Fly higher

Reach new heights with our

International Currency Cards.

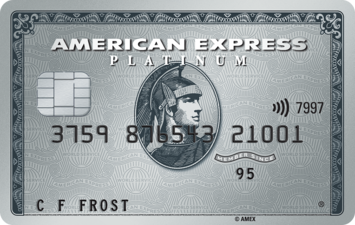

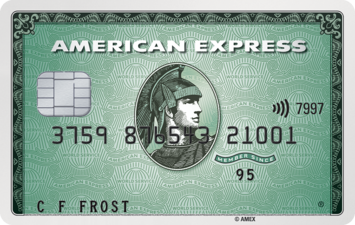

The American Express® International Currency Cards

Enjoy service, benefits and rewards on another level. Your American Express Charge Card in euros or dollars is the

ultimate travelling companion.

They have no pre-set spending limit and no interest charges, as long as you pay off your balance in full each month.

All charges are billed in the currency of your Card so you’ll benefit from one foreign exchange fee without incurring

additional bank transfer fees.

Discover benefits, rewards and experiences on another level

BENEFITS

Offering exceptional travel benefits as well as unrivalled experiences and offers wherever you are in world.

REWARDS

Our Membership Rewards® Programme awards you points every time you spend. Spend them on shopping and shows, flights or fuel bills. Your points. Your choice.

EXPERIENCES

Be our guest with American Express® Experiences. Enjoy exclusive experiences from wine tasting to white water rafting and concerts to carnivals.

We're currently not accepting new applications for The Gold Business International Currency Card. We’ll update this page with more information soon.

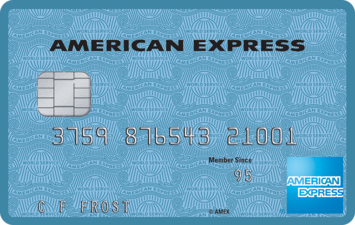

Personal Cards

You can view your Personal Card benefits here - please note, you can no longer apply for these Cards directly from American Express.

Need help?

Browse our frequently asked questions or contact us