What is a Chip Card and how is it different from a Magnetic Stripe Card?

A Chip Card contains a small, embedded microchip, which encrypts your Account information, making it difficult to duplicate, copy or access. Transactions can be completed when your Card is inserted into a chip-enabled Card reader, and you enter your unique PIN – a number that identifies you as the rightful holder of your Card and replaces your signature. This technology is more advanced than magnetic stripe technology, and it will make an already safe payment system even more secure.

How to make a purchase with Contactless

Contactless is a quick, easy, and secure way to make payments. Now these can be made without the need to enter a PIN for transactions up to $200.

Step 1

Check your Card and the store or reader has the Contactless symbol.

Step 2

Tap your Contactless Card on the reader at the checkout.

Step 3

Spend up to $200 in a single transaction without a PIN.

Managing your Account on the go

Use the American Express® Mobile App to manage your Account, view your transaction history, or access Amex offers any time, at any place.

How to use Chip & PIN

The microchip inside your Card keeps you safe while you shop.

Follow these three steps at the payment counter to complete your transaction.

Step 1

Insert your Chip Card into the slot in the card reader. Make sure to keep the Card in the slot for the duration of the transaction.

Step 2

Follow the prompts and key in your unique four-digit PIN to authorise the transaction. Your PIN replaces your signature.

Step 3

After successfully completing the payment, you will receive a receipt that confirms your transaction.

How to select and view your PIN

We’ve made PIN management easy through our Online Services. Please log in to your Account for additional information.

Manage your PIN

The unique PIN you set helps to identify you as the sole owner of your Card when you make transactions. This not only keeps your Account safe from fraud, but also helps to confirm that every transaction on the Card is made by you.

- To keep your Account protected, you must also protect your PIN.

- Never share your PIN with anyone, including family, friends, or merchants. We'll never ask you for your PIN either.

- Don't record your PIN anywhere, memorize it.

- Protect your PIN when entering it at a cash machine or shop.

Forgot your PIN?

We’ve made PIN management easy for you. Log in to our Online Services for additional information on managing your PIN.

Here's how you can manage your PIN through our Online Services

To view, change or unlock PIN simply log into your account, go to Account Management, select security & privacy then the link to View or Change PIN. Follow any security prompts such as One-time code to access your PIN. If your PIN has been locked an alert will appear to unlock it. Follow the prompts to view PIN to unlock it.

Here's how you can manage your PIN through our Amex App

To view your PIN, continue to Step 1. To change your PIN, proceed to Step 4.

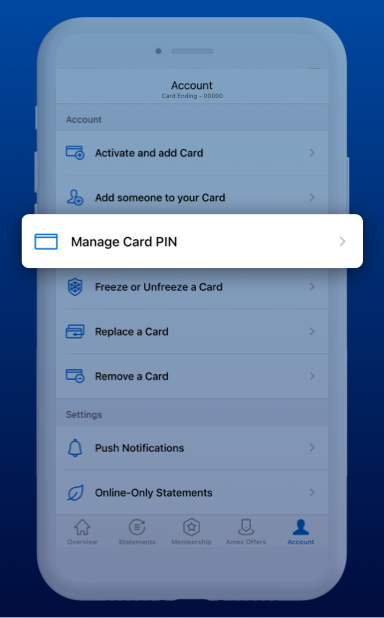

1. Go to the Account tab. Under the Account section, tap on Manage Card PIN.

To view your PIN:

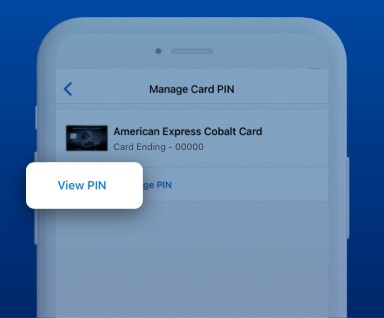

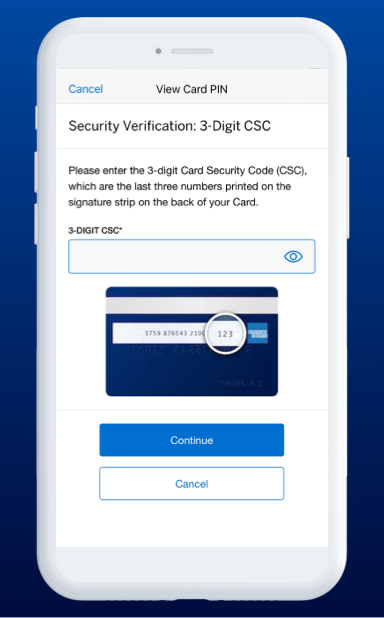

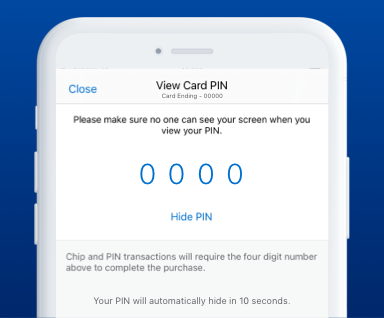

2. Select View PIN and answer the security questions(s).

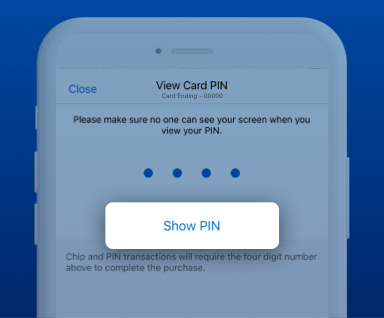

3. Tap Show PIN.

All done! Your PIN will automatically hide in 10 seconds or, if you're done, you can select Hide PIN.

To change your PIN:

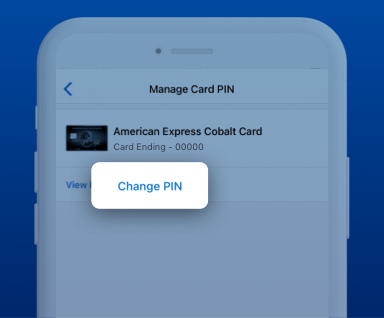

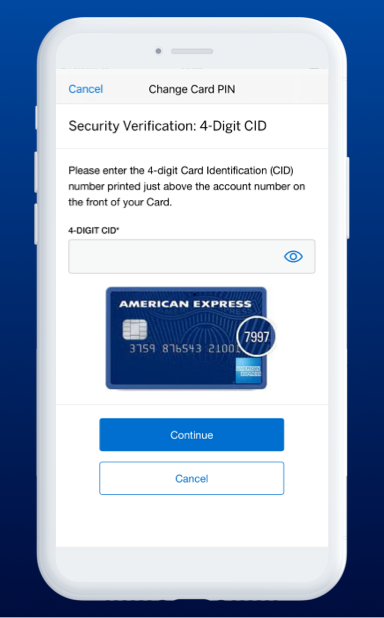

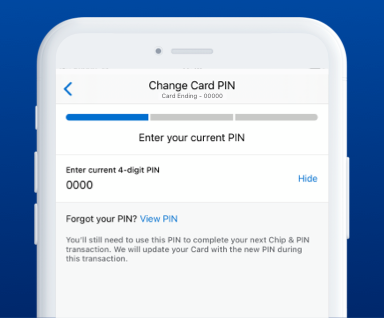

4. Go to the Account tab. Under the Account section, tap on Manage Card PIN. Select Change PIN and answer the security question(s).

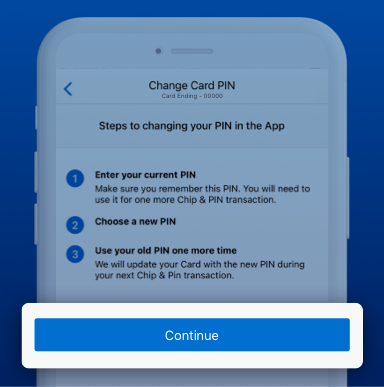

5. Once you've reviewed the steps required to change your PIN, tap Continue, then enter your current PIN on the next screen.

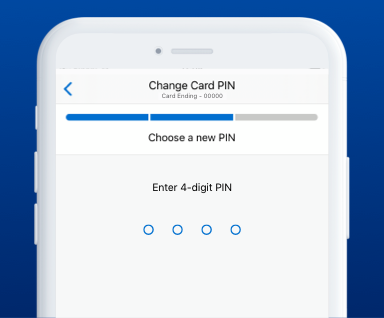

6. On the next screen, enter a new PIN.

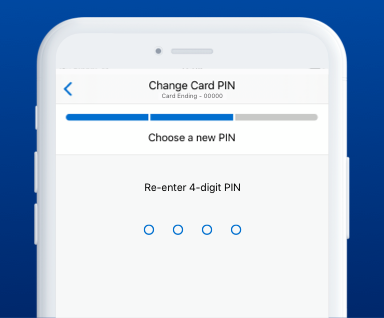

7. You will be asked to re-enter your new PIN to confirm.

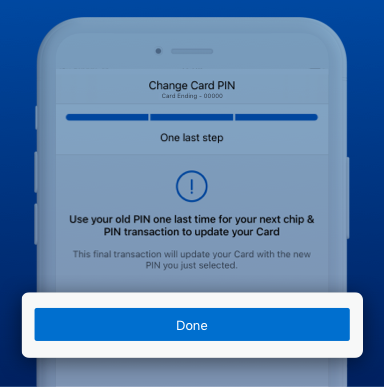

8. Tap Done to continue.

All done! Remember, use your old PIN one last time for your next chip & PIN transaction to update your Card's PIN. If you have multiple Cards, repeat these steps for each Card.

Shop with confidence

At American Express, we take your security seriously. That is why we have measures in place to ensure

you can shop and make easy payments without questioning safety.

Protection against fraud

Your security is our priority. We stay alert and are on the look out for any suspicious, fraudulent or unauthorised transactions in your Account through our Intelligent Security Systems, Secure Payment Process, and Fraud Protection Guarantee1.

Protection on purchases

Having trouble getting a refund or returning a damaged purchase? With eligible Cards, you can rely on us to put things right with 90 days’ Card Purchase and Refund Cover2.

Protection against phishing

We keep your information safe and secure by continually updating our online security features, but there are also some simple steps you can take to protect yourself. Click on the link below to find out how.

Frequently Asked Questions

- How can I choose my PIN?

To view, change or unlock PIN simply log into your Account, go to Account Management, select security & privacy then the link to View or Change PIN. Follow any security prompts such as One-time code to access your PIN. If your PIN has been locked an alert will appear to unlock it. Follow the prompts to view PIN to unlock it. - What happens if my American Express Chip Card is stolen?

Don’t worry, we'll work to get a replacement Card to you as soon as possible (often within two working days). Call us anytime, day or night, on 1300 132 639 (from Australia) or +612 9271 8666 (from overseas).

- Do I use the same PIN for cash access?

Yes. If you are enrolled for cash advances, your existing PIN on your Card will work for both purchases and cash access. To request a PIN reminder, please log into Online Services.

1. Fraud Protection. Provided that you don’t contribute to, or unreasonably delay, reporting any misuse of your Account, and you have complied with your Card Conditions, you won’t be held liable for any unauthorised charges.

2. Card Purchase and Refund Cover. American Express Card Insurances are underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb.