The American Express® Gold Rewards Card

This is Gold

| Annual Fee: | $200 p.a. |

| Card Type: | Credit Card |

| Interest Free Period: | Up to 55 days6 |

| Interest Rate: | 22.95% p.a. on purchases7 |

| View key information for this Card and American Express® Credit Card Terms |

| Learn more about Credit Cards to ensure its right for you |

WELCOME OFFER

Get $200 back

When you apply, are approved and spend $1,500 in the first 3 months. T&Cs apply. New Card Members only.1

Featured benefits

Up to $200 Dining Credit

Enjoy 2x $100 Dining Credits each year when you spend at our extensive Dining Collection2 of top NZ restaurants.

Sleek Metal Card

Choose from the elegant Gold or Rose Gold new metal Card.

Additional Cards are $0

Earn more points by getting Additional Cards for family members at no extra fee5, up to 4 Additional Card Members.

Apple Pay

Make easy and secure purchases with American Express and Apple Pay®. With a quick setup on your Apple device, you can make payments on the go12.

Get up to 55 days interest free

You will have up to 55 days interest free on Credit Card purchases6.

Earn Rewards Fast

Earn fast with 2 Membership Rewards points per dollar spent, our fastest earn rate. Use points for gift cards, travel or to pay off eligible purchases3.

Travel with confidence

Receive complimentary domestic and overseas Travel Insurance when you use your Gold Rewards Card to pay for your return trip4.

Local Dining Collection

Explore our participating Dining Collection Restaurants

and you could enjoy up to $200 Dining Credit each year2.

Earn rewards fast. Get 2 points per $1 spent with

the award-winning Membership Rewards programme.

Example monthly household spend:

For illustrative purposes only

$800

Groceries

$480

Utilities/Bills

$240

Petrol

$300

Shopping

$120

Entertainment

$260

Home

$300

Dining and Cafe's

At the Gold rate

$2,500 |

= 60,000 |

= $450 | |

| spend per month | points per year | when paying with points for travel with Amex. Or 400 Airpoints Dollars™ when transferred to Air New Zealand.3 |

$2,500 |

= 60,000 |

= $450 |

| spend per month | points per year | when paying with points for travel with Amex. Or 400 Airpoints Dollars™ when transferred to Air New Zealand.3 |

To find out more ways you can use Membership Rewards points, visit the Membership Rewards Catalogue. Full options available to your Card can only be seen once logged-in with your Account.

See how fast everyday

spend could earn you rewards

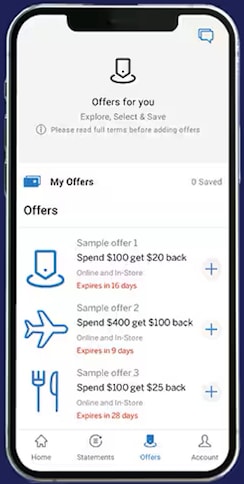

Get the most out of your Amex Card

Now accepted in more places

75,000 places across NZ now welcome American Express Cards since the start of 2019*.

Outstanding Amex App

See how the Amex App makes having an Amex Card a breeze

Receive an emergency Card within 48 hours

If your Card is ever lost or stolen, you can

usually get a replacement within 48 hours,

virtually anywhere in the world8.

Complimentary Travel Insurance4

Travel with confidence

When you book and pay for your return trip with your Gold Rewards Card, you can take advantage of complimentary domestic and overseas travel insurance for you, your spouse and your dependent children under the age of 23. The insurance includes cover for:

- Medical Emergency Expenses (including Repatriation) up to $2,500,000

- Travel Cancellation up to $30,000

- Baggage, Money and Documents up to $30,000

Sub limits apply. Other terms, conditions and exclusions apply (such as maximum age limits, exclusions for pre-existing medical conditions and cover limits)4.

Interested? Check the eligibility criteria.

To apply for an American Express Gold Rewards Card, you’ll need to be able to meet the following criteria:

- Be aged 18 or over

- Have no history of bad debt or payment default

- Have the right to work in New Zealand, and

- If self-employed, have been trading for at least 18 months (or 12 months if I hold an existing American Express issued Card)

Documents and information to have ready:

- NZ Driver’s Licence number (if you have one)

- Details of your income, expenses and debts

- Proof of your annual income and employment details (e.g. Inland Revenue Department (IRD) Statement, payslips)

Ready to apply ?

The American Express Airpoints Platinum Card

WELCOME OFFER

300 Bonus Airpoints DollarsTM

Get rewarded with 300 bonus Airpoints Dollars™ when you apply, are approved and spend $1,500 on your new Amex Airpoints Platinum Card within the first 3 months. New Amex Card Members only9.

$70 spend = 1 Airpoints Dollar10

The American Express

Airpoints Card

WELCOME OFFER

$0 Annual Card Fee

- Bonus & Eligibility. To receive $200 Credit, you must apply online, be approved and spend $1,500 or more on eligible purchases on your new Card in the first 3 months from the Card approval date. Please allow 8–10 weeks for the credit to be credited to your Account after the spend criteria has been met. Card Members who opt in to receiving payment alerts, may receive a payments received email once the $200 Credit has been applied to their Account. The credit is not redeemable for cash or other payment form. The credit will not be applied to your Account if it has been suspended or cancelled. The Statement Credit may be reversed if your qualifying purchase is refunded or cancelled. Card Members who currently hold or who have previously held any Card product issued by American Express International (NZ), Inc. in the preceeding 18 month period are ineligible for this offer. Eligible purchases do not include annual Card fees, cash advances, interest, balance transfers, fees and charges for traveller’s cheques and foreign currencies. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer and may be removed at any time.

- Annual Dining Credit. Valid when dining in at participating location Dining Collection restaurants only. Some locations are excluded, please refer to the full list of participating restaurant locations before dining. Limited to one $100 credit each defined calendar period, per Gold Rewards Card Account. The defined calendar periods are between 1 January and 30 June, and between 1 July and 31 December. Limited to a maximum of two credits at a total of $200 each year, per Gold Rewards Card Account. Your Card must be charged prior to the end of each defined calendar period to be eligible for the credit in the defined calendar period. Spend on Additional Cards will count towards the offer. Excludes spend on gift vouchers, online orders for pick up or delivery and transactions where you do not spend directly with your Card at a participating location Dining Collection restaurant. Credit should appear on your billing statement within 5 business days from qualifying spend but may take up to 90 days from the end of the defined calendar period. Excludes transactions made through a third-party establishment or payment processor, apart from Windcave. Credit is not redeemable for cash or other payment form. Credit will not be applied to your Gold Rewards Card Account if your Card has been suspended or cancelled. Credit may be reversed if your qualifying purchase is refunded or cancelled. If you hold multiple American Express Cards linked to one Membership Rewards® account, the Credit will be credited to the Primary Card Account only.

- Membership Rewards Points Transfer. Subject to the Terms and Conditions of the Membership Rewards Programme available at www.membershiprewards.co.nz/termsandconditions. To transfer Membership Rewards points into an airline partner programme or a frequent guest partner programme, you must be a member of the partner programme. Membership of the partner programme is the Card Member's responsibility and is subject to the terms and conditions of the applicable programme. A joining fee may apply. Minimum redemption amounts apply. Partners are subject to change. Visit membershiprewards.co.nz for details.

- Complimentary Travel Insurance. The American Express Gold Rewards Card insurance is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits) - see the full terms and conditions available here. You must use your American Express Gold Rewards Card to pay for your return trip in order to be eligible for the travel insurance in order to be covered under the insurance. The insurance is underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) under a group policy held by American Express International (NZ), Inc. (Company Number 867929). Card members are not a party to the group policy, but may be able to claim under it as third party beneficiaries. This website does not take into account your objectives or financial situation. You should read the full terms and conditions to decide if this insurance meets your needs.

- Additional Cards. Additional Credit Card Members must be over 18 years of age. You will be liable for all Additional Credit Card spending.

- 55 Days Interest Free. You will have up to 55 days interest free on purchases provided you pay the full closing balance of your monthly statement by the due date each month. There is no interest free period on balance transfers or if you carry forward a balance from the previous statement period. The total of interest free days will depend on when you make the purchase and when your statement is issued.

- Interest Rates. Interest rates, fees and charges apply. All interest rates are quoted as an Annual Percentage Rate. All information, including fees, charges and interest rates are correct as at 3 May 2023 and are subject to change. This interest rate does not apply for Cash Advances and fees relating to Cash Advance.

- Emergency Card Replacement. If your Credit Card is lost or stolen, you must report it immediately. You can call American Express 24 hours a day. In New Zealand, call us on 0800 656 660. If you are overseas, report your lost or stolen Card to the nearest American Express Travel Service or Representative Office or call +64 9 583 8287. Once you have notified us, you are not liable for any unauthorised charges.

- Bonus & Eligibility. Offer only available to new American Express Card Members who apply, are approved and spend $1,500 or more on eligible purchases on their new Card in the first 3 months from Card approval date. Eligible purchases do not include purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Card Members who currently hold or who have previously held any other Card product offered by American Express International (NZ), Inc in the preceding 18 month period are ineligible for this offer. 300 bonus Air New Zealand Airpoints Dollars will be awarded to the eligible Card Member’s Account 8-10 weeks after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- Airpoints Terms & Conditions. Subject to the American Express Airpoints Platinum Card Benefits Terms and Conditions available here. Status Points and Airpoints Dollars are not earned on purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Air New Zealand Airpoints Programme also apply. Airpoints Dollars and Status Points earning rates are subject to change with reasonable notice.

- Bonus & Eligibility. Offer only available to new American Express Card Members who apply online, are approved and spend $750 on their new Card in the first 3 months from Card approval date. Card Members who currently hold or who have previously held any other Card product offered by American Express International (NZ), Inc in the preceding 18 month period are ineligible for this offer. 50 bonus Air New Zealand Airpoints Dollars will be awarded to the eligible Card Member’s Account 8-10 weeks after the spend criteria has been met. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- Apple Pay is a trademark of Apple Inc.

Appreciate the

value of Gold

Discover better benefits and faster points-earning potential with the American Express Gold Rewards Card, available in two shades of metal

The American Express®

Gold Rewards Card

Get $200 back

When you apply, are approved and spend $1,500 in the first 3 months. T&Cs apply. New Card Members only.1

| Annual Fee: | $200 p.a. |

| Card Type: | Credit Card |

| Interest Free Period: | Up to 55 days2 |

| Interest Rate: | 22.95% p.a. on purchases3 |

View key information for this Card and American Express® Credit Card Terms

Up to $200 Dining Credit

Receive a $100 Dining Credit, when you spend $100 or more in one transaction, on your American Express® Gold Rewards Card at a participating Dining Collection restaurant. Valid up to 2 times per year.

Travel with confidence

Receive complimentary domestic and overseas apply. Travel Insurance when you use your Gold Rewards Card to pay for your return trip5.

Up to $200 Dining Credit

Receive a $100 Dining Credit, when you spend $100 or more in one transaction, on your American Express® Gold Rewards Card at a participating Dining Collection restaurant. Valid up to 2 times per year.

Additional Cards are $0

Get Additional Cards for family members at no extra fee6, for up to 4 Additional Card Members.

Earn Rewards Fast

Earn fast with 2 Membership Rewards® points per dollar spent, our fastest earn rate. Use points for Gift Cards, travel or to pay off eligible purchases7.

Get up to 55 days interest free

You will have up to 55 days interest-free on Credit Card purchases, once your previous statement’s balance is paid in full2.

Amex Card

Explore our participating American Express Dining Collection Restaurants and you could enjoy up to $200 Dining Credit each year4.

From groceries, fuel, to shopping online, earn rewards in the places you spend the most. We’ve added thousands of new places where American Express is welcome across NZ since 2019* .

making transactions

Travel with confidence

Receive complimentary domestic and overseas Travel

Insurance when you use your Gold Rewards Card to pay

for your return trip5.

Global Card support

Amex support is there for you with help, wherever you are in the world, for whatever you need and whenever you need it. You can call our Customer Service Centre anytime, day or night. Just call the number on the back of your Card.

Enjoy safety and security

You’ll also be protected against fraudulent transactions made using your Card details with our Fruad Protection Guarantee8.

Apple Pay

Make easy and secure purchases with American Express and Apple Pay®. With a quick setup on your Apple device, you can make payments on the go6.

Ready to apply? Check your eligibility first.

To apply for an American Express Gold Rewards Card, you’ll need to be able to meet the following criteria:

- Be aged 18 or over

- Have no history of bad debt or payment default

- Have the right to work in New Zealand, and

- If self-employed, have been trading for at least 18 months (or 12 months if I hold an existing American Express issued Card)

Documents and information to have ready:

- NZ Driver’s Licence number (if you have one)

- Details of your income, expenses and debts

- Proof of your annual income and employment details (e.g. Inland Revenue Department (IRD) Statement, payslips)

The American Express Airpoints Platinum Card

$70 spend = 1 Airpoints Dollar7. The fastest Airpoints DollarTM earning Platinum Card.

The American Express Airpoints Card

$0 Annual Card fee $100 spend = 1 Airpoints DollarTM10

Make it easy with

the Amex App

From purchase alerts, 24/7 chat, paying with

points to amazing offers, the Amex App makes

having an Amex Card a breeze.

- Bonus & Eligibility. To receive $200 Credit, you must apply online, be approved and spend $1,500 or more on eligible purchases on your new Card in the first 3 months from the Card approval date. Please allow 8–10 weeks for the credit to be credited to your Account after the spend criteria has been met. Card Members who opt in to receiving payment alerts, may receive a payments received email once the $200 Credit has been applied to their Account. The credit is not redeemable for cash or other payment form. The credit will not be applied to your Account if it has been suspended or cancelled. The Statement Credit may be reversed if your qualifying purchase is refunded or cancelled. Card Members who currently hold or who have previously held any Card product issued by American Express International (NZ), Inc. in the preceeding 18 month period are ineligible for this offer. Eligible purchases do not include annual Card fees, cash advances, interest, balance transfers, fees and charges for traveller’s cheques and foreign currencies. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer and may be removed at any time.

- 55 Days Interest Free. You will have up to 55 days interest free on purchases provided you pay the full closing balance of your monthly statement by the due date each month. There is no interest free period on balance transfers or if you carry forward a balance from the previous statement period. The total of interest free days will depend on when you make the purchase and when your statement is issued.

- Interest Rates. Interest rates, fees and charges apply. All interest rates are quoted as an Annual Percentage Rate. All information, including fees, charges and interest rates are correct as at 3 May 2023 and are subject to change. This interest rate does not apply for Cash Advances and fees relating to Cash Advance.

- Annual Dining Credit.Valid when dining in at participating location Dining Collection restaurants only. Some locations are excluded, please refer to the full list of participating restaurant locations before dining (amex.co.nz/golddining). Limited to one $100 credit each defined calendar period, per Gold Rewards Card Account. The defined calendar periods are between 1 January and 30 June, and between 1 July and 31 December. Limited to a maximum of two credits at a total of $200 each year, per Gold Rewards Card Account. Your Card must be charged prior to the end of each defined calendar period to be eligible for the credit in the defined calendar period. Spend on Additional Cards will count towards the offer. Excludes spend on gift vouchers, online orders for pick up or delivery and transactions where you do not spend directly with your Card at a participating location Dining Collection restaurant. Credit should appear on your billing statement within 5 business days from qualifying spend but may take up to 90 days from the end of the defined calendar period. Excludes transactions made through a third-party establishment or payment processor, apart from Windcave. Credit is not redeemable for cash or other payment form. Credit will not be applied to your Gold Rewards Card Account if your Card has been suspended or cancelled. Credit may be reversed if your qualifying purchase is refunded or cancelled. If you hold multiple American Express Cards linked to one Membership Rewards® account, the Credit will be credited to the Primary Card Account only.

- Complimentary Travel Insurance. The American Express Gold Rewards Card insurance is subject to terms, conditions and exclusions (such as maximum age limits, pre- existing medical conditions and cover limits) - see the full terms and conditions available here. You must use your American Express Gold Rewards Card to pay for your return trip in order to be eligible for the travel insurance in order to be covered under the insurance. The insurance is underwritten by Chubb Insurance New Zealand Limited (Company No. 104656) under a group policy held by American Express International (NZ), Inc. (Company Number 867929). Card members are not a party to the group policy, but may be able to claim under it as third party beneficiaries. This website does not take into account your objectives or financial situation. You should read the full terms and conditions to decide if this insurance meets your needs.

- Additional Cards. Additional Credit Card Members must be over 18 years of age. You will be liable for all Additional Credit Card spending.

- Airpoints Terms & Conditions. Subject to the American Express Airpoints Platinum Card Benefits Terms and Conditions available here. Status Points and Airpoints Dollars are not earned on purchases of American Express Travellers Cheques, Gift Cards or for purchases of Foreign Exchange, cash advances, balance transfers, interest, annual Card fees or other fees and charges billed to the account. Air New Zealand Airpoints Programme terms and conditions also apply. Airpoints Dollars and Status Points earning rates are subject to change with reasonable notice.

- Online Fraud Protection Guarantee. Provided that you notify us immediately upon discovery of any fraudulent transactions and you have complied with your Card Conditions, you will not be held liable for any unauthorised charges.

- Apple Pay is a trademark of Apple Inc.