Fine Hotels & Resorts and The Hotel Collection bookings. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

3. Employee Cards

Employee Cards, also known as "Supplementary Cards", allow you to share the benefits of your American Express Card with others close to you.

You will be the main Cardmember and you will be responsible for all charges made on the Employee Cards (s).

- Business Gold/Platinum Charge Card with Flexible Payment Option: Company Liability supported by a business personal guarantee applies to charges made on all Employee Card(s).

Employee Cardmembers must be aged 18 or over. Written details available on request. Approval subject to status and Terms and Conditions.

4. You can use your Points to apply a credit to your Card Account against certain eligible fees and/or purchases (Eligible Transactions). The rate at which we convert Points may vary and we will tell you what the conversion rate is when you arrange the redemption. The conversion rate is also on our website. Visit membershiprewards.co.uk/terms for full Membership Rewards Terms and Conditions.

5. The types of Rewards available are subject to change. Those available to you at any time will be shown on our website at membershiprewards.co.uk.

6. Enrolment is required to receive programme benefits. Individual benefits vary by partner and are subject to availability. Please refer to each airline partner’s Terms and Conditions.

7. Enrolment is required to receive programme benefits. Individual benefits vary by partner and are subject to availability. Please refer to each hotel loyalty partner’s Terms and Conditions. American Express reserves the right to instruct Hotel Partners to cancel your membership if you cease to be a Cardmember or your Account is not in good standing. Benefits are subject to availability.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.

Copyright© 2021. American Express Company. All Rights Reserved.