AR Automation Solutions for Smarter Receivables

Streamline Accounts Receivable (AR) with automation software from our trusted partners

How AR automation solutions accelerate payment cycles

Manual Accounts Receivable can lead to slow or late payments — but automated AR can simplify payment processes to help improve cash flow.

Explore our AR automation partners to find the solution that works best with your receivables strategy.

Automate Virtual Card payments with Boost Intercept

Boost Intercept is a patented, straight-through processing solution for efficient commercial Card payments.

How Boost Intercept works

See how Boost Intercept automates Virtual Card payments with efficient, straight-through processing.

Benefits of Boost Intercept

of CFOs say payment digitization has improved their data security1

of CFOs say payment digitization has made operations more efficient2

of CFOs say payment digitization has helped them cut costs3

Manual inefficiencies:

solved by automating Virtual Card processing4

Delayed payments:

solved by shortening time between payment authorization and fund settlement6

Reconcilation challenges:

solved by automating data to reduce errors8

Staffing strain:

solved by reducing time finance teams spend on payment processing5

Data sensitivity risks:

mitigated by generating unique Virtual Card details for each transaction7

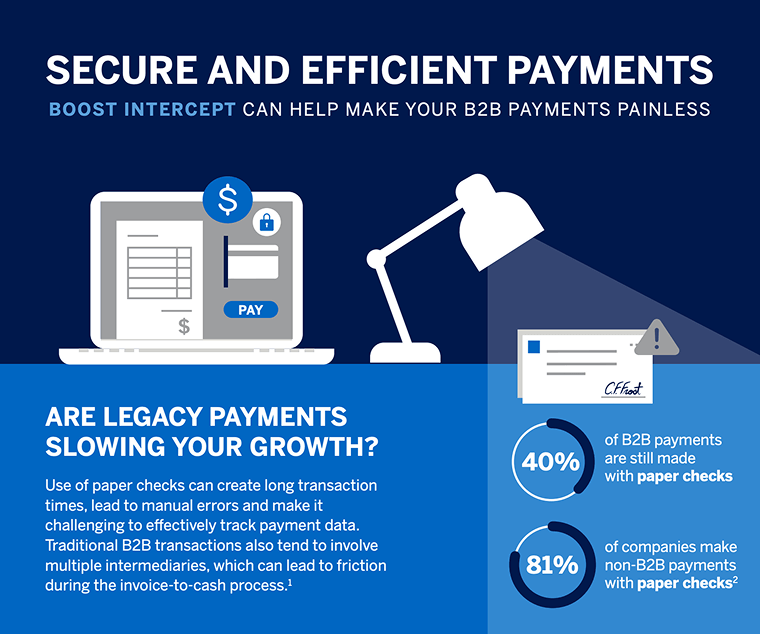

Enable secure and efficient digital payments

of B2B payments are still made with paper checks9

of survey respondents say fraud activity was most common with checks10

of CFOs say payment digitization improved their data security11

Painless B2B payments

See why 93% of large firms are digitizing their AR operations.12

Start accepting Virtual Cards with a special offer from Boost Payment Solutions

Get free Boost Intercept Virtual Card processing for Merchants referred by AXP. Terms apply.*

Boost Intercept success stories

See how Boost Intercept helped improve working capital and reduce manual processing.

Manufacturer Improves Cash Flow Management

"Boost has helped improve our working capital management by enabling us to bring cash in more quickly and efficiently."13

Industrial Construction Company Saves Time

"We've saved significant time by reducing manual processing using Boost. It has saved our team about 10 to 15 hours monthly."14

What is Versapay?

See how Versapay helps close the communication gap to deliver accelerated cash flow, efficiency gains and strong customer relationships.

Versapay by the numbers

less time managing receivables15

faster payments16

fewer past-due invoices17

Versapay helps solve manual payment headaches

Delays and inefficiencies

in the invoice-to cash process18

Unexpected cash flow delays

that derail planning19

Disconnected financial systems

that limit visibility20

Manual collections and payment

tasks that waste time21

Invoices in email threads

that create tracking challenges22

Cash left unapplied for days,

slowing down reconciliation23

The high cost of manual payments

of surveyed companies still use paper checks despite high processing costs and inefficiency24

of surveyed businesses say up to 30% of their monthly invoice sales are overdue25

of surveyed businesses say they need to contact customers 1 to 4 times to secure an overdue payment26

Reduce payment friction

See how cloud-based AR automation can lead to 50% less time managing receivables for your team.27

Start AR automation with a special offer from Versapay

Get 15% off subscription fees for 36 months with Versapay for Merchants referred by AXP. Terms apply.**

Want to learn more about AR automation?

More resources for AR teams

Learn more about how accounts receivable automation can benefit your business.

Your Guide to Automating Payment Acceptance

Payment portals can speed up the time it takes for your business to get paid.

From Friction to Flow: AR Automation in 2025

In an uncertain economic climate, automating accounts receivable is imperative.

Virtual Cards: The Future of B2B Payments

Organizations are recognizing the strategic advantages of modernizing manual processes.

1,2,3,11Simpler, Smarter, Safer B2B Payment Acceptance, Boost, 2025.

4,5,6,7,8American Express and Boost Payment Solutions Bring Optimized Virtual Card Payments to Suppliers, American Express, October 1, 2024.

9Excel’s Long Reach Sheds Light on Enterprises’ Back Office Pain Points, PYMNTS, March 22, 2024.

105 Reasons Why Virtual Cards are the Safest B2B Payment Method, Boost, August 2023.

12Boost Intercept, Boost, 2025.

13User Interview: The Responsive Support, Boost Intercept, n.d.

14User Interview: We’ve Saved Significant Time, Boost Intercept, n.d.

15,16,17,18,19,20,21,22,23The Platform for Turning Cash Flow Chaos Into Clarity, Versapay, 2025.

2475% of Companies Still Use Paper Checks Despite High Cost, PYMNTS, August 29, 2024.

25,26From Friction to Flow: AR Automation in 2025, PYMNTS, June 2025.

27Make Accounts Receivable Your Competitive Edge, Versapay, 2025.

* This offer is made by Boost Intercept and is for eligible American Express-referred merchants to use Boost Intercept for American Express virtual card transactions at no additional cost. To be eligible for this offer you must (i) be an American Express accepting merchant referred by your American Express representative and (ii) sign an agreement with Boost Intercept after being referred by your American Express representative. Fulfillment of the offer is the sole responsibility of Boost Intercept. Merchants offers are subject to change at any time without notice to you. Limit one offer per American Express merchant.

** This offer by Solupay Consulting, LLC d/b/a Versapay (“Versapay”) is for either (a) a waiver of Versapay’s standard implementation fees, or (b) a 15% discount off Versapay’s standard monthly software subscription fees for thirty-six (36) months. To be eligible for this offer you must: (i) be located in the US or Canada; (ii) be an American Express accepting merchant referred by your American Express representative, (iii) be a new Versapay customers, and (iv) sign a 36-month contract with Versapay within 12 months of being referred by your American Express representative. The amount of the discount may vary depending on the services you choose and Versapay's assessed pricing and fees for such services. If you choose the 15% discount off the standard monthly subscription fee, your contract will automatically renew, and you will be automatically charged at a non-discounted rate starting on the 37th month of your contract. Any information you provide Versapay is subject to Versapay’s privacy policies and terms of use, available at Versapay.com. No guarantee is made regarding savings, service performance, or specific business outcomes. This offer is non-transferable and may not be combined with any other offer. Limit one offer per customer. Fulfillment of the offer is the sole responsibility of Versapay. Versapay reserves the right to modify, suspend, or revoke this offer at any time for any reason, without prior notice, to the maximum extent permitted by law. Void where prohibited.